TIDMBOO

RNS Number : 1928O

boohoo group plc

28 May 2020

The information contained within this announcement is deemed by

the company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014. Upon the publication of

this announcement via the Regulatory Information Service, this

inside information is now considered to be in the public

domain.

For Immediate Release 28 May 2020

boohoo group plc

("boohoo" or "the Group")

Acquisition of remaining 34% minority stake in

prettylittlething.com Limited

boohoo (AIM: BOO), a leading online fashion group, is pleased to

announce the acquisition of the remaining 34% of shares in

prettylittlething.com Limited ("PLT") from its minority

shareholders (Umar Kamani and Paul Papworth) for an initial

consideration of GBP269.8 million, potentially rising to GBP323.8

million. The acquisition is expected to be significantly earnings

enhancing on a fully diluted basis with immediate effect.

Transaction rationale and financial impact

By acquiring the remaining 34% stake in PLT today, the Group is

taking an important further step towards achieving its vision to

lead the fashion e-commerce market globally by accelerating full

ownership of a brand that is in high growth with enormous growth

potential ahead of it, in a transaction that creates significant

value for the Group's shareholders. After this acquisition and with

its growing platform of wholly owned, innovative fashion brands,

the Group believes it can continue to successfully disrupt the

international markets it operates in today, whilst retaining a

strong balance sheet in order to take advantage of numerous M&A

opportunities that are likely to emerge in the global fashion

industry over the coming months.

Since the Group acquired its initial 66% stake in PLT on 3

January 2017, the brand has gone from strength to strength as part

of the Group's multi-brand platform; generating GBP516 million of

net sales in the year ending 29 February 2020 vs. GBP55 million in

the year ending 28 February 2017, which represents a CAGR of 111%

in this timeframe. In the last financial year, PLT's statutory

after tax profit totalled GBP45.2 million, and its adjusted after

tax profit totalled GBP47.2 million. The Group intends the senior

management team at PLT, including Umar Kamani and Paul Papworth, to

remain in their current roles and continue focusing on developing

PLT into a global brand.

In the Group's most recent financial year ending 29 February

2020, it generated an adjusted after tax profit of GBP86.0 million,

with Adjusted Net Income to Shareholders of GBP69.9 million; the

difference (GBP16.0 million) being the minority shareholders' 34%

interest in the adjusted after tax profits of PLT. Going forwards,

this figure will be fully consolidated from the date of completion,

and as a result, the group expects the acquisition to be

significantly earnings enhancing on a fully diluted basis with

immediate effect.

Transaction structure

The acquisition is for an initial consideration of GBP269.8

million, with a further GBP54.0m of consideration contingent on the

Group's share price averaging 491 pence per share over a 6 month

period between completion and a longstop date of 14 March 2024.

The initial consideration is to be settled through a combination

of shares in the Group totalling GBP107.9 million and an up-front

cash payment of GBP161.9 million, funded from the GBP240.7 million

of net cash that the Group had on its balance sheet at 29 February

2020. Since its financial year end the Group has remained cash

generative, and immediately following completion of the acquisition

will retain over GBP350m of net cash; leaving it well-positioned to

take advantage of future investment opportunities. The shares

element of the consideration will be satisfied as outlined

below:

-- By the immediate issue of 16,112,331 Ordinary Shares in

boohoo group plc representing GBP54.0 million, subject to a lock-up

period of 18 months from the date of completion (based on the

closing middle market quotation on 27 May 2020);

-- By a further immediate issue of 16,112,331 Ordinary Shares in

boohoo group plc representing GBP54.0 million, subject to a lock-up

period of 24 months from the date of completion (based on the

closing middle market quotation on 27 May 2020); and

-- And by further contingent consideration of a further

16,112,331 Ordinary Shares in boohoo group plc, representing

GBP54.0 million, that are to be issued subject to the Group's share

price averaging 491 pence per share over a 6 month period up until

a longstop date of 14 March 2024. If this condition is not met, the

consideration will lapse.

The maximum total number of shares used for consideration in the

transaction is 48,336,993, representing 3.9% of the group's issued

share capital. Application has been made for 32,224,662 New

Ordinary Shares to be admitted to trading on AIM at 8.00 a.m. on 2

June 2020 ("Admission").

Transaction process

Since the Group initially acquired its majority stake three

years ago, the board has constantly reviewed and appraised PLT's

future prospects, and the potential purchase price required in

order to complete the buyout of the minority shareholding in PLT at

any point in time.

The transaction is defined as a significant transaction under

the AIM Rules. In addition, given the transaction is with a

relative of the Executive Chairman, the Group has taken the

following steps to ensure it represents fair value for the Group's

shareholders:

-- Set up an independent board committee comprising members of

the Group's Executive (Neil Catto and John Lyttle) and

Non-Executive Directors (Brian Small, Iain McDonald and Pierre

Cuilleret) to negotiate and manage the transaction;

-- Engaged with KPMG to appraise the transaction structure and valuation; and

-- The independent Board committee has sought advice from Zeus

Capital in its capacity as NOMAD to satisfy itself that the

transaction has been conducted at arm's length and is in the best

interests for boohoo group plc shareholders.

Upon completion of these steps, the members of the independent

board committee are of the opinion that the acquisition is one that

immediately creates significant value for the Group's shareholders;

at a valuation that is deemed to be fair for all parties; factors

in a material valuation discount for the minority stake; and

supported by the valuation work performed by KPMG.

Umar Kamani, Founder & CEO of PLT commented:

"This deal represents another milestone in our journey at PLT.

Since being a disruptive start-up in 2012 to a global fashion brand

that generates over half a billion pounds in sales today, I am

incredibly proud of what my team and I have achieved in such a

short period of time. The team and myself have big ambitions for

the brand, and I'm incredibly excited about what the future holds

for PLT as it embarks on the next stage of its global journey as a

fully-owned part of the boohoo group."

John Lyttle, Group CEO commented:

"We are delighted to be acquiring the remaining 34% stake in

PLT. It has been a brand that has delivered strong growth as part

of the boohoo group's platform, and has a great future ahead of it

in the UK and overseas. I look forward to building on the great

working relationship with Umar and the senior team at PLT as the

Group continues to move forwards with its multi-brand strategy as

part of its vision to lead the fashion e-commerce market

globally."

Total Voting Rights

Following Admission, the total number of Ordinary Shares and

voting rights in the Company will be 1,258,899,050. The Company

does not hold any shares in treasury. The above figure may be used

by Shareholders as the denominator for the calculations by which

they will determine if they are required to notify their interest

in, or a change to their interest in, the share capital of the

Company under the FCA's Disclosure Rules and Transparency Guidance

and the articles of association of the Company.

-ends-

Enquiries

boohoo group plc

Neil Catto, Chief Financial Officer Tel: +44 (0)161 233

2050

Alistair Davies, Investor Relations Tel: +44 (0)161 233

2050

Clara Melia, Investor Relations Tel: +44 (0)20 3289

5520

Zeus Capital - Nominated adviser and joint

broker

Nick Cowles/Andrew Jones (Corporate Finance) Tel: +44 (0)161 831

1512

John Goold/Benjamin Robertson (Corporate Tel: +44 (0)20 3829

Broking) 5000

Jefferies - Joint broker

Philip Noblet/Max Jones Tel: +44 (0)20 7029

8000

Buchanan - Financial PR adviser boohoo@buchanan.uk.com

Richard Oldworth/ Kim Looringh-van Beeck/Toto Tel: +44 (0)20 7466

Berger 5000

About boohoo group plc

"Leading the fashion eCommerce market"

Founded in Manchester in 2006, boohoo is an inclusive and

innovative brand targeting young, value-orientated customers. Since

2006, boohoo has been pushing boundaries to bring its customers

up-to-date and inspirational fashion, 24/7. boohoo has grown

rapidly in the UK and internationally, expanding its offering with

range extensions into menswear, through boohooMAN.

In early 2017 the group extended its customer offering through

the acquisitions of the vibrant fashion brand PrettyLittleThing,

and free-thinking brand Nasty Gal. In March 2019 the group acquired

the MissPap brand and in August 2019, the Karen Millen and Coast

brands, all complementary to the group's scalable multi-brand

platform. United by a shared customer value proposition, our brands

design, source, market and sell great quality clothes, shoes and

accessories at unbeatable prices. These investment propositions

have helped us grow from a single brand, into a major multi-brand

online retailer, leading the fashion eCommerce market for 16 to

40-year-olds around the world. As at 29 February 2020, the boohoo

group had around 14 million active customers across all its brands

around the world.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQGSGDUDSDDGGI

(END) Dow Jones Newswires

May 28, 2020 02:00 ET (06:00 GMT)

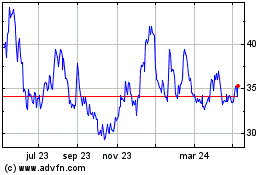

Boohoo (LSE:BOO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

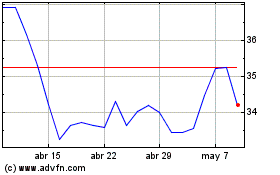

Boohoo (LSE:BOO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024