TIDMFARN

RNS Number : 2477N

Faron Pharmaceuticals Oy

18 May 2020

Faron Pharmaceuticals Oy

("Faron" or the "Company")

Results of the Annual General Meeting and Decisions of the Board

of Directors

Company announcement, 18 May 2020 at 6 pm (EEST)

TURKU, FINLAND - The annual general meeting ("AGM") of Faron

Pharmaceuticals Oy (AIM: FARN, First North: FARON) took place in

Turku, Finland today, 18 May 2020. The AGM approved all the

proposals of the board of directors ("Board") and its committees

set out in the notice of the AGM published on 14 April 2020.

Due to the current COVID-19 situation, strict precautionary

measures were taken to ensure safety at the AGM while at the same

time ensuring the shareholders' possibility to exercise their

rights. The number of persons physically present at the AGM was in

total ten, including participating shareholders, representatives

from the Company, the chairperson and the secretary of the meeting,

as well as technical staff.

Decisions of the AGM

The AGM adopted the financial statements of the Company and

resolved to discharge the members of the Board and the CEO of the

Company from liability for the financial year 2019. No dividend for

the financial year 2019 will be paid, and the losses of the Company

for the financial year, amounting to EUR 13,261,911.93 (IFRS), will

be carried forward to the reserve for invested unrestricted

equity.

Composition and remuneration of the Board

The number of members of the Board was confirmed as six. Frank

Armstrong, Markku Jalkanen, Matti Manner, Leopoldo Zambeletti,

Gregory Brown and John Poulos were re-elected to the Board for a

term that ends at the end of the next AGM.

The AGM resolved that an annual remuneration of EUR 35,000 will

be paid to the Board members, in addition to which an annual

remuneration of EUR 35,000 will be paid to the Chair of the Board.

In addition, a further annual remuneration of EUR 11,000 will be

paid to the Chair of the Audit Committee, a further annual

remuneration of EUR 9,000 will be paid to the Chair of the

Remuneration Committee and a further annual remuneration of EUR

6,000 will be paid to the Chair of the Nomination Committee. In

addition, a further annual remuneration of EUR 6,000 will be paid

to the Audit Committee members, a further annual remuneration of

EUR 5,000 will be paid to the Remuneration Committee members and a

further annual remuneration of EUR 3,000 will be paid to the

Nomination Committee members.

Meeting fees will be paid to the Board members as follows:

-- A meeting fee of EUR 1,000 will be paid to Board members per

Board meeting where the Board member was physically present, and

which was held on another continent than the member's place of

residence.

-- No meeting fees will be paid to Board members who were

attending a Board meeting but not physically present or for Board

meetings held on the same continent than the member's place of

residence.

In addition, all reasonable and properly documented expenses

incurred in the performance of duties of the members of the Board

will be compensated. No remuneration will be paid based on the

Board membership of the CEO of the Company or a person serving the

Company under a full-time employment or service agreement.

Auditor

Audit firm PricewaterhouseCoopers Oy ("PwC") was re-elected as

the Company's auditor. PwC has appointed Panu Vänskä, authorised

public accountant (KHT), as the key audit partner. It was decided

that the auditor be remunerated in accordance with the invoice

presented.

Amendment of option programmes

The AGM resolved to amend the terms and conditions of the option

programme adopted by the Company's extraordinary general meeting on

15 September 2015, which have later been amended by the decision of

the annual general meeting held on 16 May 2017 (the "Option Plan

2015") so that the options may be transferred or pledged after the

conditions for share subscription have been fulfilled under the

terms and conditions of the Option Plan 2015.

The AGM further resolved to approve implementing a change

corresponding the aforementioned in the rules of the option plan

for the employees and directors of, and persons providing services

to, the Company's group adopted by the Board based on the

authorisation granted by the Company's annual general meeting on 28

May 2019 (the "Share Option Plan 2019") so that the options may be

transferred or pledged after the conditions for share subscription

have been fulfilled.

Authorisation to the Board to decide on the issuance of shares,

options or other special rights entitling to shares

The Board was authorised to resolve by one or several decisions

on issuances of shares, options or other special rights entitling

to shares referred to in chapter 10, section 1 of the Finnish

Limited Liability Companies Act, which authorisation contains the

right to issue new shares or dispose of the shares in the

possession of the Company. The authorisation consists of up to

8,650,000 shares in the aggregate (including shares to be received

based on options or other special rights), which corresponds to

approximately 18.5% of the existing shares and votes in the Company

on the date of the AGM.

The authorisation does not exclude the Board's right to decide

on the issuance of shares, options or other special rights

entitling to shares in deviation from the shareholders' pre-emptive

rights. The authorisation can be used for material arrangements

from the Company's point of view, such as financing or implementing

business arrangements, investments or for other such purposes

determined by the Board in which case a weighty financial reason

for issuing shares, options or other special rights entitling to

shares, and possibly deviating from the shareholders' pre-emptive

rights, exists.

The Board was authorised to resolve on all other terms and

conditions of the issuance of shares, options or other special

rights entitling to shares. The authorisation will be effective

until 30 June 2021 and will not replace the authorisation related

to the Share Option Plan 2019.

Decisions of the Board

At the meeting of the Board held following the AGM, Frank

Armstrong was re-elected Chair of the Board and Matti Manner was

re-elected Vice-Chair of the Board.

In addition, the Board elected the Chairs and other members to

the Board committees from among its members as follows:

-- Leopoldo Zambeletti was elected the Chair of the Audit

Committee and Matti Manner and Gregory Brown were elected as the

other members of the Audit Committee.

-- Matti Manner was elected the Chair of the Nomination

Committee and Frank Armstrong was elected as the other member of

the Nomination Committee.

-- Frank Armstrong was elected as the Chair of the Remuneration

Committee and John Poulos and Leopoldo Zambeletti were elected as

the other members of the Remuneration Committee.

Minutes of the AGM

The minutes of the AGM will be available on the Company's

website from 1 June 2020 at the latest.

For more information please contact:

Faron Pharmaceuticals Oy

Dr Markku Jalkanen, Chief Executive Officer

investor.relations@faron.com

Panmure Gordon (UK) Limited, Nomad and Broker

Emma Earl, Freddy Crossley (Corporate Finance)

James Stearns (Corporate Broking)

Phone: +44 207 886 2500

Sisu Partners Oy, Certified Adviser on Nasdaq First North

Juha Karttunen, Jussi Majamaa

Phone: +358 (0)40 555 4727

Consilium Strategic Communications

Mary-Jane Elliott, David Daley, Lindsey Neville

Phone: +44 (0)20 3709 5700

E-mail: faron@consilium-comms.com

About Faron Pharmaceuticals Oy

Faron (AIM: FARN, First North: FARON) is a clinical stage

biopharmaceutical company developing novel treatments for medical

conditions with significant unmet needs. The Company currently has

a pipeline based on the receptors involved in regulation of immune

response in oncology and organ damage. Clevegen(R), its precision

immunotherapy, is a novel anti-Clever-1 antibody with the ability

to switch immune suppression to immune activation in various

conditions, with potential across oncology, infectious disease and

vaccine development. Currently in phase I/II clinical development

as a novel macrophage checkpoint immunotherapy for patients with

untreatable solid tumours, Clevegen(R) has potential as a

single-agent therapy or in combination with other standard

treatments including immune checkpoint molecules. Traumakine(R),

the Company's pipeline candidate to prevent vascular leakage and

organ failures, has completed a phase III clinical trial in Acute

Respiratory Distress Syndrome (ARDS). Plans for its future

development are being finalised to avoid interfering steroid use

together with Traumakine(R). Faron is based in Turku, Finland.

Further information is available at www.faron.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

RAGFLFVSELITLII

(END) Dow Jones Newswires

May 18, 2020 11:00 ET (15:00 GMT)

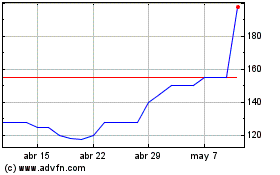

Faron Pharmaceuticals Oy (LSE:FARN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Faron Pharmaceuticals Oy (LSE:FARN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024