Euro Drops On Weak Eurozone PMI, German Factory Orders Data

06 Mayo 2020 - 1:33AM

RTTF2

The euro depreciated against its major counterparts in the

European session on Wednesday, as the euro area private sector

activity shrank in April and German factory orders plunged in

March, led by the severe disruption caused by the coronavirus

pandemic.

Final survey results from IHS Markit showed that the composite

output index slid to a new series low of 13.6 from March's 29.7.

The flash score was 13.5.

The services Purchasing Managers' Index sank to 12.0 from 26.4

in the previous month.

Germany's composite output index posted a historic low of 17.4,

down from the previous record of 35.0 in March and the flash

reading of 17.1.

The services PMI came in at an all-time low 16.2 versus 31.7 in

the previous month. The initial reading was 15.9.

Data from Destatis showed that German factory orders declined

the most since the records began in 1991, due to the coronavirus

pandemic.

Factory orders declined sharply by 15.6 percent on a monthly

basis in March, much bigger than the 1.2 percent drop logged in

February.

This was the biggest fall since January 1991. Economists had

expected a 10 percent decrease.

The euro fell to near a 2-week low of 1.0791 against the

greenback, 3-1/2-year low of 114.72 against the yen and a 6-day low

of 1.5168 against the loonie, pulling away from its early highs of

1.0848, 115.60 and 1.5253, respectively. The next likely support

for the euro is seen around 1.05 against the greenback, 111.00

against the yen and 1.48 against the loonie.

The euro depreciated to 6-day lows of 1.6778 against the aussie

and 1.7827 against the kiwi, and held steady thereafter. The euro

had ended Tuesday's trading session at 1.6843 against the aussie

and 1.7900 against the kiwi.

The euro edged down to 1.0524 against the franc, from a high of

1.0550 hit at 5:00 pm ET. On the downside, 1.02 is possibly seen as

the next support level for the euro.

In contrast, the euro rallied to 0.8734 against the pound. If

the euro rises further, 0.90 is possibly seen as its next

resistance level.

Survey data from IHS Markit showed that the UK construction

sector contracted at the sharpest pace since the survey began in

1997 amid site closures due to the coronavirus, or covid-19,

pandemic.

The IHS Markit/Chartered Institute of Procurement & Supply

construction Purchasing Managers' Index fell to 8.2 in April from

39.3 in March. A score below 50 indicates contraction. The expected

score was 22.0.

Looking ahead, U.S. ADP private payrolls data for April is due

out at 8:15 am ET.

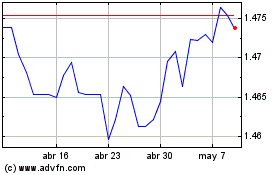

Euro vs CAD (FX:EURCAD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

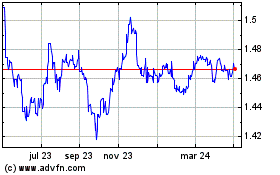

Euro vs CAD (FX:EURCAD)

Gráfica de Divisa

De Abr 2023 a Abr 2024