TIDMBIOM

RNS Number : 8026J

Biome Technologies PLC

16 April 2020

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 ("MAR")

16 April 2020

Biome Technologies plc

("Biome", "the Company" or "the Group")

Final Results 2019

Biome Technologies plc announces its audited Final Results for

the year ended 31 December 2019.

Highlights:

Final Results

-- A strong year for the Bioplastics division with reported

revenue growth of 81% over 2018 and enters 2020 with its strongest

pipeline of customer positions and prospects

-- Stanelco RF division revenues, as expected, returned to a

more normalised revenue level after the exceptional demand levels

experienced in 2018

-- Reported Group EBITDA loss of GBP0.5m (2018: EBITDA profit of

GBP0.6m), in line with expectations, with Group operating loss of

GBP1.0m (2018: profit of GBP0.1m)

-- Group cash position at 31 December 2019 was GBP2.1m (31 December 2018: GBP2.6m)

Covid-19 Update

-- The Group has been monitoring the impact of Covid-19 since

the outbreak began and is caring for its staff and customers and

adjusting its continuing commercial and manufacturing activities

accordingly

-- Bioplastics division is in a strong growth phase, with the

many market opportunities expected to grow this year in the food

and beverage sector, particularly in the USA and with new

opportunities continuing to emerge

o The Group is focussed on taking best advantage of these

opportunities although there may be supply chain disruption as well

as potential impact in demand for these products in the near

future

-- Stanelco RF division will be more adversely impacted than the

Bioplastics division. The large Stanelco RF customers are based in

China and India and there is an economic slowdown in these

territories in addition to pre-existing overcapacity in the optical

fibre market

o The Board believes Covid-19 will further delay any upturn in

orders for Stanelco RF's furnaces

-- The Board is implementing a number of measures to reduce the

Group's cost s and manage its cash-flow. These include:

o A voluntary 20% reduction in base sa lary for the Executive

Directors and Non-Executive Directors for a period of three months

from 1 May 2020

o Use of the UK Government 's "furlough scheme"

o Curtailment of any discretionary operational and capital

expenditure

-- Impact of Covid-19 on Biome during the first quarter of 2020

was limited, with trading in the quarter in line with management's

expectations at the time of the Group's trading update on 30

January 2020

-- As at 14 April 2020 the Group had a cash balance of GBP1.7m and no debt

Paul Mines, Chief Executive Officer said : "2019 saw an

encouraging performance from the Group's Bioplastics division in in

terms of revenue growth and a broadening of its customer and

product base. The demand for bioplastic packaging from the coffee

sector that underpins the division's revenues is showing resilience

in the current crisis. We will continue to work our cash resources

to maximise our ability to overcome the challenges posed by

Covid-19 and deliver good medium-term growth for shareholders"

- Ends -

For further information please contact: Biome

Technologies plc

Paul Mines, Chief Executive Officer

Declan Brown, Group Finance Director

www.biometechnologiesplc.com Tel: +44 (0) 2380 867

100

Allenby Capital

David Hart/Alex Brearley (Nominated Adviser)

Kelly Gardiner (Broker)

www.allenbycapital.com Tel: +44 (0) 20 3328

5656

About Biome

Biome Technologies plc is an AIM listed, growth-orientated,

commercially driven technology group. Our strategy is founded on

building market-leading positions based on patented technology and

serving international customers in valuable market sectors. We have

chosen to do this by developing products in application areas where

the value-added pricing can be justified and that are not reliant

on government legislation. These products are driven by customer

requirements and are compatible with existing manufacturing

processes. They are market rather than technology-led.

The Group comprises two divisions, Biome Bioplastics Limited and

Stanelco RF Technologies Limited. Biome Bioplastics is a leading

developer of highly-functional, bio-based and biodegradable

plastics. The company's mission is to produce bioplastics that

challenge the dominance of oil-based polymers. Stanelco RF

Technologies designs, builds and services advanced radio frequency

(RF) systems. Dielectric and induction heating products are at the

core of a product offering that ranges from portable sealing

devices to large furnaces for the fibre optics markets

www.biometechnologiesplc.com

www.biomebioplastics.com and www.thinkbioplastic.com

www.stanelcorftechnologies.com

Chairman's Statement

The Group's encouraging performance in 2019 was notable for the

improvement in the prospects and performance of the Bioplastics

division and the raising of GBP1.2m, net of costs, in new equity

funds in October to support its anticipated further growth.

The Bioplastics division, driven by a variety of new product

launches with both existing and new customers, increased reported

revenues substantially. Encouragingly, the trajectory of demand for

bioplastics in a number of markets inflected upwards significantly

during the year. The underlying drivers of this change in demand

are fundamental, being the development of a low carbon economy (in

response to climate change) and the better management of plastic

waste. Consumers and brands are changing their purchasing practices

with regard to plastics and there are early signs of legislative

response. The division entered 2020 with its strongest pipeline of

customer positions and prospects and continues to move towards

being the principal revenue generator within the Group.

As anticipated the Stanelco RF division returned to a more

normalised revenue level after the exceptional demand levels

experienced in 2018. The division's main source of income remains

the supply of furnaces to the fibre optic cable market. Whilst it

is clear that the medium-term prospects for this market are strong,

driven by the demand for 5G telecoms and internet connectivity, in

the short-term the Board believes that there will be over-capacity

and subdued demand for the capital goods that the division

manufactures.

The Group has been monitoring the impact of Covid-19 since the

outbreak began and is caring for its staff and customers and

adjusting its activities accordingly. Both divisions continue their

operations with staff working from home wherever possible. The

Stanelco RF division continues its manufacturing on a limited basis

and, in particular, is providing service support to medical and

energy sector customers in the UK. Manufacturing for the

Bioplastics division continues in line with customer demand in both

the USA and Europe with associated commercial and technical support

provided remotely from the UK.

Demand in early 2020 for both divisions was as expected with a

strong demand-pull from the bioplastics market. However, travel and

operating constraints are having an increasing effect. At this time

it is too early to predict with any confidence the likely overall

impact that there may be on the business from Covid-19. Biome

Technologies is a resilient business, bolstered by the additional

cash raised in October 2019 to support its growth plan. The Group

has a strong management team in place and has consistently

demonstrated that it can adapt and respond quickly to changing

market conditions.

The Board remains confident in its strategy and believes that

the Group is well positioned to benefit from the growth of the

global bioplastics market. Clearly, current conditions are evolving

fast and the Group will provide further updates as the situation

develops.

Results

Group reported revenues totalled GBP7.4m (which includes

government grant income of GBP0.4m (2018: GBP0.4m) recorded as

other operating income) compared with GBP8.9m in 2018, which was in

line with market expectations and reflects the significant increase

in the Bioplastics division revenues and subdued demand in the

Stanelco RF division. Gross margins at Group level (including

government grant income) were 47% (2018: 54%), largely as a result

of the change in mix of Group revenues towards the Bioplastics

division.

The Group's loss before interest, taxation, depreciation,

amortisation, and share option scheme charges ("EBITDA") was

GBP0.5m (2018: EBITDA profit of GBP0.6m), which is in line with

market expectations, with the Group also recording an operating

loss of GBP1.0m (2018: operating profit of GBP0.1m). The loss after

taxation was GBP0.9m (2018: profit after tax of GBP0.1m). The basic

loss per share in 2019 was 35 pence (2018: earnings per share of 6

pence).

The Bioplastics division's reported revenues, inclusive of

government grant income, increased substantially in the year to

GBP3.4m (2018: GBP1.9m) as a result of strong demand for its

existing products as well as sales of its newly launched products

in the year. The division recorded a reduced EBITDA loss for the

year of GBP0.3m (2018: EBITDA loss of GBP0.5m) as a result of the

increased revenue levels with some of this benefit being offset by

increased spend on research and development on novel

biotechnology-based materials (supported by government grants). The

resultant operating loss also reduced to GBP0.6m (2018: loss of

GBP0.8m).

The Stanelco RF division's revenues were GBP4.0m (2018: GBP7.0m)

as revenues reduced from the exceptionally high level of demand for

fibre optic furnaces in 2018. This division recorded an EBITDA

profit for the year of GBP1.2m (2018: GBP2.7m). Operating profit

also reduced, reflecting the lower revenue levels, to GBP1.1m

(2018: GBP2.6m).

The Group's cash balances at 31 December 2019 were GBP2.1m (31

December 2018: GBP2.6m). Working capital levels increased year on

year as the Bioplastics division's revenues increased requiring

additional stocks as well as increased receivables balances. Within

the Stanelco RF division there was a working capital outflow as a

result of the unwinding of customer deposits from the previous year

during the first quarter of 2019.

The Group successfully raised GBP1.2m of equity, net of costs,

during the year to support the growth, and increased working

capital requirements, in the Bioplastics division. Capitalised

investment in product development was GBP0.3m (2018: GBP0.3m).

Markets

The Bioplastics division continues to see increasing demand,

predominantly in overseas markets, in the conversion of end

products from traditional petro-chemical based persistent materials

to bio-based and biodegradable alternatives. Whilst the price

differential between the two options remains, adoption will

continue to be driven by markets which have the clearest consumer

focus, such as single use packaging. It should be noted that the

division is seeing the greatest adoption of its products in the US

although increasing demand is also appearing across Europe and the

UK. As such markets grow, metrics to better dimension them are

emerging with indications that a number of the main markets have

doubled over the last 12-18 months. The division continues to focus

its efforts on supplying solutions to specific customer

requirements rather than the larger, but lower margin, volume

market. Varied short-term impacts from the Covid-19 crisis are

emerging. Enhanced demand is being seen from the division's long

standing customers serving the on-line food and drink market

(particularly coffee). Reduced demand is apparent from those

serving the restaurant sector and those in the early stages of new

product deployment. Robust revenue growth is anticipated to

continue in this division in the medium term.

The Stanelco RF division's principal products and revenues are

derived from the production and maintenance of furnaces for the

manufacture of fibre optical cable. During 2018 there was an

exceptional level of capacity expansion by the division's customers

resulting in the previously announced exceptional revenue levels in

that year. 2019 saw a return to a more normalised level of furnaces

delivered. Market intelligence currently indicates that there is

over capacity in the fibre optic cable market and therefore it is

anticipated that the number of fibre optic furnaces sold in 2020

will reduce further. Whilst an upturn in fibre optic cable demand

had been envisaged for the end of 2020 into 2021, this is likely to

be delayed given current global circumstances. The division is also

continuing to explore other markets which can utilise its expertise

in induction heating.

The Group is also monitoring the potential downside associated

with the UK not concluding a trade arrangement with the European

Union at the end of this year. However, this is not deemed to be a

significant risk for the Group as the majority of the Bioplastics

products that are sourced within the European Union are either sold

locally into the continental European market or exported directly

to the North American market. Within the Stanelco RF division, its

products are generally bespoke with a lead time of over a month and

therefore tariffs or customs delays can be incorporated into the

sales contract.

Strategy

The Group's strategy is to build a leading position in its

chosen markets. Products have been developed in both divisions

which are focussed closely on customer requirements and where the

Group feels it has commercial and technical edge. Development work

is focussed on areas where it is believed that there is the

potential for us to be the supplier of choice and where the Group

can achieve satisfactory returns.

The Group has just completed its second year of the three

covered by high-level Key Performance Indicators (KPIs) that the

Board adopted for the period 2018 to the end of 2020. These KPIs

were set with attainment at the end of a three-year horizon being

as important as year by year performance.

The KPI's status as at the end of year two is:

-- KPI: Compound Group reported revenue growth (including

government grant income) of 25% per annum across the Group and 40%

compound reported revenue growth in the Bioplastics division.

In 2019 neither the Group or the Bioplastics division met this

target although the Bioplastics division exceeded this level of

growth within the year.

-- KPI: Diversify the Group's reported revenues by product and

market to ensure that no one product or end customer contributes

more than 15% of revenues by the end of 2020.

Good progress towards achieving this KPI has been made. In 2019

only two customers had more than 15% of Group reported revenues,

one in each of the Bioplastics and Stanelco RF divisions, with each

accounting for approximately 17% of Group revenues.

-- KPI: Increase investment in the Group's next generation of

products by spending significantly more per annum on average than

the GBP0.3m per annum average spend over the previous strategic

objective cycle.

The Group met this target in 2019 with GBP1.0m spent in the year

of which GBP0.4m was spent on developing its near-term product

pipeline plus an additional GBP0.6m on its medium-term Industrial

Biotechnology programme (funded in part by GBP0.4m of government

grants).

Given the impact of the Covid-19 virus, the Board will reset the

KPI time horizon to a four-year period (rather than the current

three years) which will cover the period to the end of 2021. Future

reporting will be adjusted accordingly.

Biome Bioplastics

The Bioplastics division had a very encouraging year with a

mixture of strong demand for its existing product line plus new

product launches resulting in reported revenues increasing by 81%

year on year (including government grant income).

The increase in reported revenues has come from a number of new

market opportunities mainly in the US market. The projects

commercialising in the year have included the rigid ring to

complete the coffee pod offering plus a biodegradable pod for the

nutrition market. Revenues have also increased within both the UK

and Europe although this is relatively minor compared to the

increase in revenues to the US.

The division's medium-term research activities in Industrial

Biotechnology continued in the year focussing on the development of

a new range of performance polymers with properties which are

expected to improve the existing generation of products. This work,

which is supported by government grants, is based on the use of

advanced Industrial Biotechnology techniques to form polymers from

waste bi-products. Two of the government grant-backed projects

successfully concluded in the year and further grants are being

sought to continue this work. These polymers are subject to patent

applications.

Stanelco RF Technology

The Stanelco RF division saw a predicted lower level of activity

from the exceptional year it had in 2018. The excess capacity in

the fibre optic cable market is taking longer than anticipated to

unwind as growth has faltered, and therefore a lower level of

demand for the division's fibre optic furnaces is expected to

continue into 2020. It should be noted, however, that the division

still remained cash positive.

The Stanelco RF division remains committed to a strategy to sell

products that complement its expertise outside the furnace market

and a number of other end use markets are being explored to

diversify away from the cyclical fibre optic furnace market.

Board and Personnel Changes

As announced in January 2020, Declan Brown, Group Finance

Director, has decided to step down from the Board and leave the

Company at the end of April to pursue a new challenge. He has

helped the Company enormously over the last six years, particularly

in setting in place the foundations for the Bioplastics business.

The Board wishes him well.

David Hughes will join the business as a non-main Board Interim

Finance Director in mid-April. David is a chartered accountant who

qualified with KPMG. He spent his early career as a CFO in large

corporates such as Simon Engineering, ABB, Calor Gas both in the UK

and internationally. He has spent the last 15 years as CFO/COO in a

variety of PE-backed businesses including specific experience in

both the engineering and biotechnology sectors. The Board looks

forward to his contribution.

Also, during the year, Sally Morley, previously Commercial

Director for the Bioplastics division, was promoted to Managing

Director of the division. This promotion has been combined with the

strengthening of the Bioplastics team as it looks to service the

current, and anticipated growth curve of the business.

Outlook

It is apparent to the Board that Covid-19, with the resultant

restrictive social and travel practices and associated economic

impact is having an impact on the operations of the Group. It is

too early at this stage to be confident in trying to make any

accurate overall forecasts of the impact that Covid-19 will have,

for example, on employees, customers or growth. However, we will do

our utmost to keep shareholders abreast of developments and any

unanticipated further impact on the Group.

We are implementing a number of measures to reduce the Group's

costs and manage its cash-flow in this period. These include a

voluntary 20% reduction in base salary for the Executive Directors

and Non-Executive Directors for a period of three months from 1 May

2020, use of the UK Government's "furlough scheme" and curtailment

of any discretionary operational and capital expenditure. These and

other potential actions are being reviewed on a regular basis.

Consideration is also being given to other relevant UK Government

business support schemes.

We believe that the Bioplastics division is in a strong growth

phase, with the many market opportunities we have already forecast

to grow this year in the food and beverage sector, and with new

opportunities continuing to emerge. We are focussed on taking best

advantage of these opportunities although there may be supply chain

disruption as well as potential impact in demand for these products

in the forthcoming period. In contrast, the Stanelco RF division

will be more adversely impacted than the Bioplastics division. The

large Stanelco RF customers are based in China and India and

reference has already been made to the slowdown in these

territories and the overcapacity in the optical fibre market. We

believe Covid-19 will further delay any upturn in orders for

Stanelco RF's furnaces. We have adjusted our expectations for the

Group accordingly.

Given the lead times to which the Company's divisions operate,

the impact of Covid-19 on Biome during the first quarter of the

financial year was limited, with trading in the quarter in line

with management's expectations at the time of the Group's trading

update on 30 January 2020. A full trading update for the first

quarter will be made on 22 April 2020, in line with Company's usual

reporting timetable.

We will continue to work our cash resources to maximise our

ability to overcome the challenges posed by Covid-19 and deliver

good medium-term growth for shareholders.

John Standen

Chairman

Strategic Report

Biome Technologies plc is a growth orientated, commercially

driven technology group. Its strategy is founded on building

market-leading positions based on patented technology and serving

international customers in the biodegradable plastics and radio

frequency heating sectors. We have chosen to do this by developing

products in application areas where value-added pricing can be

justified and that are not reliant on government legislation. These

products are driven by customer requirements and are compatible

with existing manufacturing processes. They are market rather than

technology led.

The directors consider its shareholders, employees, customers

and suppliers as its key stakeholders and the divisional analysis

below outlines the strategies that have been adopted to promote the

success of the Group and to meet its objectives.

Biome Bioplastics Division

Reported revenues in the Bioplastics division (inclusive of

government grant income of GBP0.4m (2018: GBP0.4m) recorded as

within other operating income) increased to GBP3.4m (2018:

GBP1.9m). This increase in reported revenues, relating to existing

products as well as new product launches, reflects the increased

activity and enquiry levels that currently exist both in the

Bioplastics division and also the wider market. Staffing levels

were adjusted accordingly to accommodate this increased activity,

which is anticipated to maintain its upward trajectory over the

coming years. The net effect of the increase in revenues was to

decrease the division's operating loss to GBP0.6m (2018: loss of

GBP0.8m).

Markets

Plastic waste has remained a key topic for the environment both

in the UK and overseas. Whilst public opinion in the UK has

continued to focus on this area there is still a continuing debate

as to how to combat this problem. As such the UK market remains a

smaller part of the Bioplastics division's short-term focus with

the more immediate sales opportunities and growth being in the US

market.

Cost and functionality will remain key hurdles over the wide

spread adoption of bioplastics over petro-chemical plastics.

Current adoption is therefore driven by consumer pull, and their

willingness to pay a premium for biodegradability/compostability,

or government legislation. To overcome these hurdles the

Bioplastics division focuses on areas of the market where there is

a high technical performance requirement, the cost of the

biomaterial is a small fraction of the end product price, and where

there is a consumer willingness to convert to a biodegradable

material.

Research and development within the Bioplastics division is

therefore focussed on these three areas and in particular targeted

towards customer requirements for a biodegradable solution. The

commercial lifecycle of our products can be categorised in the

following stages of the product lifecycle:

-- Research phase - technology and product development occurring

within Biome's own laboratories or at external support

facilities

-- Development phase - the product is being developed and tested

with small scale supplies to customers for end use testing

-- Initial manufacturing phase - the product is signed off by

the customer as suitable for its requirements and is now undergoing

significant long-term testing to ensure the end product can be run

in commercial quantities across the supply chain

-- Commercial phase - the product has been through the above

phases with the customer and is now achieving regular and

significant sales with the end product being purchased and used by

the final consumer

Technical Development

Biome Bioplastic's development work remains focussed on

innovative developments where there is a customer requirement for

the product and a willingness to pay a premium for the

environmental attributes. During 2019, the development team

commercialised three new products, including the rigid ring for the

coffee pod offering and also a pod for the nutritional supplements

market. Initial sales of these products commenced during 2019 and

it is anticipated that sales in these products will grow throughout

2020.

The Bioplastics division also continued its work in medium term

Industrial Biotechnology research into the transformation of

lignocellulose (often sourced from agricultural waste) into low

cost bioplastics using microbial and enzymatic routes. If

successful, it is anticipated that this work will result in

bioplastics at a cost comparable to current petro-based plastics

which has the potential to transform the demand for bioplastics.

This development work is supported by a number of research grants

with research expenditure, both in terms of headcount and other

sub-contracting and materials costs, increased in the year as two

of the projects reach their conclusion and work is transferred from

the universities. Patent applications have been made to support the

materials and technology under development.

Stanelco RF Technologies Division

The Stanelco RF division is a specialist engineering business

focused on the design and manufacture of electrical/electronic

systems based on advanced radio frequency technology.

The division's core offering is the supply of fibre optic

furnaces, although the business is also exploring other markets

where its expertise in induction heating can be utilised. Total

revenues in 2019 of GBP4.0m were lower than the prior year (2018:

GBP7.0m) due to the previously reported exceptional demand

experienced in the prior year. Operating profit for the period was

GBP1.1m (2018: GBP2.6m).

The business currently focuses on four key revenue streams:

Optical Fibre Furnace Systems

The Stanelco RF division is a world leader in the design and

manufacture of induction furnace systems used in the manufacture

and processing of silica glass "preforms" to produce optical fibre.

Each system is bespoke to customers' exact requirements. There is

currently a reported imbalance in the global demand for optical

fibre compared to the installed capacity base. Whilst this

overcapacity is expected to reverse in the medium term the Group

anticipates that there will be a lower level of demand for fibre

optic furnaces in 2020.

Plastic Welding Equipment

These units are used in a multitude of end-user applications

including the nuclear, medical and industrial sectors. The

equipment is provided in either hand-held, mobile or fully

automated static solutions, dependent on customers'

requirements.

Induction Heating Equipment

The division sells bespoke induction heating equipment into

other market sectors. Whilst this is a small part of the division's

sales it is a strategic aim to increase the equipment offering of

the division into other markets.

Service and Spares

The business continues to support its large installed equipment

base through the provision of maintenance support, system upgrades

and specialist spares across the globe.

Principal risks and uncertainties

The business is subject to a number of risks. The Directors have

set out below the principal risks facing the business. The

Directors continually review the risks identified below and, where

possible, processes are in place to monitor or mitigate all of

these risks.

Covid-19

The potential impact of this virus is evolving. The Group

operates on a global level and is exposed to potential restrictions

in the supply of raw materials, lower customer demand, and

production ceasing due to either travel restrictions or employees

being infected by the virus. This would have consequential

implications to the Group results and its cash balances.

Whilst it is impossible to plan for every possible scenario the

Group has looked to protect the effectiveness of its workforce by

minimising, where possible, the interaction of members of teams

performing similar tasks, remote working and restricting

travel.

The Group also has a flexible overhead base which will enable it

to adapt and flex operations as this highly uncertain event across

the globe unfolds.

Brexit

There still remains a risk that the UK will leave the European

Union without a 'deal' or with less than optimal arrangements in

place, which could lead to short term turmoil and uncertainty in

the ability to import and export goods between the UK and European

Union and uncertainty as to the rights of employees within the

Group who originate from the European Union.

The majority of the Bioplastics products that are produced in

the European Union are sold either locally into the continental

European market or exported directly to the US market. Deliveries

of these goods are not therefore transported through the UK and

therefore import and export delays are not considered a significant

risk for the division.

The Stanelco RF division focusses on bespoke equipment which is

designed to the customers' specification. These items have a lead

time of over a month and therefore there is the ability to

incorporate increased time required to export to the European Union

if required.

The Group employs a number of European Union nationals and is

providing assistance to them in applying to the EU Settlement

Scheme in order to secure their employment eligibility and rights

post the UK's exit from the European Union.

Political, economic and regulatory environment

The Group is subject to political, economic and regulatory

factors in the various countries in which it operates. There may be

a change in government regulation or policies which materially

and/or adversely affect the Group's ability to successfully

implement its strategy. The Directors aim to focus their product

range on areas where demand is not reliant on government

regulation.

The Group exports the majority of its products and therefore

fluctuations in exchange rates may affect product demand in

different regions and may adversely affect the profitability of

products provided by the Group in foreign markets where payment is

made for the Group's products in local currency.

The Directors are informed regularly of the potential impact of

exchange rate movements on the business and act to mitigate any

adverse movements wherever possible. In order to mitigate the

medium term impact of any adverse exchange rate movements, the

Group will look to move production and match the currency of its

input costs with those of the contractual selling price thereby

reducing the currency movement risk to the gross margin of the

product.

The Group's products and manufacturing processes utilise a

number of raw materials and other commodities. In particular the

Bioplastics division requires a few, key raw materials to

manufacture its biodegradable polymer resins. There are very few

suppliers of these key raw materials and with the current increased

demand for biodegradable products there is a risk that the division

may not be able to purchase the required volumes of materials to

meet customer demand or that prices may be increased at short

notice. To try and mitigate this risk the division is seeking to

validate new materials coming onto the market which may be used in

substitution.

Some of the Group's products are employed in the food and

pharmaceutical industries, both of which are highly regulated.

There is a risk that the Group may lose contracts or be subject to

fines or penalties for any non-compliance with the relevant

industry regulations. The Group ensures its staff are well versed

in the regulatory environment of its end-use industries and

regularly reviews its product portfolio to ensure compliance with

relevant regulations.

Intellectual property

Although the Group attempts to protect its intellectual

property, there is a risk that patents will not be issued with

respect to applications now pending. Furthermore, there is a risk

that patents granted or licensed to Group companies may not be

sufficiently broad in their scope to provide protection against

other third party technologies. The Group takes professional advice

from experienced patent attorneys and works hard to win patents

applied for and to ensure that the scope is sufficiently broad.

Other companies are actively engaged in the development of

bioplastics. There is a risk that these companies may have applied

for (or been granted) patents which impinge on the areas of

activity of the Group. This could prevent the Group from carrying

out certain activities or, if the Group manufactures products which

breach (or may appear to breach) such patents there is a risk that

the Group could become involved in litigation which could be costly

and protracted and ultimately be liable for damages if the breach

is proven.

The Group keeps up-to-date with its competitors' product

developments and patent portfolios and aims to ensure that no

infringements occur. Professional advice is sought from experienced

patent attorneys if there are any concerns.

Competition

There is a risk that competitors may be able to develop products

and services that are more attractive to customers, either through

price or technical performance, than the Group's products and

services.

The Group aims to be ahead of the competition through working

closely with customers to produce products that meet their exact

requirements rather than offering "off the shelf" solutions.

Commercialisation of new products

There is a risk that the Group will not be successful in the

commercialisation of its products from early-stage research and

development to full-scale commercial sales. The Group develops a

number of products and some may not prove to be successful.

Specifically, the risks associated with the product life cycle are

as follows:

-- Research and Development phase - the development of the

products may prove not to be technically feasible or do not exactly

match the perceived customer need

-- Initial manufacturing phase - whilst the product matches the

customer needs it may not be able to be produced at the required

commercial speeds and/or at the required efficiency and quality

-- Commercialisation phase - the product may be superseded

either through price or a competitor product being more

advanced

The Directors ensure that regular reviews of product development

are undertaken so that unsuccessful developments can be terminated

early in their life cycle. Impairment testing of the capitalised

costs is performed twice a year with any impaired capitalised costs

written off.

Customers

The Group's ability to generate revenues for a number of its

products is reliant on a small number of customers. If one of these

customers was to significantly reduce its orders, then this could

have a significant impact on the Group's results.

The Group works closely with its customers with the aim of

ensuring that its products evolve in line with their requirements.

In addition, the Group is continually seeking to add to its

customer base and, as its revenues grow, seeks to become less

dependent on any single customer.

Suppliers and Raw Materials

The Group is reliant on a few key suppliers to manufacture its

products. If one of these was to cease supplying the market or

demand for these key products exceeding supply then this could have

a significant impact on the Group's ability to fulfil its orders

and achieve its strategic aims.

The Group is constantly testing and seeking alternative

suppliers of raw materials to reduce its reliance on a small number

of key suppliers.

Financial review

The KPIs which the Board uses to assess the performance of the

Group are detailed in the Chairman's Statement. The Chairman's

statement forms part of the Strategic Report.

The summary results for the Group are shown below.

2019 2018 Growth

GBP'm GBP'm

LIKE-FOR-LIKE COMPARISONS

Revenues

Biome Bioplastics

- Revenues 3.0 1.5

- Grant income (Other operating

income) 0.4 0.4

-------- --------

3.4 1.9 81%

Stanelco RF 4.0 7.0 (43%)

Reported Group revenues 7.4 8.9 (16%)

======== ========

EBITDA

Biome Bioplastics (0.3) (0.5)

Stanelco RF 1.2 2.7

Central costs (1.4) (1.6)

Reported EBITDA (0.5) 0.6

Less depreciation, amortisation

and equity share option charges:

Biome Bioplastics (0.3) (0.3)

Stanelco RF (0.1) (0.1)

Central costs (0.1) (0.1)

-------- --------

(0.5) (0.5)

(Loss)/profit from Operations

Biome Bioplastics (0.6) (0.8)

RF Technologies 1.1 2.6

Central Costs (1.5) (1.7)

-------- --------

Like for Like Operating Profit/(loss) (1.0) 0.1

Non-current assets 1.5 1.1

Inventories 0.6 1.0

Trade and other receivables 1.9 0.9

Cash 2.1 2.6

Trade and other payables (1.5) (1.8)

Long term lease commitments (0.4) -

Net assets 4.2 3.8

======== ========

Revenues

Reported Group revenues, including grant income included as

other operating income, decreased in the year to GBP7.4m from

GBP8.9m due to the return to a more normalised level of Stanelco RF

revenues which have almost been offset by significant increases in

revenues within the Bioplastics division.

A reclassification has been made to both 2019 and the 2018 prior

year comparative in the consolidated income statement to move

government grant income from revenues to other operating income.

This is purely to present the classification of this income in

accordance with the requirements of IAS 20 (Accounting for

Government Grants).

EBITDA

Reported EBITDA for the year was a loss of GBP0.5m (2018: profit

of GBP0.6m). This reduction in EBITDA is a direct result of the

lower revenues in the Stanelco RF division. This has been slightly

offset by increases in revenues in the Bioplastics division as well

as reduced overhead costs.

Operating profits/(losses)

The Group recorded an operating loss for the year of GBP1.0m

compared to an operating profit of GBP0.1m in the prior year.

Administrative costs across the Group in 2019 were GBP4.5m

(2018: GBP4.7m). When the non-cash effects of depreciation,

amortisation and equity settled share option charges are removed,

the cash administrative expenses in 2019 decreased to GBP4.0m

compared to prior year (2018: GBP4.2m). This decrease in expenses

is mainly attributable to a decrease within the Stanelco RF

division, as costs were scaled back as a result of the lower

activity levels, and also lower incentive scheme costs within

central costs. These cost savings were partially offset by an

increase in spend in the grant backed Industrial Biotechnology

research work.

The Group also adopted IFRS 16, the new accounting standard for

leases using the modified retrospective approach. After a review of

the lease obligations the Group concluded that only two car leases

required opening adjustments. No other opening adjustments were

required as all the other leases had either less than twelve months

to expiry or were of low value. The Group has, however, signed a

new property lease on 11 March 2020 which has been back dated to

the expiry of the old lease on 11 October 2019 and this lease has

been brought onto the statement of financial position as at the

year end as a right-of-use asset. The total value of right-of-use

assets brought onto the statement of financial position in the year

amounted to GBP0.5m with a corresponding lease liability recorded

also.

Investment in product research and development was GBP1.1m in

the year (2018: GBP0.9m), which includes the research work in the

grant backed Industrial Biotechnology, of which GBP0.3m (2018:

GBP0.3m) was capitalised in the year. Tax R&D claims resulted

in a credit being received in the year of GBP0.1m (2018: credit of

GBP0.1m).

The Group recorded a loss after tax for the year of GBP0.9m

(2018: profit after tax of GBP0.1m), giving a basic loss per share

of 35p (2018: earnings per share of 6p).

Statement of financial position

The carrying value of intangible assets relate to capitalised

development costs predominantly within the Biome Bioplastics

division for development of the Group's own intellectual property

and product range.

As at 31 December 2019, there was GBP0.9m of capitalised

development costs (2018: GBP0.9m) within the Group's statement of

financial position, of which GBP0.5m relates to BiomeMesh. An

assessment is made at least annually which assumes future potential

market take up of the products and the margins achievable.

Cashflow

2019 2018

GBP'm GBP'm

Cashflow

(Loss)/profit from operations (1.0) 0.1

Adjustment for non-cash items 0.5 0.6

Movement in working capital (1.1) -

Cash (utilised)/generated by operations (1.6) 0.7

Investment activities (0.3) (0.4)

R&D Tax credit 0.2 -

Financing activities 1.2 -

Net (decrease)/increase in cash (0.5) 0.3

Opening cash balance 2.6 2.3

Closing cash balance 2.1 2.6

The cash utilised from operations, before working capital

movements, was GBP0.5m (2018: cash generation of GBP0.7m) mainly

reflecting the decrease in performance within the Stanelco RF

division compared to the prior year. Working capital movements

reflected the increases in working capital required in the

Bioplastics division as its revenues increased significantly as

well as the unwind of customer deposits in place for the Stanelco

RF division at the beginning of the year. As a result, the cash

utilised by operations during 2019 was GBP1.6m (2018: cash

generated GBP0.7m).

Investment in the year in capitalised product development and

capex (excluding the effect of IFRS 16) was GBP0.3m (2018:

GBP0.4m). The effect of the adoption of IFRS 16 (Leases) resulted

in the new property lease for the main building being brought onto

the statement of financial position as at 31 December 2019. This

also had the effect of increasing capex and the resultant liability

in financing activities by GBP0.5m. Also included in financing

activities for 2019 was the placement of new shares in the Company

raising GBP1.2m net of costs. R&D tax credits received in 2019

and were GBP0.2m (2018: nil).

The resultant closing cash position was GBP2.1m (2018:

GBP2.6m).

Going concern

The Directors have prepared forecasts for the period of 12

months following the approval of the accounts, which have been

drawn up with appropriate regard for the current macroeconomic

environment, including the current Covid-19 situation, the impact

of Brexit at the end of the year, and the circumstances in which

the Group operates. These were prepared with reference to the

forward order book, prospects and repeat business within the

Stanelco RF division, and the existing base business and

anticipated increased volume from new products within the

Bioplastics division. In particular the directors have put

considerable focus on the potential impacts that the evolving

Covid-19 situation may have on the Group's operations and

performance, including potential delays to projected orders,

product development, supply chain, operational capacity, and access

to further development capital.

As mentioned in the Chairman's Statement the Board believes that

the Covid-19 situation will have a more severe impact on the

Stanelco RF division than that of the Bioplastics division. A

number of scenarios have been modelled which assume limited sales

for a three-month and six-month period as well as reverse stress

testing using a worse case scenario where there are no sales for a

protracted period running into quarter one of 2021. Our use of

three months as one of the scenarios uses the experience of China,

now experiencing a return to near normality following a twelve week

period and also six months based on a continuation of the current

situation, the Group's exposure to international markets and a

longer timeframe before a return to normality. These scenarios have

been combined with various cost cutting measures, including use of

the government furlough scheme, to mitigate some of these

downsides. Whilst there are multiple uncertainties associated with

the evolving Covid-19 situation in determining the appropriateness

of the going concern assumption the directors believe that, given

the flexibility in the overhead base, the Group's cash resources

should be sufficient to operate for a period of twelve months from

the date of approval of the accounts. The Group successfully raised

GBP1.2m net of expenses in October 2019 and as at 14 April 2020 has

cash balances of GBP1.7m.

As a result of this process, at the time of approving the

financial statements, the Directors consider that the Company and

the Group have sufficient resources to continue in operational

existence for the foreseeable future, and accordingly, that it is

appropriate to adopt the going concern basis in the preparation of

the financial statements.

By order of the Board.

Paul Mines

Chief Executive Officer

CONSOLIDATED STATEMENT

OF COMPREHENSIVE INCOME

For the year ended 31 December 2019

2019 2018

Total

Total Restated*

----------------------------------------- --------- -------- ----------

Note GBP'000 GBP'000

----------------------------------------- --------- -------- ----------

REVENUE 4a - 4c 6,957 8,459

Cost of sales (3,933) (4,042)

GROSS PROFIT 3,024 4,417

Other operating income 436 391

Administrative expenses (4,480) (4,745)

4a - 4c,

PROFIT/(LOSS) FROM OPERATIONS 5 (1,020) 63

Investment revenue 6 4

Finance charges (9) -

Foreign exchange (loss)/gain - 17

PROFIT/(LOSS) BEFORE TAXATION (1,023) 84

Taxation/ 6 146 59

PROFIT/(LOSS) AND TOTAL COMPREHENSIVE

INCOME FOR THE YEAR (877) 143

======== ==========

Basic earnings/(loss) per share - pence 7 (35) 6

Diluted earnings/(loss) per share -

pence 7 (35) 5

======== ==========

* See note 4a

CONSOLIDATED STATEMENT

OF FINANCIAL POSITION

As at 31 December 2019

2019 2018

Restated*

Note GBP'000 GBP'000

--------------------------------------- ----- -------- ----------

NON-CURRENT ASSETS

Other intangible assets 8 883 918

Property, plant and equipment 9 653 185

-------- ----------

1,536 1,103

-------- ----------

CURRENT ASSETS

Inventories 10 555 955

Trade and other receivables 1,885 873

Cash and cash equivalents 2,126 2,614

-------- ----------

4,566 4,442

-------- ----------

TOTAL ASSETS 6,102 5,545

======== ==========

CURRENT LIABILITIES

Trade and other payables 11 1,381 1,792

Lease liabilities 12 76 -

1,457 1,792

-------- ----------

NON-CURRENT LIABILITIES

Lease liabilities 12 438 -

-------- ----------

438 -

-------- ----------

TOTAL LIABILITIES 1,895 1,792

======== ==========

NET ASSETS 4,207 3,753

======== ==========

EQUITY

Share capital 140 118

Share premium account 1,250 77

Capital redemption reserve 4 4

Share options reserve 377 316

Translation reserve (85) (85)

Retained profits/(losses) 2,521 3,323

EQUITY ATTRIBUTABLE TO EQUITY HOLDERS

OF THE PARENT AND TOTAL EQUITY 4,207 3,753

======== ==========

* See note 4a

The financial statements were approved by the Board on 15 April

2020.

Signed on behalf of the Board of Directors

Paul Mines (Chief Executive)

Declan Brown (Group Finance Director)

15 April 2020

CONOLIDATED STATEMENT

OF CHANGES IN EQUITY

As at 31 December 2019

Share Capital Share

Share premium Redemption options Translation Retained TOTAL

capital account Reserve reserve reserves earnings EQUITY

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 January

2019 118 77 4 316 (85) 3,323 3,753

========= ========= ============ ========= ============ ========== ========

Share options charges

in year - - - 136 - - 136

Issue of share

capital 22 1,173 - - - - 1,195

Cancellation of

expired share options - - - (75) - 75 -

Transactions with

owners 22 1,173 - 61 - 75 1,331

--------- --------- ------------ --------- ------------ ---------- --------

Loss for the year - - - - - (877) (877)

Total comprehensive

income for the

year - - - - - (877) (877)

--------- --------- ------------ --------- ------------ ---------- --------

Balance 31 December

2019 140 1,250 4 377 (85) 2,521 4,207

========= ========= ============ ========= ============ ========== ========

Balance at 1 January

2018* 117 12 4 219 (85) 3,070 3,337

==== === ====== ===== ====== ======

Share options charges

in year - - - 218 - - 218

Issue of share

capital 1 54 - - - - 55

Exercise of share

options - 11 - (11) - - -

Cancellation of

expired share options - - - (110) - 110 -

Transactions with

owners 1 65 - 97 - 110 273

---- --- ------ ----- ------ ------

Profit for the

year - - - - - 143 143

Total comprehensive

income for the

year - - - - - 143 143

---- --- ------ ----- ------ ------

Balance 31 December

2018* 118 77 4 316 (85) 3,323 3,753

==== === ====== ===== ====== ======

* See note 4a

CONSOLIDATED STATEMENT

OF CASH FLOWS

For the year ended 31 December 2019

2019 2018

GBP'000 GBP'000

------------------------------------------- -------- --------

(Loss)/profit from operations (1,020) 63

Adjustment for:

Amortisation and impairment of intangible

assets 317 290

Depreciation of property, plant and

equipment 77 57

Share based payments 136 218

Foreign exchange 9 16

-------- --------

Cash generated before movement in

working capital (481) 644

Decrease/(increase) in inventories 400 (158)

(Increase)/decrease in receivables (1,087) 521

(Decrease)/increase in payables (405) (277)

-------- --------

Cash utilised by operations (1,573) 730

Corporation tax received 205 -

Interest paid (2) -

-------- --------

Net cash inflow from operating activities (1,370) 730

-------- --------

Cash flows from investing activities

Interest received 6 4

Investment in intangible assets (282) (293)

Purchase of property, plant and equipment (27) (120)

-------- --------

Net cash used in investing activities (303) (409)

-------- --------

Financing activities

Proceeds of issue of ordinary share

capital 1,300 -

Costs of issue of ordinary share

capital (104) -

Repayment of obligations under leasing

activities (11) -

-------- --------

1,185 -

-------- --------

Net increase/(decrease) in cash and

cash equivalents (488) 321

Cash and cash equivalents at beginning

of year 2,614 2,293

Effect of foreign exchange rate changes - -

-------- --------

Cash and cash equivalents at end

of year 2,126 2,614

======== ========

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2019

1. NON-STATUTORY FINANCIAL STATEMENTS

The financial information set out in this preliminary results

announcement does not constitute the Group's statutory financial

statements for the year ended 31 December 2019 or 2018 but is

derived from those financial statements. Statutory financial

statements for 2018 have been delivered to the Registrar of

Companies. Those for 2019 will be delivered following the Company's

Annual General Meeting, which, due to Covid-19, will be arranged

for a date in June 2020. The auditors have reported on those

accounts: their reports on those financial statements were

unqualified and did not contain statements under Section 498 of the

Companies Act 2006.

The financial statements, and this preliminary statement, of the

Group for the year ended 31 December 2019 were authorised for issue

by the Board of Directors on 15 April 2020 and the statement of

financial position was signed on behalf of the Board by Paul Mines

and Declan Brown.

2. BASIS OF PREPARATION

The Group's financial statements have been prepared in

accordance with International Financial Reporting Standards

("IFRS") as adopted by the EU.

3. BASIS OF CONSOLIDATION

The Group financial statements consolidate the results of the

Company and all of its subsidiary undertakings drawn up to 31

December 2019. Subsidiaries are entities over which the Group has

control. Control comprises an investor having power over the

investee and is exposed, or has rights, to variable returns from

its involvement with the investee and has the ability to affect

those returns through its power. At 31 December 2019 the subsidiary

undertakings were Biome Bioplastics Limited, Stanelco RF

Technologies Limited, Aquasol Limited, and InGel Technologies

Limited (dormant).

The assets and liabilities of the Biome Technologies plc

Employee Benefit Trust ("EBT") are included within the consolidated

statement of financial position on the basis that the Group has the

ability to exercise control over the EBT.

4a. PRIOR YEAR ADJUSTMENTS

A prior year adjustment has been made, relating to the

reclassification of GBP0.4m of grant income from revenue to other

operating income in the consolidated income statement. This is

purely to correct the classification of this income in accordance

with the requirements of IAS 20 (Accounting for Government Grants).

This reclassification has no impact on the consolidated profit of

the Group for the year end 31 December 2018.

In addition, a further reclassification has been made in the

consolidated statement of financial position to resolve a

historical difference with the subsidiary Ingel Technologies

Limited's share premium account of GBP0.7m being included within

the Group's share premium figure. This balance is being

reclassified to retained profits within the consolidated statement

of financial position. Again, this adjustment has no impact on the

profit of the Group for the year ended 31 December 2018.

Consolidated income statement for the year ended 31 December

2018

As reported Reclassification Restated

of grant

income and

share premium

GBP'000 GBP'000 GBP'000

Revenue 8,850 (391) 8,459

Gross profit 4,808 (391) 4,417

Other operating income - 391 391

Profit from operations 63 - 63

Loss before taxation 84 - 84

Loss after taxation 143 - 143

Consolidated statement of financial position as at 31 December

2018

Reclassification

of grant

income and

As reported share premium Restated

GBP'000 GBP'000 GBP'000

Equity

Share capital 118 - 118

Share premium account 805 (728) 77

Capital redemption reserve 4 - 4

Share options reserve 316 - 316

Translations reserve (85) - (85)

Retained profits 2,595 728 3,323

Equity attributable to equity

holders of the parent and

total equity 3,753 - 3,753

There is no change to the previously reported consolidated

statement of cash flows.

4b. SEGMENTAL INFORMATION FOR YEARED 31 DECEMBER 2019

Central

Bioplastics RF Technologies Costs Total

2019 2019 2019 2019

GBP'000 GBP'000 GBP'000 GBP'000

Revenue from external

customers 2,991 3,966 - 6,957

------------ ---------------- -------- --------

(LOSS)/PROFIT FROM

OPERATIONS (597) 1,081 (1,504) (1,020)

Investment revenue 6

Finance charges (9)

LOSS BEFORE TAXATION (1,023)

========

TOTAL ASSETS 2,292 1,073 2,737 6,102

============ ================ ======== ========

4c. SEGMENTAL INFORMATION FOR YEARED 31 DECEMBER 2018

RESTATED

Central

Bioplastics RF Technologies Costs Total

2018 2018 2018 2018

GBP'000 GBP'000 GBP'000 GBP'000

Revenue from external

customers 1,499 6,960 - 8,459

------------ ---------------- -------- --------

(LOSS)/PROFIT FROM

OPERATIONS (792) 2,601 (1,746) 63

Investment revenue 4

Foreign exchange gain 17

PROFIT BEFORE TAXATION 84

========

TOTAL ASSETS 1,846 945 2,754 5,545

============ ================ ======== ========

The Bioplastics division comprises of Biome Bioplastics Limited

and Aquasol Limited.

5. EARNINGS BEFORE INTEREST, TAXATION, DEPRECIATION, AND

AMORTISATION

The Group, and divisions, define earnings before interest,

taxation, depreciation and amortisation ("EBITDA") as the operating

profit or loss adjusted for share option charges, depreciation, and

amortisation. The Group EBITDA is reconciled as follows:

2019 2018

GBP'000 GBP'000

Operating (loss)/profit (1,020) 63

Amortisation 317 290

Depreciation 77 57

Share option scheme charges 136 218

EBITDA (490) 628

======== ========

6. TAXATION

The Group's policy is to recognise tax credits resulting from

tax R&D claims on a cash received basis. The claim in respect

of the year ended 31 December 2018 has now been settled with the

cash received in during 2019. A tax credit has, therefore, been

recognised in the Group's financial statements in respect of that

claim.

7. EARNINGS PER SHARE

The calculation of earnings per share is based on the loss

attributable to the equity holders of the parent for the year of

GBP877,000 (2018: profit of GBP143,000) and a weighted average of

2,472,038 (2018: 2,357,986) ordinary shares in issue for basic

earnings per share and a weighted average of 2,472,038 (2018:

2,782,194) ordinary shares in issue for diluted earnings per

share.

8. OTHER INTANGIBLE ASSETS

During the year there was a capitalisation of GBP282,000 of

product development costs (2018: GBP293,000). The amortisation

charge for the year was GBP317,000 (2018: GBP290,000).

9. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment of GBP545,000 were acquired in the

year (2018: GBP120,000). Included in the additions were GBP518,000

of right-of-use assets under the adoption of IFRS 16 Leases. The

depreciation charge for the year was GBP77,000 (2018:

GBP57,000).

10. TRADE AND OTHER RECEIVABLES

Trade and other receivables increased in the year due to

increased levels of trade debtors due to the timing of equipment

sales shipments within the Stanelco RF division at the year end and

also the increased activity levels within the Bioplastics

division.

11. TRADE AND OTHER PAYABLES

Trade and other payables decreased in the year due mainly to

levels of deposits within the Stanelco RF division compared to the

prior year.

12. LEASE LIABILITIES

The Group leases its main building with the previous lease

expiring on 11 October 2019 and a new lease coming into effect on

12 October 2020. The Group has applied the exemption for the

previous lease, as its expiry was less than twelve months from the

adoption date of IFRS 16, and not reflected this on the statement

of financial position as a right-of-use asset. In addition, the

Group has applied the modified retrospective approach for car

leases and not restated the prior year. The leases have been

reflected on the statement of financial position under property,

plant and equipment as right-of-use assets as follows:

Opening Additions Depreciation Closing

Book Value Charge Book Value

GBP'000 GBP'000 GBP'000 GBP'000

Office buildings - 493 (10) 483

Motor Vehicles - 25 (12) 13

------------- ---------- ------------- ------------

Total - 518 (22) 496

Lease liabilities are presented in the statement of financial

position as follow:

As at 1 Lease Obligations Interest Payments As at 31

January Incurred Charged Made December

2019 2019

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Current - 80 9 13 76

Non-current - 438 - - 438

---------- ------------------ --------- --------- ----------

- 518 9 13 514

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR BRGDSLDBDGGU

(END) Dow Jones Newswires

April 16, 2020 02:00 ET (06:00 GMT)

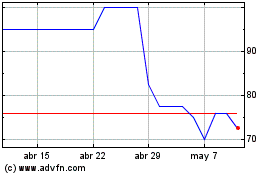

Biome Technologies (LSE:BIOM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Biome Technologies (LSE:BIOM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024