TIDMBHP

RNS Number : 2703K

BHP Group PLC

20 April 2020

Release Time IMMEDIATE

Date 21 April 2020

Release Number 4/20

BHP OPERATIONAL REVIEW

FOR THE NINE MONTHSED 31 MARCH 2020

Note: All guidance is subject to potential impacts from COVID-19

during the June 2020 quarter.

-- Our highest priority is the safety, health and wellbeing of

our workforce and communities. We have taken action to reduce the

spread of COVID-19.

-- Our financial position is strong. Underpinned by our low-cost

operations, our business is resilient and expected to continue to

generate solid cash flow.

-- Strong underlying operational performance across the

portfolio offset the impacts of planned maintenance, natural field

decline and wet weather in Australia. Group copper equivalent

production was broadly unchanged over the nine months ended March

2020, with volumes for the full year now expected to be in line

with last year.

-- R ecord production was achieved at Western Australia Iron Ore

(WAIO) and Caval Ridge, while record average concentrator

throughput was delivered at Escondida and record ore was stacked at

Spence.

-- Production guidance for the 2020 financial year remains unchanged for petroleum, iron ore and metallurgical coal. Copper guidance for our operated assets is broadly unchanged and Antamina guidance is under review following temporary suspension of operations due to COVID-19. Energy coal production guidance is under review with Cerrejón placed on temporary care and maintenance due to COVID-19.

-- Full year unit cost guidance(1) remains unchanged for the 2020 financial year.

-- Our major projects under development in petroleum and iron

ore are tracking to plan. As a result of measures put in place to

reduce the spread of COVID-19, the Spence Growth Option schedule

and timing for completion of the shafts at Jansen are under

review.

-- We have flexibility in our capital and exploration

expenditure. We are reviewing our guidance for the 2021 financial

year and it will be lower than the current guidance of around US$8

billion. We will provide updated guidance with our full year

results.

-- An update on COVID-19 measures and our short-term economic

and commodities outlook is included on pages 3 to 5.

Mar YTD20 Mar Q20

(vs Mar (vs Dec

Production YTD19) Q19) Mar Q20 vs Dec Q19 commentary

-------------- --------- -------- ---------------------------------------------

Petroleum 82 25 Lower production due to increased downtime

(MMboe) at Bass Strait caused by adverse weather

conditions, planned maintenance at

Atlantis and lower seasonal gas sales.

(10%) (11%)

Lower production at Escondida due to

the impact of expected lower copper

grades, partially offset by continued

strong concentrator throughput. Lower

volumes at Olympic Dam due to unplanned

Copper (kt) 1,310 425 downtime at the smelter.

5% (7%)

Production was broadly flat at WAIO

despite weather impacts from Tropical

Cyclone Blake and Tropical Cyclone

Iron ore Damien, reflecting increased car dumper

(Mt) 181 60 availability and reliability.

3% (1%)

Metallurgical 30 9 Lower volumes at Queensland Coal due

coal (Mt) to substantially higher rainfall in

January and February 2020, by a factor

of almost two at Peak Downs and almost

three at Blackwater compared with historical

averages.

(3%) (16%)

Energy coal 18 6 Volumes broadly flat at New South Wales

(Mt) Energy Coal (NSWEC), while lower volumes

at Cerrejón as a result of a focus

on higher quality products.

(13%) (5%)

Higher volumes following completion

of major maintenance activities at

the Kwinana refinery and Kalgoorlie

Nickel (kt) 56 21 smelter in the prior quarter.

(4%) 53%

1

Summary

BHP Chief Executive Officer, Mike Henry:

"We have operated safely for the quarter and have achieved

another strong operational performance.

We have implemented extensive measures across our operations to

keep our people and communities safe from COVID-19. Working closely

with relevant authorities and medical experts, strict travel and

working practice arrangements have been established, including

deferral of non-critical activity on our operating sites to support

social distancing, revised rosters to reduce people travelling to

site, more intensive site cleaning and health checks. I am

encouraged to know that the small number of colleagues from our

72,000 strong global workforce who have tested positive for the

virus have recovered or are recovering well.

The coupling of our disciplined controls, the commitment of

people across BHP, and our financial strength has enabled us to

continue to safely operate and supply our customers with the

critical resources they require, and to continue to provide jobs

and an underpinning of economic activity both locally and around

the world. We have accelerated payments to many of our suppliers

and have established COVID-19 relief funds to help our communities

and local health and social services. BHP is committed to playing

its part in the collective, global response to this pandemic. Our

business continuity plans have been effective and our operations

have continued to perform well, thanks to the effort of our

employees, contractors and suppliers. We have delivered strong

performance across the portfolio despite the impacts of planned

maintenance, natural field decline and wet weather in Australia.

Western Australia Iron Ore achieved record year-to-date production,

while Escondida production also increased supported by record

concentrator throughput.

While demand in China has strengthened in recent weeks, we

expect other major economies, including the US, Europe and India,

to contract sharply in the June 2020 quarter. The situation remains

fluid, however, with our strong financial position and low-cost

operations, our business is resilient, with capacity to generate

solid cash flow through this period and emerge well placed as the

global economy recovers.

Our priorities are the continued safety of our people,

continuing reliable operations and supporting our customers,

suppliers and communities in these challenging times."

Operational performance

Production and guidance are summarised below.

Note: All guidance is subject to potential impacts from COVID-19

during the June 2020 quarter.

Mar Mar

Mar YTD20 Q20 Q20

vs vs vs Previous Current

Mar Mar Mar Mar Dec FY20 FY20

Production YTD20 Q20 YTD19 Q19 Q19 guidance guidance

-------------------- ------ ---- --------- ------ ------ --------- ---------

110 - 110 - Bottom of

Petroleum (MMboe) 82 25 (10%) (13%) (11%) 116 116 range

1,705 Under

Copper (kt) 1,310 425 5% 1% (7%) - 1,820 review

1,160 1,160

Escondida (kt) 891 290 5% 8% (6%) - 1,230 - 1,230 Unchanged

230 - 230 -

Pampa Norte (kt) 188 64 9% (4%) 7% 250 250 Unchanged

180 -

Olympic Dam (kt) 124 38 8% (24%) (24%) 205 170 Lowered

Under

Antamina (kt) 107 33 (3%) (5%) (9%) 135 review

242 - 242 -

Iron ore (Mt) 181 60 3% 7% (1%) 253 253

WAIO (100% basis) 273 - 273 -

(Mt) 205 68 4% 7% 0% 286 286 Unchanged

Metallurgical coal

(Mt) 30 9 (3%) (7%) (16%) 41 - 45 41 - 45

Queensland Coal Lower end

(100% basis) (Mt) 52 16 (3%) (8%) (18%) 73 - 79 73 - 79 of range

Under

Energy coal (Mt) 18 6 (13%) (14%) (5%) 24 - 26 review

NSWEC (Mt) 11 4 (13%) (16%) 1% 15 - 17 15 - 17 Unchanged

Cerrejón Under

(Mt) 6 2 (12%) (10%) (15%) 9 review

Nickel (kt) 56 21 (4%) 9% 53% 87 80 - 83 Lowered

2

Major development projects

At the end of March 2020, BHP had six major projects under

development in petroleum, copper, iron ore and potash, with a

combined budget of US$11.4 billion over the life of the projects.

Our major projects under development in petroleum and iron ore are

currently tracking to plan and are subject to potential impacts

from COVID-19.

The Spence Growth Option is continuing to progress, however the

schedule is under review with first production potentially a few

months later than December 2020 as a result of the measures taken

to facilitate social distancing protocols. First production is

still expected to be in the 2021 financial year.

In March 2020, final shaft lining work at Jansen for two shafts

was reduced to focus on one shaft at a time, with reduced crews.

This reduction in activity was taken as part of our COVID-19

response plan and was aligned with the Provincial and Federal

Government of Canada's emergency measures for COVID-19. It reflects

a reduction in the number of contractors and in the need for

out-of-Province workers on site. Timing for completion of the

shafts continues to be under review. BHP will continue to assess

the impacts of COVID-19 and the temporary reduction in

activity.

COVID-19 update on operations

At this time, among our global workforce of 72,000 people, BHP

has had a small number of confirmed cases of COVID-19, all of whom

have either recovered or are recovering well. Our protocols have

functioned effectively and there has not been any transmission from

these individuals to co-workers.

BHP has taken action to help keep its people, their families and

communities safe. Strict health and travel guidelines have been put

in place to reduce the spread of COVID-19. While each of our

operated sites is different, these measures include:

-- Reduced number of people at mine sites and other operational

facilities to business critical employees and contractors only.

-- Changed rosters to reduce workforce movements. In addition,

some non-residential workers have temporarily relocated to the

jurisdiction of operation to meet tighter border controls.

-- Regular health screenings and temperature checks for workers,

for example before boarding planes or buses and when entering

sites.

-- Strong uptake of social distancing practices and changes to

the way we travel to work, operate at work and run accommodation

camps including hygiene practices and deep cleaning to reduce the

risk of transmission.

-- Further information on the measures we have implemented is available at: bhp.com/covid-19.

We continue to monitor the situation and to update our measures

based on advice from country-specific health authorities and

governments.

Our operations continue to run well. The changes we have put in

place have resulted in the deferral of non-critical activity. Our

supply chains remain open and we have adequate supplies to operate

and maintain critical equipment, with alternative suppliers

identified for many of these.

Our financial position is strong. As at 31 December 2019(2), net

debt was US$12.8 billion, at the lower end of our target range, and

cash and cash equivalents were US$14.3 billion. This strong

position, combined with our low-cost operations, means our business

is resilient and expected to generate solid cash flow through the

cycle.

3

We are in a differentiated position to be able to continue to

provide regional jobs, products to customers and payments to

suppliers. In doing so, we can help underpin continued economic

activity. We have accelerated payments to many of our suppliers and

established funds to help support regional and Indigenous

communities and health and community services. We are committed to

playing our part in the collective response to the COVID-19

pandemic.

Our strong position allows us to continue to invest through the

cycle and we have flexibility in our capital and exploration

expenditure. We are reviewing our capital and exploration

expenditure guidance for the 2021 financial year and it will be

lower than the current guidance of around US$8 billion. We will

provide updated guidance with our full year Results Announcement to

be released on 18 August 2020.

Marketing update (3)

Short term economic outlook

The global economy has been dramatically impacted by COVID-19.

Many major economies will contract heavily in the June 2020

quarter, including the United States (US), Europe and India. In

contrast, China has moved from intensive viral suppression to early

indications of economic recovery. The majority of heavy industrial

activity had restarted as of the end of March 2020, albeit with

considerable variation across provinces and sectors. We note that

the developed world in aggregate may have tentatively passed the

peak in new COVID-19 cases for wave one infections, while the

developing world is unfortunately still in the escalation phase(4)

.

The arc of recovery will vary widely across countries. Where

"hibernation policies"(5) have been enacted, we anticipate a

smoother resumption of activity after the first wave than would

otherwise have been the case. A considerable amount of monetary,

liquidity and fiscal policy support has been mobilised in response

to COVID-19. Early indications are that liquidity support measures

have been effective in dampening financial volatility. It is still

uncertain whether traditional monetary and fiscal stimulus policies

will have below-average or above-average multiplier effects. A

lower multiplier could result from depressed consumer and business

confidence due to the deleterious impact of COVID-19 on both jobs

and profitability. A higher multiplier could occur if the lagged

impact of stimulus coincides with the release of pent-up demand as

economies wake from hibernation, with the important caveat that

major second waves are averted. Each is a plausible book-end for

assessing where the global economy might be as the 2021 calendar

year approaches.

Chinese domestic industrial activity has been improving, spurred

on by supportive credit and fiscal policy. The major risk to

maintaining that positive trajectory is the possibility of a second

wave of infections emerging. That is among the range of pathways

that we consider and it is the key caveat for each of our regional

outlooks. Indications are that the US and Europe will see a more

protracted period of activity disruption, a deeper labour market

impact and a flatter trajectory for the recovery once it arrives.

India, Japan and South Korea will see negative impacts on

industrial activity from their own suppression efforts and those of

their trading partners. Negative feedback loops to China from the

downturn in the rest of the world are factored in to our range

analysis.

Short term commodities outlook

Exchange traded commodities have been sold rapidly down close

to, or even through, cash cost support. Bulk prices have been more

resilient. Across the portfolio, a combination of economic

curtailments and COVID-19 induced disruptions are a partial offset

to the demand shock.

4

Based on our bottom-up analysis, informed by engagement with our

customers, we expect that steel production ex-China could contract

by a double-digit percentage in the 2020 calendar year. Steel

makers from a variety of regions, including Europe, the Americas,

India and Japan have announced or signalled full shutdowns or

curtailments in the June 2020 quarter. This reflects both

logistical difficulties created by COVID-19 (e.g. inter-state

labour availability in India) as well as collapsing demand in

downstream industries such as automotive (e.g. Europe, where at one

stage every major auto plant on the Continent was constrained).

Some of our customers are choosing to reduce production at their

blast furnaces in the face of this demand shock.

In China, blast furnace utilisation rates have increased from

around 73 per cent earlier in the year to almost 79 per cent in

April. Daily rebar transactions are now at or above normal seasonal

levels. Finished inventories are falling as downstream activity

improves, although the level is still very high relative to

history. While we note that only about 10 per cent of Chinese

apparent steel demand(6) is exported in finished products (for

example in excavators, ships or wind turbines), the depth of the

weakness in global demand will weigh on Chinese flat products

manufacturers. Electric-arc furnace utilisation fell as low as 12

per cent, but has now recovered to 56 per cent. If China can avoid

a second wave of COVID-19, steel production may rise slightly in

the 2020 calendar year.

The Platts 62% Fe Iron Ore Fines price index has been resilient

to the COVID-19 shock so far. This outcome reflects solid Chinese

pig iron production in the year-to-date (1.7 per cent increase from

last year), and a continuation of the relatively soft seaborne

supply picture that was in evidence prior to the shock. Port

outflows have been roughly 10 per cent higher year-on-year from

March 2020 through mid-April 2020. Chinese domestic production had

fallen back to less than 190 Mtpa in February 2020, but has since

recovered to around 202 Mtpa. That compares to 211 Mtpa in December

2019. Chinese port stocks have declined consistently since February

2020, with the latest weekly data showing an 18 per cent decline

(26 Mt) year-on-year. Weakness ex-China is less consequential for

price formation in iron ore than in other commodities, with China's

1.1 billion tonne import requirement set against Japan's 120 Mt,

Europe's 100 Mt and South Korea's 75 Mt, for example (all figures

rounded).

The Platts Premium Low-Volatile Metallurgical Coal price index

actually increased during the first few weeks of the COVID-19

outbreak, partly reflecting supply disruptions in China, Mongolia,

Australia and elsewhere. However, as COVID-19 began to spread to

the major importing regions of Europe, India and developed Asia,

the demand side of the equation has begun to outweigh constrained

supply. As the velocity of demand disruption accelerated in late

March 2020 and early April 2020, prices have returned to the lows

seen in the second half of the 2019 calendar year. The geographic

diversification of metallurgical coal demand is a long term

advantage but an impediment under today's unique circumstances.

Copper prices fell sharply to levels close to cost support in

March 2020 amidst depressed macro investor sentiment. They have

since stabilised a little above the March lows. Our judgement,

informed by our regular customer engagements, is that the decline

in ex-China demand will be less severe than for steel. Conversely,

in China, copper demand could be marginally weaker than steel in

the 2020 calendar year, based partly on copper's greater exposure

to indirect exports (approximately 20 per cent versus approximately

10 per cent), although recent trends within our customer base have

been promising relative to top-down expectations. On the supply

side, evidence of both economic curtailments and COVID-19 related

disruptions have emerged. We note that marginal sources of supply

behaved quite rationally during the 2015/16 downturn, with a number

of smaller, higher cost operations across multiple continents

choosing to curtail(7) . Additionally, we observe that prices that

are challenging for higher cost mines are also associated with

lower availability of scrap. This is another mechanism whereby the

copper market dynamically rebalances at times of stress.

5

Crude oil fundamentals shifted abruptly in March 2020 as the

result of collapsing transport activity on the demand side and the

unexpected flip of the OPEC Plus grouping from supply discipline to

a price war. After crashing in March 2020, prices have exhibited

considerable two-way volatility in April 2020, with speculation of

a grand bargain to curtail global supply offset by the physical

reality of the current glut. Notwithstanding the 9 April 2020

agreement by OPEC Plus to cut output by 10 MMbpd, with possibly

more to come from G-20 producers, such is the scale of the demand

loss that global storage capacity is expected to be tested over

coming weeks and months. It is possible that differentials for

inland crudes that are disadvantaged with respect to storage

availability will remain historically wide over this phase of

market adjustment. Large and small producers alike have announced

sharp cuts in capital spending in response to the price

decline.

Average realised prices

The average realised prices achieved for our major commodities

are summarised below.

Mar Q20 Mar YTD20

vs vs

Average realised prices(i) Mar YTD20 Mar Q20 Dec H19 FY19 Dec H19 FY19

------------------------------------- ---------- -------- -------- ------ --------- ---------

Oil (crude and condensate) (US$/bbl) 57.63 51.19 60.64 66.59 (16%) (13%)

Natural gas (US$/Mscf)(ii) 4.07 3.56 4.26 4.55 (16%) (11%)

LNG (US$/Mscf) 7.62 7.61 7.62 9.43 0% (19%)

Copper (US$/lb) 2.43 2.08 2.60 2.62 (20%) (7%)

Iron ore (US$/wmt, FOB) 76.97 74.28 78.30 66.68 (5%) 15%

Metallurgical coal (US$/t) 138.31 132.72 140.94 179.67 (6%) (23%)

Hard coking coal (US$/t)(iii) 151.35 145.69 154.01 199.61 (5%) (24%)

Weak coking coal (US$/t)(iii) 98.59 93.36 101.06 130.18 (8%) (24%)

Thermal coal (US$/t)(iv) 59.42 61.13 58.55 77.90 4% (24%)

Nickel metal (US$/t) 14,552 12,644 15,715 12,462 (20%) 17%

(i) Based on provisional, unaudited estimates. Prices exclude

sales from equity accounted investments, third party product and

internal sales, and represent the weighted average of various sales

terms (for example: FOB, CIF and CFR), unless otherwise noted.

Includes the impact of provisional pricing and finalisation

adjustments.

(ii) Includes internal sales.

(iii) Hard coking coal (HCC) refers generally to those

metallurgical coals with a Coke Strength after Reaction (CSR) of 35

and above, which includes coals across the spectrum from Premium

Coking to Semi Hard Coking coals, while weak coking coal (WCC)

refers generally to those metallurgical coals with a CSR below

35.

(iv) Export sales only; excludes Cerrejón. Includes thermal coal

sales from metallurgical coal mines.

The oil sales were linked to West Texas intermediate (WTI) or

Brent based contracts, with price differentials applied for

quality, locational and transportation costs. The large majority of

iron ore shipments were linked to the index price for the month of

shipment, with price differentials predominantly a reflection of

market fundamentals and product quality. The large majority of

metallurgical coal and energy coal exports were linked to the index

price for the month of shipment or sold on the spot market at fixed

or index-linked prices, with price differentials reflecting product

quality.

6

Petroleum

Production

Mar YTD20 Mar Q20 Mar Q20

vs vs vs

Mar Mar Mar Dec

Mar YTD20 Q20 YTD19 Q19 Q19

---------- ---- --------- ------- -------

Crude oil, condensate and

natural gas liquids (MMboe) 38 12 (10%) (12%) (14%)

Natural gas (bcf) 270 81 (10%) (13%) (9%)

Total petroleum production

(MMboe) 82 25 (10%) (13%) (11%)

Petroleum - Total petroleum production decreased by 10 per cent

to 82 MMboe. Guidance for the 2020 financial year remains unchanged

at between 110 and 116 MMboe, with volumes expected to be at the

bottom of the guidance range. Potential impacts from COVID-19,

including weakness in customer demand, in the June 2020 quarter

represent possible downside risk to full year guidance.

Crude oil, condensate and natural gas liquids production

declined by 10 per cent to 38 MMboe due to the impacts of Tropical

Storm Barry in the Gulf of Mexico, Tropical Cyclone Damien at our

North West Shelf operations and natural field decline across the

portfolio. This decline was partially offset by higher uptime at

Pyrenees following the 70 day dry dock maintenance program during

the prior year.

Natural gas production decreased by 10 per cent to 270 bcf,

reflecting a decrease in tax barrels at Trinidad and Tobago in

accordance with the terms of our Production Sharing Contract,

impacts of maintenance and Tropical Cyclone Damien at North West

Shelf, reduced domestic gas sales in Western Australia and natural

field decline across the portfolio.

Projects

Initial

Capital production

Project and expenditure target

ownership US$M date Capacity Progress

--------------------- ------------ ----------- ------------------------- -----------------------

Atlantis Phase 696 CY20 New subsea production On schedule and budget.

3 system that will The overall project

(US Gulf tie back to the existing is 53% complete.

of Mexico) Atlantis facility,

44% (non-operator) with capacity to

produce up to 38,000

gross barrels of

oil equivalent per

day.

Ruby 283 CY21 Five production wells On schedule and budget.

(Trinidad tied back into existing The overall project

& Tobago) 68.46% operated processing is 23% complete.

(operator) facilities, with

capacity to produce

up to 16,000 gross

barrels of oil per

day and 80 million

gross standard cubic

feet of natural gas

per day.

Mad Dog Phase 2,154 CY22 New floating production On schedule and budget.

2 facility with the The overall project

(US Gulf of capacity to produce is 70% complete.

Mexico) up to 140,000 gross

23.9% (non-operator) barrels of crude

oil per day.

The Bass Strait West Barracouta project is on schedule and

budget, and is expected to achieve first production in the 2021

calendar year.

Across each of our projects currently in execution, additional

measures have been put in place to protect workforce health and

safety as a result of COVID-19. These projects are tracking to plan

and at this point, we do not expect an impact on the timing of

first production.

In light of the recent significant disruption to oil and gas

markets and heightened risk of interruption to field activity, we

are reviewing our capital, operating, exploration and appraisal

expenditure programs, and where relevant, together with our joint

venture partners.

7

While we are completing our five year plan, we can highlight the

following flexibility for the 2021 financial year:

-- The confirmed delay of the Scarborough gas development to the

2021 calendar year, as announced by Woodside (the operator) on 27

March 2020. A final investment decision by BHP is now expected to

be approximately 12 months later than the original timing, which

was from the middle of the 2020 calendar year.

-- The potential deferral of approximately US$200 million

non-committed exploration and appraisal expenditure in the 2021

financial year, representing approximately 30 per cent of the

average annual exploration spend over the last two years.

-- In conjunction with joint venture partners, the potential

delay of several small and medium sized projects with short

lifecycles, to a time when we expect prices to be higher.

These actions will result in the deferral of production in the

2021 and 2022 financial years, however the reduction in capital

projects across the sector may provide the opportunity to further

enhance the cost competitiveness of these options.

Beyond these projects, our Petroleum growth portfolio includes

many attractive opportunities progressing through development

studies and related activities, which do not have material

investment levels in the 2021 financial year, including Trion and

Trinidad and Tobago North.

We will provide updated capital and exploration expenditure

guidance for the 2021 financial year with our full year Results

Announcement released on 18 August 2020.

Petroleum exploration

No exploration and appraisal wells were drilled during the March

2020 quarter.

During the March 2020 quarter, the Deepwater Invictus rig

completed regulatory abandonment work on Shenzi appraisal and

exploration boreholes and is currently in the US Gulf of Mexico

undergoing maintenance. The Deepwater Invictus rig is anticipated

to mobilise to Trinidad and Tobago in the middle of the 2020

calendar year to drill one exploration well, Broadside, in our

Southern licences as part of Phase 5 of our Deepwater drilling

campaign, subject to any potential COVID-19 constraints on

mobilisation .

In the US Gulf of Mexico, we were the apparent high bidder on

blocks GC80 and GC123 in the central Gulf of Mexico, building on

our Green Canyon position. Additionally, we were the apparent high

bidder on blocks AC36, AC80, AC81 and GB721, which would expand our

position in the western Gulf of Mexico.

Petroleum exploration expenditure for the nine months ended

March 2020 was US$405 million, of which US$246 million was

expensed. A US$0.6 billion exploration and appraisal program is

being executed for the 2020 financial year and reflects a reduction

of US$0.1 billion from prior guidance as a result of slightly later

timing for the commencement of our Phase 5 Deepwater drilling

campaign in Trinidad and Tobago.

Copper

Production

Mar YTD20 Mar Q20 Mar Q20

vs vs vs

Mar YTD20 Mar Q20 Mar YTD19 Mar Q19 Dec Q19

--------- -------- ---------- -------- --------

Copper (kt) 1,310 425 5% 1% (7%)

Zinc (t) 74,726 31,789 (1%) 52% 41%

Uranium (t) 2,662 776 3% (30%) (18%)

8

Copper - Total copper production increased by five per cent to

1,310 kt. Guidance for the 2020 financial year is broadly unchanged

for our operated assets and reflects lower volumes at Olympic Dam.

Guidance for Antamina is under review due to impacts from COVID-19

.

Escondida copper production increased by five per cent to 891

kt, supported by record average concentrator throughput of 367

ktpd, which offset expected grade decline. Strong concentrator

throughput was driven by ongoing improvements in maintenance and

operational performance and was achieved despite Escondida

operating with a reduced headcount on site during March 2020.

Guidance for the 2020 financial year remains unchanged at between

1, 160 and 1,230 kt. Continued improvements in concentrator

throughput are expected to offset a reduction of approximately five

per cent in the copper grade of concentrator feed in the 2020

financial year versus the prior year.

Pampa Norte copper production increased by nine per cent to 188

kt, with record ore stacked at Spence in the nine months to March

2020. Guidance for the 2020 financial year remains unchanged at

between 230 and 250 kt, including expected grade decline of

approximately 10 per cent.

For the June 2020 quarter, our Chilean copper operations are

expected to operate with a reduction of more than 30 per cent in

their operational workforces as we have prioritised critical roles

for operational continuity and incorporated a series of planned

preventative measures for COVID-19.

Olympic Dam copper production increased by eight per cent to 124

kt as a result of the prior period acid plant outage, partially

offset by the impact of planned preparatory work undertaken in the

September 2019 quarter related to the replacement of the refinery

crane and unplanned downtime at the smelter during the March 2020

quarter. Production for the 2020 financial year is now expected to

be approximately 170 kt. The physical replacement of the refinery

crane and commissioning planned for commencement in the March 2020

quarter, has been impacted by COVID-19 restrictions, and completion

is now expected by the end of the 2020 calendar year.

Antamina copper production decreased by three per cent to 107 kt

and zinc production decreased by one per cent to 75 kt, reflecting

lower copper head grades. During March 2020, Antamina operated with

a reduced workforce in response to COVID-19, before being given

Government approval to demobilise the workforce and then taking a

decision on 14 April 2020 to temporarily suspend operations. Timing

on resuming operations at Antamina is uncertain and guidance for

the 2020 financial year is under review. The Peruvian state of

emergency has been extended until 26 April 2020.

Projects

Initial

Capital production

Project and expenditure target

ownership US$M date Capacity Progress

------------- ------------ ----------- ------------------------ ---------------------

Spence Growth 2,460 Under New 95 ktpd concentrator On budget.

Option review is expected to increase

payable copper in

concentrate production

by 185 ktpa in the

first 10 years of

operation and extend

the mining operations

by more than 50 years.

(Chile) The schedule is

under review.

100% The overall project

is 91% complete.

The Spence Growth Option is continuing to progress, however the

schedule is under review with first production potentially delayed

until early in the 2021 calendar year as a result of lower

headcount on site, reflecting the decision to reduce the occupancy

at the construction camp, to facilitate social distancing

protocols. As a result of the reduction of the on-site workforce,

the commissioning of the desalination plant could potentially be

delayed a few months until the first half of the 2021 financial

year. The capitalisation of the lease will follow commissioning,

with an update on the timing and recognition on the balance sheet

to be provided in the June 2020 Quarter Operational Review to be

released on 21 July 2020.

9

Iron Ore

Production

Mar YTD20 Mar Q20 Mar Q20

vs vs vs

Mar YTD20 Mar Q20 Mar YTD19 Mar Q19 Dec Q19

--------- ------- ---------- -------- --------

Iron ore production (kt) 181,430 60,030 3% 7% (1%)

Iron ore - Total iron ore production increased by three per cent

to 181 Mt (205 Mt on a 100 per cent basis). Guidance for the 2020

financial year remains unchanged at between 242 and 253 Mt (273 and

286 Mt on a 100 per cent basis).

WAIO achieved record production, with higher volumes reflecting

record production at Jimblebar and the impact of the train

derailment in the previous period. Weather impacts from Tropical

Cyclone Blake and Tropical Cyclone Damien were offset by strong

performance across the supply chain, including improved car dumper

reliability, with completion of a major car dumper maintenance

campaign in October 2019, implementation of improved maintenance

strategies, and delivery of consistent performance across our mine

operations. This strong performance has resulted in healthy stock

levels across our mines.

Consistent with our revised mine plan, Jimblebar fines Fe grade

has improved during the March 2020 quarter, with the typical

specification expected to return to above 60 per cent in the June

2020 quarter.

WAIO continues to focus on operating safely and has incorporated

a series of preventative measures to help reduce the spread of

COVID-19. W e have reduced the number of workers on our sites, with

those not critical to operations working from home. To meet border

controls introduced by the Western Australian Government, over 900

employees and contractors in business critical roles have been

temporarily relocated to Western Australia, including the majority

of specialist roles who are based interstate, such as train drivers

and train load out operators.

Mining and processing operations at Samarco remain suspended

following the failure of the Fundão tailings dam and Santarém water

dam on 5 November 2015. Approval of the Corrective Operating

Licence (LOC) for Samarco's operating activities at its Germano

Complex was received in October 2019. A s a result of precautions

taken for COVID-19, operation readiness activities for restart have

been slowed, with only critical activities being undertaken.

Restart can occur when the filtration system is complete and

Samarco has met all necessary safety requirements, and will be

subject to final approval by Samarco's shareholders.

Projects

Initial

Capital production

Project and expenditure target

ownership US$M date Capacity Progress

------------- ------------ ----------- -------------------- -----------------------

South Flank 3,061 CY21 Sustaining iron On schedule and budget.

ore mine to replace

production from

the 80 Mtpa (100

per cent basis)

Yandi mine.

(Australia) The overall project

is 66% complete.

85%

The South Flank project is tracking well and remains on schedule

for first production in the 2021 calendar year. As at the end of

March 2020, approximately 80 per cent of the contracts awarded are

being performed in Australia, of which 95 per cent is within

Western Australia. Some interstate employees have relocated to

Western Australia to help with the project delivery. Consistent

with our operations, the South Flank project continues to implement

increased measures to conduct safe operations in compliance with

strict health and travel guidelines put in place to help reduce the

spread of COVID-19.

10

Coal

Production

Mar YTD20 Mar Q20 Mar Q20

vs vs vs

Mar YTD20 Mar Q20 Mar YTD19 Mar Q19 Dec Q19

--------- ------- ---------- -------- --------

Metallurgical coal (kt) 29,504 9,222 (3%) (7%) (16%)

Energy coal (kt) 17,513 5,788 (13%) (14%) (5%)

Metallurgical coal - Metallurgical coal production was down

three per cent to 30 Mt (52 Mt on a 100 per cent basis). Guidance

for the 2020 financial year remains unchanged at between 41 and 45

Mt (73 and 79 Mt on a 100 per cent basis), with volumes now

expected to be at the lower end of the guidance range following

significantly higher rainfall during January and February 2020, by

a factor of almost two at Peak Downs and almost three at Blackwater

compared with historical averages. Potential impacts from COVID-19,

including weak demand as a result of customer disruptions, in the

June 2020 quarter, represent possible downside risk to full year

guidance.

At Queensland Coal, strong underlying operational performance,

was offset by planned major wash plant shutdowns in the first half

of the year and significant wet weather impacts in the March 2020

quarter . Blackwater, our largest mine, was the most severely

impacted, with five site evacuations following the flooding of pits

and haul roads during January and February 2020. Mining operations

at Blackwater are expected to be stabilised in the June 2020

quarter and to return to full capacity during the September 2020

quarter as inventory levels are rebuilt. We are implementing

further measures to reduce the risk of COVID-19 and meet new

restrictions on interstate travel, including temporarily relocating

workers and amending rosters to minimise travel within Queensland,

while further protecting the community and facilitating the

continuation of safe mining operations.

Energy coal - Energy coal production decreased by 13 per cent to

18 Mt. As a result of actions by the Colombian Government to

contain the spread of COVID-19, a decision has been made to place

Cerrejón on temporary care and maintenance, and guidance for the

2020 financial year is now under review.

New South Wales Energy Coal production decreased by 13 per cent

to 11 Mt as a result of the change in product strategy to focus on

higher quality products. In addition, reduced air quality at our

operations negatively impacted production in December 2019 and

January 2020, with wet weather further constraining operations

during February 2020. Guidance for the 2020 financial year remains

unchanged at between 15 and 17 Mt. The COVID-19 situation continues

to be monitored with preventative measures in place to protect the

workforce, including reduced site travel, social distancing

practices and strict hygiene protocols.

Cerrejón production decreased by 12 per cent to 6 Mt mainly due

to a focus on higher quality products, in line with the mine plan.

On 23 March 2019, following the Colombian Government's declaration

of a 15-day national quarantine to contain the spread of COVID-19,

a decision was made to ramp down operations at Cerrejón and place

it on temporary care and maintenance. Discussions about the timing

of production resumption are ongoing. Guidance for the 2020

financial year is under review.

Other

Nickel production

Mar YTD20 Mar Q20 Mar Q20

vs vs vs

Mar YTD20 Mar Q20 Mar YTD19 Mar Q19 Dec Q19

--------- ------- ---------- -------- --------

Nickel (kt) 56.2 20.9 (4%) 9% 53%

11

Nickel - Nickel West production decreased by four per cent to 56

kt due to the major quadrennial maintenance shutdowns at the

Kwinana refinery and the Kalgoorlie smelter, as well as planned

routine maintenance at the concentrators, in the December 2019

quarter. Operations ramped back up to full capacity during the

March 2020 quarter. With the transition to new mines underway,

first ore was achieved at Yakabindie, a new open-cut development at

Mt Keith, during the quarter. Production for the 2020 financial

year is now expected to be lower than the 2019 financial year due

to the extended shutdown. We continue to take action to reduce the

risk of COVID-19 and safely conduct operations in compliance with

strict health and travel guidelines, including the reduction in the

number of people at our operational facilities and sites through

flexible shifts.

Operations Services - In Australia, we have created over 2,000

permanent jobs, with Operations Services deployed at 14 locations

across WAIO, Queensland Coal and NSWEC and successfully

accelerating safety and productivity outcomes.

Potash project

Project

and Investment

ownership US$M Scope Progress

---------- ------------------------------- -----------------------------

Jansen Potash 2,700 Investment to finish The project is 85% complete.

the excavation and lining Shaft completion timing

of the production and is under review.

service shafts, and to

continue the installation

of essential surface

infrastructure and utilities.

(Canada)

100%

In March 2020, final shaft lining work at Jansen for two shafts

was reduced to focus on one shaft at a time, with reduced crews.

This reduction in activity was taken as part of our COVID-19

response plan and was aligned with the Provincial and Federal

Government of Canada's emergency measures for COVID-19 and reflects

a reduction in the number of contractors and the need for

out-of-Province workers on site. Timing for completion of the

shafts continues to be under review. BHP will continue to assess

the impacts of COVID-19 and the temporary reduction in

activity.

Minerals exploration

Minerals exploration expenditure for the nine months ended March

2020 was US$124 million, of which US$89 million was expensed.

Greenfield minerals exploration is predominantly focused on

advancing copper targets within Chile, Ecuador, Mexico, Peru,

Canada, South Australia and the south-west United States.

At Oak Dam in South Australia, the third phase of the drilling

program remains on track to be completed in the June 2020 quarter.

This follows encouraging results from the previous drilling phases,

which confirmed high-grade mineralised intercepts of copper, with

associated gold, uranium and silver.

12

Variance analysis relates to the relative performance of BHP

and/or its operations during the nine months ended March 2020

compared with the nine months ended March 2019, unless otherwise

noted. Production volumes, sales volumes and capital and

exploration expenditure from subsidiaries are reported on a 100 per

cent basis; production and sales volumes from equity accounted

investments and other operations are reported on a proportionate

consolidation basis. Numbers presented may not add up precisely to

the totals provided due to rounding. Copper equivalent production

based on 2019 financial year average realised prices.

The following footnotes apply to this Operational Review:

(1) 2020 financial year unit cost guidance: Petroleum

US$10.50-11.50/boe, Escondida US$1.20-1.35/lb, WAIO US$13-14/t,

Queensland Coal US$67-74/t and NSWEC US$55-61/t; based on exchange

rates of AUD/USD 0.70 and USD/CLP 683.

(2) The inclusion of derivatives (US$0.4 billion) and the

application of IFRS 16 Leases (US$1.9 billion) increased net debt

by US$2.3 billion to US$12.8 billion at 31 December 2019, compared

to US$9.2 billion reported at 30 June 2019. Figures exclude cash

inflows and outflows since 31 December 2019, including the dividend

payment of US$3.3 billion determined in respect of December 2019

half year paid on 24 March 2020. In addition, the Group has access

to a US$5.5 billion undrawn revolving credit facility. There are no

covenants on our revolving credit facility.

(3) All data presented in this report is the latest available as of 13 April 2020.

(4) Based on global tracking activity conducted by Exante Data.

(5) The phrase "economic hibernation" was coined by ANU

Professor's Tourky and Pitchford. It describes the comprehensive

support that the public balance sheet can provide to mitigate the

no-fault unemployment, default and insolvency that the effort to

suppress a pandemic can bring.

(6) Incremental to apparent demand is around 35 Mt in direct net exports of steel.

(7) Wood Mackenzie documents 848 kt of annualised economic

supply disruptions, from 36 operations, across the 2015 and 2016

calendar years.

The following abbreviations may have been used throughout this

report: barrels (bbl); billion cubic feet (bcf); cost and freight

(CFR); cost, insurance and freight (CIF); dry metric tonne unit

(dmtu); free on board (FOB); grams per tonne (g/t); kilograms per

tonne (kg/t); kilometre (km); metre (m); million barrels of oil

equivalent (MMboe); million barrels of oil per day (MMbpd); million

cubic feet per day (MMcf/d); million tonnes (Mt); million tonnes

per annum (Mtpa); ounces (oz); pounds (lb); thousand barrels of oil

equivalent (Mboe); thousand barrels of oil equivalent per day

(Mboe/d); thousand ounces (koz); thousand standard cubic feet

(Mscf); thousand tonnes (kt); thousand tonnes per annum (ktpa);

thousand tonnes per day (ktpd); tonnes (t); and wet metric tonnes

(wmt).

In this release, the terms 'BHP', 'Group', 'BHP Group', 'we',

'us', 'our' and ourselves' are used to refer to BHP Group Limited,

BHP Group plc and, except where the context otherwise requires,

their respective subsidiaries as defined in note 28 'Subsidiaries'

in section 5.1 of BHP's 30 June 2019 Annual Report and Form 20-F,

unless stated otherwise. Notwithstanding that this release may

include production, financial and other information from

non-operated assets, non-operated assets are not included in the

BHP Group and, as a result, statements regarding our operations,

assets and values apply only to our operated assets unless stated

otherwise. Our non-operated assets include Antamina, Cerrejón,

Samarco, Atlantis, Mad Dog, Bass Strait and North West Shelf. BHP

Group cautions against undue reliance on any forward-looking

statement or guidance, particularly in light of the current

economic climate and the significant volatility, uncertainty and

disruption caused by the COVID-19 outbreak.

13

Further information on BHP can be found at: bhp.com

Authorised for lodgement by:

Rachel Agnew

Company Secretary

Media Relations Investor Relations

Email: media.relations@bhp.com Email: investor.relations@bhp.com

Australia and Asia Australia and Asia

Gabrielle Notley Tara Dines

Tel: +61 3 9609 3830 Mobile: Tel: +61 3 9609 2222 Mobile:

+61 411 071 715 +61 499 249 005

Europe, Middle East and Africa Europe, Middle East and Africa

Neil Burrows Elisa Morniroli

Tel: +44 20 7802 7484 Mobile: Tel: +44 20 7802 7611 Mobile:

+44 7786 661 683 +44 7825 926 646

Americas Americas

Judy Dane Brian Massey

Tel: +1 713 961 8283 Mobile: Tel: +1 713 296 7919 Mobile:

+1 713 299 5342 +1 832 870 7677

BHP Group Limited ABN 49 004 BHP Group plc Registration

028 077 number 3196209

LEI WZE1WSENV6JSZFK0JC28 LEI 549300C116EOWV835768

Registered in Australia Registered in England and Wales

Registered Office: Level 18, Registered Office: Nova South,

171 Collins Street 160 Victoria Street

Melbourne Victoria 3000 Australia London SW1E 5LB United Kingdom

Tel +61 1300 55 4757 Fax +61 Tel +44 20 7802 4000 Fax +44

3 9609 3015 20 7802 4111

Members of the BHP Group which is

headquartered in Australia

Follow us on social media

14

Production summary

Quarter ended Year to date

BHP Mar Jun Sep Dec Mar Mar Mar

interest 2019 2019 2019 2019 2020 2020 2019

Petroleum (1)

Petroleum

Production

Crude oil, condensate

and NGL (Mboe) 13,236 13,366 12,507 13,412 11,589 37,508 41,820

Natural gas (bcf) 92.9 97.8 100.4 88.7 80.7 269.8 299.1

Total (Mboe) 28,719 29,666 29,240 28,195 25,039 82,475 91,670

Copper (2)

Copper

Payable metal in concentrate

(kt)

Escondida (3) 57.5% 205.4 224.1 237.0 240.3 220.1 697.4 658.0

Antamina 33.8% 34.5 37.4 37.6 36.2 32.9 106.7 109.8

Total 239.9 261.5 274.6 276.5 253.0 804.1 767.8

Cathode (kt)

Escondida (3) 57.5% 62.4 63.5 55.9 68.4 69.6 193.9 189.7

Pampa Norte (4) 100% 67.2 74.1 63.9 60.0 64.3 188.2 172.4

Olympic Dam 100% 50.2 45.2 35.1 50.5 38.4 124.0 115.1

Total 179.8 182.8 154.9 178.9 172.3 506.1 477.2

Total copper (kt) 419.7 444.3 429.5 455.4 425.3 1,310.2 1,245.0

Lead

Payable metal in concentrate

(t)

Antamina 33.8% 456 770 405 383 621 1,409 1,619

Total 456 770 405 383 621 1,409 1,619

Zinc

Payable metal in concentrate

(t)

Antamina 33.8% 20,848 22,469 20,454 22,483 31,789 74,726 75,643

Total 20,848 22,469 20,454 22,483 31,789 74,726 75,643

15

Production summary

Quarter ended Year to date

BHP Mar Jun Sep Dec Mar Mar Mar

interest 2019 2019 2019 2019 2020 2020 2019

Gold

Payable metal in concentrate

(troy oz)

Escondida (3) 57.5% 73,998 74,704 48,801 49,209 35,990 134,000 211,302

Olympic Dam (refined

gold) 100% 28,609 37,032 43,205 35,382 33,235 111,822 69,936

Total 102,607 111,736 92,006 84,591 69,225 245,822 281,238

Silver

Payable metal in concentrate

(troy koz)

Escondida (3) 57.5% 2,189 2,074 1,626 1,798 1,390 4,814 6,756

Antamina 33.8% 1,062 1,209 1,101 1,173 1,216 3,490 3,549

Olympic Dam (refined

silver) 100% 230 268 245 203 241 689 655

Total 3,481 3,551 2,972 3,174 2,847 8,993 10,960

Uranium

Payable metal in concentrate

(t)

Olympic Dam 100% 1,106 975 937 949 776 2,662 2,590

Total 1,106 975 937 949 776 2,662 2,590

Molybdenum

Payable metal in concentrate

(t)

Antamina 33.8% 82 178 405 527 491 1,423 963

Total 82 178 405 527 491 1,423 963

Iron Ore

Iron Ore

Production (kt) (5)

Newman 85% 15,608 17,058 16,316 15,766 16,449 48,531 49,564

Area C Joint Venture 85% 11,627 13,837 12,620 12,727 12,179 37,526 33,603

Yandi Joint Venture 85% 15,214 17,486 17,827 14,857 17,491 50,175 47,711

Jimblebar (6) 85% 13,658 14,209 14,239 17,045 13,911 45,195 44,337

Wheelarra 85% 10 5 3 - - 3 154

Samarco 50% - - - - - - -

Total 56,117 62,595 61,005 60,395 60,030 181,430 175,369

16

Production summary

Quarter ended Year to date

Mar Jun Sep Dec Mar Mar

BHP interest 2019 2019 2019 2019 Mar 2020 2020 2019

Coal

Metallurgical coal

Production (kt) (7)

BMA 50% 7,608 9,090 6,905 8,723 6,869 22,497 23,046

BHP Mitsui Coal (8) 80% 2,269 2,804 2,453 2,201 2,353 7,007 7,461

Total 9,877 11,894 9,358 10,924 9,222 29,504 30,507

Energy coal

Production (kt)

Australia 100% 4,552 5,412 3,592 3,763 3,810 11,165 12,845

Colombia 33.3% 2,199 2,017 2,055 2,315 1,978 6,348 7,213

Total 6,751 7,429 5,647 6,078 5,788 17,513 20,058

Other

Nickel

Saleable production

(kt)

Nickel West (9) 100% 19.2 28.7 21.6 13.7 20.9 56.2 58.7

Total 19.2 28.7 21.6 13.7 20.9 56.2 58.7

Cobalt

Saleable production

(t)

Nickel West 100% 194 302 211 120 132 463 597

Total 194 302 211 120 132 463 597

(1) LPG and ethane are reported as natural gas liquids (NGL).

Product-specific conversions are made and NGL is reported in

barrels of oil equivalent (boe). Total boe conversions are based on

6 bcf of natural gas equals 1,000 Mboe.

(2) Metal production is reported on the basis of payable metal.

(3) Shown on a 100% basis. BHP interest in saleable production is 57.5%.

(4) Includes Cerro Colorado and Spence.

(5) Iron ore production is reported on a wet tonnes basis.

(6) Shown on a 100% basis. BHP interest in saleable production is 85%.

(7) Metallurgical coal production is reported on the basis of

saleable product. Production figures include some thermal coal.

(8) Shown on a 100% basis. BHP interest in saleable production is 80%.

(9) Production restated to include other nickel by-products.

Throughout this report figures in italics indicate that this

figure has been adjusted since it was previously reported.

17

Production and sales report

Quarter ended Year to date

Mar Jun Sep Dec Mar Mar Mar

2019 2019 2019 2019 2020 2020 2019

Petroleum (1)

Bass Strait

Crude oil and

condensate (Mboe) 893 1,246 1,409 1,427 926 3,762 3,947

NGL (Mboe) 849 1,299 1,810 1,405 958 4,173 4,136

Natural gas (bcf) 21.0 30.6 36.6 27.8 18.4 82.8 81.3

Total petroleum

products (Mboe) 5,242 7,645 9,319 7,465 4,957 21,741 21,633

North West Shelf

Crude oil and

condensate (Mboe) 1,431 1,357 1,337 1,376 1,266 3,979 4,465

NGL (Mboe) 193 189 202 200 191 593 641

Natural gas (bcf) 36.6 34.8 32.1 32.9 35.0 100.0 110.7

Total petroleum

products (Mboe) 7,724 7,346 6,889 7,059 7,287 21,235 23,556

Pyrenees

Crude oil and

condensate (Mboe) 940 1,001 979 934 917 2,830 2,323

Total petroleum

products (Mboe) 940 1,001 979 934 917 2,830 2,323

Other Australia

(2)

Crude oil and

condensate (Mboe) 6 7 8 1 1 10 21

Natural gas (bcf) 13.0 12.2 12.0 11.4 11.2 34.6 40.7

Total petroleum

products (Mboe) 2,173 2,040 2,008 1,901 1,874 5,783 6,804

Atlantis (3)

Crude oil and

condensate (Mboe) 3,888 3,607 2,759 3,525 2,769 9,053 10,880

NGL (Mboe) 275 248 192 245 178 615 758

Natural gas (bcf) 2.0 2.2 1.4 1.8 1.3 4.5 5.4

Total petroleum

products (Mboe) 4,496 4,222 3,184 4,070 3,170 10,424 12,538

Mad Dog (3)

Crude oil and

condensate (Mboe) 1,258 1,246 1,096 1,202 1,272 3,570 3,686

NGL (Mboe) 58 23 49 52 55 156 173

Natural gas (bcf) 0.2 0.2 0.2 0.2 0.2 0.6 0.6

Total petroleum

products (Mboe) 1,349 1,302 1,178 1,287 1,355 3,821 3,959

Shenzi (3)

Crude oil and

condensate (Mboe) 1,881 1,725 1,345 1,671 1,645 4,661 5,921

NGL (Mboe) 112 (2) 70 94 94 258 355

Natural gas (bcf) 0.4 0.4 0.2 0.3 0.3 0.8 1.2

Total petroleum

products (Mboe) 2,060 1,790 1,448 1,815 1,791 5,054 6,476

Trinidad/Tobago

Crude oil and

condensate (Mboe) 284 235 175 166 97 438 931

Natural gas (bcf) 19.5 17.3 17.9 14.2 14.0 46.1 57.5

Total petroleum

products (Mboe) 3,534 3,118 3,158 2,533 2,427 8,118 10,514

Other Americas

(3) (4)

Crude oil and

condensate (Mboe) 284 272 185 230 344 759 709

NGL (Mboe) 18 3 2 4 22 28 25

Natural gas (bcf) 0.2 0.1 - 0.1 0.3 0.4 0.3

Total petroleum

products (Mboe) 335 292 187 251 412 850 784

18

Production and sales report

Quarter ended Year to date

Mar Jun Sep Dec Mar Mar Mar

2019 2019 2019 2019 2020 2020 2019

UK (5)

Crude oil and

condensate (Mboe) - - - - - - 72

NGL (Mboe) - - - - - - 42

Natural gas (bcf) - - - - - - 1.4

Total petroleum

products (Mboe) - - - - - - 347

Algeria

Crude oil and

condensate (Mboe) 866 910 889 880 854 2,623 2,735

Total petroleum

products (Mboe) 866 910 889 880 854 2,623 2,735

Petroleum (1)

Total production

Crude oil and

condensate (Mboe) 11,731 11,606 10,182 11,412 10,091 31,685 35,690

NGL (Mboe) 1,505 1,760 2,325 2,000 1,498 5,823 6,130

Natural gas (bcf) 92.9 97.8 100.4 88.7 80.7 269.8 299.1

Total (Mboe) 28,719 29,666 29,240 28,195 25,039 82,475 91,670

(1) Total boe conversions are based on 6 bcf of natural gas

equals 1,000 Mboe. Negative production figures

represent finalisation adjustments.

(2) Other Australia includes Minerva and Macedon.

(3) Gulf of Mexico volumes are net of royalties.

(4) Other Americas includes Neptune, Genesis and Overriding Royalty Interest.

(5) BHP completed the sale of its interest in the Bruce and

Keith oil and gas fields on 30 November 2018.

The sale has an effective date of 1 January 2018.

Copper

Metals production is payable metal unless

otherwise stated.

Escondida, Chile

(1)

Material mined (kt) 103,936 100,693 101,026 100,057 107,268 308,351 316,776

Sulphide ore milled (kt) 32,027 32,519 33,956 33,659 33,440 101,055 93,047

Average concentrator

head grade (%) 0.82% 0.86% 0.86% 0.87% 0.82% 0.85% 0.88%

Production ex

mill (kt) 216.9 230.9 245.0 246.1 230.0 721.1 678.7

Production

Payable copper (kt) 205.4 224.1 237.0 240.3 220.1 697.4 658.0

Copper cathode

(EW) (kt) 62.4 63.5 55.9 68.4 69.6 193.9 189.7

- Oxide leach (kt) 20.9 23.4 21.9 28.3 29.3 79.5 63.8

- Sulphide leach (kt) 41.5 40.1 34.1 40.1 40.2 114.4 125.8

Total copper (kt) 267.8 287.6 292.9 308.7 289.7 891.3 847.7

(troy

Payable gold concentrate oz) 73,998 74,704 48,801 49,209 35,990 134,000 211,302

Payable silver (troy

concentrate koz) 2,189 2,074 1,626 1,798 1,390 4,814 6,756

Sales

Payable copper (kt) 212.0 223.4 222.2 248.3 212.0 682.5 657.7

Copper cathode

(EW) (kt) 56.6 67.5 52.3 70.6 65.9 188.8 182.1

(troy

Payable gold concentrate oz) 73,999 74,704 48,801 49,209 35,990 134,000 211,303

Payable silver (troy

concentrate koz) 2,189 2,074 1,626 1,798 1,390 4,814 6,756

(1) Shown on a 100% basis. BHP interest in saleable production is 57.5%.

19

Production and sales report

Quarter ended Year to date

Mar Jun Sep Dec Mar Mar Mar

2019 2019 2019 2019 2020 2020 2019

Pampa Norte, Chile

Cerro Colorado

Material mined (kt) 15,561 13,534 15,071 18,102 18,710 51,883 53,924

Ore milled (kt) 4,277 4,740 3,995 5,009 4,574 13,578 14,148

Average copper

grade (%) 0.63% 0.64% 0.54% 0.57% 0.54% 0.55% 0.59%

Production

Copper cathode

(EW) (kt) 18.2 23.4 16.4 13.8 20.4 50.6 51.8

Sales

Copper cathode

(EW) (kt) 15.5 26.8 14.5 15.8 18.3 48.6 48.3

Spence

Material mined (kt) 18,632 19,213 21,040 23,132 23,304 67,476 63,300

Ore milled (kt) 4,376 5,224 5,635 5,133 5,191 15,959 15,446

Average copper

grade (%) 1.03% 1.02% 0.95% 0.90% 0.87% 0.91% 1.12%

Production

Copper cathode

(EW) (kt) 49.0 50.7 47.5 46.2 43.9 137.6 120.6

Sales

Copper cathode

(EW) (kt) 46.1 55.0 46.7 44.3 44.8 135.8 114.9

Copper (continued)

Metals production is payable metal

unless otherwise stated.

Antamina, Peru

Material mined

(100%) (kt) 57,900 58,994 59,299 63,224 52,872 175,395 183,220

Sulphide ore milled

(100%) (kt) 11,466 12,864 13,121 13,637 12,906 39,664 37,575

Average head grades

- Copper (%) 1.04% 1.02% 0.99% 0.96% 0.88% 0.94% 1.01%

- Zinc (%) 0.87% 0.86% 0.80% 0.82% 1.09% 0.90% 0.94%

Production

Payable copper (kt) 34.5 37.4 37.6 36.2 32.9 106.7 109.8

Payable zinc (t) 20,848 22,469 20,454 22,483 31,789 74,726 75,643

(troy

Payable silver koz) 1,062 1,209 1,101 1,173 1,216 3,490 3,549

Payable lead (t) 456 770 405 383 621 1,409 1,619

Payable molybdenum (t) 82 178 405 527 491 1,423 963

Sales

Payable copper (kt) 33.3 36.0 33.1 43.6 30.8 107.5 107.6

Payable zinc (t) 20,595 21,750 20,196 23,808 31,007 75,011 78,489

(troy

Payable silver koz) 1,027 937 954 1,396 815 3,165 3,456

Payable lead (t) 749 296 844 432 151 1,427 2,010

Payable molybdenum (t) 256 127 173 400 531 1,104 999

20

Production and sales report

Quarter ended Year to date

Mar Jun Sep Dec Mar Mar Mar

2019 2019 2019 2019 2020 2020 2019

Olympic Dam, Australia

Material mined

(1) (kt) 2,191 2,425 2,477 2,347 1,920 6,744 6,669

Ore milled (kt) 2,371 2,195 2,200 2,153 2,178 6,531 5,770

Average copper

grade (%) 2.22% 2.30% 2.31% 2.36% 2.31% 2.33% 2.14%

Average uranium

grade (kg/t) 0.65 0.65 0.65 0.71 0.69 0.68 0.63

Production

Copper cathode

(ER and EW) (kt) 50.2 45.2 35.1 50.5 38.4 124.0 115.1

Payable uranium (t) 1,106 975 937 949 776 2,662 2,590

(troy

Refined gold oz) 28,609 37,032 43,205 35,382 33,235 111,822 69,936

(troy

Refined silver koz) 230 268 245 203 241 689 655

Sales

Copper cathode

(ER and EW) (kt) 47.4 50.5 32.1 49.0 41.4 122.5 107.9

Payable uranium (t) 550 1,427 778 638 702 2,118 2,143

(troy

Refined gold oz) 27,574 36,133 40,073 36,507 36,956 113,536 66,531

(troy

Refined silver koz) 241 257 250 202 259 711 634

(1) Material mined refers to run of mine ore mined and hoisted.

Iron Ore

Iron ore production and sales are

reported on a wet tonnes basis.

Pilbara, Australia

Production

Newman (kt) 15,608 17,058 16,316 15,766 16,449 48,531 49,564

Area C Joint Venture (kt) 11,627 13,837 12,620 12,727 12,179 37,526 33,603

Yandi Joint Venture (kt) 15,214 17,486 17,827 14,857 17,491 50,175 47,711

Jimblebar (1) (kt) 13,658 14,209 14,239 17,045 13,911 45,195 44,337

Wheelarra (kt) 10 5 3 - - 3 154

Total production (kt) 56,117 62,595 61,005 60,395 60,030 181,430 175,369

Total production

(100%) (kt) 63,609 71,133 69,257 68,044 68,168 205,469 198,466

Sales

Lump (kt) 13,603 15,568 14,785 15,982 15,617 46,384 42,637

Fines (kt) 41,981 48,064 45,509 45,785 44,764 136,058 132,567

Total (kt) 55,584 63,632 60,294 61,767 60,381 182,442 175,204

Total sales (100%) (kt) 62,853 72,173 68,291 69,481 68,439 206,211 198,032

(1) Shown on a 100% basis. BHP interest in saleable production is 85%.

Samarco, Brazil

(1)

Production (kt) - - - - - - -

Sales (kt) - - - - - - 10

(1) Mining and processing operations remain suspended following

the failure of the Fundão tailings dam and Santarém water dam on 5

November 2015.

21

Production and sales report

Quarter ended Year to date

Mar Jun Sep Dec Mar Mar Mar

2019 2019 2019 2019 2020 2020 2019

Coal

Coal production is reported on the basis

of saleable product.

Queensland Coal

Production (1)

BMA

Blackwater (kt) 1,484 1,735 1,045 1,734 1,063 3,842 4,868

Goonyella (kt) 2,141 2,620 1,489 2,662 1,963 6,114 5,943

Peak Downs (kt) 1,468 1,649 1,423 1,386 1,339 4,148 4,284

Saraji (kt) 1,250 1,243 1,214 1,325 1,025 3,564 3,649

Daunia (kt) 470 669 556 579 447 1,582 1,509

Caval Ridge (kt) 795 1,174 1,178 1,037 1,032 3,247 2,793

Total BMA (kt) 7,608 9,090 6,905 8,723 6,869 22,497 23,046

Total BMA (100%) (kt) 15,216 18,180 13,810 17,446 13,738 44,994 46,092

BHP Mitsui Coal

(2)

South Walker Creek (kt) 1,429 1,624 1,378 1,196 1,577 4,151 4,570

Poitrel (kt) 840 1,180 1,075 1,005 776 2,856 2,891

Total BHP Mitsui

Coal (kt) 2,269 2,804 2,453 2,201 2,353 7,007 7,461

Total Queensland

Coal (kt) 9,877 11,894 9,358 10,924 9,222 29,504 30,507

Total Queensland

Coal (100%) (kt) 17,485 20,984 16,263 19,647 16,091 52,001 53,553

Sales

Coking coal (kt) 7,221 7,932 7,299 7,775 7,084 22,158 22,091

Weak coking coal (kt) 3,282 2,942 2,466 2,475 2,335 7,276 9,153

Thermal coal (kt) 379 350 94 30 224 348 677

Total (kt) 10,882 11,224 9,859 10,280 9,643 29,782 31,921

Total (100%) (kt) 19,176 19,789 17,145 18,459 16,928 52,532 56,096

(1) Production figures include some thermal coal.

(2) Shown on a 100% basis. BHP interest in saleable production

is 80%.

NSW Energy Coal,

Australia

Production (kt) 4,552 5,412 3,592 3,763 3,810 11,165 12,845

Sales

Export thermal coal (kt) 3,529 5,181 3,075 3,952 3,403 10,430 11,887

Inland thermal coal (kt) 302 975 567 - - 567 1,027

Total (kt) 3,831 6,156 3,642 3,952 3,403 10,997 12,914

Cerrejón, Colombia

Production (kt) 2,199 2,017 2,055 2,315 1,978 6,348 7,213

Sales thermal coal

- export (kt) 2,200 2,245 2,069 2,261 2,028 6,358 7,086

22

Production and sales report

Quarter ended Year to date

Mar Jun Sep Dec Mar Mar Mar

2019 2019 2019 2019 2020 2020 2019

Other

Nickel production is reported on the

basis of saleable product

Nickel West, Australia

Mt Keith

Nickel concentrate (kt) 52.5 52.8 43.7 31.5 42.8 118.0 147.6

Average nickel grade (%) 19.2 19.5 18.3 17.3 15.8 17.1 19.3

Leinster

Nickel concentrate (kt) 51.8 48.3 67.2 56.6 57.8 181.6 195.9

Average nickel grade (%) 9.3 10.8 10.0 8.6 9.8 9.5 8.6

Saleable production

Refined nickel (1)

(2) (kt) 17.6 19.9 17.4 11.1 16.6 45.1 53.7

Intermediates and

nickel by-products

(1) (3) (kt) 1.6 8.8 4.2 2.6 4.3 11.1 5.0

Total nickel (1) (kt) 19.2 28.7 21.6 13.7 20.9 56.2 58.7

Cobalt by-products (t) 194 302 211 120 132 463 597

Sales

Refined nickel (1)

(2) (kt) 17.9 19.9 17.0 10.6 16.8 44.4 54.5

Intermediates and

nickel by-products

(1) (3) (kt) 0.1 8.4 5.7 2.7 2.9 11.3 4.4

Total nickel (1) (kt) 18.0 28.3 22.7 13.3 19.7 55.7 58.9

Cobalt by-products (t) 194 302 212 131 132 475 597

(1) Production and sales restated to include other nickel by-products.

(2) High quality refined nickel metal, including briquettes and powder.

(3) Nickel contained in matte and by-product streams.

23

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDSEAEESESSESL

(END) Dow Jones Newswires

April 21, 2020 02:00 ET (06:00 GMT)

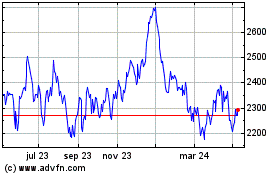

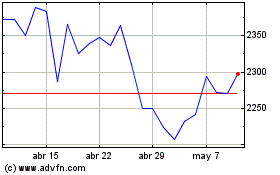

Bhp (LSE:BHP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Bhp (LSE:BHP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024