TIDMJDW

RNS Number : 3885L

Wetherspoon (JD) PLC

29 April 2020

The following amendment has been made to the 'Further Covid-19

Update and Equity Placing' announcement released on 29 April 2020

at 16:45 under RNS No 3800L.

PDF of full announcement text including tables are now shown

below.

All other details remain unchanged.

The full amended text is shown below.

Click on, or paste the following link into your web browser, to

view the associated PDF document.

http://www.rns-pdf.londonstockexchange.com/rns/3885L_1-2020-4-29.pdf

THIS ANNOUNCEMENT IS RESTRICTED AND IS NOT FOR RELEASE,

PUBLICATION, DISTRIBUTION OR FORWARDING, IN WHOLE OR IN PART,

DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA,

CANADA, THE REPUBLIC OF SOUTH AFRICA, JAPAN OR ANY OTHER

JURISDICTION IN WHICH SUCH PUBLICATION, RELEASE OR DISTRIBUTION

WOULD BE UNLAWFUL.

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND

IS NOT AN OFFER OF SECURITIES IN ANY JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

LEI: 213800CHWARFAAN7UB85

For immediate release

29 April 2020

JD Wetherspoon plc ("the company")

Further Covid--19 Update, Equity Placing

The company's immediate priority is to manage the business

during the current 'lockdown' period. It is also starting to plan

for a reopening of pubs and hotels in or around June.

The company's long-stated "mission" is to have well trained

staff, offering excellent products, at reasonable prices, in

individually designed and well-maintained pubs.

Investec Bank plc ("Investec") is acting as sole bookrunner in

connection with the equity placing.

Current Trading

In its interim results announcement for the six months ended 26

January 2020, released on 20 March 2020, the company announced

revenue of GBP933.0m (up 4.9%), like-for-like sales up 5.0%, profit

before tax of GBP57.9m (up 15.2%), earnings per share (including

shares held in trust) of 43.3p (up 15.8%) and free cash flow per

share of 46.7p (down 31.2%).

In the six weeks to 8 March 2020, like-for-like sales increased

by 3.2%.

In the week to 15 March 2020, like-for-like sales declined by

4.5%. The Prime Minister advised customers to avoid restaurants,

bars, pubs and clubs on 16 March 2020.

The UK government ordered the closure of pubs on 20 March 2020,

from which point the company's sales have been zero.

Management Actions

The company has implemented an extensive set of measures to

protect profit and cash. These include:

- Operational reductions. The company closed its pubs and

hotels, putting them, in effect, into 'hibernation' in which

ongoing costs, for example utilities, are minimised.

- Opening programme. This has been stopped and is not expected

to restart until FY22, from which point the company intends to open

approximately five pubs each year.

- Labour costs. Around 43,000 employees, more than 99% of the workforce, have been furloughed.

On average, the company is paying 80% of pre-lockdown pay

levels; the cost to the company of additional 'top-up' payments is

approximately GBP0.6 million per month.

To date, there has been no headcount reduction, although that

will remain under review.

- Suppliers. The company paid suppliers due at the end of March

2020. The majority, comprising 83% of suppliers, have now been paid

in full. Extended payment terms have been agreed with a number of

larger suppliers.

- Board salary reductions. The board has volunteered to take the

following reductions: Tim Martin - 50%; John Hutson - 50%; Ben

Whitley 38%; Su Cacioppo - 42%; each of the non-executive directors

- 50%.

- Rents. The majority of rental payments due in March, other

than some concessions, have been deferred.

The company has agreed extended payment terms with many

landlords.

- Rates. The government has said that business rates will not be

payable from April 2020 to March 2021, resulting in a cash saving

of approximately GBP60 million for that period.

- Repairs and maintenance. Reduced from an annualised run rate

of GBP83 million to GBP10 million during closure.

- Overheads. Overhead expenditure (e.g. utilities, distribution

centre costs, HQ running costs, IT) has been reduced from an

annualised run rate of GBP210 million to approximately GBP35

million.

- Capital Expenditure. Up to the point when pubs closed, GBP34

million had been spent in the second half year on new pubs,

freehold reversions and reinvestment.

GBP70 million of additional capital expenditure, planned for the

rest of the second half of the financial year, has been

deferred.

- Taxation. In general, the government and HMRC have been

helpful in agreeing delays in payments of tax. Just under GBP20

million of PAYE and VAT payments have been deferred. It is

anticipated that an additional GBP40 million of PAYE, VAT and

(fruit/slot) machine gaming duty, due after the pub closure, will

also be deferred.

- Dividend. As previously announced, the interim dividend has been cancelled.

The income statement costs that are payable during the closure

period total about GBP3 million per month, the majority of which

relates to loan interest and 'top-up' payments, so that employees

receive 80% of their pre-closure income. All other costs are either

variable, and have been reduced to nil, have been deferred until

after pubs reopen, or were paid in advance of the closure period.

Some costs, such as insurance, broadband and IT software, were paid

before the pubs closed on 20 March 2020.

UK Government actions

Since pubs closed, HM Treasury has announced a package of

temporary measures to support public services, people and

businesses through the period of disruption. These include the

Coronavirus Job Retention Scheme ("CJRS"), deferred VAT payments

and business rate payment holidays.

The company expects to be eligible for a loan of up to GBP50

million under the new Coronavirus Large Business Interruption Loan

Scheme ("CLBILS"), as updated by the Chancellor of the Exchequer on

16 April 2020. The company will consider making an application

under this scheme in due course.

As regards the COVID Corporate Financing Facility ("CCFF"), the

company has made enquiries, but does not believe it is eligible,

since it is not 'investment grade'. The company is regarded as

investment grade by its two 'lead banks' and by its USPP lender,

and is charged investment grade rates, we understand.

Financing arrangements

As at 22 March 2020, the company had net debt, including bank

borrowings and finance leases, but excluding derivatives, of GBP836

million, compared to GBP804.5 million at 26 January 2020. This

resulted in leverage of approximately 3.85 net debt / EBITDA,

calculated over the previous 12 months.

The board believes that no covenants are expected to be breached

in the short term, with certain costs being treated as exceptional

during the Covid-19 pandemic.

However, as a precaution, the board requested, and has received,

signed covenant waivers for the quarters ending April and July

2020. The Bank of England has said that banks should waive covenant

breaches that stem from the Covid-19 crisis and the company

believes that further waivers should be forthcoming, if

required.

The company has fully drawn down its revolving credit

facility.

As previously stated, it is the company's intention that the

maximum net-debt-to-EBITDA ratio should be around 3.5 times, other

than in the short term.

The ratio has risen, as a result of the temporary closure of

pubs, and the company intends to reduce the level in a timely

manner.

The company has previously stated that debt levels of between 0

and 2 times EBITDA are a sensible long-term benchmark, although

higher levels may be justified at times of very low interest

rates.

Property

As at 26 January 2020, the company had 874 pubs capable of being

open, absent current restrictions.

10 years ago, the company's freehold/leasehold split was

41.3%/58.7%. As at 26 January 2020, as a result of investment in

freehold reversions (relating to pubs where the company was

previously a tenant) and freehold pub openings, the split was

63.6%/36.4%.

As at 26 January 2020, the net book value of the property, plant

and equipment of the company was GBP1.45 billion, which included

GBP1.05 billion of freehold and long leasehold property. The

properties have not been revalued since 1999.

UK taxes and regulations

In the six months ended 26 January 2020, taxes paid by the

company totalled GBP402.7 million (including VAT, excise duty,

PAYE, climate change levy etc.), equating to GBP462,000 tax per pub

or 43.2% of the company's sales. In comparison, the company's

profit after tax as a percentage of sales was 4.9%.

As a result of a reduction in profit expectations, a refund of

corporation tax of approximately GBP10.5 million has been

received.

Non-recurring items

Exceptional costs of GBP15.9 million were incurred in the first

half. GBP9.5 million related to impairment of IT assets and GBP6.4

million to property charges. These exceptional costs gave rise to a

cash inflow of GBP2m from property sales.

Further exceptional costs are likely to be incurred during the

second half of the financial year. These are expected to comprise

income statement costs as a result of the closure period and a

small amount of stock write-offs.

Dividends

In the current circumstances, the board does not intend to

propose a final dividend for the year ending 26 July 2020, when the

full year results are announced in September 2020.

Outlook

The duration of the Covid--19 impact is uncertain at this stage,

as are its consequences for the financial performance for the full

year. The company does not intend to issue a trading update on the

previously indicated date of 13 May 2020.

The company's current assumptions are that its pubs will remain

closed until late June 2020.

During the closure period, the company have deferred or reduced

as many costs as possible, until after reopening - for example,

rent, utilities and repairs. The 'cash burn', or actual cash spent,

during this period (excluding payments to suppliers) is estimated

at GBP3 million per month. However, assuming the pubs were to be

closed for a longer than anticipated period, the cash burn would

increase to around GBP11 million per month, as a result of the

inclusion of costs such as rent, national distribution centre

overheads and IT contracts. These estimates exclude historic

creditors, including suppliers and HMRC. The company estimates that

it has sufficient liquidity until the end of November 2020.

Once pubs reopen, there will be a working capital inflow. Trade

creditors at the balance sheet date of 26 January were GBP316

million, compared to GBP308 million at the previous year end (28

July 2019) and GBP321 million at the previous half year end (27

January 2019)*.

*Source: interim report 2020, page 36, note 20.

The company is likely to make some changes to its operating

model, assuming increased social distancing, and anticipates a

gradual recovery in customer numbers.

Wetherspoon pubs are substantially larger than average, and most

have outside facilities. The company believes these factors are

likely to assist if social distancing measures apply.

The company has traded well during previous recessions, in the

last 40 years. Competitive pricing may have been an important

factor. Sales have increased by around GBP1 billion since 2008, the

approximate start of the last recession.

Scenario Analysis

The principal assumption is that like-for-like sales will be

minus 10% for the first month after reopening, increasing by 2% per

month, and levelling out at +3%. Sales were about +5% in the 18

months before closure, therefore it is assumed that initial sales

will be about 15% below pre-closure levels.

The company has a history of making a large number of small

changes to its operations that, over time, has led to sales per pub

per week increasing substantially, and intends to utilise a similar

approach after reopening.

If correct, the above estimates would result in a total sales

decline in the year ending July 2020 of 26%, incorporating the

closure period.

On the basis of these estimates, with LFL sales reaching +3%,

about 7 months after reopening, the financial performance for 2021

and 2022 could be as follows:

Click on, or paste the following link into your web browser, to

view the associated PDF document.

http://www.rns-pdf.londonstockexchange.com/rns/3885L_1-2020-4-29.pdf

The figures above are pre IFRS16 and exclude the net benefit of

the Equity Placing and Subscription.

(1) Zero business rates for the first three quarters of FY21

will benefit profits.

(2) As in the 2008 to 2010 financial years, a reduction in

reinvestment is anticipated, to 2% of sales, from around 4% of

sales. This will increase free cash flow, but will have a

negligible effect on profits.

Effect of larger sales decline

In the event of LFL sales falling by 25% (that is approximately

30% less than pre-closure levels) for the first 7 months after

reopening, and then increasing by 3% per month from those low

levels, the financial performance for 2021 and 2022 could be as

follows:

Click on, or paste the following link into your web browser, to

view the associated PDF document.

http://www.rns-pdf.londonstockexchange.com/rns/3885L_1-2020-4-29.pdf

The figures above are pre IFRS16 and exclude the net benefit of

the Equity Placing and Subscription.

* If sales on reopening are -25%, the company plans to introduce

a series of measures to reduce costs, including lower staff

bonuses, the benefit of which would flow through into 2022. These

initiatives would be temporary, but would produce unusually high

profits in 2022.

General comment on low sales on reopening

The company believes it would be cash flow neutral at minus 50%

like-for-like sales, and that it would generate positive cash flow

at sales above those levels. The company's average weekly sales per

pub are significantly larger than those of other large managed

house pub companys, which creates some scope for profits at reduced

sales levels.

Clearly the duration of Covid-19's impact, including on the UK

hospitality sector is very uncertain at this stage as are its

consequences for the company's financial performance for the

current financial year and beyond. Accordingly, no assurance can be

given that any particular assumptions will prove correct or

predictions or modelled scenarios will result.

The outlook is taken from the company's assessment of the

knowledge and information it currently has available, and reliance

must not be placed on any forward-looking statements - please see

the cautionary statement below.

Equity Placing

The company has taken decisive action to preserve cash and

ensure sufficient liquidity.

The company has separately announced today an intention to

conduct a non--pre--emptive placing of new ordinary shares of

GBP0.02 each in the capital of the company representing up to 15%

of the company's existing issued ordinary share capital (the

"equity placing"). The placing is expected to raise GBP141m.

Directors and members of the senior management team including

John Hutson, CEO, Ben Whitley, Finance Director, and Tim Martin,

founder and Chairman will participate alongside the equity placing,

in a separate subscription with the company (the "subscription"),

and intend to contribute GBP300,000.00. The equity placing and

subscription are not being underwritten.

The net proceeds of the equity placing will be used to

strengthen the company's balance sheet, working capital and

liquidity position during the period of disruption.

Based on the 'scenario planning' undertaken, the additional

capital will provide sufficient liquidity to deal with very low

sales after reopening, helping the company to return to growth as

the market normalises.

The board has concluded that the equity placing is in the best

interests of shareholders; a conclusion endorsed in the course of

recent shareholder consultation.

The placing structure minimises cost and time to completion at

an important time for the company.

Commenting on this announcement, Tim Martin, chairman of

Wetherspoon, said:

"The Covid--19 outbreak is having a severe impact on the UK pub

sector. In these challenging times I would like to thank everyone

at the company, its suppliers, landlords, banks and the government

for their support and commitment. We've had to take significant

action to reduce costs, decisions which have not been taken

lightly. We look forward to re--opening our pubs and hotels and

welcoming back our teams in the near future.

As a result of the actions taken, the cooperation of many

stakeholders, and the equity placing announced today, we will be

well positioned to reopen our pubs and to return to growth, as the

market recovers."

This announcement is released by J D Wetherspoon plc and

contains inside information for the purposes of Article 7 of the

Market Abuse Regulation (EU) 596/2014 (MAR), and is disclosed in

accordance with the company's obligations under Article 17 of

MAR.

J D Wetherspoon plc

John Hutson , Chief Executive Officer

Ben Whitley, Finance Director

(please address all enquiries

to Alex Bull (email: abull@jdwetherspoon.co.uk

or 07770 966 923)

Investec Bank plc - Sole Financial Adviser, Tel: +44 (0)20 7597

Sole Broker, Sole Global Coordinator & Sole 5970

Bookrunner

Christopher Baird, David Flin, Tejas Padalkar

NOTES TO EDITORS

1. J D Wetherspoon owns and operates pubs throughout the UK and

Ireland. The company aims to provide customers with good-quality

food and drink, served by well-trained and friendly staff, at

reasonable prices. The pubs are individually designed and the

company aims to maintain them in excellent condition.

2. Visit our website www.jdwetherspoon.com .

3. The annual report and financial statements 2019 has been

published on the company's website on 13 September 2019.

4. The current financial year comprises 52 trading weeks to 26

July 2020. The Trading Update previously scheduled for 13 May 2020

will no longer be issued.

5. For the purposes of MAR and Article 2 of Commission

Implementing Regulation (EU) 2016/1055, the person responsible for

releasing this announcement is Ben Whitley, Finance Director.

CAUTIONARY STATEMENT

This COVID--19 Update (the "report") has been prepared in

accordance with the Disclosure Guidance and Transparency Rules of

the UK Financial Conduct Authority and is not audited. No

representation or warranty, express or implied, is or will be made

in relation to the accuracy, fairness or completeness of the

information or opinions contained in this report. Statements in

this report reflect the knowledge and information available at the

time of its preparation.

A variety of factors may cause the company's actual results to

differ materially from the forward--looking statements contained in

this report. Certain statements included or incorporated by

reference within this report constitute "forward-looking

statements" in respect of the company's operations, performance,

prospects and/or financial condition. These forward--looking

statements may be identified by the use of forward--looking

terminology, including the terms "believes", "estimates", "plans",

"anticipates, "expects", "intends", "may", "will", or "could" or

words of similar substance or the negative thereof, or by

discussions of strategy, plans, objectives, goals, economic

performance, dividend policy, future events or intentions. By their

nature, forward-looking statements involve a number of risks,

uncertainties and assumptions because they relate to events and

depend on circumstances that may or may not occur in the future or

are beyond the company's control. Actual results or events may and

often do differ materially from those expressed or implied by those

statements. Any forward--looking statements reflect the

company's current view with respect to future events and are

subject to risks relating to future events and other risks,

uncertainties and assumptions relating to the company's business,

results of operations, financial position, liquidity, prospects,

growth and strategies. Forward--looking statements speak only as of

the date they are made. The company's actual operating results and

financial condition and the development of the industry in which it

operates may differ materially from the impression created by the

forward--looking statements contained in this announcement.

Important factors that could cause these differences include, but

are not limited to, the ongoing national and international impact

of the COVID-19 pandemic, general economic and business conditions,

industry trends, foreign currency rate fluctuations, competition,

changes in government and other regulation, including in relation

to the environment, health and safety and taxation, labour

relations and work stoppages, changes in political and economic

stability and changes in business strategy or development plans and

other risks.

Accordingly, no assurance can be given that any particular

expectation will be met and reliance shall not be placed on any

forward-looking statement. Additionally, forward-looking statements

regarding past trends or activities shall not be taken as a

representation that such trends or activities will continue in the

future. The information contained in this report is subject to

change without notice and no responsibility or obligation is

accepted to update or revise any forward-looking statement

resulting from new information, future events or otherwise.

In particular, no statement in this report is intended to be a

profit forecast and no statement of a financial metric (including

estimates of EBITDA, profit before tax, free cash flow or net debt)

should be interpreted to mean that any financial metric for the

current or future financial years would necessarily match or exceed

the historical published position of the company. The estimates set

out in the report have been prepared based on numerous assumptions

and forecasts, including those set out in this report, some of

which are outside of the company's influence and/or control, and is

therefore inherently uncertain and there can be no guarantee or

assurance that it will be correct. The estimates have not been

audited, reviewed, verified or subject to any procedures by our

auditors. You should not place undue reliance on them and there can

be no guarantee or assurance that they will be correct.

This report does not constitute or form part of any offer or

invitation to sell, or any solicitation of any offer to purchase or

subscribe for any shares in the company, nor shall it or any part

of it or the fact of its distribution form the basis of, or be

relied on in connection with, any contract or commitment or

investment decisions relating thereto, nor does it constitute a

recommendation regarding the shares of the company or any

invitation or inducement to engage in investment activity under

section 21 of the Financial Services and Markets Act 2000. Past

performance cannot be relied upon as a guide to future performance.

Liability arising from anything in this report shall be governed by

English Law, and neither the company nor any of its affiliates,

advisors or representatives shall have any liability whatsoever (in

negligence or otherwise) for any loss howsoever arising from any

use of this report or its contents or otherwise arising in

connection with this report. Nothing in this report shall exclude

any liability under applicable laws that cannot be excluded in

accordance with such laws.

This announcement has been issued by, and is the sole

responsibility, of the company. No representation or warranty

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by

Investec or by any of its affiliates, agents, directors, officers,

employees, advisers or anyone acting on their behalf ("affiliates")

as to or in relation to, the accuracy or completeness of this

announcement or any other written or oral information made

available to or publicly available to any interested party or its

advisers, and any liability therefore is expressly disclaimed.

This announcement is for information only and does not itself

constitute or form part of an offer to sell or issue or the

solicitation of an offer to buy or subscribe for securities

referred to herein in any jurisdiction including, without

limitation, the United States or any restricted territory (as

defined below) or in any jurisdiction where such offer or

solicitation is unlawful.

This announcement, and the information contained herein, is not

for release, publication or distribution, directly or indirectly,

to persons in the United States, Australia, Canada, the Republic of

South Africa or Japan or in any jurisdiction in which such

publication or distribution is unlawful (each a "restricted

territory"). The distribution of this announcement and the placing

and/or the offer or sale of the placing shares in certain

jurisdictions may be restricted by law. No action has been taken by

the company, Investec, any of their respective affiliates or any

person acting on its or their behalf which would permit an offer of

the placing shares or possession or distribution of this

announcement or any other offering or publicity material relating

to such placing shares in any jurisdiction where action for that

purpose is required. Persons distributing any part of this

announcement must satisfy themselves that it is lawful to do

so.

Investec is acting exclusively for the company and no-one else

in connection with the placing and are not, and will not be,

responsible to anyone (including the placees) other than the

company for providing the protections afforded to their clients nor

for providing advice in relation to the placing and/or any other

matter referred to in this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDKKCBDABKDPQB

(END) Dow Jones Newswires

April 29, 2020 12:30 ET (16:30 GMT)

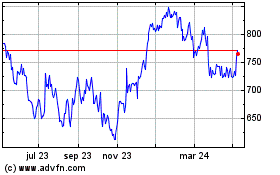

Wetherspoon ( J.d.) (LSE:JDW)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

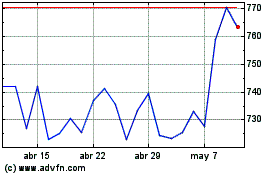

Wetherspoon ( J.d.) (LSE:JDW)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024