TIDMMNTN

RNS Number : 4415J

Schiehallion Fund Limited (The)

09 April 2020

The Schiehallion Fund Limited

Legal Entity Identifier: 213800NQOLJA1JCWXQ56

Regulated Information Classification: Annual Financial and Audit

Reports

Annual Report and Financial Statements

Further to the preliminary statement of audited annual results

announced to the Stock Exchange on 20 March 2020, The Schiehallion

Fund Limited ("Schiehallion" or "the Company") announces that the

Company's Annual Report and Financial Statements for the period

from incorporation on 4 January 2019 to 31 January 2020, including

the Notice of Annual General Meeting, has today been posted to

shareholders and submitted electronically to the National Storage

Mechanism where it will shortly be available for inspection at

http://www.morningstar.co.uk/uk/NSM .

It is also available on the Schiehallion page of the Baillie

Gifford website at: www.schiehallionfund.com (as is the preliminary

statement of audited annual results announced by the Company on 20

March 2020).

Responsibility Statement of the Schiehallion Directors in

respect of the Annual Report and Financial Statements

The Schiehallion Fund Limited Directors confirm that, to the

best of their knowledge:

3/4 the Financial Statements set out in the Annual Report and

Financial Statements, prepared in accordance with the applicable

set of accounting standards, give a true and fair view of the

assets, liabilities, financial position and profit or loss of the

Company; and

3/4 the Strategic Report set out in the Annual Report and

Financial Statements includes a fair review of the development and

performance of the business and the position of the issuer,

together with a description of the principal risks and

uncertainties they face.

The Directors consider the Annual Report and Financial

Statements, taken as a whole, is fair, balanced and understandable

and provides the information necessary for shareholders to assess

the Company's position and performance, business model and

strategy.

Principal and Emerging Risks relating to the Company

As explained on pages 20 and 21 of the Annual Report and

Financial Statements, there is a process for identifying,

evaluating and managing the risks, including emerging risks, faced

by the Company on a regular basis. The Directors have carried out a

robust assessment of the principal and emerging risks facing the

Company, including those that would threaten its business model,

future performance, solvency or liquidity. A description of these

risks and how they are being managed or mitigated is set out

below:

Financial Risk - the Company's investments consist of private

investee companies' securities and its principal financial risks

are therefore market-related and include market risk (comprising

currency risk, interest rate risk and other price risk), liquidity

risk and credit risk. An explanation of those risks and how they

are managed is contained in note 14 on pages 42 to 45 of the Annual

Report and Financial Statements. As oversight of this risk, the

Board considers at each meeting various metrics including top and

bottom stock contributors to performance along with sales and

purchases of investments. Individual investments are discussed with

the portfolio managers together with their general views on the

various investment markets and sectors.

Investee Companies - the Company's investments in private

investee companies will not be liquid and there may be restrictions

on transfer of those investments. This may limit the Company's

ability to realise investments at short notice, at a fair value or

at all. A large proportion of the overall value of the portfolio

may at any time be accounted for by a relatively limited number of

investee companies. If the value of one or more such investee

companies were to be adversely affected, it could have a material

adverse impact on the overall value of the portfolio and the

Company's financial condition, results of operations and prospects,

with a consequential adverse effect on the market value of the

ordinary shares. Risk is diversified by having a portfolio of

investments which at the end of the initial investment period, two

years from the date of Admission of the ordinary shares to trading

on the Specialist Fund Segment of the Main Market of the London

Stock Exchange, is expected to number between 20 and 60 holdings in

investee companies.

Valuation Risk - the Company invests predominately in late stage

private businesses which are valued in accordance with

International Private Equity and Venture Capital Valuation ('IPEV')

Guidelines using appropriate valuation methods. Such methods

include an element of judgement which may lead to a material

misstatement of the valuation and consequently in the Company's net

asset value. The Investment Manager has a robust valuation

methodology which it applies consistently to make valuation

recommendations to the Board.

The Company's Directors meet with the Investment Manager at

special meetings solely to consider the valuations to be included

in the Interim and Annual Financial Statements. At these meetings,

valuation analysis on the Company's investments is provided by the

Investment Manager. The Directors have the opportunity to challenge

the valuations, request further information and make changes before

the valuations are finally approved.

Investment Strategy Risk - pursuing an investment strategy to

fulfil the Company's objective which the market perceives to be

unattractive or inappropriate, or the ineffective implementation of

an attractive or appropriate strategy, may lead to reduced returns

for shareholders and, as a result, a decreased demand for the

Company's shares. This may lead to the Company's shares trading at

a widening discount to their net asset value. To mitigate this

risk, the Board regularly reviews and monitors the Company's

objective and investment policy and strategy, the investment

portfolio and its performance, the level of discount/premium to net

asset value at which the shares trade and movements in the

share register. A strategy meeting is held annually.

Discount Risk - the discount/premium at which the Company's

shares trade relative to its net asset value can change. The risk

of a widening discount is that it may undermine investor confidence

in the Company. The Board monitors the level of discount/ premium

at which the shares trade and the Company has authority to buyback

its existing shares, when deemed by the Board to be in the best

interests of the Company and its shareholders.

Legal and Regulatory Risk - failure to comply with applicable

legal and regulatory requirements such as, the tax rules applicable

to Guernsey domiciled investment funds, the laws and regulations

applicable in Guernsey, and the continuing obligations imposed on

all investment companies whose shares are admitted to trading on

the Specialist Fund Segment of the Main Market of the London Stock

Exchange could lead to suspension of trading in the Company's

shares on the Specialist Fund Segment of the Main Market of the

Stock Exchange, financial penalties, a qualified audit report or

the Company being subject to tax on capital gains. To mitigate this

risk, Baillie Gifford's Business Risk, Internal Audit and

Compliance Departments and Alter Domus; the Administrator,

Secretary and Designated Manager ('Administrator'); provide regular

reports to the Audit Committee on their monitoring programmes.

Major regulatory change could impose disproportionate compliance

burdens on the Company. Shareholder documents and announcements,

including the Company's published Interim and Annual Report and

Financial Statements, are subject to stringent review processes and

procedures are in place to ensure adherence to the Transparency

Directive and the Market Abuse Directive with reference to inside

information.

Custody and Depositary Risk - safe custody of the Company's

assets may be compromised through control failures by the

Depositary, including breaches of cyber security. To monitor

potential risk, the Audit Committee receives six monthly reports

from the Depositary confirming safe custody of the Company's assets

held by the Custodian. Cash and portfolio holdings are

independently reconciled to the Custodian's records by the

Investment Manager. The Custodian's audited internal controls

reports are reviewed by Baillie Gifford's Business Risk Department

and a summary of the key points is reported to the Audit Committee

and any concerns investigated.

Operational Risk - failure of Baillie Gifford's systems or those

of other third-party service providers could lead to an inability

to provide accurate reporting and monitoring or a misappropriation

of assets. To mitigate this risk, Baillie Gifford has a

comprehensive business continuity plan which facilitates continued

operation of the business in the event of a service disruption or

major disaster. The Audit Committee reviews Baillie Gifford's

Report on Internal Controls and the reports by other key

third-party providers are reviewed by Baillie Gifford on behalf of

the Board.

Political and Associated Economic Risk - the Board is of the

view that political change in areas in which the Company invests or

may invest may have practical consequences for the Company.

Political developments are closely monitored and considered by the

Board. The Board has noted the UK's departure from the European

Union on 31 January 2020. Whilst considerable uncertainty remains,

the Board will continue to monitor developments as they occur and

assess the potential consequences for the Company's future

activities.

The investment portfolio has global reach and is exposed to

external and emerging threats such as cyber risk and Coronavirus.

These risks are mitigated by the Investment Manager's close links

to investee companies and their ability to ask questions on

contingency plans. The Investment Manager believes the impact of

such events may be to slow growth rather than to invalidate the

investment rationale.

Baillie Gifford & Co Limited

9 April 2020

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACSILMFTMTMMBJM

(END) Dow Jones Newswires

April 09, 2020 12:05 ET (16:05 GMT)

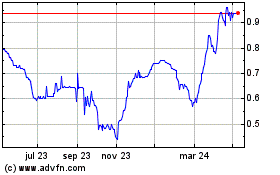

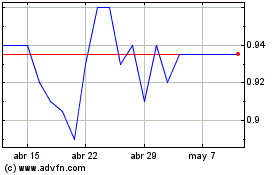

The Schiehallion (LSE:MNTN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

The Schiehallion (LSE:MNTN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024