Snap Revenue Soars With Users Stuck at Home

21 Abril 2020 - 3:41PM

Noticias Dow Jones

By Georgia Wells

Snap Inc. on Tuesday reported a surge in quarterly growth in

users and revenue in the first quarter, as homebound users turned

to its chat app for connection with friends amid the pandemic.

The results mark a surprise as many analysts estimate sharp

decreases in digital ad spending in the quarter, the first to show

the impact of the coronavirus crisis. As Snap is the first

social-media company to report results for the quarter, its

performance could bode well for heavyweights Facebook Inc. and

Alphabet Inc., which deliver earnings next week.

Communication with friends on the company's Snapchat app

increased by more than 30% in the last week of March compared with

the last week of January, the company said. In areas hardest hit by

the pandemic, communication with friends on Snapchat increased more

than 50%.

The Santa Monica, Calif., company said its daily user base rose

11 million from the previous quarter to 229 million, marking the

fifth consecutive quarter of growth. Snapchat's ability to increase

its user count is crucial to attracting more advertisers and

revenue. Analysts polled by FactSet had expected the user count to

rise to 224 million.

Snap's revenue rose 44% in the first quarter to $462.5 million,

up from $320.4 million a year earlier and significantly beating

analyst estimates of $430 million, according to FactSet.

"Snapchat is helping people stay close to their friends and

family while they are separated physically," Snap Chief Executive

Evan Spiegel said in prepared remarks.

Through Monday's close, shares of Snap had lost about 20% this

year. The value of the company's stock more than doubled in 2019.

Following the first-quarter report, Snap's stock rose about 8% in

after-hours trading.

The results indicate that Snap may be well positioned despite

increasing uncertainty in the global economy. Nevertheless, the

company didn't provide guidance for the second quarter, citing the

continuing pandemic and rapidly changing economic conditions. In

the past, Snap has provided forecasts for revenue and adjusted

earnings.

Mr. Spiegel said the pandemic has forced a shift to digital

behavior across every aspect of people's lives that could benefit

Snap. As people are sheltering in place, he said, their

communication, commerce, entertainment, fitness and learning habits

are forcing companies to shift to digital more quickly.

"We believe that this will accelerate the digital transformation

across many businesses, and that the heightened levels of activity

we are seeing today will lead to a sustained uplift in the digital

economy over time," Mr. Spiegel said.

Jeremi Gorman, Snap's chief business officer, said the company

has also shifted its sales team to focus on categories that are

faring better during the pandemic, such as gaming, home

entertainment, e-commerce and consumer packaged goods.

Still, Snap is far from profitable. Snap reported its loss

shrank slightly in the first quarter to $305.9 million, or 21 cents

a share, from $310.4 million, or 23 cents a share, in the same

period a year ago. Analysts polled by FactSet had expected a loss

of 20 cents a share.

In 2019, Mr. Spiegel had made it his company's "stretch" goal to

become profitable that year.

Write to Georgia Wells at Georgia.Wells@wsj.com

(END) Dow Jones Newswires

April 21, 2020 16:26 ET (20:26 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

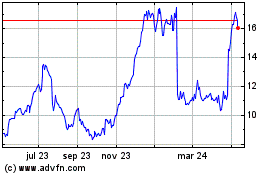

Snap (NYSE:SNAP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

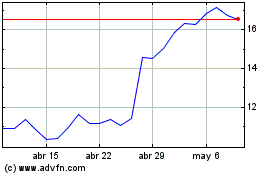

Snap (NYSE:SNAP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024