TIDMBPET

RNS Number : 5355N

BMO Private Equity Trust PLC

21 May 2020

To: Stock Exchange For immediate release:

21 May 2020

BMO Private Equity Trust PLC

Quarterly results for the three months to 31 March 2020

(unaudited)

-- NAV total return per Ordinary Share for the three-month

period ended 31 March 2020 of (0.5) per cent.

-- NAV of 405.63p per Ordinary Share.

-- Share price total return for the three months of (23.1) per cent for the Ordinary Shares.

-- Quarterly dividend of 3.99p per Ordinary Share.

Introduction

As at 31 March 2020, the net assets of the Company were GBP299.9

million, giving a Net Asset Value ("NAV") per share of 405.63p,

which taking into account the dividend of 3.87p paid on 31 January

2020, gives a decrease of 0.5 per cent over the quarter. At 31

March 2020 the Company had net debt of GBP48.6 million. Outstanding

undrawn commitments were GBP145.9 million, including GBP15 million

to funds where the investment period has expired.

It is worth noting that this valuation is mainly comprised of

valuations at 31 December 2019 updated for subsequent cashflows.

Only a minority of valuations for 31 March 2020 have been received

at the time of preparation of the valuation. The effects of the

Coronavirus (COVID-19) on company valuations will take some time to

be fully reflected. 19 per cent of the portfolio by value has been

valued based upon 31 March 2020 valuations and of these the

weighted average decrease in NAV is approximately 7 per cent. The

funds element of this was down by 13.4 per cent and the

co-investment element by 3.8 per cent. At this stage it is not

possible to be sure that this is a fully representative sample but

there is no evidence of any subsequent deterioration. By the June

valuation we should have all the March reports and some of the June

reports and this will give a better, although still incomplete,

view of the impact on the Company's portfolio.

In line with the Company's policy to pay dividends quarterly and

in accordance with its published calculation basis, a dividend of

3.92p per share was paid on 30 April 2020 and a further dividend of

3.99p per share will be paid on 31 July 2020 to shareholders on the

register on 10 July 2020 with an ex-dividend date of 9 July 2020.

Please note that this dividend calculation incorporates the

Company's audited NAV for the year ended 31 December 2019 announced

to the market on 15 April 2020.

New Investments

During the first quarter two new commitments to funds were made.

EUR6.0 million has been committed to Poland focused mid-market

buyout fund Avallon MBO III. EUR5.0 million has been committed to

Montefiore V, a France based mid-market buyout fund with an

emphasis on the services sector. Both of these involved backing

management teams that we have backed successfully before. There

were no further new commitments to funds or co-investments from

January onwards. Our approach from here is to be highly cautious

until the outcome of the COVID-19 crisis is clearer and the timing

of recovery is more easily discernible.

The funds in our portfolio have made new investments during the

first quarter. The more significant individual investments are

diverse by sector and geography. Avallon MBO III's first investment

is in Clovin (washing powder) and GBP0.8 million was called for

this. GBP0.7 million has been invested by Czech Republic focused

fund ARX IV in TES Vestin (components for electric motors and

machines). GBP0.7 million has been invested by Nordic fund Summa II

in Olink (protein analysis technology) and Infobric ( access and

energy control solutions) . In the co-investment portfolio there

were some calls for add-ons or re-financings. Our US based

co-investment in electric motor components company Sigma, called

GBP1.3 million for the acquisition of Tooling Dynamics ( metal

stamping and processing company) . There was a capital call of

GBP0.7 million by UK based pet shop chain Jollyes. Our

co-investment in US based restaurant chain Rosa Mexicano was

refinanced with a further investment of GBP0.5 million.

In total the combination of drawdowns from funds and

co-investments amounted to GBP11.7 million in the first

quarter.

Realisations

The largest realisation was the previously announced exit of

Nordic insurance services company Recover Nordic which has been

sold by Agilitas to EQT. The proceeds are being paid in two stages

with the first amount of GBP4.3 million received during the

quarter. The remainder of the proceeds (GBP3.8 million) is expected

imminently. The overall return is 3.7x cost and IRR of 24 per cent.

There were a number of distributions from our fund's portfolio.

Corpfin IV returned GBP1.5 million, much of which related to the

sale of medical equipment distributor Palex which has been sold to

Ergon, achieving an excellent 3.8x cost and 50 per cent IRR. Capvis

III returned GBP0.8 million from the exit of medical OEM supplier

Ondal which has been sold to IK Investment Partners delivering 2.0x

cost and 10 per cent IRR. DBAG V completed its sale of its holding

in packing and process technology company Romaco returning GBP0.4

million which represented 2.5x cost and 16 per cent IRR. In the US

Graycliff Private Equity Partners III has had two exits. GBP0.6

million came in from the sale of electronic systems supplier 901D,

representing an excellent 6.1x cost and 76 per cent IRR. GBP0.6

million was also returned from the exit of logistics and

installation services company NAL Holdings. The total proceeds of

realisations in the first quarter was GBP9.7 million.

Valuation Changes

The largest single influence on valuations this quarter was the

move in currencies with Sterling's relative weakness adding

approximately GBP6.0 million to the valuation after accounting for

the Euro denomination of the Company's debt. There were a number of

uplifts in the co-investment portfolio including Sigma (+GBP2.0

million), TWMA (+GBP0.5 million), CETA (+0.4 million) and Coretrax

(+GBP0.3 million). In each case this reflects good trading and

progress made by 31 March 2020. In the fund's portfolio Life

Science Partners III was up by GBP0.2 million. There were,

unsurprisingly, a number of downgrades. The largest of these was

for Accuvein (-GBP3.2 million) where the postponement of the

anticipated exit and a requirement for new funding has caused this

adjustment. The overall outlook for the company remains promising.

Our large holding in oil services group Ashtead is down by GBP0.7

million and other co-investments such as Avalon (-GBP0.3 million)

and Babington (-GBP0.3 million) are also down.

In addition, there were a number of downward adjustments across

a range of funds internationally. Collectively this gave a marginal

overall decline in the valuation. As noted above this valuation

does not yet fully reflect the impact of the COVID-19 which will

take time to feed through into trading and valuations of the

portfolio companies.

Financing

The Company's net debt of GBP48.6 million at 31 March 2020 gives

gearing of 13.9%. The Company has just under half of its revolving

credit facility available to meet any difference between the

proceeds from realisations and the combined drawdowns for

co-investments and from funds. It is expected that for the next few

months there will be a sharp fall-off in both new investments and

in exits. There are likely to be a series of drawdowns to support

companies with re-financings. We have conducted a detailed review

of our portfolio in conjunction with our investment partners

identifying those companies which expect to have a requirement for

fresh equity. Our assessment is that somewhat fewer than a quarter

of portfolio companies will be in this situation and that the

equity required to support them will in most cases be a small

proportion of the invested capital per company. The Company is well

placed to meet these requirements as they arise. For all companies

it is a serious situation with nearly all of them facing

considerable challenges due to the lockdowns internationally. Most

companies will be able to cope with some months of this upheaval. A

small number are in jeopardy. All of them are receiving intensive

attention from their private equity investors.

Outlook

The overwhelming concern of investors and investee companies

alike is the extent of the impact of COVID-19 on the value and

prospects of portfolio companies. Our portfolio contains over 30

direct holdings in companies and, through its portfolio of over 100

funds, over 400 additional underlying companies. These companies

collectively cover many countries and industrial sectors with no

one area being significantly over-represented. The portfolio's

diversity means that there are literally hundreds of specific

examples of the impact which we could retell in a blizzard of data.

The nearly universal feature is that the lockdowns have radically

altered plans and budgets for 2020 with the great majority

adversely affected. Generalisations are potentially misleading,

however our portfolio companies that are involved in healthcare or

software are the least adversely affected. Those involved in what

can broadly be described as retail, leisure and transport are the

most badly affected and industrial and services companies which

operate business to business are somewhere between the two. Within

these categories there are companies that do not conform. It is

also clear that the relative resilience of companies is likely to

alter as the lockdown is either extended or lifted in different

countries and for different sectors. The various government support

schemes have been actively used by our portfolio companies and

their private equity managers, but a significant proportion of

companies are not eligible under the stringent rules on, for

example, state aid. The first port of call for aid is, quite

rightly, the companies' shareholders. Private equity as a form of

investment management is distinguished by its practitioners being

much more than simple providers of appropriately priced capital.

The provision of expertise above and beyond this through

strategic and operational advice has long been a hallmark. As

has the alignment of interest between the tiers of ownership and

management through incentives which means that the problems faced

by companies and their management teams are very definitely our

problems as well. It is our assessment based on numerous

interactions over the last few months that the private equity

sector is tackling this unprecedented threat with energetic

resourcefulness and that together with similarly motivated company

management they are doing their best to mitigate and adapt to the

situation. Accordingly, our broad portfolio stands a fair chance of

coming through the 'valley' later this year largely intact. There

could also be value opportunities to be taken and we will keep a

lookout for these.

Hamish Mair

Investment Manager

BMO Investment Business Limited

BMO PRIVATE EQUITY TRUST PLC

Statement of Comprehensive Income for the

three months ended 31 March 2020 (unaudited)

Revenue Capital Total

GBP'000 GBP'000 GBP'000

-------------------------------------------- --------- --------- ----------

Income

Gains on investments held at fair value - 1,897 1,897

Exchange losses - (1,982) (1,982)

Investment income 177 - 177

Other income 6 - 6

-------------------------------------------- --------- --------- ----------

Total income 183 (85) 98

-------------------------------------------- --------- --------- ----------

Expenditure

Investment management fee - basic fee (72) (649) (721)

Investment management fee - performance - - -

fee

Other expenses (222) - (222)

-------------------------------------------- --------- --------- ----------

Total expenditure (294) (649) (943)

-------------------------------------------- --------- --------- ----------

Loss before finance costs and taxation (111) (734) (845)

Finance costs (64) (578) (642)

-------------------------------------------- --------- --------- ----------

Loss before taxation (175) (1,312) (1,487)

Taxation - - -

Loss for period/total comprehensive income (175) (1,312) (1,487)

Return per Ordinary Share (0.24)p (1.77)p (2.01)p

BMO PRIVATE EQUITY TRUST PLC

Statement of Comprehensive Income for the

three months ended 31 March 2019 (unaudited)

Revenue Capital Total

GBP'000 GBP'000 GBP'000

---------------------------------------------- --------- --------- -----------

Income

Losses on investments held at fair value - (1,672) (1,672)

Exchange gains - 1,060 1,060

Investment income 634 - 634

Other income 31 - 31

---------------------------------------------- --------- --------- -----------

Total income 665 (612) 53

---------------------------------------------- --------- --------- -----------

Expenditure

Investment management fee - basic fee (68) (619) (687)

Investment management fee - performance - - -

fee

Other expenses (208) - (208)

---------------------------------------------- --------- --------- -----------

Total expenditure (276) (619) (895)

---------------------------------------------- --------- --------- -----------

Profit/(loss) before finance costs and

taxation 389 (1,231) (842)

Finance costs (41) (373) (414)

---------------------------------------------- --------- --------- -----------

Profit/(loss) before taxation 348 (1,604) (1,256)

Taxation (66) 66 -

Profit/(loss) for period/total comprehensive

income 282 (1,538) (1,256)

Return per Ordinary Share 0.38p (2.08)p (1.70)p

BMO PRIVATE EQUITY TRUST PLC

Statement of Comprehensive Income for the

year ended 31 December 2019 (audited)

Revenue Capital Total

GBP'000 GBP'000 GBP'000

-------------------------------------------- --------- --------- ---------

Income

Gains on investments held at fair value - 30,687 30,687

Exchange gains - 2,352 2,352

Investment income 3,788 - 3,788

Other income 63 - 63

-------------------------------------------- --------- --------- ---------

Total income 3,851 33,039 36,890

-------------------------------------------- --------- --------- ---------

Expenditure

Investment management fee - basic fee (279) (2,509) (2,788)

Investment management fee - performance

fee - (1,878) (1,878)

Other expenses (844) - (844)

-------------------------------------------- --------- --------- ---------

Total expenditure (1,123) (4,387) (5,510)

-------------------------------------------- --------- --------- ---------

Profit before finance costs and taxation 2,728 28,652 31,380

Finance costs (181) (1,632) (1,813)

-------------------------------------------- --------- --------- ---------

Profit before taxation 2,547 27,020 29,567

Taxation - - -

Profit for year/total comprehensive income 2,547 27,020 29,567

Return per Ordinary Share 3.45p 36.54p 39.99p

BMO PRIVATE EQUITY TRUST PLC

Balance Sheet

As at 31 As at 31 As at 31 December

March 2020 March 2019 2019

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

--------------------------------------- ------------ ------------ ------------------

Non-current assets

Investments at fair value through

profit or loss 352,588 296,830 348,644

--------------------------------------- ------------ ------------ ------------------

Current assets

Other receivables 42 34 26

Cash and cash equivalents 5,673 14,789 6,509

--------------------------------------- ------------ ------------ ------------------

5,715 14,823 6,535

Current liabilities

Other payables (4,130) (4,126) (3,038)

Interest-bearing bank loan (33,173) (25,799) (27,794)

--------------------------------------- ------------ ------------ ------------------

(37,303) (29,925) (30,832)

Net current liabilities (31,588) (15,102) (24,297)

Total assets less current liabilities 321,000 281,728 324,347

--------------------------------------- ------------ ------------ ------------------

Non-current liabilities

Interest-bearing bank loan (21,072) - (20,070)

--------------------------------------- ------------ ------------ ------------------

Net assets 299,928 281,728 304,277

--------------------------------------- ------------ ------------ ------------------

Equity

Called-up ordinary share capital 739 739 739

Share premium account 2,527 2,527 2,527

Special distributable capital

reserve 15,040 15,040 15,040

Special distributable revenue

reserve 31,403 31,403 31,403

Capital redemption reserve 1,335 1,335 1,335

Capital reserve 248,884 230,684 253,233

Shareholders' funds 299,928 281,728 304,277

--------------------------------------- ------------ ------------ ------------------

Net asset value per Ordinary Share 405.63p 381.01p 411.51p

BMO PRIVATE EQUITY TRUST PLC

Reconciliation of Movements in Shareholders' Funds

Three months Three months Year ended

ended 31 March ended 31 31 December

2020 March 2019 2019

(unaudited) (unaudited) (audited)

------------------------------------ ---------------- ------------- -------------

GBP'000 GBP'000 GBP'000

Opening shareholders' funds 304,277 285,631 285,631

(Loss)/profit for the period/total

comprehensive income (1,487) (1,256) 29,567

Dividends paid (2,862) (2,647) (10,921)

------------------------------------ ---------------- ------------- -------------

Closing shareholders' funds 299,928 281,728 304,277

------------------------------------ ---------------- ------------- -------------

Notes (unaudited)

1. The unaudited quarterly results have been prepared on the

basis of the accounting policies set out in the statutory accounts

of the Company for the year ended 31 December 2019. Earnings for

the three months to 31 March 2020 should not be taken as a guide to

the results for the year to 31 December 2020.

2. Investment management fee:

Three months ended Three months ended Year ended 31 December

31 March 2020 31 March 2019 2019

(unaudited) (unaudited) (audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- --------- --------- --------- --------- --------- --------- --------- --------- ---------

Investment

management

fee - basic fee 72 649 721 68 619 687 279 2,509 2,788

Investment

management

fee - performance

fee - - - - - - - 1,878 1,878

------------------- --------- --------- --------- --------- --------- --------- --------- --------- ---------

72 649 721 68 619 687 279 4,387 4,666

------------------- --------- --------- --------- --------- --------- --------- --------- --------- ---------

3. Finance costs:

Three months ended Three months ended Year ended 31 December

31 March 2020 31 March 2019 2019

(unaudited) (unaudited) (audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ --------- --------- --------- --------- --------- --------- --------- --------- ---------

Interest payable

on bank loans 64 578 642 41 373 414 181 1,632 1,813

4. Returns and net asset values

Three months ended Three months Year ended 31

31 March 2020 ended 31 March December 2019

2019

(unaudited) (unaudited) (audited)

The returns and net asset

values per share are based

on the following figures:

Revenue Return (GBP175,000) GBP282,000 GBP2,547,000

Capital Return (GBP1,312,000) (GBP1,538,000) GBP27,020,000

Net assets attributable GBP299,928,000 GBP281,728,000 GBP304,277,000

to shareholders

Number of shares in issue

during the year 73,941,429 73,941,429 73,941,429

Weighted average number

of shares in issue during

the year 73,941,429 73,941,429 73,941,429

5. The financial information for the three months ended 31 March

2020, which has not been audited or reviewed by the Company's

auditor, comprises non-statutory accounts within the meaning of

Section 434 of the Companies Act 2006. Statutory accounts for the

year ended 31 December 2019, on which the auditor issued an

unqualified report, will be lodged shortly with the Registrar of

Companies. The quarterly report will be available shortly on the

Company's website www.bmoprivateequitytrust.com

Legal Entity Identifier: 2138009FW98WZFCGRN66

For more information, please contact:

Hamish Mair (Investment Manager) 0131 718 1184

Scott McEllen (Company Secretary) 0131 718 1137

hamish.mair@bmogam.com / scott.mcellen@bmogam.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

QRFKZGZKKGGGGZM

(END) Dow Jones Newswires

May 21, 2020 02:00 ET (06:00 GMT)

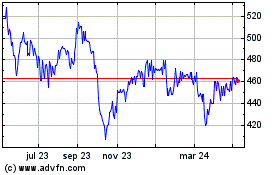

Ct Private Equity (LSE:CTPE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

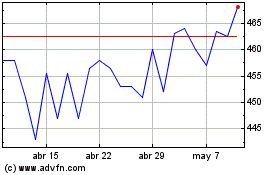

Ct Private Equity (LSE:CTPE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024