Boeing Drops Embraer Deal -- WSJ

27 Abril 2020 - 2:02AM

Noticias Dow Jones

U.S. jet maker moves to save cash by aborting joint ventures

after pandemic halted travel

By Doug Cameron

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 27, 2020).

Boeing Co. said it dropped plans to take control of the jetliner

business of Brazil's Embraer SA, saving around $4 billion in

much-needed cash but adding further uncertainty to its own product

strategy.

The U.S. aerospace giant said Saturday the companies failed to

agree to final terms by the initial termination date and opted to

walk away from the two planned joint ventures announced in 2018,

which had already been delayed by some competition regulators.

Boeing had pursued Embraer to acquire access to smaller

jetliners seating around 100 passengers and engineering expertise,

but the Brazilian company's market value has fallen by two-thirds

since the start of the year as the coronavirus upended air travel

and led to the grounding of much of the global airline fleet.

The companies didn't detail what conditions weren't met. Boeing

doesn't expect to have to pay a break fee -- which varied from $75

million to $100 million in the original contract -- according to

people familiar with the situation.

"We all aimed to resolve those by the initial termination date,

but it didn't happen," said Marc Allen, who headed Boeing's team on

Embraer integration.

Embraer said Boeing had wrongfully terminated the agreement and

used false claims as a pretext to avoid its commitments to close

the transaction. The Brazilian company said that it intends to use

all remedies available regarding the damages incurred by Embraer

because of Boeing's decision.

"We believe Boeing has engaged in a systematic pattern of delay

and repeated violations of the [purchase agreement], because of its

unwillingness to complete the transaction in light of its own

financial condition and 737 MAX and other business and reputational

problems."

Boeing had agreed to pay $4.2 billion in cash for an 80% stake

in Embraer's commercial business, which focused on small regional

jetliners, as well as a 49% stake in a unit producing a new

military cargo jet. Boeing said it still wanted to continue a joint

marketing deal involving Embraer's military cargo jet.

"Boeing argues in its statement that the withdrawal occurred due

to unsatisfactory conditions in the final negotiations, but our

view is that the economic crisis that is starting globally could

hurt companies in the sector and retaining liquidity is the most

sensible path at the moment," said Pedro Galdi, an analyst at São

Paulo-based brokerage Mirae Asset.

The U.S. company last year raised funds for a deal it had hoped

to close by the end of 2019, only for European antitrust regulators

to voice objections. Their probe wasn't due to conclude until

August.

Boeing had redirected the funds from last year's bond issue and

has been raising more funding to address the liquidity squeeze from

the grounding of the 737 MAX and the collapse in air travel, which

has left airlines unable or unwilling to take new aircraft.

Rival Airbus SE moved into the small-jetliner business by

acquiring an aircraft program from Canada's Bombardier Inc.

Boeing's aircraft-development program had already been derailed

by the prolonged grounding of the MAX, following two fatal

accidents. Boeing also shelved plans for a new midsize jet to focus

on returning the MAX to commercial service.

--Jeffrey T. Lewis contributed to this article.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

April 27, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

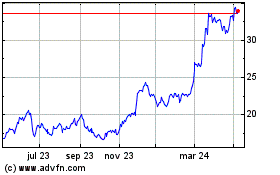

EMBRAER ON (BOV:EMBR3)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

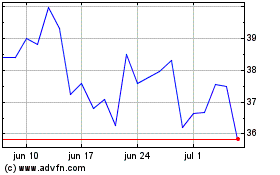

EMBRAER ON (BOV:EMBR3)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024