TIDMBGLF

RNS Number : 5624K

Blackstone / GSO Loan Financing Ltd

23 April 2020

Blackstone / GSO Loan Financing Limited

23 April 2020

COVID-19 Review, Dividend Policy and Declaration

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, DIRECTLY OR

INDIRECTLY, TO U.S. PERSONS OR INTO OR IN THE UNITED STATES,

AUSTRALIA, CANADA OR JAPAN.

Blackstone / GSO Loan Financing Limited ("BGLF" or the

"Company")

The Company announces its Q1 2020 dividend, together with an

update on GSO's detailed review of the companies within its

portfolio, as previously announced on 23 March 2020, and an amended

dividend policy in light of the global spread of the Coronavirus

Disease 2019 ("COVID-19") and its expected impact on the global

economy.

COVID-19 is a human event first and foremost, and the Board and

GSO encourage everyone to be safe and secure.

COVID-19 Review Update

Further to the announcement made by the Company on 23 March

2020, GSO has conducted a detailed, bottom-up review of all c. 970

companies within its portfolios to determine the potential impact

of COVID-19 on the performance of these businesses. GSO focused not

only on those sectors that have been directly impacted by COVID-19,

including hotels, gaming and leisure, transportation, retail,

automotive, and energy, but the entire universe of industries

within its portfolios. The results of this exercise have allowed

GSO to consider the likely impact on cashflows generated by the

Company's investments in directly held CLOs and those held

indirectly through Blackstone / GSO Corporate Funding DAC ("BGCF").

This impact assessment has enabled the Board and GSO to assess the

sustainability of the Company's dividend in the short-term. The

medium- and long-term impacts of the global pandemic remain

uncertain. However, in the short-term, rating agency downgrades and

corporate defaults of companies within GSO's portfolios may lead to

temporary cashflow diversions away from subordinate note

distributions as a result of breaches in interest diversion and/or

over-collateralisation ratios within a number of CLOs to which the

Company has exposure (through BGCF).

GSO has already taken numerous steps to seek to mitigate the

impact of COVID-19 on the performance of its portfolios and will

continue to monitor the rapidly evolving economic environment to

identify risks and opportunities. Despite the near-term economic

disruption and resulting dislocation in the global credit markets,

GSO believes that these events create good investment opportunities

and provide further prospects for BGLF to enhance shareholder

value.

Dividend Policy

Taking all of these factors into account, the Board recognises

the importance of dividends to its shareholders and seeks to

generate attractive and predictable dividend payments.

Concurrently, the Board believes it is prudent to adjust its

Dividend Policy for the calendar year 2020 pursuant to the

comprehensive discussions between the Board and GSO regarding the

portfolio review and uncertain near-term outlook.

The Board announces that the Company has adopted a revised

Dividend Policy targeting a total 2020 annual dividend of between

EUR0.06 and EUR0.07 per ordinary share, which will consist of

quarterly payments of EUR0.015 per ordinary share for the first

three quarters and a final quarter payment of a variable amount to

be determined at that time.(1) The 2020 total target dividend

represents a dividend yield of between 10.5% and 12.2% based on the

BGLF closing price of EUR0.5725 on 22 April.

The Board will keep the Dividend Policy under close review and

may adjust the target dividend up or down as the impact of the

pandemic unfolds.

Dividend Declaration

The Board has today declared a dividend of EUR0.015 per ordinary

share in respect of the period from 1 January 2020 to 31 March

2020.

This dividend is payable on 29 May 2020 to shareholders on the

Company's share register as at the close of business on 1 May 2020,

and the corresponding ex-dividend date will be 30 April 2020.

The dividend is capable of being paid in Pound Sterling, rather

than Euros, provided that the relevant shareholder has registered

to receive their dividend in Pound Sterling under the Company's

Dividend Currency Election, or registers to do so by the close of

business on 11 May 2020.

A copy of the Dividend Currency Election form, which should be

sent to Link Asset Services, The Registry, 34 Beckenham Road,

Beckenham, Kent BR3 4TU when completed, can be found on the

Company's website at http://blackstone.com/bglf . The Dividend

Currency Election Form should only be completed by shareholders who

hold shares in certificated form.

CREST shareholders must elect via CREST.

Full details of how to elect are set out in the Terms and

Conditions which are included on the Company's website.

(1) The target dividend set out in this announcement is a target

only and not a profit forecast. It should not be taken as an

indication of the Company's expected future performance or results.

There is no guarantee that the target dividend set out in this

announcement can or will be achieved or can be continued if

achieved. There may be other additional risks, uncertainties and

factors that could cause the returns generated by the Company to be

materially lower than the target dividend set out in this

announcement. Accordingly, investors should not place any reliance

on such target.

IMPORTANT NOTICE

This announcement is for information purposes only and may not

be used in making any investment decision. This announcement does

not contain sufficient information to support an investment

decision and investors should ensure that they obtain all available

relevant information before making any investment. This

announcement does not constitute and may not be construed as any

offer to sell or issue, or any solicitation of an offer to

purchase, subscribe for or otherwise acquire, investments of any

description, nor as a recommendation regarding the possible

offering or the provision of investment advice by any party. No

information in this announcement should be construed as providing

financial, investment or other professional advice and each

prospective investor should consult its own legal, business, tax

and other advisers in evaluating the investment opportunity. No

reliance may be placed by any person for any purposes whatsoever on

this announcement (including, without limitation, any illustrative

modelling information contained herein), or its accuracy, fairness

or completeness.

Past performance is not a reliable indicator of future results.

Certain countries have been susceptible to epidemics, most recently

COVID-19, which may be designated as pandemics by world health

authorities. The outbreak of such epidemics, together with any

resulting restrictions on travel or quarantines imposed, has had

and will continue to have a negative impact on the economy and

business activity globally (including in the countries in which the

Company invests), and thereby is expected to adversely affect the

performance of the Company's investments. Furthermore, the rapid

development of epidemics could preclude prediction as to their

ultimate adverse impact on economic and market conditions, and, as

a result, presents material uncertainty and risk with respect to

the Company and the performance of its Investments. Potential

investors should be aware that any investment in the Company is

speculative, involves a high degree of risk, and could result in

the loss of all or substantially all of their investment. Share

prices may go down as well as up and you may not get back the

original amount invested. Results can be positively or negatively

affected by market conditions beyond the control of the Company,

GSO or any other person.

The target dividend set out in this announcement is a target

only and not a profit forecast. It should not be taken as an

indication of the Company's expected future performance or results.

There is no guarantee that the target dividend set out in this

announcement can or will be achieved or can be continued if

achieved. There may be other additional risks, uncertainties and

factors that could cause the returns generated by the Company to be

materially lower than the target dividend set out in this

announcement. Accordingly, investors should not place any reliance

on such target.

The information in this announcement may include forward-looking

statements, which are based on the current expectations and

projections about future events and in certain cases can be

identified by the use of terms such as "may", "will", "should",

"expect", "anticipate", "project", "estimate", "intend",

"continue", "target", "believe" (or the negatives thereon) or other

variations thereon or comparable terminology. These forward-looking

statements, as well as those included in any related materials, are

subject to risks, uncertainties and assumptions about the Company,

including, among other things, the development of its business,

trends in its operating industry, and future capital expenditures

and acquisitions. In light of these risks, uncertainties and

assumptions, the events in the forward-looking statements may not

occur. No representation or warranty is given to the achievement or

reasonableness of future projections, management targets,

estimates, prospects or returns, if any.

Any information or opinions contained herein are based on

financial, economic, market and other conditions prevailing as at

the date of this announcement (unless otherwise marked) and are

subject to change. No representation or warranty, express or

implied, is or will be made in relation to the accuracy or

completeness of the information contained herein and no

responsibility, obligation or liability or duty (whether direct or

indirect, in contract, tort or otherwise) is or will be accepted by

the Company or GSO. Each of the Company and GSO expressly disclaims

any obligation or undertaking to update, review or revise any

statement contained in this announcement whether as a result of new

information, future developments or otherwise. This announcement

has not been approved by any competent regulatory or supervisory

authority.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DIVPPUQCCUPUGQP

(END) Dow Jones Newswires

April 23, 2020 02:00 ET (06:00 GMT)

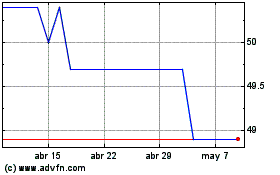

Blackstone Loan Financing (LSE:BGLP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

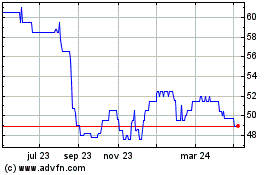

Blackstone Loan Financing (LSE:BGLP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024