Yen Higher On Renewed Virus Concerns

13 Mayo 2020 - 1:31AM

RTTF2

The Japanese yen appreciated against its major counterparts in

the European session on Wednesday, as worries about a rise in

COVID-19 cases after easing lockdowns in certain countries and

renewed trade tensions between the U.S. and China dampened

sentiment.

A leading U.S. Republican senator on Tuesday proposed

legislation that would authorize President Donald Trump to impose

far-reaching sanctions on China if it fails to give a full account

of events leading to the outbreak of the novel coronavirus.

The range of sanctions include asset freezes, travel bans and

visa revocations, as well as restrictions on loans to Chinese

businesses by U.S. institutions and bans on U.S. listings by

Chinese firms.

Data from the Bank of Japan showed that Japan overall bank

lending rose 3.0 percent on year in April, coming in at 553.486

trillion yen.

That's up sharply from the 2.0 percent annual increase in

March.

The yen appreciated to 2-day highs of 106.96 versus the

greenback, 115.94 versus the euro and 110.21 versus the franc,

reversing from its previous lows of 107.28, 116.41 and 110.66,

respectively. The next possible resistance for the yen is seen

around 102.5 versus the greenback, 112.00 versus the euro and

106.00 versus the franc.

The yen firmed to a 5-day high of 76.03 versus the loonie, after

falling to 76.32 at 12:45 am ET. On the upside, 72.00 is likely

seen as the next resistance level for the yen.

The yen rose back to 131.25 versus the pound, heading to pierce

a 6-day peak of 131.20 seen in the Asian session. The yen is likely

to find resistance around the 127.00 level.

Extending early rally, the yen advanced to a 6-day peak of 64.23

versus the kiwi. The pair had closed Tuesday's deals at 65.09. Next

key resistance for the yen is likely seen around the 60.00

level.

In contrast, the yen held steady against the aussie, after

having strengthened to a 5-day high of 69.10 in the Asian session.

At yesterday's trading close, the pair was quoted at 69.31.

Survey data from Westpac showed that Australia's consumer

confidence recovered in May from a very low level.

The Westpac-Melbourne Institute Index of Consumer Sentiment rose

to 88.1 in May from 75.6 in April.

Looking ahead, U.S. PPI for April is scheduled for release in

the New York session.

Federal Reserve Chair Jerome Powell will deliver a speech about

current economic issues at a webinar organized by the Peterson

Institute for International Economics at 8:00 am ET.

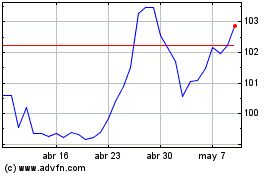

AUD vs Yen (FX:AUDJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

AUD vs Yen (FX:AUDJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024