Noble Energy, Shake Shack, J.C. Penney: Stocks That Defined the Week

24 Abril 2020 - 6:53PM

Noticias Dow Jones

By Francesca Fontana

Noble Energy Inc.

It was another wild, chaotic week for the oil world. Crude

prices dropped below zero for the first time Monday, the result of

falling demand from the coronavirus pandemic and a failure by

energy and oil producers to drop output fast enough. Noble Energy

fell 2% the following day, while Chevron Corp. fell 2.3% and

Occidental Petroleum fell 2%. Oil prices then rebounded later in

the week, sparked by the prospect of fresh U.S.-Iran tensions.

Shake Shack Inc.

Shake Shack is returning a $10 million loan meant to help small

businesses during the coronavirus pandemic. The burger chain, which

employs more than 8,000 people, is one of several larger restaurant

operators that have received funds from the federal Paycheck

Protection Program. The company said Monday that it would return

its PPP loan, after raising additional capital from stock

investors. Many restaurants and other small businesses said they

didn't get funding from the program before it ran out of funds last

week. The Treasury Department on Thursday asked publicly traded

companies to repay loans they received from the program. Shake

Shack shares gained 6.7% Monday.

HCA Healthcare Inc.

Coronavirus is upending how hospitals make money. HCA

Healthcare, one of the nation's largest hospital chains, said

Tuesday that its first-quarter profit fell as emergency departments

and operating rooms emptied out in response to state orders to

combat the pandemic. The company suspended its quarterly dividend

and joined other companies that have withdrawn guidance in recent

weeks, saying it couldn't predict how the pandemic would continue

to affect HCA's performance. Many states have required some or all

hospitals and surgery centers to suspend procedures that weren't

urgent or emergencies, with orders beginning in mid-March. Shares

lost 4.5% Tuesday.

Expedia Group Inc.

Expedia has reached a deal to sell a stake to private-equity

firms Silver Lake and Apollo Global Management Inc. after

widespread travel bans ravaged the online-booking company's

business. The Wall Street Journal reported late Tuesday that the

investment is likely to total around $1 billion and could tide the

company over until travel restrictions are lifted and the economy

recovers. The company named a new CEO and confirmed the investment

on Thursday. Demand for its flights and lodging has disappeared as

much of the world's population stays at home to limit the spread of

coronavirus. Expedia shares added 7.3% Wednesday.

Snap Inc.

People stuck at home are turning to Snapchat to connect with

friends during the pandemic. Snap on Tuesday reported a surge in

growth in revenue and users on its chat app, surprising analysts

who have estimated sharp decreases in digital ad spending in the

quarter. Communication with friends on the company's Snapchat app

increased by more than 30% in the last week of March compared with

the last week of January, the company said. In areas hardest hit by

the pandemic, communication with friends on Snapchat increased more

than 50%. Snap's performance could bode well for social-media

heavyweights like Facebook Inc., which delivers earnings next week.

Snap shares soared 37% Wednesday.

Target Corp.

Coronavirus lockdowns are cutting into Target's bottom line.

Consumers flocked to stores to stock up in late February and early

March, but Target Chief Executive Brian Cornell said Thursday that

traffic slowed considerably as shoppers grew more reluctant to

venture outside amid the pandemic. Sales from stores weakened

significantly in late March and early April, and buying has shifted

online through home delivery, store pickup and other services.

Throughout, Target experienced a surge in sales of food, household

goods and, more recently, office supplies and cooking appliances,

while sales of higher-margin goods such as apparel and accessories

fell. Target shares fell 2.8% Thursday.

J.C. Penney Co.

One of the dominant department-store chains of the last century

appears closer to succumbing to the economic collapse caused by the

coronavirus pandemic. The Wall Street Journal reported late

Thursday that J.C. Penney is in advanced talks with a group of

lenders for funding that would keep the department-store chain's

operations funded during a court-supervised bankruptcy. The loan

package could total roughly $800 million to $1 billion, with some

of that money potentially including existing debt. The company has

been losing money for years, and with its stores unlikely to reopen

soon J.C. Penney has been forced to put aside its latest turnaround

strategy. J.C. Penney shares fell 11% Friday.

Write to Francesca Fontana at francesca.fontana@wsj.com

(END) Dow Jones Newswires

April 24, 2020 19:38 ET (23:38 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

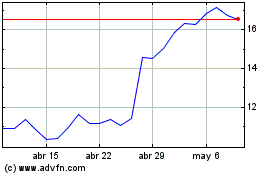

Snap (NYSE:SNAP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

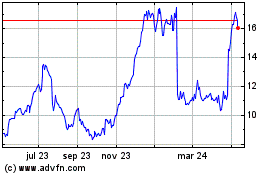

Snap (NYSE:SNAP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024