TIDMFAR

RNS Number : 6294L

Ferro-Alloy Resources Limited

01 May 2020

Dissemination of a Regulatory Announcement that contains inside

information according to REGULATION (EU) No 596/2014 (MAR).

1 May 2020

Ferro-Alloy Resources Limited

("Ferro-Alloy" or "the Company")

Full year results deferral in response to FCA statement of

policy

Production, Operations & Finance Update and

Appointment of Financial Adviser

Overview

-- Financial results deferred in line with FCA statement of policy

-- Production of acid-recoverable concentrates temporarily

suspended due to the unavailability of staff from Covid-19

restrictions but restarting in May 2020

-- Other operations have continued but with slower progress on

feasibility study due to travel restrictions during the Covid-19

pandemic

-- First stage of expansion plan completed

-- Outlook for Vanadium prices and high margins remains positive

Ferro-Alloy Resources Limited (LSE: FAR), the vanadium mining

and processing company with operations based in Southern Kazakhstan

announces that it will utilise the temporary relief measures

implemented by the Financial Conduct Authority ( " FCA " ) and the

Financial Reporting Council ( " FRC " ) regarding the publication

of annual financial results during the COVID-19 pandemic. The

Company will therefore defer the publication of its audited

financial results for the year ending 31 December 2019 ( "2019

Accounts"). The reason for the need to delay is that travel

restrictions are in place internationally and so the reporting and

auditing process is taking longer than usual.

The maximum delay permitted by the FCA exemption is two months;

hence, following the deferral, the Company's reporting timetable

for the 2019 Accounts means they must be published by no later than

30 June 2020. The Company expects to publish the 2019 Accounts in

June 2020.

Production update and shipment of vanadium pentoxide

Production Shipments

(tonnes of vanadium (tonnes of vanadium

pentoxide contained pentoxide contained

in AMV) in AMV)

Q3 2019 38.3 40.0

Q4 2019 43.1 35.7

Q1 2020 49.1 61.0

Work to further expand and improve production has continued and

the second new roasting oven was brought into operation in February

2020, effectively doubling the capacity to treat high-grade

concentrates. As described under the Covid-19 section below, the

acid-recoverable treatment process for low-grade concentrates was

temporarily closed in March 2020, leaving the new line as the sole

operation for the remainder of the first quarter of 2020.

Production outlook

The Company has successfully completed the first stage of its

expansion plan, including the construction of a 1,000m(2) extension

to the plant facility, the installation of the new

pyrometallurgical production facility including two roasters and

the new leaching circuit, and the improvement of the existing

acid-recoverable production line. The completion of the connection

to the adjacent high-voltage power line is well underway but

currently stalled by the Covid-19 restrictions on the availability

of our contractors. Although full use of the new facilities has not

yet been possible, the capacity of the two lines is now up to 40

tonnes per month, depending on the vanadium grade of input raw

materials.

Production from the low-grade acid-recoverable line is expected

to resume in early May but the combined output will be somewhat

restricted until the new power connection is completed.

Covid-19

Kazakhstan has been significantly less affected by Covid-19 than

many European countries but nevertheless, there have been over

3,000 detected cases and, sadly, over 25 people have died. With a

population only some 28% of that of the UK, this is a relatively

small but still serious outbreak. Kazakhstan was quick to respond

and declared a state of emergency on 16 March 2020. Measures taken

to control the spread have included a complete lock-down of several

major cities, the temporary closure of non-essential businesses and

industries, and an almost complete standstill on international and

domestic travel.

The protection of the health and safety of our employees is our

paramount concern and the Company has implemented all the measures

recommended and required by the Kazakhstan authorities. So far,

none of our employees has been affected and our operations have

continued. However, the restrictions on travel have disrupted and

curtailed operations in a number of ways which have reduced output

and progress with our projects.

The Company's main operation in Kazakhstan is manned by two

teams of workers, each working for half of the month while residing

on site, followed by half of the month on leave. During the

lock-down it was not possible to rotate the staff in the middle of

April as usual. Furthermore, it has not been possible to bring some

professional managers to site from their homes which in many cases

are long distances from the operation and normally involve flights

or long car journeys, or subcontracted staff for various tasks

involved in the project work.

The Company has responded to these challenges by asking the team

on site to stay on site for a second rotation, meaning they have

worked for the entire month on site. Whilst certain professional

managers have been retained on site, the more technically difficult

production circuit that treats acid-recoverable concentrates was

closed in March and our production was concentrated on the

pyrometallurgical line treating higher grade concentrates.

The current state of emergency has been extended by the

government to 11(th) May 2020 but the lock-down conditions have

already started to be relaxed, with industrial and construction

sectors, and certain types of services reopening in Nur-Sultan and

Almaty. The Company is bringing in the new rotation of staff today

and plans to re-start production from the acid-recoverable

concentrates with the new team early in May, so that production

from both lines will again be possible.

Progress on our feasibility study has likewise been slowed.

Visits by specialists to site have not been possible, and although

there is no curtailment of the shipment of samples, the necessary

radiological examination in order to complete transport and import

documentation has not been possible. The relevant institute is now

slowly returning to work.

It is not possible to forecast the course of the Covid-19

outbreak, but Kazakhstan's early intervention and relatively strong

countermeasures have enabled an early relaxation of controls and we

are looking forward to a slow but steady return to more efficient

operations.

Vanadium prices and outlook

The price of vanadium pentoxide in Europe started the year at

around US$5.30/lb and is currently a little over $7.00/lb. The

price had fallen throughout 2019 from extreme highs of approaching

$30/lb in late 2018. The unusually high price in 2018 and early

2019 resulted in some substitution with what was then cheaper

niobium and some production increases, resulting in an

overcorrection which caused the price to fall below its expected

long run level. Some recovery has already been experienced this

year and more is predicted as substitution by niobium is reversed

and the high-cost production instigated by the exceptionally high

prices becomes uneconomic to sustain.

The Company has been and continues to use a long-term forecast

price of around US$7.50/lb, close to today's level, which is a

little lower than external forecasters and other vanadium project

companies are using. Both the current market price and our

long-term estimate provide an exceptionally high margin to the

Company's forecast cash cost of production of US$1.54, contained in

the Competent Person's Report on our Balasausqandiq project by

GBM.

Covid-19 is likely to affect world production and supply in the

short term, but so far the price has been moving upwards overall.

Longer term, the implementation of higher standards for

construction steel throughout the world and increasing use of other

alloys using vanadium are likely to increase demand for vanadium

from its traditional markets. The roll-out of vanadium redox flow

batteries for renewable energy storage, which was stalled by the

exceptionally high vanadium price in 2018 and 2019, is now expected

to resume and grow to be a very significant additional market for

vanadium.

Financing

At the time of the Company's listing in March 2019, the Company

outlined its expansion plans of which around half have been

completed. As announced in December 2019, the nature of the fall in

the vanadium price in 2019 was further and faster than expected and

impacted the profitability and cash flows of the Company,

particularly during the period when production was limited by the

implementation of the expansion and Covid-19 restrictions. The

Company's previous forecasts, based on a slower fall in vanadium

prices over 2019 and 2020, would have been sufficient to meet the

capital expenditure requirements for the completion of the

expansion out of operating cash flows but the reduction in vanadium

prices has reduced the cash flows available. The Company has

limited excess cash at this time but we are mindful that in the

current Covid-19 environment it is important to raise capital only

on terms that will be advantageous to existing shareholders and, in

conjunction with our advisers, have commenced discussions with

multilateral institutions, strategic partners and global capital

providers in the mining industry. We expect to report further on

progress on these initiatives at the time of the announcement of

our Final results in June.

Appointment of new Financial Adviser

We are pleased to announce that VSA Capital has been appointed

as a financial adviser to the Company alongside the Company's

existing broker, Shore Capital. VSA will be providing research

services going forward. VSA has unique knowledge of the Vanadium

space through their long involvement in mining and also Vanadium

Flow Batteries.

For further information, visit www.ferro-alloy.com or

contact:

Ferro-Alloy Resources Limited info@ferro-alloy.com

Nick Bridgen, Chief Executive Officer

Shore Capital (Broker) Tel: +44 (0)207 408

Corporate Advisory: Toby Gibbs / Mark 4090

Percy / John More

Corporate Broking: Jerry Keen

---------------------

VSA Capital (Financial Adviser) Tel: +44 (0)203 005

Andrew Monk / Simon Barton 5000

---------------------

St Brides Partners Limited (Financial Tel: +44 (0)207 236

PR & IR Adviser) 1177

Catherine Leftley / Priit Piip

---------------------

Further information about Ferro-Alloy Resources Limited

The Company's operations are all located at the Balasausqandiq

Deposit in Kyzylordinskaya Oblast in the South of Kazakhstan.

Currently the Company has two main business activities:

a) the high grade Balasausqandiq Vanadium Project (the "Project"); and

b) an existing profitable vanadium concentrate processing operation (the "Existing Operation")

Balasausqandiq is a very large deposit, situated in

Kyzylordinskaya Oblast in Southern Kazakhstan. The ore contains

vanadium as the principal product, together with by-products of

carbon, molybdenum, uranium, rare earth metals, potassium, and

aluminium.

A reserve on the JORC 2012 basis has been estimated only the

first ore-body number which amounts to 23 million tonnes, not

including the small amounts of near-surface oxidised material which

is in the Inferred resource category. In the system of Reserve

estimation used in Kazakhstan the Reserves are estimated to be over

70m tonnes in ore-bodies 1 to 5 but this does not include the full

depth of ore-bodies 2-5.

There is an additional existing concentrate processing operation

is situated at the site of the Balasausqandiq Deposit. The

production facilities were originally created from a 15,000 tonnes

per year pilot plant which was then adapted to treat low-grade

concentrates and is now in the process of being expanded and

further adapted to treat a wider variety of rawmaterials.

The Company has already completed the first steps of a

development plan which is expected to result in annualised

production capacity increasing gradually to around 1,500 tonnes of

contained vanadium pentoxide. The development plan includes

upgrades to infrastructure, an extension to the existing factory

and the installation of equipment to increase the throughput and to

add the facilities to convert AMV into vanadium pentoxide.

The strategy of the Company is to develop both the Existing

Operation and the Project in parallel. Although they are located on

the same site and use some of the same infrastructure, they are

separate operations.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDABMATMTAMMAM

(END) Dow Jones Newswires

May 01, 2020 02:00 ET (06:00 GMT)

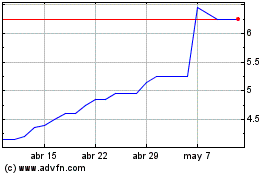

Ferro-alloy Resources (LSE:FAR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Ferro-alloy Resources (LSE:FAR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024