TIDMBOR

RNS Number : 4656J

Borders & Southern Petroleum plc

14 April 2020

14 April 2020

Borders & Southern Petroleum plc

("Borders & Southern" or "the Company")

Audited Results for the 12 month period ended 31 December

2019

Borders & Southern (AIM: BOR), the London based independent

oil and gas exploration company with assets offshore the Falkland

Islands, announces its audited results for the year ending 31

December 2019. Full copies of the Company's Annual Report and

Accounts, including the Company Overview, Chairman's Statement,

Remuneration Committee Report, Directors' Report, Auditor's Report

and full Financial Statements, will be available shortly on the

Company's website and posted to Shareholders in May.

Highlights

-- Farm-out process remains active. Progress has been impacted

by current industry capital allocation constraints.

-- The Company's prospect inventory has been updated to include

additional smaller pools close to the Darwin discovery.

-- The loss before tax for the year was $1.37 million (2018: $1.96 million).

-- Cash Balance at 31 December 2019: $3.7 million (2018: $5.6 million).

-- Reduced administrative expense for the year: $1.45 million

(2018: $1.8 million). A 25% cost reduction target has been set for

2020.

For further information please visit www.bordersandsouthern.com

or contact:

Borders & Southern Petroleum plc

Howard Obee, Chief Executive

Tel: 020 7661 9348

Strand Hanson Limited (Nominated & Financial Adviser)

James Spinney / Ritchie Balmer / Georgia Langoulant

Tel: 020 7409 3494

Mirabaud Securities Limited (Broker)

Peter Krens

Tel: 020 7878 3362

Tavistock (Financial PR)

Simon Hudson / Nick Elwes / Barney Hayward

Tel: 020 7920 3150

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Notes to Editors:

Borders & Southern Petroleum plc is an oil & gas

exploration company listed on the London Stock Exchange AIM (BOR).

The Company operates and has a 100% interest in three Production

Licences in the South Falkland Basin covering an area of nearly

10,000 square kilometres. The Company has acquired 2,517 square

kilometres of 3D seismic and drilled two exploration wells, making

a significant gas condensate discovery with its first well.

Competent Person Disclosure:

The technical aspects of this announcement have been reviewed,

verified and approved by Dr Howard Obee in accordance with the

Guidance Note for Mining, Oil and Gas Companies, issued by the

London Stock Exchange in respect of AIM companies. Dr Obee is a

petroleum geologist with more than 30 year's relevant experience.

He is a Fellow of the Geological Society and member of the American

Association of Petroleum Geologists and the Petroleum Exploration

Society of Great Britain.

Chairman's and CEO's review

Our principal objective for 2019 was to secure funding for the

next phase of operations in the South Falkland Basin.

Unfortunately, the team has been frustrated by the slow progress,

largely due to factors outside of its control. The industry has

experienced significant constraints on capital availability during

the last five years. Smaller companies, such as ours, are finding

it particularly challenging to raise risk capital and attract

partners for large conventional offshore projects in frontier

areas. This issue has recently been exacerbated by the unknown and

unpredictable impact of the global Covid-19 pandemic and the

simultaneous over-supply of crude caused by lack of agreement on

production levels by OPEC+ countries. Oil prices have again fallen

below $30 per barrel and the outlook over the next 12 months

appears very challenging.

Nevertheless, history suggests oil prices will bounce back and

create conditions that will allow us to proceed with Darwin's

appraisal and development. Darwin represents an exciting

opportunity for all those involved, and we remain hopeful that we

can deliver success. Our confidence is based on very strong project

fundamentals. Darwin is a liquids-rich, gas condensate that has

been independently assessed to contain an un-risked recoverable

resource of over 450 million barrels of condensate and LPGs. The

reservoir is of high quality, the hydrocarbons have good mobility

and low contaminants, which means the development does not require

a large number of wells. In the attractive Falkland Islands fiscal

regime, project economics are particularly robust, even at lower

oil prices. Our current economic model suggests the project

break-even oil price is less than $35 per barrel which compares

favourably against many other global opportunities.

During this period of slow project headway, we have been

particularly conscious of our balance sheet strength. The Company

has always maintained strict financial discipline, with a low

overhead. But we have targeted a 25% reduction in Sterling

expenditures during 2020 (the majority of the Company's current

expenditures are in Sterling). Our cash balance at year-end was

$3.68 million (2018: $5.6 million). Administrative expense was

lower at $1.45 million (2018: $1.8 million), although some of the

reduction was due to exchange rate differences. We aim to keep our

overhead base cost low in order to ensure the Company is able to

continue along its path to monetise Darwin, post these

unprecedented times.

As part of our effort to continually enhance the sub-surface

technical aspects of the project, we have been assessing the

potential small pools of hydrocarbons not previously captured in

our assessment of Darwin or the near-field prospects. Detailed

mapping and evaluation of the 3D depth migrated seismic volume has

revealed a number of interesting amplitude anomalies adjacent to

Darwin. Individual leads have un-risked best estimate prospective

resource values of up to 17 million barrels. These would not

provide stand-alone targets, but might be able to be tied into a

development at a later stage. Detailed structural mapping and

evaluation of the area to the north of Darwin has highlighted a

number of small structural closures with strong amplitude anomalies

and small associated flat spots. These have potential un-risked

prospective resource volumes of up to 29 million barrels. Again,

these structures may not represent economic stand-alone targets,

but they offer us confidence that the hydrocarbon system is working

across a large area of the Aptian shelf.

Possibly the most interesting lead to emerge from the technical

work is the newly defined Stewart prospect, mapped on the more

recently generated 3D seismic inversion volume. Measuring

approximately 20 square kilometres, it occurs at the same

stratigraphic interval as near-field prospects Sulivan and Stokes.

The un-risked prospective resource estimate is 40 million barrels.

Whilst this is a relatively small volume, the target interval could

be tested by extending a Darwin West well approximately 385 metres

below the Darwin reservoir. The outcome would provide important

insights into the larger Sulivan (473 million barrels) and Stokes

(134 million barrels) prospects.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 December 2019

2019 2018

--------------------------------------------

$000 $000

-------------------------------------------- ------------- -------------

Administrative expenses (1,447) (1,802)

--------------------------------------------- ------------- -------------

Loss from operations (1,447) (1,802)

Finance income 88 29

Finance expense (11) (193)

Loss before tax (1,370) (1,966)

Tax expense - -

Loss for the year and total comprehensive

loss for the year attributable to equity

owners of the parent (1,370) (1,966)

--------------------------------------------- ------------- -------------

Basic and diluted loss per share (see note

3) (0.28) cents (0.41) cents

--------------------------------------------- ------------- -------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 31 December 2019

2019 2018

--------------------------- ------ --------- ------ ---------

$000 $000 $000 $000

--------------------------- ------ --------- ------ ---------

Assets

Non-current assets

Property, plant and

equipment 118 15

Intangible assets 291,765 291,367

---------------------------- ------ --------- ------ ---------

Total non-current

assets 291,883 291,382

---------------------------- ------ --------- ------ ---------

Current assets

Other receivables 233 260

Cash and cash equivalents 3,682 5,626

---------------------------- ------ --------- ------ ---------

Total current assets 3,915 5,886

---------------------------- ------ --------- ------ ---------

Total assets 295,798 297,268

---------------------------- ------ --------- ------ ---------

Liabilities

Current liabilities

Trade and other payables (235) (337)

---------------------------- ------ --------- ------ ---------

Total net assets 295,563 296,931

---------------------------- ------ --------- ------ ---------

Equity attributable

to the equity owners

of the parent company

Share capital 8,530 8,530

Share premium 308,602 308,602

Other reserves 1,777 1,775

Retained deficit (23,330) (21,960)

Foreign currency

reserve (16) (16)

---------------------------- ------ --------- ------ ---------

Total equity 295,563 296,931

---------------------------- ------ --------- ------ ---------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 31 December 2019

Foreign

Share Share Other Retained currency

capital premium reserves deficit reserve Total

$000 $000 $000 $000 $000 $000

------------------------------ --------- --------- ---------- --------- ---------- --------

Balance at 1 January 2018 8,530 308,602 1,773 (19,994) (16) 298,895

Loss and total comprehensive

loss for the year - - - (1,966) - (1,966)

Recognition of share-based

payments - - 2 - - 2

------------------------------ --------- --------- ---------- --------- ---------- --------

Balance at 31 December

2018 8,530 308,602 1,775 (21,960) (16) 296,931

Loss and total comprehensive

loss for the year - - - (1,370) - (1,370)

Recognition of share-based

payments - - 2 - - 2

------------------------------ --------- --------- ---------- --------- ---------- --------

Balance at 31 December

2019 8,530 308,602 1,777 (23,330) (16) 295,563

------------------------------ --------- --------- ---------- --------- ---------- --------

The following describes the nature and purpose of each reserve

within owners' equity:

Reserve Description and purpose

Share capital This represents the nominal value of shares

issued.

Share premium Amount subscribed for share capital in excess

of nominal value.

Other reserves Fair value of options issued, less transfers

to retained deficit on expiry.

Retained deficit Cumulative net gains and losses recognised

in the Consolidated Statement of Comprehensive

Income.

Foreign currency reserves Differences arising on change of presentation

and functional currency to US dollars.

CONSOLIDATED STATEMENT OF CASH FLOWS

For the year ended 31 December 2019

2019 2018

----------------

$000 $000 $000 $000

--------------------------------------- ------ -------- ------ --------

Cash flow from operating activities

Loss before tax (1,370) (1,966)

Adjustments for: Depreciation 92 1

Share-based payment 2 2

Finance costs 11 193

Finance income (88) (29)

Realised foreign exchange gains 27 21

---------------------------------------- ------ -------- ------ --------

Cash flows used in operating

activities before changes in

working capital (1,326) (1,778)

Decrease in other receivables 29 180

Decrease in trade and other payables (176) (296)

---------------------------------------- ------ -------- ------ --------

Net cash outflow from operating

activities (1,473) (1,894)

Cash flows used in investing

activities

Interest received 27 29

Purchase of intangible assets (398) (541)

Purchase of tangible fixed assets (11) (5)

Net cash used in investing activities (382) (517)

---------------------------------------- ------ -------- ------ --------

Cash flows from financing

Cash flows from financing activities

Lease interest (11) -

Lease repayments (112) -

(123) -

Net decrease in cash and cash

equivalents (1,978) (2,411)

---------------------------------------- ------ -------- ------ --------

Cash and cash equivalents at

the beginning of the year 5,626 8,251

Exchange (loss)/gain on cash

and cash equivalents 34 (214)

---------------------------------------- ------ -------- ------ --------

Cash and cash equivalents at

the end of the year 3,682 5,626

---------------------------------------- ------ -------- ------ --------

Notes

1. Accounting policies

Basis of preparation

The financial information for the year ended 31 December 2019

set out in this announcement does not constitute the Company's

statutory accounts. These financial statements included in the

announcement have been extracted from the Group annual financial

statements for the year ended 31 December 2019. The financial

statements have been prepared in accordance with the recognition

and measurement criteria of International Financial Reporting

Standards adopted for use in the European Union. However, this

announcement does not itself contain sufficient information to

comply with IFRS.

The auditor has issued its opinion on the Group's financial

statements for the year ended 31 December 2019 which is unmodified

and is available for inspection at the Company's registered address

and will be posted to the Group's website.

2. Going concern

The Directors are of the opinion that the Group has adequate

financial resources to enable it to undertake its planned programme

of exploration and appraisal activities for 2020.

3. Basic and dilutive loss per share

The calculation of the basic and dilutive loss per share is

based on the loss attributable to ordinary shareholders divided by

the weighted average number of shares in issue during the year. The

loss for the financial year for the group was $1.370 million (2018

- loss $1.966 million) and the weighted average number of shares in

issue for the year was 484.1 million (2018 - 484.1 million). During

the year the potential ordinary shares are anti-dilutive and

therefore diluted loss per share has not been calculated. At the

statement of financial position date, there were 6.1 million (2018

- 7.05 million) potentially dilutive ordinary shares being the

share options.

4. Subsequent Date Events

There were no subsequent date events requiring disclosure

-ends-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR UOUBRRVUSAAR

(END) Dow Jones Newswires

April 14, 2020 02:00 ET (06:00 GMT)

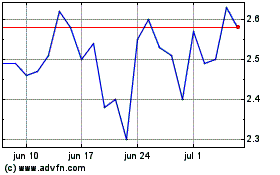

Borders & Southern Petro... (LSE:BOR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Borders & Southern Petro... (LSE:BOR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024