TIDMPGH

RNS Number : 2630K

Personal Group Holdings PLC

21 April 2020

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

PERSONAL GROUP HOLDINGS PLC

("Personal Group", "Company" or "Group")

Preliminary Results for the Year Ended 31 December 2019

Another solid year with revenue and pre-tax profit growth

Personal Group Holdings Plc, a leading provider of employee

services in the UK, is

pleased to announce its Preliminary Results for the year to 31

December 2019 together with comments on the impact of the

coronavirus pandemic (COVID-19) on the business.

2019 Highlights

Financial

-- Group revenue of GBP70.9m (2018: GBP55.3m) increased by 28%

o Includes GBP18.4m transactional spend and commission on Hapi

(2018: GBP6.9m)

-- Adjusted EBITDA of GBP11.0m (2018: GBP11.4m) down 4%

-- Profit before tax of GBP10.5m (2018: GBP10.2m) increased 3%

-- Basic EPS of 28.4p (2018: 27.2p) up 4%

-- Balance sheet remains strong with cash and deposits of GBP17.0m and no debt

-- Surplus capital resources of GBP13.8m over required resources of GBP4.9m

-- Dividend per share paid in the period up 1.3% to 23.3p (2018: 23.0p)

Operational

-- Group's refined strategy proving effective

-- Accessed new insurance markets, enabling people on a

contingent worker basis to benefit from our insurance products

-- PG Let's Connect revenue up 26% to GBP18.8m with adjusted

EBITDA up 43% to GBP1.7m without any headcount increase

-- SaaS revenue of GBP21.5m is up 146% fuelled by an increase in

transactional spend from GBP6.9m to GBP18.4m

o Hapi users up 28% to 410,000 active employees with over 175

organisations using the platform

o Successful acquisition of Innecto enables Personal Group to

engage with a greater variety of employers

o Sage Employee Benefits launched in September 2019 and Sage

have launched a new marketing campaign in Q1 2020

-- Marketing team overhauled and new website launched

-- ISO 27001 accreditation for the Group

Conronavirus Pandemic (COVID-19)

-- Safety and welfare of staff has been a priority, with almost

all employees working from home in accordance with UK Government

advice

-- Business continuity plans put in place - the Group has near

full capability to support customers and policyholders and maintain

business operations

-- Detailed operational plans in place across the business

including furloughing c22% of employees and developing alternative

sales and retention strategies

-- Financial impact on 2020 and 2021 modelled and stressed,

considering the potential impact on premiums and claims, solvency

ratios, liquidity and non-insurance activities

-- 2020 will be adversely impacted but confident business will

remain profitable supported by strong balance sheet

-- Q2 dividend to be reduced to 1.5p per share; this shortfall

and the remaining 2020 dividends will be revisited later in the

year once the situation is clearer

Deborah Frost, Chief Executive of Personal Group, commented:

"2019 saw a strong performance across the Group amidst a

challenging market backdrop, with adjusted EBITDA of GBP11.0m -

ahead of market expectations, reflecting the strength of the

underlying business. Our refreshed strategy, announced in September

2019, is starting to show positive signs.

The impact of COVID-19 on the UK and world-wide economy is very

far reaching. It is clearly too early to accurately assess the

final impact of the outbreak on our customers and our business.

However, we have a robust recurring revenue model across different

parts of the Group, including insurance, our benefits platform

Hapi, and Innecto Digital products. Long-established client

relationships and repeat business forms the core of the Innecto and

Let's Connect business models.

The effect of COVID-19 is likely to have short as well as long

term implications for the Group - we anticipate our insurance

claims ratios could increase this year but our messages about

protecting the unprotected, being dependable and paying claims are

well received by clients and build on the trust we already have

with them, their employees and our policy-holders.

We also expect PG Let's Connect and Innecto revenues and profits

to be impacted over the short-term by the global slowdown, as

clients defer decisions about pay and benefits until later in the

year.

To mitigate these effects, we have put in place alternative

activities including switching our face to face team to telesales

and focussing on policy-holder retention. Whilst we expect that the

ongoing impacts of the virus could have a material impact on EBITDA

for 2020, and into 2021, we remain confident that the business will

be profitable with a strong balance sheet and no debt. In addition,

we have significant headroom and are taking actions to protect the

business.

Turning our attention to the next 6-12 months, we are confident

that our key messages around connecting and protecting workers,

both employed and contingent, continue to resonate strongly."

S

For more information please contact:

Personal Group Holdings Plc

Deborah Frost / Mike Dugdale +44 (0)1908 605 000

Cenkos Securities Plc

Max Hartley / Callum Davidson (Nomad) +44 (0)20 7397 8900

Russell Kerr (Sales)

Hudson Sandler

Nick Lyon / Lucy Wollam +44 (0)20 7796 4133

Notes to Editors

Personal Group Holdings Plc (AIM: PGH) is a technology enabled

employee services business, working with employers to drive

productivity though better employee engagement and a more motivated

workforce. With over 35 years' experience, the Company provides

employee benefits and services to a large number of employees

across the UK.

Personal Group's offer comprises in-house services, including

employee insurance products (hospital, convalescence plans and

death benefit), the provision of home technology via salary

sacrifice (iPads, computers, laptops, smart phones and smart TVs),

the provision of e-payslips, and pay and reward consulting via

Innecto, the leading independent UK consultancy acquired in 2019.

Third party services include retail discounts, employee assistance

programmes, wellbeing programmes and salary sacrifice cars and

bikes.

The product offer is provided via the Company's proprietary

technology platform, Hapi. The platform is intuitive, designed

primarily for app deployment and also accessible via web and

tablet, driving better engagement, communication and value

recognition. Hapi is flexible and can quickly integrate additional

services, such as existing employee services and partner platforms.

Hapi is a digital SaaS product.

Through technology and select acquisitions, the Company has

grown its addressable market to the majority of the working

population in the UK; including 15.6m SME employees targeted via

its partnership with Sage, the UK's largest software company.

Personal Group's innovative approach to using technology to

deliver its programmes, in combination with its face-to-face method

of communicating with employees, delivers a compelling offer to

blue-chip clients across the UK as a way of attracting, retaining

and motivating employees. The acquisition of Innecto in February

2019 allows Personal Group to engage with clients earlier in their

thinking around Pay and Reward, and to interact with a new base of

blue-chip and fast growth clients typically at HR Director and CEO

level.

Personal Group has a strong client base across a diverse range

of sectors. Clients include: Arsenal F.C., Barchester Healthcare

Ltd, DHL Supply Chain Limited, The Go-Ahead Group plc, Samworth

Brothers Ltd, Independent Television News, Stagecoach Group plc and

Wincanton plc.

For further information, please see www.personalgroup.com

Chairman's Introduction:

Personal Group has a rare consistency - we have again delivered

a good profit from our operations and, once again, increased our

dividend to shareholders. We continue to deliver benefits, both in

financial terms and in peace of mind, to individual employees, many

of whom make up the working backbone of the UK. This is reflected

in our refreshed mission to connect the unconnected, protect the

unprotected and equip employers to engage and reward their

employees.

Underneath this consistency, things are changing within our

market. Our clients are more thoughtful in how they engage with

their workforce to improve their wellbeing. Many have more involved

and sophisticated procurement approaches to tackle this.

Consequently, our engagement with our existing and prospective

clients is changing. We are becoming more targeted and consistent

in our account management. We have a much more integrated style

which takes advantage of a more able marketing function within the

Group and the strengths of our combined business propositions and

salesforce. All of which is led by a new dynamic Chief Executive,

Deborah Frost who, having been a Non-Executive Director of the

Group since September 2015, was appointed on 28 February 2019.

Overall, our business delivered revenue up GBP16m (28%) from

last year and profit before tax slightly improved. However, we

consider Adjusted EBITDA to be a more appropriate measure of our

performance as it has a consistent composition and does not include

one-off elements that might distract from the underlying

performance.

Adjusted EBITDA for 2019 was lower than 2018. This reduction was

less than 4%, reflecting that the growth in revenue came

predominantly from those areas of the business where the margin is,

by nature, lower and costs that, whilst below budget, were higher

than 2018. Increased investment also helped improve the marketing

and sales capabilities and introduced some necessary credentials in

system security - recognised by our ISO 27001 accreditation.

Many people have contributed to the Personal Group throughout

2019, I and the Board thank all our colleagues for their continued

enthusiasm and efforts. In addition, we do not take for granted the

continued support of our shareholders large and small. Thank you

all.

Fairness is an often-stated aspiration by companies, but making

it happen is rarely discussed. Making aspects of financial security

accessible to more people at a fair price is what Personal Group

does, consistently. Our insurance products have been providing

benefits for people in their time of need for over 35 years. Our

hospital, convalescence and death benefit plans are designed to

offer support and assurance and the discounts offered through our

benefit platform help reduce the burden of cost on a daily basis.

I'm confident our strong financial position and operational

resilience will enable us to continue to fulfil these commitments

during the current challenges caused by COVID-19.

Chief Executive operational update

Core Insurance Business

Since my appointment we've spent time focussing on what is

important in Personal Group. We provide insurance and employee

benefits to hundreds of thousands of employees all over the UK, but

what is our key purpose and unique offer in a crowded

marketplace?

We have identified that the central purpose of the core

insurance business is to 'protect the unprotected' and 'connect the

unconnected'. Behind these two statements is a recognition that

many of our policyholders are the working backbone of the UK. In

their roles as bus drivers, food manufacture operatives, care home

staff or retail employees, not all have employer-paid benefits if

they are ill, need to attend hospital or, in the worst case, die.

Our field sales team sit down 1-2-1 with over 73,000 employees a

year to connect them to the benefits their employer offers them,

via Hapi on a mobile phone app, and over 64,000 employees to talk

about protecting themselves and their loved ones from the financial

impact of an unexpected event. Personal Group's insurance business

has been working with client organisations like these to ensure

that workers can have access to simple, fair-value insurance

products for over 35 years.

We believe in making it easy to claim, with our Milton Keynes

Customer Relations team handling over 32,000 claims from

policyholders in 2019. We've also been developing options for

employers to offer our insurance products to their staff on

temporary or zero-hours contracts and agency workers. In reflecting

the reality of the UK workforce and including workers as well as

employees on site visits, we can improve productivity of our field

sales team and protect more people.

When I took over the business our insurance segment was starting

to contract. Policyholder numbers have been reducing for a few

years but increases to premiums had meant that policy income

remained static. In 2019, for the first time, premium income shrank

slightly. I have made reversing this trend a major focus, and

whilst significant improvement in the financial performance will

not be immediate, we are very pleased with the foundations that we

are laying to widen our opportunities.

But we've also recognised that the long-term sustainability of

the business lies in expanding our footprint so that we compete

beyond our heartland clients. Some of these jobs may be replaced by

robots and AI over the next 15 years, so we're developing

propositions to cover a wider part of the economy such as the

public sector and talent-led businesses. My job has been to help my

management team breathe new energy into these developing areas and

set challenging goals to grow the business beyond our insurance

core.

SaaS

Our benefits platform Hapi provides a customisable platform

where employers can combine all their current provision (pension,

childcare vouchers etc) into our simple mobile and desktop product.

They can then select from an array of other products and services:

payslips, reward and recognition, salary sacrifice technology, cars

and cycles as well as our offers and discounts to build the right

benefit solution for their teams. Our technology, particularly the

mobile app, is outstanding and is a great solution for clients

whose teams aren't sitting behind a desk all day. We've had real

breakthroughs this year in working with new partners (ThinkMoney)

and new clients (Prince's Trust through Innecto). The SaaS revenue

from Hapi has grown significantly in 2019, from GBP1.8m to GBP3.1m,

and the success of the Hapi solution is shown by the massive growth

in our top-line revenue on discounts and offers. Our goal is to

reach 1 million Hapi users by 2025 and we're well on the way with

our active users up by 28% in 2019 to 410,139. Over 175

organisations use the Hapi platform for their employee benefits,

customising it to meet their own branding and employee

requirements. It's not always called Hapi - clients call it

different names from 'Smile', 'The Benefits Room', 'MyHub' to 'The

Pantry'.

Our access to the vast but fragmented SME market is primarily

through Sage's employee benefits product (Sage Employee Benefits)

for Sage customers. Sage's focus on Making Tax Digital for their

clients in 2019 meant our re-launched project suffered delays, but

a new management team within Sage, and significant internal

support, have driven progress in developing this growth

opportunity. A new marketing campaign in Q1 2020 by Sage should

drive awareness and Sage have agreed to underwrite our cost of the

platform for 2020 as part of their commitment to the roll-out.

Innecto have completed their first 10 months in the Personal

Group family. Innecto Digital, their digital pay management suite,

has been completely re-coded and re-launched on the Outsystems

platform, bringing the same level of scalability, security and

analytics as Hapi. Current clients are being migrated onto the new

system in early 2020 and new opportunities are being lined up. They

have continued to grow their consultancy business this year.

Innecto's drive, growth mindset and client focus have brought new

ideas into Personal Group too.

PG Let's Connect

Finally, PG Let's Connect have had a splendid year - both

delivering on their commitment to their adjusted EBITDA number

(+43% on 2018), with no increase in headcount, at the same time as

developing new products to meet the requirements of the NHS. We're

very excited about the opportunities we bring to NHS Trusts by

simplifying their benefits offer, putting everything in one place,

and into staff hands via the mobile app. The platform includes

access to salary sacrifice Home Technology through Let's Connect,

and cars and cycle to work schemes. We have also wrapped in access

to their pension scheme, the excellent NHS employee support line,

and their own discounts and offers. The NHS employs over 1 million

workers in the UK. We are in final contract discussions with two

Trusts and are working with others.

Team

Our Marketing team has been overhauled, with new faces and fresh

ideas. We have recently launched a new website which places our

'protect the unprotected' offer front and centre and includes real

policyholder and client case studies. I'm happy that it reflects

who we are and what we do.

Financials

Group revenue for the year increased by 28% to GBP70.9m (2018:

GBP55.3m). The Group saw strong revenue growth from SaaS and PG

Let's Connect whilst the insurance business was hindered by a

slowdown of new client business wins resulting in fewer new

policies written.

Group revenue growth in SaaS was driven by increased user spend

on Hapi and the fact that the provision of products such as

reloadable cards, e-vouchers and cinema tickets are now serviced

largely in-house. An increase in paid-for Hapi subscriptions and

the addition of consultancy income following the acquisition of

Innecto have also helped to drive this growth.

PG Let's Connect significantly improved its year-on-year

performance. The Company expects this growth to continue following

a positive reaction to the new proposition created for the NHS.

Adjusted EBITDA for the year has dropped to GBP11.0m (2018:

11.4m), despite increased revenue. The improved trading

performances from PG Let's Connect of GBP0.5m and SaaS of GBP0.4m

which, by nature, are lower margin businesses, were offset by the

insurance business being GBP1.5m down on last year. Insurance

continues to contribute the majority of Adjusted EBITDA* and the

reduced contribution reflects the reducing policy numbers.

The Group continued to retain a prudent focus on costs, which

were below budget for the year but up on the prior year. The

increase in costs includes the planned investment in sales and

marketing to drive additional sales opportunities to reverse the

current decline in the insurance business and additional legal

costs incurred in pursuing the damages from a long standing

judgement, awarded to the Group in October 2014, which is expected

to come to a successful conclusion early in 2021.

Profit before tax was GBP10.5m during the year (2018: GBP10.2m).

This increase was predominantly due to the GBP1.3m (2018: GBP0.6m)

release of the tax provision and the increase in trading

performance in PG Let's Connect and SaaS, offset by reduced

contribution from the insurance business. The tax charge for the

year was GBP1.6m (2018: GBP1.8m), resulting in profit after tax for

the year of GBP8.8m (2018: GBP8.4m). Basic EPS was 28.4p (2018:

27.2p).

The Company paid a total dividend of 23.3p per share over the

year (2018: 23.0p), representing a 1.3% increase over the prior

year. The Group's core insurance business retains its strong

profitability, despite facing new business challenges, and

continues to underpin the dividend and support investment across

the wider business. Whilst profits remain relatively flat, the

Company has sufficient distributable reserves to support a

progressive dividend policy as the Group works towards implementing

its strategy. The first quarterly dividend for 2020, of 5.9p per

share, reflects this policy and represents a 1.3% increase over the

corresponding period in 2019. The dividend was paid to shareholders

on 27 March 2020.

The Group's balance sheet remains strong, with cash and deposits

at the year-end of GBP17.0m (2018: GBP17.7m) and no debt.

The slight reduction in cash balances in the year was due to a

combination of Group trading, the decision to sell two properties

held by the Company, realising GBP0.5m, the purchase of Innecto for

a cash consideration of GBP3.2m and the receipt of GBP1.1m for

newly created shares purchased at fair market value by two

directors of Innecto, including Deborah Frost.

The Group's main underwriting subsidiary, Personal Assurance Plc

(PA), continues to maintain a conservative solvency ratio of 259%

(unaudited), with a surplus over its Solvency Capital Requirement

of GBP6.6m. The Company has consistently maintained a prudent

position in relation to its Solvency II requirement.

Outlook

Despite the substantial global impact of the COVID-19 virus,

which necessitates a significant degree of prudence for 2020, we

remain positive in terms of the longer-term outlook for the

business. We have implemented our contingency plans and almost all

of our employees are currently working from home, in accordance

with UK Government advice. We have considered the developing

COVID-19 situation in detail and have modelled numerous scenarios.

Whilst we expect that the ongoing impacts of the virus could have a

material impact on EBITDA for 2020, and into 2021, we remain

confident that the business will remain profitable with a strong

balance sheet and no debt. In addition, we have significant

headroom and are taking actions to protect the business.

These include furloughing a number of employees, setting up

outbound sales activity with our field sales teams whilst

continuing to process claims and serve our customers. The changes

we have implemented this year will undoubtedly take time to bear

fruit, and they will be joined by new developments in 2020, but at

the end of my first year, I recognise the strength, resilience and

determination of not just my senior team but the wider Personal

Group family to create and drive the business forward into new and

existing markets.

Whilst the current challenges being faced in the light of

COVID-19 may temporarily change our focus in the short term, they

may also present longer-term opportunities to reinforce our central

purpose of connecting the unconnected and protecting the

unprotected further.

Consolidated Income Statement

2019 2018

GBP'000 GBP'000

Continuing Operations

Gross premiums written 30,369 31,445

Outward reinsurance premiums (204) (231)

Change in unearned premiums 59 28

Change in reinsurers' share

of unearned premiums (10) (10)

(_________) (_________)

Earned premiums net of reinsurance 30,214 31,232

Other insurance related income 191 218

IT salary sacrifice income 18,794 14,970

SaaS income 21,459 8,729

Other non-insurance income 100 115

Investment income 131 83

(_________) (_________)

Revenue 70,889 55,347

(_________) (_________)

Claims incurred (6,670) (7,175)

Insurance operating expenses (15,964) (15,073)

Other insurance related expenses (210) (261)

IT salary sacrifice expenses (17,157) (13,851)

SaaS costs (20,930) (8,561)

Share-based payment expenses (19) (117)

Charitable donations (100) (100)

Amortisation of intangible assets (489) (661)

(___________) (___________)

Expenses (61,539) (45,799)

(___________) (___________)

Operating profit 9,350 9,548

Finance costs (131) (148)

Release of provisions 1,259 646

Share of profit/(loss) of equity-accounted

investee net of tax 9 164

(_________) (_________)

Profit before tax 10,487 10,210

Tax (1,649) (1,819)

(_________) (_________)

Profit for the year 8,838 8,391

The profit for the year is attributable to equity holders

of Personal Group Holdings Plc

Earnings per share Pence Pence

Basic 28.4 27.2

Diluted 28.4 27.2

There is no other comprehensive income for the year and, as a

result, no statement of comprehensive income has been produced. All

operations are classed as continuing activities.

Consolidated Balance Sheet at 31 December 2019

2019 2018

GBP'000 GBP'000

ASSETS

Non-current assets

Goodwill 12,696 10,575

Intangible assets 1,301 500

Property, plant and equipment 5,984 6,040

Investment property - 130

(_________) (_________)

19,981 17,245

(__) (______) (________)

Current assets

Financial assets 2,565 2,530

Trade and other receivables 18,549 16,532

Equity-accounted investee - 50

Reinsurance assets 121 187

Inventories - Finished Goods 746 643

Cash and cash equivalents 14,476 15,148

(_________) (_________)

36,457 35,090

(___) (______) (_________)

Total assets 56,438 52,335

(__________) (__________)

Consolidated Balance Sheet at 31 December 2019

2019 2018

GBP'000 GBP'000

EQUITY

Equity attributable to equity

holders

of Personal Group Holdings

Plc

Share capital 1,561 1,544

Share premium 1,134 -

Capital redemption reserve 24 24

Other reserve (230) (210)

Profit and loss reserve 35,526 33,937

(_________) (_________)

Total equity 38,015 35,295

(_________) (_________)

LIABILITIES

Non-current liabilities

Deferred tax liabilities 302 102

Trade and other payables 290 356

Current liabilities

Provisions - 1,259

Trade and other payables 15,043 12,233

Insurance contract liabilities 2,104 2,376

Current tax liabilities 684 714

(_________) (_________)

17,831 16,582

(_________) (_________)

(_________) (_________)

Total liabilities 18,423 17,040

(_________) (_________)

(_________) (_________)

Total equity and liabilities 56,438 52,335

(_________) (_________)

Consolidated Statement of Changes in Equity for the year ended

31 December 2019

Equity attributable to equity holders of Personal Group Holdings

Plc

Share Share Capital Other Profit Total

capital Premium redemption reserve and loss equity

Reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance as at 1 January

2019 1,544 - 24 (210) 33,937 35,295

(________) (______) (______) (______) (________) (________)

Dividends - - - - (7,244) (7,244)

Employee share-based

compensation - - - - 19 19

Proceeds of SIP* share

sales - - - - 20 20

Cost of SIP shares sold - - - 44 (44) -

Cost of SIP shares purchased - - - (64) - (64)

Shares issued in the

year 17 1,134 - - - 1,151

(________) (________) (________) (________) (________) (________)

Transactions with owners 17 1,134 - (20) (7,249) (6,118)

(________) (________) (________) (________) (________) (________)

Profit for the year - - - - 8,838 8,838

(________) (________) (________) (________) (________) (________)

Total comprehensive income for

the year - - - - 8,838 8,838

(________) (_______) (________) (________) (________) (________)

Balance as at 31 December

2019 1,561 1,134 24 (230) 35,526 38,015

(________) (______) (______) (________) (__________) (_________)

* PG Share Ownership Plan (SIP)

Consolidated Statement of Changes in Equity for the year ended

31 December 2018

Equity attributable to equity holders of Personal Group Holdings

Plc

Share capital Capital Available Other Profit Total

redemption for sale reserve and loss equity

reserve financial reserve

assets

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance as at 1 January

2018 as previously reported 1,540 24 85 (310) 32,417 33,756

Adjustment on initial

adoption IFRS 9 - - (85) - 85 -

Restated balance as

at 1 January 2018 1,540 24 - (310) 32,502 33,756

(________) (______) (______) (______) (________) (________)

Dividends - - - - (7,087) (7,087)

Employee share-based

compensation - - - - 94 94

Proceeds of SIP* share

sales - - - - 132 132

Cost of SIP shares sold - - - 179 (179) -

Cost of SIP shares purchased - - - (79) - (79)

Deferred tax reserve

movement - - - - 88 88

Nominal value of LTIP**

shares issued 4 - - - (4) -

(________) (________) (________) (________) (________) (________)

Transactions with owners 4 - - 100 (6,956) (6,940)

(________) (________) (________) (________) (________) (________)

Profit for the year - - - - 8,391 8,391

(________) (________) (________) (________) (________) (________)

Total comprehensive

income for the

year - - - - 8,391 8,391

(________) (_______) (________) (________) (________) (________)

Balance as at 31 December

2018 1,544 24 - (210) 33,937 35,295

(________) (______) (______) (________) (__________) (_________)

* PG Share Ownership Plan (SIP)

**Long Term Incentive Plan (LTIP)

Consolidated Cash Flow Statement

2019 2018

GBP'000 GBP'000

Net cash from operating activities

(see next page) 8,668 8,325

(__________) (__________)

Investing activities

Additions to property, plant and equipment (734) (1,024)

Additions to intangible assets (266) (178)

Proceeds from disposal of property, plant and

equipment 398 9

Proceeds from disposal of investment property 188 -

Purchase of financial assets (34) (105)

Proceeds from disposal of financial

assets - 2,056

Interest received 131 82

Dividends received from equity accounted

investee 59 750

Dividends received - 8

Acquisition of subsidiary, net of cash

acquired (2,714) -

(__________) (__________)

Net cash used in investing activities (2,972) 1,598

(__________) (__________)

Financing activities

Proceeds from the issue of shares 1,151 -

Interest paid (2) (28)

Purchase of own shares by the SIP (64) (79)

Proceeds from disposal of own shares

by the SIP 20 132

Payment of lease liabilities (229) (354)

Dividends paid (7,244) (7,087)

(__________) (__________)

Net cash used in financing activities (6,368) (7,416)

(__________) (__________)

Net change in cash and cash equivalents (672) 2,507

Cash and cash equivalents, beginning

of year 15,148 12,641

Cash and cash equivalents, end of year 14,476 15,148

(_________) (_________)

Consolidated Cash Flow Statement 2019 2018

GBP'000 GBP'000

Operating activities

Profit after tax 8,838 8,391

Adjustments for

Depreciation 970 797

Amortisation of intangible assets 489 661

(Profit) / loss on disposal of property,

plant and equipment (127) 59

Profit on disposal of investment property (60) -

Realised net investment loss - 10

Interest received (131) (82)

Dividends received - (8)

Interest charge 131 148

Share of profit of equity-accounted

investee, net of tax (9) (164)

Share-based payment expenses 19 94

Taxation expense recognised in income

statement 1,649 1,819

Changes in working capital

Trade and other receivables (1,520) (1,920)

Trade and other payables 1,406 865

Provisions (1,259) (646)

Inventories (103) (83)

Taxes paid (1,625) (1,616)

(__________) (__________)

Net cash from operating activities 8,668 8,325

(__________) (__________)

Notes to the Financial Statements

1 Segment analysis

The segments used by management to review the operations of the

business are disclosed below.

1) Core Insurance

Personal Assurance Plc (PA), a subsidiary within the Group, is a

PRA regulated general insurance Company and is authorised to

transact accident and sickness insurance. It was established in

1984 and has been underwriting business since 1985. In 1997

Personal Group Holdings Plc (PGH) was created and became the

ultimate parent undertaking of the Group.

Personal Assurance (Guernsey) Limited (PAGL), a subsidiary

within the Group, is regulated by the Guernsey Financial Services

Commission and has been underwriting death benefit policies since

March 2015.

This operating segment derives the majority of its revenue from

the underwriting by PA and PAGL of insurance policies that have

been bought by employees of host companies via bespoke benefit

programmes.

2) IT Salary Sacrifice

IT salary sacrifice refers to the trade of PG Let's Connect, a

salary sacrifice technology Company purchased in 2014.

3) SaaS

Revenue in this segment relates to the annual subscription

income and other related income arising from the licensing of Hapi,

the Group's employee benefit platform. This includes sales to both

the large corporate and SME sectors. Also included in this segment,

from 1 March 2019, is consultancy and license income derived from

selling Innecto digital platform subscriptions.

4) Other

The other operating segment consists exclusively of revenue

generated by Berkeley Morgan Group (BMG) and its subsidiary

undertakings along with any investment and rental income obtained

by the Group.

IT Salary

Core Insurance Sacrifice SaaS Other Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Operating segments

2019

Revenue

Earned premiums net

of reinsurance 30,205 - 9 - 30,214

Other income - Insurance

Related 3 - - 188 191

Other income - IT Salary

Sacrifice - 18,794 - - 18,794

Other income - Platform - - 3,104 - 3,104

Other income - Transactional

and commission - - 18,355 - 18,355

Other income - - - 100 100

Investment income - - - 131 131

(_________) (_________) (_________) (_________) (_________)

30,208 18,794 21,468 419 70,889

Total revenue (_________) (_________) (_________) (_________) (_________)

Net result for year

before tax 7,322 2,764 219 182 10,487

PG Let's Connect -

Tax provision - (1,259) - - (1,259)

Amortisation - Acquisition

intangibles - 53 171 - 224

Acquisition costs - - - 145 145

Interest 91 23 17 - 131

Share based payments - - - 19 19

Depreciation 791 112 58 9 970

Amortisation (other) 79 55 131 - 265

Adjusted EBITDA* 8,283 1,748 596 355 10,982

(_________) (_________) (_________) (_________) (_________)

Segment assets 25,195 12,023 4,669 14,551 56,438

Segment liabilities 7,948 7,045 3,430 - 18,423

Depreciation and amortisation 870 220 360 9 1,459

* Adjusted EBITDA is defined as earnings before interest, tax,

depreciation, amortisation of intangible assets, goodwill

impairment, share-based payment expenses, corporate acquisition

costs, restructuring costs, write-back of contingent consideration

and release of tax provision.

IT Salary

Core Insurance Sacrifice SaaS Other Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Operating segments

2018

Revenue

Earned premiums net

of reinsurance 31,219 - 13 - 31,232

Other income - Insurance

Related (9) - - 227 218

Other income - IT Salary

Sacrifice - 14,970 - - 14,970

Other income - Platform - - 1,800 - 1,800

Other income - Transactional

and commission - - 6,929 - 6,929

Other income - - - 114 114

Investment property - - - 1 1

Investment income - - - 83 83

(_________) (_________) (_________) (_________) (_________)

31,210 14,970 8,742 425 55,347

Total revenue (_________) (_________) (_________) (_________) (_________)

Net result for year

before tax 8,869 1,350 29 (38) 10,210

PG Let's Connect - Tax

provision - (646) - - (646)

PG Let's Connect - Amortisation

of intangibles - 330 - - 330

Acquisition costs - - - 150 150

Interest 110 28 10 - 148

Share based payments - - - 117 117

Depreciation 665 108 15 9 797

Amortisation (other) 133 56 142 - 331

Adjusted EBITDA* 9,777 1,226 196 238 11,437

(_________) (_________) (_________) (_________) (_________)

Segment assets 25,403 12,567 2,612 11,753 52,335

Segment liabilities 6,947 8,035 1,883 175 17,040

Depreciation and amortisation 798 494 157 9 1,458

2. Taxation comprises United Kingdom corporation tax of

GBP1,600,000 (2018: GBP1,650,000) and a deferred tax charge of

GBP49,000 (2018: GBP169,000)

3. The basic and diluted earnings per share are based on profit

for the financial year of GBP8,838,000 (2018: GBP8,391,000) and on

31,118,589 basic (2018: 30,798,840) and 31,122,136 diluted (2018:

30,806,261) ordinary shares, the weighted average number of shares

in issue during the year.

4. The total dividend paid in the year was GBP7,244,000 (2018: GBP7,087,000)

This preliminary statement has been extracted from the 2019

audited financial statements that will be posted to shareholders in

due course. The statutory accounts for each of the two years to 31

December 2018 and 31 December 2017 received audit reports, which

were unqualified and did not contain statements under section 498

(2) or (3) of the Companies Act 2006. The 2018 accounts have been

filed with the Registrar of Companies but the 2018 accounts are not

yet filed.

Alternative Performance Measures

The Group uses an alternative (non-Generally Accepted Accounting

Practice (non-GAAP)) financial measure when reviewing performance

of the Group, evidenced by executive management bonus performance

targets being measured in relation to Adjusted EBITDA*. As such,

this measure is important and should be considered alongside the

IFRS measures.

For Adjusted EBITDA*, the adjustments taken into account in

addition to the standard IFRS measure, are those that are

considered to be non-underlying to trading activities and which are

significant in size. For example, goodwill impairment is a non-cash

item relevant to historic acquisitions; share-based payments are a

non-cash item which have historically been significant in size, can

fluctuate based on judgemental assumptions made about share price

and have no impact on total equity; corporate acquisition costs and

reorganisation costs are both one-off items which are not incurred

in the regular course of business; and write-back of contingent

consideration and the movement in the PG Let's Connect tax

provision are both considered to be non-underlying items, relates

to a liability inherited on acquisition of that business and have

the potential to fluctuate and be of significant size.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR SEUFWSESSELL

(END) Dow Jones Newswires

April 21, 2020 02:00 ET (06:00 GMT)

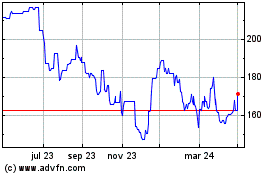

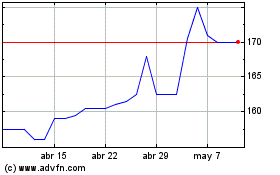

Personal (LSE:PGH)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Personal (LSE:PGH)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024