UniCredit to Book Additional EUR900 Million Loan Loss Provisions in 1Q

22 Abril 2020 - 1:30AM

Noticias Dow Jones

By Mauro Orru

UniCredit SpA said Wednesday that it would take an additional

900 million euros ($976 million) in generic loan loss provisions in

the first quarter of 2020 as it anticipates the IFRS9 macroeconomic

scenario update.

The Italian bank said it expects a 13% fall in eurozone gross

domestic product for 2020, with a 10% recovery in 2021, assumptions

which include the projected impact of the coronavirus pandemic.

UniCredit said cost of risk for the first quarter is projected

around 110 basis points, with 80 basis due to the updated IFRS9

scenario.

Cost of risk for 2020 is expected to be in a range of 100 basis

points and 120 basis points, the lender said, projecting a range of

70 basis points and 90 basis points for 2021.

The announcement comes as Chief Executive Jean Pierre Mustier

proposed a 25% reduction to his own 2020 salary, renouncing his

full variable remuneration for the year.

UniCredit said it has a "strong liquidity position", with a

liquidity coverage ratio above 140% at the end of the first

quarter.

Write to Mauro Orru at mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

April 22, 2020 02:15 ET (06:15 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

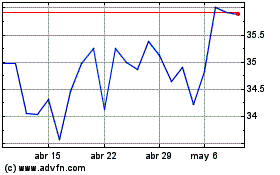

Unicredit (BIT:UCG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Unicredit (BIT:UCG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024