BlackRock Throg Tst Portfolio Update

29 Mayo 2020 - 4:56AM

UK Regulatory

TIDMTHRG

BLACKROCK THROGMORTON TRUST PLC (LEI: 5493003B7ETS1JEDPF59)

All information is at 30 April 2020 and unaudited.

Performance at month end is calculated on a cum income basis

One Three One Three Five

Month months year years years

% % % % %

Net asset value 13.8 -22.9 -7.5 8.4 55.8

Share price 13.9 -23.2 -1.8 37.0 97.6

Benchmark* 13.2 -22.2 -16.5 -15.7 4.7

Sources: BlackRock and Datastream

*With effect from 22 March 2018 the Numis Smaller Companies plus AIM (excluding

Investment Companies) Index replaced the Numis Smaller Companies excluding AIM

(excluding Investment Companies) Index as the Company's benchmark. The

performance of the indices have been blended to reflect this.

At month end

Net asset value capital only: 512.72p

Net asset value incl. income: 516.96p

Share price 526.00p

Premium to cum income NAV 1.7%

Net yield1: 1.9%

Total Gross assets2: GBP432.1m

Net market exposure as a % of net asset value3: 111.7%

Ordinary shares in issue4: 83,588,462

2019 ongoing charges (excluding performance fees)5,6: 0.6%

2019 ongoing charges ratio (including performance 1.8%

fees)5,6,7:

1. Calculated using the 2019 interim dividend declared on 23 July 2019 and paid

on 28 August 2019, together with the 2019 final dividend declared on 06

February 2020 and paid on 27 March 2020.

2. Includes current year revenue and excludes gross exposure through contracts

for difference.

3. Long exposure less short exposure as a percentage of net asset value.

4. Excluding 0 shares held in treasury.

5. Calculated as a percentage of average net assets and using expenses,

excluding performance fees and interest costs for the year ended 30 November

2019.

6. With effect from 1 August 2017 the base management fee was reduced from

0.70% to 0.35% of gross assets per annum.

7. Effective 1st December 2017 the annual performance fee is calculated using

performance data on an annualised rolling two year basis (previously, one year)

and the maximum annual performance fee payable is effectively reduced to 0.90%

of two year rolling average month end gross assets (from 1% of average annual

gross assets over one year). Additionally, the Company now accrues this fee at

a rate of 15% of outperformance (previously 10%). The maximum annual total

management fees (comprising the base management fee of 0.35% and a potential

performance fee of 0.90%) are therefore 1.25% of average month end gross assets

on a two year rolling basis (from 1.70% of average annual gross assets).

Sector Weightings % of Total Assets

Industrials 30.3

Consumer Services 19.3

Financials 17.9

Consumer Goods 12.5

Technology 8.3

Health Care 7.0

Telecommunications 2.7

Basic Materials 1.8

Net current assets 0.2

-----

Total 100.0

=====

Market Exposure (Quarterly)

31.05.19 31.08.19 30.11.19 29.02.20

% % % %

Long 113.7 109.1 103.2 119.3

Short 13.2 11.2 7.4 8.9

Gross exposure 126.9 120.3 110.6 128.2

Net exposure 100.5 97.9 95.8 110.4

Ten Largest Investments

Company % of Total Gross Assets

YouGov 3.1

Breedon 3.0

IntegraFin 2.9

Serco Group 2.9

Dechra Pharmaceuticals 2.7

Gamma Communications 2.7

Games Workshop 2.4

Watches of Switzerland 2.3

Qinetiq Group 2.2

Bodycote 2.0

Commenting on the markets, Dan Whitestone, representing the Investment Manager

noted:

During the month the Company returned 13.8% (net of fees), outperforming our

benchmark which returned 13.2%. The positive performance was generated by the

long book, with the short book detracting modestly (circa 0.5%).

Equity markets rebounded during April as news flow surrounding COVID-19 showed

signs of improvement, with many countries appearing to have passed the peak and

taking steps to lift restrictions. Meanwhile monetary support continued to

provide liquidity to financial markets, with governments around the world

signalling the intention to use a wide variety of measures to stimulate

economic activity, which is being significantly impacted by lockdowns.

Whilst the long book benefited from the reversal in performance of many shares

that were impacted during the initial market sell-off back in March, our short

book also experienced a similar effect. It is often the case that in the early

stages of a recovery/rebound, our shorts recover faster than our longs,

vindicating our decision to close a number of shorts in late March / early

April.

Two of the largest contributors to performance came from holdings in Consumer

Services, a sector that has been impacted by Government lockdowns. Games

Workshop, the creator of the Warhammer miniatures game, rose in response to a

positive trading update where the company confirmed that online orders would

recommence in May following assessments to ensure health and safety for staff.

Shares in luxury watch retailer, Watches of Switzerland, also rallied from

their March lows. While sales in airport outlets will undoubtedly be impacted

by travel disruption, we believe this is a market where long-term demand

exceeds supply and we believe Watches of Switzerland has built itself an

advantaged market position.

Companies at the forefront of digital transformation have fared particularly

well. This is an industrial trend we have highlighted before and remains a key

investment proposition for the Company. Looking forward, we expect an

acceleration in digitisation across many business verticals (niche businesses

serving a specific audience) and we have deliberately sought to increase

exposure to this multi-year secular trend across digital payments,

software-as-a-service, unified communications, and exchanges to name but a few.

Our holding in Gamma Communications, a UK leader in unified

communications-as-a-service, was a top contributor during the month, and we

expect the company to continue to benefit from this trend.

There are little conclusions to be drawn from detractors during the month, with

many simply being companies that failed to keep pace with the market rally or

those which gave back some relative outperformance from the prior month, for

example, Team17 which was the largest positive contributor during March.

Similarly, Qinetiq and Serco both underperformed during the month, which we

would attribute to these businesses being more defensive.

The economic backdrop remains highly uncertain as a result of the ongoing

COVID-19 pandemic. We are continuing to engage with companies to understand the

trends and impacts to the industries in which they operate, and how Management

teams expect to deal with this disruption. We believe that this crisis is

likely to see an acceleration of some secular industry trends, notably to the

benefit of digital-ready businesses and businesses that enable the digital

transformation. Other companies with strong financial footing with a

differentiated product offering should be able to use this market disruption to

their long-term advantage, as and when competitors and capacity exit the

market. Therefore, we do not expect to alter the positioning of the portfolio

materially but are always looking to add or remove individual holdings where

our latest research suggests there is change occurring. We continue to operate

with a lower gross exposure than usual given the ongoing market volatility but

have started to increase our net exposure in recent weeks as we have reduced/

taken profits in a number of shorts that had fallen a long way. We continue to

thank shareholders for their ongoing support.

29 May 2020

1Source: BlackRock as at 30 April 2020S

Latest information is available by typing www.blackrock.co.uk/thrg on the

internet, "BLRKINDEX" on Reuters, "BLRK" on Bloomberg or "8800" on Topic 3 (ICV

terminal). Neither the contents of the Manager's website nor the contents of

any website accessible from hyperlinks on the Manager's website (or any other

website) is incorporated into, or forms part of, this announcement.

END

(END) Dow Jones Newswires

May 29, 2020 05:56 ET (09:56 GMT)

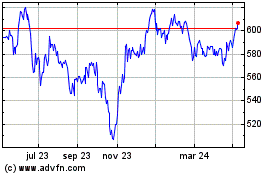

Blackrock Throgmorton (LSE:THRG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

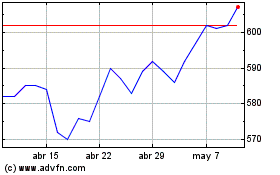

Blackrock Throgmorton (LSE:THRG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024