TIDMTHR

RNS Number : 4666L

Thor Mining PLC

30 April 2020

30 April 2020

THOR MINING PLC

("THOR" OR THE "COMPANY")

QUARTERLY REPORT JANUARY TO MARCH 2020

Highlights Outlook for June Quarter 2020

-------------------------------------------------------------------- --------------------------------------------------

COPPER

Kapunda, SA Australia

* Successful borehole pump testing * Large scale column leach work.

* Tracer testing demonstrated connectivity between * Trial groundwater ion exchange work to separate

holes necessary for successful ISR activities. dissolved copper from other metals.

* High tenor copper (preliminary) from pump test * Electrowinning (EW) testwork.

drilling.

* Bench scale copper cementation testwork.

TUNGSTEN & MULTI COMMODITIES

* Preparation work for field recovery trials.

Molyhil, NT Australia

* Marketing activities around potential project finance * Discussions with Australian government agencies

and off-take agreements for both tungsten and mandated to assist Australian critical minerals

molybdenum concentrates. projects.

* Drilling success at Bonya results in maiden resource * Continued discussions with potential Molyhil project

estimates. financiers and off-take partners.

Pilot Mountain, Nevada USA

* Ongoing discussions with various US parties aimed at * Continuing discussions with US parties to secure

securing specific investment to progress this project investment.

project.

GOLD & OTHER COMMODITIES

* Ground reconnaissance survey over Pilbara tenements * Secure grant of Hamersley tenements

provided very encouraging gold, nickel & chromium

results.

* Subject to relaxation of COVID-19 restrictions,

follow-up ground reconnaissance work over areas of

* Execution of agreements with traditional owners of gold, nickel, & chromium prospectivity.

Hamersley licences

NEW PROJECTS

The Company is in active due diligence and negotiations, in respect

of a potential new asset to enhance the portfolio. The Company

will provide further details as the process develops.

CORPORATE & FINANCE

The Spring Hill gold royalty sale process continues, and it is

expected that the Company will be in a position to advise

successful completion in June.

During the quarter the Company completed the sale of its

interest in Hawkstone Mining Limited.

Mr Mick Billing, Executive Chairman, commented:

"Challenging market conditions prevail, & we have taken

further steps to reduce overheads, along with taking advantage of

Australian government COVID-19 initiatives aimed at meeting some

employment costs. We expect also that we will be able to complete

the sale of the Spring Hill royalty shortly, and we look forward to

providing details of our exciting potential new asset acquisition

when finalised."

"Our ISR copper investments continue to develop value with

excellent outcomes from testwork at Kapunda. We hope to be able to

advise final drill assays shortly. Critically however the real

story at Kapunda is the ongoing buildup of evidence that the ISR

process will work in practice".

"We have continued to add value to the Molyhil project with the

release of resource estimates at Bonya in January, potentially

adding materially to the life and economic outcomes of the

project".

"In addition, recent renewed interest by the Australian

government in critical minerals has resulted in increased support

for projects of this nature, and we hope to be able to take

advantage of this."

"Finally, the initial sampling program in our 100% owned Pilbara

project produced some outstanding initial results, and we look

forward to follow up work on these, once COVID-19 access

restrictions are lifted."

COPPER PROJECTS

KAPUNDA and MOONTA COPPER PROJECTS - SA

Thor holds a 25% equity interest in private Australian company,

EnviroCopper Limited ("ECL"), along with rights to acquire a

further 5% interest via investment of an additional A$0.4million,

of which A$0.1million has been advanced. In turn ECL has entered

into an agreement to earn, in two stages, up to 75% of the rights

over metals which may be recovered via in-situ recovery ("ISR")

contained in the Kapunda deposit from Australian listed company,

Terramin Australia Limited ("Terramin" ASX: "TZN"), and rights to

75% of Moonta copper project comprising the northern portion of

exploration licence EL5984 held by Andromeda Metals Limited

(ASX:ADN).

Information about EnviroCopper Limited and its projects can be

found on the EnviroCopper website:

https://www.envirocopper.com.au/

During 2018, the Australian Government Ministry for Science,

Jobs and Innovation announced an offer to ECR for research funding

of A$2,851,303, over a 30 month period, for the Kapunda In-Situ

Copper and Gold Recovery Trial.

During the June 2019 quarter the Company advised of successful

gold recovery from Kapunda core, in addition to copper recovery,

using a CSIRO developed thiosulphate product, instead of, the more

normal, cyanide. As reported (ref ASX announcement of 3 April

2019), gold has been intersected in a number of holes at Kapunda,

within the existing copper resource, and results for 28 surface

& drill core samples historically reported to range from 0.6 to

5.54 dwts /ton (approx 0.93 to 8.58 g/t), with best results of 95.1

metres @ 3.06g/t gold from 2.4metres depth.

Field pump tests of the flow of fluids through the deposit for

successful ISR activities were conducted during the quarter. The

program involved drilling three holes, in the southern portion of

the deposit during the December quarter, all of which intersected

copper, followed by a series of testwork which are ongoing. This

testwork continues, however to date, all results consistently

support the concept that ISR copper recovery at Kapunda is

technically feasible.

Pumping of groundwater from the holes drilled showed a rapid

response in the water levels from those nearby, indicating good

connectivity associated with favourable porosity and permeability.

This has been reinforced with specific inert tracer chemical tests

demonstrating successful flow through the ground rock between

holes.

Ongoing work includes large scale column leach testwork of

drilling samples, & also some extractive work (ion exchange

& electro-winning) on copper & other metals contained in

the local groundwater, which have dissolved naturally over time. We

expect to be able to release the results of these activities during

the June quarter.

Other near-term activities at Kapunda include continued

community liaison in respect of project activities, testwork on

historical drill core to determine the optimum extraction agent

(lixiviant) most suited to the Kapunda deposit and establishing

appropriate parameters for future field recovery trial work.

Moonta

During the September 2019 quarter the Company advised that

EnviroCopper Limited, on behalf of Environmental Metals Recovery,

had completed a Mineral Resource Estimate (MRE) on several of the

deposits at Moonta, based on substantial historical drilling. The

results of this study was an Inferred Resource estimate of 66.1

million tonnes (MT) grading 0.17% copper (Cu), containing 114,000

tonnes of contained copper, at a cutoff grade of 0.05%Cu.

The full details of the resource announcement may be accessed

via the following link:

https://www.asx.com.au/asxpdf/20190815/pdf/447hw9dbbkg94b.pdf

The Company is not aware of any new information or data which

would materially affect the Mineral Resource, and all assumptions

and key technical parameters relevant to the estimate remain

unchanged.

TUNGSTEN PROJECTS

Tungsten and Molybdenum Price Trends

During March and April, global tungsten and molybdenum prices

dipped in response to weaker manufacturing and infrastructure

demand, brought on by the global COVID-19 pandemic.

At the date of this report, the price of tungsten, per mtu of

APT (Ammonium Para Tungstate) sits between US$195/mtu and

US$220/mtu, while the molybdenum price sits at US$8.25/lb.

Industry discussion continues to forecast tight supply

conditions for tungsten concentrates and downstream products, with

dominant global supplier, China, enforcing improved environmental

standards, and restricting the issue of new mine production

licences . This implies a recovery in tungsten pricing when the

global economy commences an upturn. In addition, industry

expectations are that molybdenum will be subject to supply

constraints for several years.

MOLYHIL TUNGSTEN PROJECT - NT (100% Thor)

During the quarter, Thor continued discussions with various

potential partners who have expressed interest, in either off-take,

joint venture or debt finance arrangements. It is hoped that, on

the back of improved global markets, a favourable arrangement can

be finalised in the near term.

Adjacent to Molyhil, the Bonya tenements, in which Thor holds a

40% interest, host outcropping tungsten deposits, a copper resource

and a vanadium deposit.

During the quarter, following completion of a reverse

circulation (RC) drilling program at the nearby Bonya JV tenement,

maiden mineral resource estimates on the White Violet and Samarkand

tungsten deposits were published.

A full background on the project is available on the Thor Mining

website www.thormining.com/projects .

During the December quarter, on 10 October 2019, the Company

reported an updated Mineral resource estimate for the Molyhil

deposit comprising Indicated and Inferred Mineral Resources of 4.7

million tonnes at 0.28% WO (Tungsten trioxide), 0.14% Mo

(Molybdenum), 0.05% Cu (Copper), and 18.0% Fe (Iron) above a

cut-off grade of 0.12% WO(3) equivalent.

The revised resource estimate increased contained WO by 1.5%,

and contained Mo by 9.3% compared with the previous estimate, and

includes copper, which had not previously been reported since

2006.

An update to the Open Cut Ore Reserve, and the Definitive

feasibility Study (DFS) has not been commissioned at this stage,

however the directors may elect to revisit these with any

improvement in the Bonya deposits resources classification beyond

Inferred status.

Table A: Molyhil Summary JORC (2012) Mineral Resource Estimate -

Reported 10 October, 2019

Classification '000 WO(3) Mo Cu Fe

Tonnes

--------

Grade Tonnes Grade Tonnes Grade Tonnes Grade

% % % %

---------------- -------- ----- ------ ----- ------- ----- ------ ------

Indicated 3,780 0.29 11,000 0.14 5,400 0.05 1,800 18.7

Inferred 930 0.25 2,300 0.15 1,400 0.04 300 15.2

-------- ----- ------ ----- ------- ----- ------ ------

Total 4,710 0.28 13,300 0.14 6,800 0.05 2,200 18.0

-------- ----- ------ ----- ------- ----- ------ ------

Notes:

-- Thor Mining PLC holds 100% equity interest in this

project.

-- The Mineral Resource is reported at 0.12% WO(3) equivalent

cut-off and above 200mRL only on a dry, in-situ basis

-- The Company is not aware of any information or data which

would materially affect the Mineral Resource, and all assumptions

and key technical parameters relevant to the previous estimate

remain unchanged.

Details of the resource announcement may be accessed via the

following link:

https://www.asx.com.au/asxpdf/20191011/pdf/449d2szw7y7hzy.pdf

The Company is in discussion with several Australian

Commonwealth government agencies each of which are mandated to

assist companies with projects to develop and produce critical

minerals, which includes tungsten. These agencies include; Export

Finance Australia, Defence Export Facility, Critical Minerals

Facilitation Office and the North Australian Infrastructure

Facility. Further announcements will be made as appropriate.

Bonya (Tungsten, Copper, Vanadium) (40% Thor)

During the quarter, after a December quarter RC drilling program

the Joint Venture was able to report a maiden resource estimate for

the White Violet and Samarkand deposits on 29 January 2020.

https://www.thormining.com/sites/thormining/media/pdf/asx-announcements/20200129-mineral-resource-estimates---bonya-tungsten--copper.pdf

The updated Mineral Resource Inventory for Bonya licence to date

is shown in Table B and Table C below:

Table B: Bonya Tungsten Mineral Resources (announced 29 January

2020)

Oxidation Tonnes WO(3) Cu

% Tonnes % Tonnes

White Violet Inferred Oxide 25,000 0.41 90 0.16 40

Fresh 470,000 0.21 980 0.06 260

Sub Total 495,000 0.22 1,070 0.06 300

Samarkand Inferred Oxide 25,000 0.11 30 0.07 20

Fresh 220,000 0.20 430 0.13 290

Sub Total 245,000 0.19 460 0.13 310

Combined Inferred Oxide 50,000 0.26 120 0.14 60

Fresh 690,000 0.21 1,410 0.08 550

Total 740,000 0.21 1,530 0.09 610

-------------------------- ----------- -------- ----- ------- ----- -------

Notes:

-- 0.05% WO(3) cut-off grade.

-- Totals may differ from the addition of columns due to rounding.

-- Thor Mining PLC holds 40% equity interest in this project.

-- The Company is not aware of any information or data which

would materially affect this previously announced resource

estimate, and all assumptions and technical parameters relevant to

the estimate remain unchanged.

Table C: Bonya Copper Mineral Resources (announced 26 November

2018)

Oxidation Tonnes Cu

% Tonnes

Inferred Oxide 25,000 1.0 200

Fresh 210,000 2.0 4,400

Total 230,000 2.0 4,600

----------------------- -------- ---- -------

Notes:

-- 0.2% Cu cut-off grade.

-- Totals may differ from the addition of columns due to rounding.

-- Thor Mining PLC holds 40% equity interest in this project

-- The Company is not aware of any information or data which

would materially affect this previously announced resource

estimate, and all assumptions and technical parameters relevant to

the estimate remain unchanged.

Vanadium

During the September quarter, Thor and Arafura Resources,

released details of a study outlining the potential of the Jervois

Vanadium Project, along with a proposed development plan. The study

details can be accessed via the following link:

https://www.asx.com.au/asxpdf/20190703/pdf/446bv386tvk7fh.pdf

PILOT MOUNTAIN TUNGSTEN PROJECT - NEVADA USA (100% Thor)

Thor's Pilot Mountain Project, acquired in 2014, is located

approximately 200 kilometres south of the city of Reno and 20

kilometres east of the town of Mina, located on US Highway 95.

The Pilot Mountain Project is comprised of four tungsten

deposits: Desert Scheelite, Gunmetal, Garnet and Good Hope. All of

these deposits are in close proximity (three kilometres) to each

other and have been subjected to small-scale mining activities at

various times during the 20th century.

A full background on the project is available on the Thor Mining

website www.thormining.com/projects .

The directors believe Pilot Mountain's resource is substantial

on a global scale, and has potential for significant growth, in

particular from the discovery in the August 2017 drilling program

of an additional parallel zone of scheelite mineralisation at the

Desert Scheelite deposit (Figure 6.).

The directors believe that the Desert Scheelite resource, which

outcrops at surface at the western end for more than 400 metres,

has potential to develop into a long term open pit mining operation

which, when supplemented by higher grade mineralisation from the

other deposits at Pilot Mountain, has the potential for a longer

term profitable operation.

This significant tungsten resource is strategically located in

the USA and tungsten has been confirmed by the US Department of the

Interior as a critical mineral in 2018.

Locked cycle testwork on material from the Desert Scheelite

deposit, was completed during the June 2019 quarter, resulting in

production of a high grade scheelite concentrate grading 68% WO

with recovery of 73.6%.

Environmental study parameters are being established with

relevant agencies, and Infrastructure studies have also

commenced.

OTHER PROJECTS

During the quarter (on 16 January 2020), the Company released

results from a field reconnaissance program incorporating soil and

stream sediment sampling conducted during the December, on the

Pilbara Gold licences, in Western Australia.

The results showed mineralisation in 17 of the 44 sites sampled.

Of the mineralised samples, 15 contained gold, and two encountered

nickel and chromium. The released results can be accessed via the

following link:

https://www.thormining.com/sites/thormining/media/pdf/asx-announcements/20200117-asx-pilbara-gold-reconn-assays.pdf

The principle focus of the stream sediment survey was the

preliminary evaluation of the gold potential, and this appears to

have been very successful. The encouraging nickel and chrome

results achieved in the western part of E46/1262 were not expected.

A subsequent literature search specific to the nickel potential on

the tenement has highlighted the presence of a north south trending

gossan with anomalous nickel (1018 ppm) previously mapped by the WA

geological survey over a 1km strike length. The gossan occurs

approximately 2km south east and in the same ultramafic unit as the

recent positive stream sediment results. Because the gossan was not

identified before the recent stream sediment survey, that gossan

will not have been tested.

The Company now has a strong nickel target, as well as several

very promising gold targets, for follow up field evaluation during

the course of 2020, and once COVID-19 related restrictions are

eased, that will be scheduled as a priority.

SPRING HILL GOLD PROJECT - NT (ROYALTY ENTITLEMENT)

In February 2017 Thor completed the A$3.5 million sale of its

Spring Hill Gold project(1). The sale transaction carries an

ongoing residual royalty of:

-- 1B A$6 per ounce of gold produced from the Spring Hill

tenements where the gold produced is sold for up to A$1,500 per

ounce; and

-- A$14 per ounce of gold produced from the Spring Hill

tenements where the gold produced is sold for amounts over A$1,500

per ounce.

(1) Refer AI M a nn o un c e m e nt of 26 F e b r u ary 2 0 16 a

nd ASX ann o uncement of 29 February 2 0 16

No royalties were received during the quarter, however the

owners of the Spring Hill project have advised that they are

progressing mine permitting, and also that the treatment plant for

toll processing the ore has been refurbished. They are hopeful of

commencement of operations in the near term.

The Company is engaged in the process of selling this royalty,

and it is expected that this will be successfully concluded

shortly.

Competent Person's Report

The information in this report that relates to exploration

results, and exploration targets, is based on information compiled

by Richard Bradey, who is a Member of The Australasian Institute of

Mining and Metallurgy. Mr Bradey is an employee of Thor Mining PLC.

He has sufficient experience which is relevant to the style of

mineralisation and type of deposit under consideration and to the

activity which he is undertaking to qualify as a Competent Person

as defined in the 2012 Edition of the 'Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves'. Richard Bradey consents to the inclusion in the report

of the matters based on his information in the form and context in

which it appears.

Enquiries:

Mick Billing +61 (8) 7324 Thor Mining PLC Executive Chairman

1935

Ray Ridge +61 (8) 7324 Thor Mining PLC CFO/Company Secretary

1935

Colin Aaronson/ +44 (0) 207 383 Grant Thornton Nominated Adviser

Richard Tonthat 5100 UK LLP

Nick Emerson +44 (0) 1483 SI Capital Ltd Joint Broker

Claire Louise Noyce 413 500 Hybridan LLP Joint Broker

/ +44 (0) 203 764

John Beresford-Peirse 2341

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Updates on the Company's activities are regularly posted on

Thor's website www.thormining.com , which includes a facility to

register to receive these updates by email, and on the Company's

twitter page @ThorMining.

Ab o u t T hor M i n i ng PLC

Thor Mining P LC (AI M, A S X: THR) is a r esources comp any

quoted on the AIM M a rket of the London Stock Exchange and on ASX

in Austr alia.

Thor holds 1 0 0% of the ad v anced Molyhil t ungsten p r oject

in t he No rthe rn T e rr ito ry of Aust r alia, for w hich an

updated feasibility study in August 2018(1) suggest ed attr a ctive

retur ns.

Adjacent Molyhil, at Bonya, Thor holds a 40% interest in

deposits of tungsten, copper, and vanadium, including an Inferred

resource for the Bonya copper deposit (2).

Thor a lso holds 1 0 0% of t he Pilot Mountain tungst en p

roject in Nevada U SA which has a JORC 20 12 Indicated and Inferred

Res o u rces Estimate (3) on 2 of the 4 k nown deposits. The US

Department of the Interior has confirmed that tungsten, the primary

resource mineral at Pilot Mountain, has been included in the final

list of Critical Minerals 2018.

Thor is also acquiring up to a 30% interest Australian copper

development company EnviroCopper Limited, which in turn holds

rights to earn up to a 75% interest in the mineral rights and

claims over the resource on the portion of the historic Kapunda

copper mine in South Australia recoverable by way of in situ

recovery , and also holds rights to earn a 75% interest in portion

of the Moonta Copper project also in South Australia, and is

considered amenable to recovery by way of in situ recovery .

Finall y, Thor also holds a production royalty entitleme nt from

t he S p ring Hill Gold project of :

-- A$6 p er ounce of gold p rod uced from the S p ring Hill te

neme nts whe re the gold produced is sold for up to A$ 1,5 00 per

ounce; and

-- A$14 p er ounce of gold p roduced from the S p ring Hill

tenements where the gold p roduced is sold for amounts over A $1 ,

5 00 per ounce.

N ot e s

(1) Refer ASX and AIM an n o u ncement of 23 August 2 0 18

(2) Refer ASX and AIM an n o u ncement of 26 November 2 0 18

(3) Refer AIM ann o un cement of 13 December 2018 and ASX ann o

unce ment of 14 December 2018

Refer AIM a nn o un c e m e nt of 10 F e b r u ary 2 0 16 a nd

ASX ann o uncement of 12 February 2 0 18

Refer AIM a nn o un c e m e nt of 26 F e b r u ary 2 0 16 a nd

ASX ann o uncement of 29 February 2 0 16

TENEMENT SCHEDULE

At 31 March 2020, the consolidated entity holds an interest in

the following Australian tenements:

Project Tenement Area kms(2) Area ha. Holder Company Interest

Molyhil Mining Pty

Molyhil EL22349 228.10 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil EL31130 9.51 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil EL31443 31.66 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil ML23825 95.92 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil ML24429 91.12 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil ML25721 56.2 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil AA29732 38.6 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS77 16.18 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS78 16.18 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS79 8.09 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS80 16.18 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS81 16.18 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS82 8.09 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS83 16.18 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS84 16.18 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS85 16.18 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS86 8.05 Ltd 100%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Bonya EL29701 204.5 Ltd 40%

---------- ----------- -------- -------------------- ----------------

Molyhil Mining Pty

Bonya EL32167 74.54 Ltd 40%

---------- ----------- -------- -------------------- ----------------

Pilbara Goldfields

Panorama E46/1190 35.03 Pty Ltd 100%

---------- ----------- -------- -------------------- ----------------

Pilbara Goldfields

Ragged Range E46/1262 57.3 Pty Ltd 100%

---------- ----------- -------- -------------------- ----------------

Hamersley Metals

Tramore South E52/3681 62.77 Pty Ltd 100%

---------- ----------- -------- -------------------- ----------------

Hamersley Metals

March Fly EL 32016 110.44 Pty Ltd 100%

---------- ----------- -------- -------------------- ----------------

Hamersley Metals

Hillside E45/5245 188.1 Pty Ltd 100%

---------- ----------- -------- -------------------- ----------------

At 31 March 2020, the consolidated entity holds an interest in

the following tenements in the US State of Nevada:

Claim Group Prospect Claim Number Area Holders Company

Interest

45 blocks

(611ha or

Platoro Desert Scheelite NT #55 - 64 1,510 acres) 100%

------------ ----------------- ---------------- --------------------------------- ---------

Garnet NT #9 - 18

Pilot Metals

Inc

------------ ----------------- ---------------- ---------------- ---------

Gunmetal NT #19 - 22,

6, 7

----------------- ----------------

Good Hope NT #1 - 5,

41 - 54

------------ ----------------- ---------------- ---------------- --------------- ---------

109 blocks

Black Fire (1,481ha or BFM Resources

BFM 1 Claims BFM1 - BFM109 3,660 acres) Inc 100%

----------------- ---------------- ---------------- --------------- ---------

Des Scheel 22blocks (299ha BFM Resources

BFM 2 East BFM109 - BFM131 or 739Acre) Inc 100%

----------------- ---------------- ---------------- --------------- ---------

Dunham BFM Resources

Mill Dunham Mill MS1 - MS4 4 blocks Inc 100%

----------------- ---------------- ---------------- --------------- ---------

Appendix 5B

1.1 Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

1.2 Name of entity

--------------------------------------------------

THOR MINING PLC

1.3 ABN 1.4 1.5 Quarter ended ("current

quarter")

------------ -----------------------------

121 117 673 31 MARCH 2020

-----------------------------

1.6 Consolidated statement of Current quarter Year to date

cash flows (9 months)

$A'000 $A'000

1. Cash flows from operating

activities

1.1 Receipts from customers 4 36

1.2 Payments for

(a) exploration & evaluation

(if expensed) (11) (24)

(b) development

(c) production

(d) staff costs (45) (157)

(e) administration and corporate

costs (145) (733)

1.3 Dividends received (see note

3)

1.4 Interest received - 2

Interest and other costs of

1.5 finance (leases) (2) (6)

1.6 Income taxes paid

1.7 Government grants - -

1.8 Other (provide details if

material)

---------------- -------------

Net cash from / (used in)

1.9 operating activities (199) (882)

----------------- ----------------------------------- ---------------- -------------

2. Cash flows from investing

activities

2.1 Payments to acquire:

(a) entities

(b) tenements

(c) property, plant and equipment

(d) exploration & evaluation

(if capitalised) (265) (913)

(e) investments

(f) other non-current assets

2.2 Proceeds from the disposal

of:

(a) entities

(b) tenements

(c) property, plant and equipment

(d) investments 32 103

(e) other non-current assets

Cash flows from loans to other

2.3 entities - (100)

2.4 Dividends received (see note

3)

2.5 Other (R&D Tax Incentive) - 222

---------------- -------------

Net cash from / (used in)

2.6 investing activities (233) (688)

----------------- ----------------------------------- ---------------- -------------

3. Cash flows from financing

activities

Proceeds from issues of equity

securities (excluding convertible

3.1 debt securities) - 890

3.2 Proceeds from issue of convertible

debt securities

3.3 Proceeds from exercise of

options

Transaction costs related

to issues of equity securities

3.4 or convertible debt securities - (81)

3.5 Proceeds from borrowings

3.6 Repayment of lease principal (14) (40)

3.7 Transaction costs related

to loans and borrowings

3.8 Dividends paid

3.9 Other (provide details if

material)

---------------- -------------

Net cash from / (used in)

3.10 financing activities (14) 769

----------------- ----------------------------------- ---------------- -------------

4. Net increase / (decrease)

in cash and cash equivalents

for the period

Cash and cash equivalents

4.1 at beginning of period 593 944

Net cash from / (used in)

operating activities (item

4.2 1.9 above) (199) (882)

Net cash from / (used in)

investing activities (item

4.3 2.6 above) (233) (688)

Net cash from / (used in)

financing activities (item

4.4 3.10 above) (14) 769

Effect of movement in exchange

4.5 rates on cash held 7 11

---------------- -------------

Cash and cash equivalents

4.6 at end of period 154 154

----------------- ----------------------------------- ---------------- -------------

5. 1.7 Reconciliation of cash Current quarter Previous quarter

and cash equivalents $A'000 $A'000

at the end of the quarter

(as shown in the consolidated

statement of cash flows) to

the related items in the accounts

5.1 Bank balances 154 593

5.2 Call deposits

5.3 Bank overdrafts

5.4 Other (provide details)

---------------- -----------------

Cash and cash equivalents

at end of quarter (should

5.5 equal item 4.6 above) 154 593

----------------- ------------------------------------ ---------------- -----------------

1.7.1

6. 1.8 Payments to related parties of the entity Current quarter

and their associates $A'000

Aggregate amount of payments to related

parties and their associates included in

6.1 item 1 98

----------------

6.2 Aggregate amount of payments to related

parties and their associates included in

item 2

----------------

Note: if any amounts are shown in items 6.1 or 6.2, your quarterly

activity report must include a description of, and an explanation

for, such payments

--------------------------------------------------------------------------------------

The amount at Item 6.1 above represents payments to Directors

for Directors fees, the salary paid to the Executive Director,

Richard Bradey, and other consulting services provided, including

services provided by Mick Billing as CEO.

7. 1.9 Financing facilities Total facility Amount drawn

Note: the term "facility' amount at quarter at quarter end

includes all forms of financing end $A'000

arrangements available to $A'000

the entity. 1.10 Add notes

as necessary for an understanding

of the sources of finance

available to the entity.

7.1 Loan facilities

------------------- ----------------

7.2 Credit standby arrangements

------------------- ----------------

7.3 Other (please specify)

------------------- ----------------

7.4 Total financing facilities

------------------- ----------------

7.5 Unused financing facilities available at

quarter end

----------------

7.6 Include in the box below a description of each facility

above, including the lender, interest rate, maturity date

and whether it is secured or unsecured. If any additional

financing facilities have been entered into or are proposed

to be entered into after quarter end, include a note providing

details of those facilities as well.

----------------- ---------------------------------------------------------------------------

8. 1.11 Estimated cash available for future $A'000

operating activities

Net cash from / (used in) operating activities

8.1 (Item 1.9) (199)

8.2 Capitalised exploration & evaluation (Item (265)

2.1(d))

8.3 Total relevant outgoings (Item 8.1 + Item (464)

8.2)

8.4 Cash and cash equivalents at quarter end 154

(Item 4.6)

8.5 Unused finance facilities available at quarter -

end (Item 7.5)

8.6 Total available funding (Item 8.4 + Item 154

8.5)

Estimated quarters of funding available

8.7 (Item 8.6 divided by Item 8.3) 0.3

----------------- ---------------------------------------------------------

8.8 If Item 8.7 is less than 2 quarters, please provide answers

to the following questions:

1. Does the entity expect that it will continue to have

the current level of net operating cash flows for the

time being and, if not, why not?

-------------------------------------------------------------------

Answer: The net operating cashflows for the next quarter

are expected to be less than the most recent quarter ending

31 March 2020 as overheads and project expenditure have

been reduced to preserve cash

-------------------------------------------------------------------

2. Has the entity taken any steps, or does it propose

to take any steps, to raise further cash to fund its operations

and, if so, what are those steps and how likely does it

believe that they will be successful?

-------------------------------------------------------------------

Answer: Thor holds a production royalty entitlement, from

the Spring Hill Gold project, of $13.30 per ounce of gold

produced while the gold price is above $1,500 per ounce

(otherwise $5.70 per ounce). The owners of the Spring

Hill project have advised that they are progressing mine

permitting, and also that the treatment plant for toll

processing the ore has been refurbished and is production

ready. Thor has engaged with several royalty companies

who have expressed interest in acquiring this royalty

entitlement from Thor. Offers have been received, and

due diligence is in progress.

-------------------------------------------------------------------

3. Does the entity expect to be able to continue its operations

and to meet its business objectives and, if so, on what

basis?

-------------------------------------------------------------------

Answer: The Company expects to continue operations and

to meet its business objectives on the basis of the imminent

finalisation of the sale of the Spring Hill royalty, together

with other alternatives being considered to raise funds.

-------------------------------------------------------------------

1.12 Compliance statement

1 This statement has been prepared in accordance with accounting

standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: 30 April 2020........................................................

Authorised by: ...By the

Board...........................................................

(Name of body or officer authorising release - see note 4)

1.13 Notes

1. This quarterly cash flow report and the accompanying activity

report provide a basis for informing the market about the entity's

activities for the past quarter, how they have been financed and

the effect this has had on its cash position. An entity that wishes

to disclose additional information over and above the minimum

required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in

accordance with Australian Accounting Standards, the definitions

in, and provisions of, AASB 6: Exploration for and Evaluation of

Mineral Resources and AASB 107: Statement of Cash Flows apply to

this report. If this quarterly cash flow report has been prepared

in accordance with other accounting standards agreed by ASX

pursuant to Listing Rule 19.11A, the corresponding equivalent

standards apply to this report.

3. Dividends received may be classified either as cash flows

from operating activities or cash flows from investing activities,

depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market

by your board of directors, you can insert here: "By the board". If

it has been authorised for release to the market by a committee of

your board of directors, you can insert here: "By the [name of

board committee - eg Audit and Risk Committee]". If it has been

authorised for release to the market by a disclosure committee, you

can insert here: "By the Disclosure Committee".

5. If this report has been authorised for release to the market

by your board of directors and you wish to hold yourself out as

complying with recommendation 4.2 of the ASX Corporate Governance

Council's Corporate Governance Principles and Recommendations, the

board should have received a declaration from its CEO and CFO that,

in their opinion, the financial records of the entity have been

properly maintained, that this report complies with the appropriate

accounting standards and gives a true and fair view of the cash

flows of the entity, and that their opinion has been formed on the

basis of a sound system of risk management and internal control

which is operating effectively.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCSDMSWSESSEEL

(END) Dow Jones Newswires

April 30, 2020 03:34 ET (07:34 GMT)

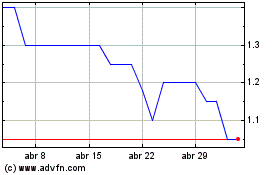

Thor Energy (LSE:THR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Thor Energy (LSE:THR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024