TIDMVOD

RNS Number : 5453O

Vodafone Group Plc

01 June 2020

1 June 2020

Vodafone Group Plc ("Vodafone" or the "Company")

Publication of the 2020 Annual Report

Vodafone will today publish on the Company's website its Annual

Report for the year ended 31 March 2020 (the '2020 Annual Report'.

The Annual Report is available at vodafone.com/ar2020.

In compliance with Listing Rule 9.6.1 of the UK Financial

Conduct Authority ('FCA'), the 2020 Annual Report will in due

course be available for inspection at data.fca.org.uk.

In accordance with FCA's Disclosure Guidance and Transparency

Rule 6.3.5, the Appendix to this announcement contains a

description of the principal risks and uncertainties affecting the

Group, related party transactions and a responsibility

statement.

A condensed set of Vodafone's financial statements and

information on important events that have occurred during the

financial year ended 31 March 2020 and their impact on the

financial statements were included in Vodafone's final results

announcement released on 12 May 2020. That information, together

with the information set out below, which is extracted from the

2020 Annual Report, constitute the material required by Disclosure

Guidance and Transparency Rule 6.3.5 which is required to be

communicated to the media in full unedited text through a

Regulatory Information Service. This announcement is not a

substitute for reading the full 2020 Annual Report. Page and note

references in the text below refer to page numbers in the 2020

Annual Report and notes to the financial statements.

APPIX

PRINCIPAL RISK FACTORS AND UNCERTAINTIES

A description of the principal risks and uncertainties that the

Company faces is extracted from pages 62 to 71 of the 2020 Annual

Report.

Managing uncertainty in our business

Our risk management framework enables a consistent approach to

the identification, management and oversight of risks. This

consistency is valuable as it allows us to take a holistic approach

to risk management and to make meaningful comparisons of the risks

we face and how we manage them across our footprint, which is

essential to achieve our strategic objectives.

Identifying our risks

Using our global risk management framework, all local markets

and Group entities identify the risks that could affect their

strategy and operations in order to implement risk mitigation

plans. These risks are then consolidated into a Group-wide view and

presented to a representative selection of our senior leaders and

executives, who add their own input on strategic, functional and

emerging risks. We then define which emerging risks warrant being

added to our risk watchlist and monitored for their impact on the

organisation.

Furthermore, we evaluate the completeness of our risk landscape

by benchmarking against comparable companies in our peer group.

After final consolidation, the proposed principal risks and risk

watchlist are reviewed and approved by our Executive Committee

('ExCo') before being submitted to the Audit and Risk Committee and

the Board.

Managing our risks

Each principal risk is assigned an executive owner who is

accountable for setting the target tolerance level. The executive

owner is responsible for confirming adequate controls are in place

and that the necessary action plans are implemented to bring the

risk profile within an acceptable tolerance. To provide adequate

oversight, we report throughout the year on principal and emerging

risks, and hold in-depth reviews of all principal risks at

different oversight committees. Figure 1 presents an overview of

our process and governance structures, including the Audit and Risk

Committee and Board.

We develop severe but plausible scenarios for all risks. These

scenarios not only provide insights into possible threats and

points of failure, allowing us to react and adjust our strategy

accordingly, but are also used for the purpose of assessing our

viability (page 71).

Strengthening our framework

Over the course of the year, we have:

- Further enhanced and driven adoption of our global risk tool,

allowing us to have a single source of risk and assurance data;

- Continued to develop the link between risk and budgeting to

inform the capital allocation reviews in a timely manner;

- Implemented a process for tracking action plans to manage our principal risks; and

- Continued with our engagement programme to develop our global risk community.

Key improvement projects underway consist of:

- Enhancing our approach to assessing the impact of emerging

risks by evaluating long-term scenarios;

- Improving the way we collect and treat early signals in the

internal and external environment by embedding the use of risk

indicators;

- Continuing to align with TCFD by assessing the impact of the

climate-related risks and opportunities to meet future

requirements; and

- Further enhancing our risk processes reflecting lessons

learned from the COVID-19 pandemic to be better prepared in the

future.

Our principle risks

We categorised our risks into four different areas to provide

the appropriate level of governance and oversight to effectively

manage these risks.

Strategic - The influence of stakeholders and industry players

on our business and our response to them:

A. Adverse political and regulatory measures - Political

pressures and new regulatory measures impact our strategy or

profitability

B. Geo-political risk in the supply chain - Global trade wars

and security concerns impact our supply chain

C. Market disruption - New telecom operators entering the

market/price wars reduce margins

D. Disintermediation - Loss of customer relevance to the big

technology players through emerging technology

Financial - Our financial status, standing and continued

growth:

E. Global economic disruption - Disruption caused by global

external events, such as pandemics, that impacts our financial

performance

Technological - The network and IT systems that support our

business and the data they hold:

F. Cyber threat and information security - External or internal

attack resulting in service unavailability or data breach

G. Technology failure - Failure of critical services and

applications causing service disruption

Operational - The ability to achieve our optimal business

model:

H. Digital transformation - Failure to deliver business and IT

transformation targets in a timely and efficient manner

I. Strategic transformation - Failure to deliver expected

business value from our existing portfolio, and new acquired

assets, or joint ventures

J. Legal and regulatory compliance - Non-compliance with

applicable laws and regulations

Our principal risks and interdependencies

We continue to consider risks both individually and collectively

in order to fully understand our risk landscape. By analysing the

correlation between risks, we can identify those that have the

potential to cause, impact, or increase another risk and that these

are weighted appropriately. This exercise informs our scenario

analysis, particularly the combined scenario used in the Long-Term

Viability Statement (page 71).

We have considered COVID-19 (a key element of risk E - global

economic disruption) which could lead to a long-term global

recession and other operating constraints that may have a knock-on

effect on several of our principal risks.

Additionally, we added health pandemic to our watchlist risks,

as we seek to learn from the current crisis so that we are better

prepared in the future.

Global economic disruption

Risk owner: Margherita Della Valle

Year-on-year risk movement: Increased

Risk category: Financial

What is the risk:

Any major economic disruption could result in reduced demand for

our services and lower spending power for our consumers, affecting

our profitability and cash flow generation. Economic disruption can

also impact financial markets, including currencies, interest

rates, borrowing costs and the availability of debt financing.

How we manage it:

We have a long average life of debt which minimises re-financing

requirements, and the vast majority of our interests costs are

fixed. We maintain sufficient liquidity resources so that we can

cope for a prolonged period of time without accessing the capital

markets.

Our target tolerance:

We need to take a conservative approach to managing financial

risks.

Scenario:

A severe contraction in economic activity leads to lower cash

flow generation for the Group and disruption in global financial

markets impacts our ability to refinance debt obligations as they

fall due.

Emerging threats:

Because this is an externally driven risk, the threat

environment is continually changing.

External factors such as the COVID-19 pandemic are currently

creating a severe contraction in economic activity across all our

markets. The financial markets are currently experiencing high

levels of volatility and the availability and cost of financing may

change significantly.

Cyber threat and information security

Risk owner: Johan Wibergh

Year-on-year risk movement: Stable

Risk category: Technological

What is the risk:

An external cyber-attack, insider threat or supplier breach

could cause service interruption or the loss of confidential data.

Cyber threats could lead to major customer, financial, reputational

and regulatory impacts across all of our local markets.

How we manage it:

We protect Vodafone and our customers from cyber threats by

continuing to strengthen global and local security controls.

Our target tolerance:

Our risk tolerance is to avoid a material cyber breach, loss of

data or reputational impact. Security underpins our commitment to

protecting our customers with reliable connections and keeping

their data safe.

Scenario:

Scenarios could include attacks on individual markets, parts of

our network or large-scale intrusions spanning multiple markets.

Each year we model a different severe but plausible scenario.

Emerging threats:

Cyber risk is constantly evolving in line with technological

advances and geo-political developments. We anticipate threats will

continue from existing sources, but also evolve in areas such as

IoT, supply chain, quantum computing and the use of AI and machine

learning.

Geo-political risk in supply chain

Risk owner: Joakim Reiter

Year-on-year risk movement: Stable

Risk category: Strategic

What is the risk:

We operate and develop sophisticated infrastructure in the

countries in which we are present. Our network and systems are

dependent on a wide range of suppliers internationally. If there

was a disruption to the supply chain, we might be unable to execute

our plans and we, the industry, would face potential delays to

network improvements and increased costs.

How we manage it:

We are closely monitoring the political situation around our key

suppliers. We are also engaging with governments, experts and

suppliers to remain fully informed so that we can respond

accordingly and comply with the latest regulations, economic

sanctions and trade rulings.

Our target tolerance:

We have a diverse range of supplier relationships and we manage

these closely with our procurement specialists. We have a

multi-vendor strategy in place across our markets to mitigate

against supply chain disruption.

Scenario:

There is disruption to our supply chain due to unilateral

decisions affecting vendor-choices or decisions that affect trade

and supply chains.

Emerging threats:

We operate in a global environment where political landscape

changes could have an effect on our operations.

Adverse political and regulatory measures

Risk owners: Joakim Reiter and Margherita Della Valle

Year-on-year risk movement: Stable

Risk category: Strategic

What is the risk:

Operating across many markets and jurisdictions means we deal

with a variety of complex political and regulatory landscapes. In

all of these environments, we can face changes in taxation,

political intervention and potential competitive disadvantage. This

also includes our participation in spectrum auctions.

How we manage it:

We address issues openly with policy makers and regulatory

authorities to find mutually acceptable ways forward.

Our target tolerance:

We aim to have strategies that are based on common objectives

with political, policy and regulatory stakeholders so as to reduce

the risk that our business will be undermined by unpredictable and

disproportionate political and regulatory environments and

interventions.

Scenario:

Exposure to additional liabilities by regulatory authorities or

if tax laws were to adversely change in the markets in which we

operate.

Emerging threats:

There is a risk that regulation will become more diverse (and

therefore more difficult to manage) as different countries, and a

variety of regulators within countries, introduce new regulations

for emerging technology such as AI, IoT and net neutrality.

Technology failure

Risk owner: Johan Wibergh

Year-on-year risk movement: Stable

Risk category: Technological

What is the risk:

Major incidents caused by natural disasters, deliberate attacks

or an extreme technology failure, although rare, could result in

the complete loss of key sites in either our data centres or our

mobile/fixed networks causing a major disruption to our

service.

How we manage it:

Unique recovery targets are set for essential assets to limit

the impact of service outages. A global policy supports these

targets with requisite controls to provide effective

resilience.

Our target tolerance:

Our customer promise is based on reliable availability of our

network, therefore the recovery of key mobile, fixed and IT

services must be fast and robust.

Scenario:

The loss of critical assets in our networks or IT infrastructure

causing a service disruptions impacting our ability to provide

service to our customers.

Emerging threats:

We could be impacted by an increase in extreme weather events

caused by climate change which may increase the likelihood of a

technology failure.

New assets inherited from acquired businesses may not be aligned

to our target resilience level which may increase the likelihood of

a technology failure.

Strategic transformation

Risk owners: Dr Hannes Ametsreiter and Vivek Badrinath

Year-on-year risk movement: Increase

Risk category: Operational

What is the risk:

We are undertaking a large-scale integration of new assets

across multiple markets. If we do not complete this in a timely and

efficient manner, we would not see the full benefit of planned

synergies and could face additional costs or delays to completion.

The successful integration also requires that an important number

of technology platforms/services are migrated on time before the

termination of the transitional services agreements.

We also have a number of joint ventures in operation and must

ensure that these operate effectively.

How we manage it:

Integration specialists and local teams are implementing the

many projects and activities that constitute the integration

plan.

We have robust governance in place to manage our joint ventures

effectively.

Our target tolerance:

Since strategic transformation is critical to our future, our

tolerance for this risk is low.

Scenario:

Delay in the integration of a major acquisition means we cannot

realise the benefits as quickly as planned.

Emerging threats:

As we increase the pace at which we transform our business there

is an emerging risk that unless managed carefully different

transformation initiatives could negatively impact each other.

Market disruption

Risk owner: Ahmed Essam

Year-on-year risk movement: Decreased

Risk category: Strategic

What is the risk:

New entrants with lean models could create pricing pressure. As

more competitors launch unlimited bundles there could be price

erosion. Our market position and revenues could be damaged by

failing to provide the services that our customers want.

How we manage it:

We closely monitor the competitive environment in all markets,

and react appropriately.

Our target tolerance:

We aim to continue to be competitive in our markets. We are

evolving our offers and adopting agile commercial models to

mitigate competitive risks using simple, targeted offers, smart

pricing models and differentiated customer experience.

Scenario:

Aggressive pricing, accelerated MVNO losses and disruptive new

market entrants in key European markets result in greater customer

churn and pricing pressures impacting our financial position.

Emerging threats:

Because this is an externally driven risk, the threat

environment is continually changing.

Digital transformation

Risk owners: Ahmed Essam and Johan Wibergh

Year-on-year risk movement: Decrease

Risk category: Operational

What is the risk:

Failure in digital or IT transformation projects could result in

loss business, a poorer customer experience and reputational

damage.

How we manage it:

We track individual programmes against our clearly defined

objectives and target KPIs throughout the lifecycle of our

projects. The aim is to identify new threats then manage and

mitigate them.

Our target tolerance:

We need to deliver these transformations programmes with the

correct mix of efficient systems, relevant skills and digital

expertise in alignment with the original planned spend and business

benefits.

Scenario:

Failure to deliver business benefits causes cost escalation,

budget overruns and increased customer churn which could negatively

impact our financial performance.

Emerging threats:

The digital transformation strategy considers emerging threats

and factors.

Disintermediation

Risk owner: Ahmed Essam

Year-on-year risk movement: Stable

Risk category: Strategic

What is the risk:

We face increased competition from a variety of new technology

platforms which aim to build alternative communication services or

different touch points, which could potentially affect our customer

relationships. We must be able to keep pace with these new

developments and competitors while maintaining high levels of

customer engagement and an excellent customer experience.

How we manage it:

We continually strive to introduce innovative propositions and

services while evolving our customer experience to deepen the

relationship with our customers. Our strategy focuses on

simplifying our offer portfolios and accelerating our digital

transformation, for a better customer experience.

Our target tolerance:

We offer a superior customer experience and continually improve

our offering through a wide set of innovative products and

services. We also develop innovative new products and explore new

growth areas such as 5G, IoT, convergence, digital services and

security so that we continue to meet our customers' needs.

Scenario:

Emerging technology impacts our market share.

Emerging threats:

Emerging risks include the development of new connectivity

systems that compete with our networks.

Legal and regulatory compliance

Risk owner: Rosemary Martin

Risk movement: Stable

Risk category: Operational

What is the risk:

Vodafone must comply with a multitude of local and international

laws and applicable industry regulations. These include privacy,

anti-money laundering, competition, anti-bribery and economic

sanctions. Failure to comply with these laws and regulations could

lead to reputational damage, financial penalties and/or suspension

of our licence to operate.

How we manage it:

We have subject matter experts in legal teams and a robust

policy compliance framework. We train our employees in "Doing

what's right". These training and awareness programmes set out our

ethical culture across the organisation and assist employees to

understand their role in ensuring compliance.

Our target tolerance:

We seek to comply with all applicable laws and regulations in

all of our markets.

Scenario:

Breaches of legal compliance could lead to reputational damage,

investigation costs and fines.

Emerging threats:

Changing workplace dynamics, digital transformation, asset

integrations and a change in our employee demographics might

degrade our control environment so we are updating our Code of

Conduct and various policies to mitigate this.

Key changes to our principal risks

The global economic disruption risk increased as a result of the

COVID-19 outbreak.

We have renamed the successful integration of new assets and

management of joint ventures risk to strategic transformation,

which now addresses not only the integration of acquisitions but

also changes occurring from the separation of our tower portfolio

and other types of strategic transformation initiatives.

Market disruption risk has decreased when compared to our other

principal risks as some of our key markets have adapted and

responded positively to competitor activities.

The digital transformation risk has decreased as a result of the

progress we made on our digital journey and the IT transformation

programme.

Risk watchlist

We face a number of uncertainties where an emerging risk may

potentially impact us in the longer term. In some cases, there may

be insufficient information to understand the likely scale, impact

or velocity of the risk. We also might not be able to fully define

a mitigation plan until we have a better understanding of the

threat. We have created a watchlist of these emerging risks which

we review on a regular basis.

We regularly provide our Audit and Risk Committee with a list of

risks on our watchlist such that future strategies take into

account future technological, environmental, regulatory or

political changes.

Some examples of these risks are:

EMF

The risk can be broken down into three areas:

- failure to comply with national legislation or international

guidelines (set by the International Commission on Non-Ionizing

Radiation Protection ('ICNIRP')) as it applies to EMF, or failure

to meet policy requirements;

- the risk arising from concerted campaigns or negative

community sentiment towards location or installation of radio base

stations, resulting in planning delays; and

- changes in the radio technology we use or the body of credible

scientific evidence which may impact either of the two risks

above.

We have an established governance for EMF risk management (a

Group leadership team that reports to the Board, and a network of

EMF leaders across all markets), as well as an EMF taskgroup which

was set up in FY20, that focus on assessing and reporting on the

impact of 5G on EMF. The taskgroup scope included quantifying the

impact of EMF restrictions in those markets with limits that do not

align with international, science-based guidelines; coordinate

engagement with policy makers relating to 5G and EMF; and assess

the impact of social media campaigns on public concern.

Vodafone continues to advocate for national EMF regulations to

be harmonised with international guidelines. In March 2020, the

ICNIRP updated their guidelines (first published 1998) following a

review of published science. ICNIRP confirmed that there are no

adverse effects on human health from 5G frequencies if exposure is

within their guidelines. We have worked in partnership with the

GSMA and national trade associations to provide information on

these new guidelines to regulators, health agencies and Government

ministries. Additionally, we have updated national regulators about

how our advanced technologies for 5G services are compliant with

regulations. Vodafone always operates its mobile networks strictly

within national regulations, which are typically based on, or go

beyond, ICNIRP's guidelines, and we regularly monitor our

operations in each country to ensure we meet those regulations.

We have established a European tower company that is required to

comply with the Group's Radio Frequency Safety Policy (which meet

international standards) and local regulations.

Brexit

The Board continues to monitor the implications for Vodafone's

operations in light of the new trading relationship between the UK

and the EU, which has yet to be negotiated.

A cross-functional steering committee has identified the impact

of the UK and EU failing to reach a free trade agreement on the

Group's operations and has produced a comprehensive mitigation

plan.

Although our headquarters are in the UK, a large majority of our

customers are in other countries, accounting for most of our

revenue and cash flow. Each of our operating companies operates as

a standalone business, incorporated and licensed in the

jurisdiction in which it operates, and able to adapt to a wide

range of local developments. As such, our ability to provide

services to our customers in the countries in which we operate,

inside or outside the EU, is unlikely to be affected by the lack of

a free trade deal. We are not a major international trading

company, and do not use passporting for any of our major services

or processes.

The lack of an agreed free trade deal between the UK and EU

could lead to a fall in consumer and business confidence. Such a

fall in confidence could, in turn, reduce consumer and business

spend on our products and services.

Climate-related disclosures

We recognise that climate change poses a number of physical

risks (i.e. caused by the increased frequency and severity of

extreme weather events) and transition-related risks (i.e.

economic, technology or regulatory challenges related to moving to

a greener economy) for our business. We are currently aligning

internal processes with the recommendations of the Taskforce on

Climate-related Financial Disclosures ('TCFD') after the initial

independent gap analysis we reported in 2019. We have summarised

our progress to date in this section and aim to be fully aligned by

2022.

Managing climate risk

As a result of the growing understanding of the impacts of

climate change on our business, this was added as a risk to our

watchlist in 2019, recognising its evolving nature. The Group

External Affairs Director, a member of the Group Executive

Committee, heads the Planet agenda as part of our purpose-led

strategy (pages 16 to 19) and has overall accountability for

climate change, which includes providing updates to the Board on

our progress towards our climate-related goals. Furthermore, as

part of our sustainable business strategy (page 40), we monitor

climate-related metrics and develop plans to address specific risks

and opportunities. An example of this is our ambition to halve our

environmental impact by 2025 which includes a commitment to set

science-based carbon targets aligned to the most ambitious goal of

the Paris Agreement, to keep global temperature increase to 1.5

degrees (page 46).

Subject to shareholder approval of our Remuneration Policy at

the 2020 AGM, our ESG priorities will be embedded in our executive

remuneration arrangements via a specific measure under our

long-term incentive plan. For the 2021 financial year's award, this

measure will include a specific GHG reduction ambition - more

details of which can be found in our Directors' Remuneration Report

on pages 96 to 120.

Material risks and opportunities

The process to assess the materiality of climate-related risks

and opportunities follows industry and sectoral relevant benchmark

data and takes into consideration our principal risks (page 63).

Based on our initial assessment, the principal risks most

influenced by climate change are "adverse political and regulatory

measures" and "technology failures".

Key risk and opportunity areas arising from the assessment

are:

- Growing external pressures and demands for action negatively

impact revenues from those companies late to react and trigger an

increase in taxation and energy prices.

- Global focus on energy efficiency increases the likelihood of

new regulation impacting energy intensive assets, however it

carries an opportunity with the application of new

technologies.

- Increase in temperature and frequency of extreme weather

events (e.g. heat waves, storms) leads to higher energy consumption

for cooling and affects the quality of radio frequency and wireless

transmission, in addition to damaging equipment and harming

people's wellbeing.

At Vodafone, we believe our approach to business resilience will

mitigate the short to medium-term physical impacts of climate

change, and we will continue to monitor longer-term trends. Our

priority, however, is to prepare ourselves to face the challenges

and seize the opportunities posed by the move to a lower carbon

economy and the policy changes required to achieve it, for

instance, by growing our IoT connectivity platform and products to

enable our customers to reduce their carbon footprint.

Climate scenario analysis

We adopted three scenarios in line with the Bank of England's

reference climate scenarios - see figure below - as outlined in

their consultation document released in December 2019. We will

conduct the required assessments to quantify the business impacts

of all material climate related risks under each scenario and over

different time horizons to better understand the financial value at

risk.

The outputs of the scenario analysis will assist us in either

adjusting existing policies or developing new ones, especially

looking at opportunities to improve our business resilience and

continuity. It will also inform the assessment of our long-term

viability and allow us to validate the priority areas of focus set

in our Planet pillar. The overall aim is to provide the Board with

reasonable assurance of the sustainability of our business in

meeting the challenges of an ever-changing global economy.

Metrics and targets

We have been measuring and reporting on energy and carbon

emissions since 2001. Our latest emissions footprint can be found

on page 2. In addition, we have set a number of 2025 targets to

manage climate-related risks and reduce our impact on the

environment, such as to reduce our greenhouse gas emissions by 50%

and to purchase 100% renewable electricity. Related data can be

found in the sustainable business section pages 40 to 51.

COVID-19

Since January 2020, the COVID-19 pandemic has brought

significant disruption to our staff, suppliers and customers. It is

likely to change the global economic, social, political and

business landscape for the foreseeable future.

In order to adapt to a new external context, we undertook a

review of the impacts of the pandemic on our principal risks to

identify new opportunities that may arise or risks which may change

materially.

We are taking a three phase approach to help us to adapt to the

changing environment. We have a good foundation with our five-point

plan (see pages 54 and 55) and strong delivery against this across

our markets.

Phase 1: Immediate crisis management

We initiated our response to this crisis drawing on existing

pandemic response plans. The objective at this stage was to

prioritise the health, safety and wellbeing our workforce and the

immediate needs of our customers and governments.

During the early stages of the crisis we ensured our critical

infrastructure, resources and activities were organised so as to

provide continuity of our operations and to enable us to implement

our five-point plan.

Phase 2: Recovery

We expected to play an instrumental role in the speed of

recovery.

Our focus will be on the acceleration of digitisation that we

have already seen in the first phase, to help all businesses, but

especially SMEs, recover quickly and to enable government sectors

to become more resilient. Investment in 5G and continued

improvement of networks will create jobs and provide a launchpad

for other sectors to recover more quickly during the economic

crisis. We will also continue to protect the vulnerable through

measures to improve digital skills and drive digital inclusion.

Phase 3: The new normal

Our hope is that phase two supports a more positive trajectory

for the industry as a whole as we transition towards a "new

normal". In this phase, if the first two phases are successful and

subject to the unknown changes that COVID-19 may have brought to

societies more generally, we will aim to emerge as trusted partners

of our customers and governments. Strong and resilient

communications infrastructure is clearly essential for a resilient

society. This is dependent on a sustainable market structure and

fair regulatory framework.

Scenario analysis and impact assessment

We evaluated the impact of the COVID-19 pandemic across all our

principal risks to support sustainability of our operations.

Information was collected through interviews with risk owners and

champions and subject matter experts and input from our local

market colleagues.

We adopted two scenarios for our assessment: a short to

medium-term impact leading to an economic slowdown and, a

longer-term global recession with impacts likely beyond 2020. We

focused on the latter, more extreme case, as the basis for our

stress testing.

The review concluded that a significant number of our principal

risks would be adversely affected if this pandemic was reoccurring

and resulted in continued lockdown measures with a subsequent deep

global recession. For these affected risks we have developed

short-term responses and long-term strategic actions to minimise

the impact on our business.

We identified the following areas as the ones with the most

impact on our principal risks:

- The health, safety and wellbeing of our employees is vital for

us, therefore we reacted quickly to take relevant actions such as

implementing a global restriction for travel, restricting

attendance/organisation of large events, and increasing

smart-working at scale. To support our employees better in these

unprecedented times and to enable remote working, we also

introduced various digital content and online learning materials to

support our line managers and employees, initiated a pulse survey

to monitor closely employee wellbeing and engagement, and

virtualised most of our recruitment and onboarding processes (see

page 58).

- Delays across the supply chain are caused by the disruptions

in availability of people, goods, services and equipment. This is

expected to persist and be further compounded by the global

economic disruption which may negatively affect the financial

stability of critical suppliers. We reviewed the risks associated

with our critical suppliers and service providers and identified if

we have sufficient stock levels in our warehouses to address

scheduled replacement and maintenance of our equipment.

- We anticipate a continued increase in volume and scale of

financially motivated cyber attacks using phishing, malware and

denial of service. Criminals and other sophisticated threat actors

are using the crisis as cover to expand or continue their actions

against all sectors, include Vodafone and our customers. We have

heightened our security monitoring and response. We track external

threats working with governments, law enforcement and industry

specialists.

Finally, we have performed additional financial stress testing

and liquidity impact analysis in order to reflect the impacts from

the COVID-19 pandemic in the assessment of the Group's long-term

viability, as set out on page 71.

Next steps

With the COVID-19 crisis consistently evolving, we remain in

close contact with our local health authorities, governmental

agencies and other key stakeholders in all our geographies, so that

we can react and adapt to any changes in circumstances and minimise

the risk to Vodafone and our customers, employees and other

stakeholders.

There are a number of ongoing business reviews at both Group and

local market level to evaluate different courses of action in

response to the crisis.

Looking ahead, we will review the lessons learned during this

crisis as part of future updates to our risk management framework,

specifically when it comes to our approach to prepare for similar

type of events.

Long-Term Viability Statement ('LTVS')

The preparation of the LTVS includes an assessment of the

Group's long-term prospects in addition to an assessment of the

ability to meet future commitments and liabilities as they fall due

over the three year review period.

Assessment of viability

Vodafone continues to adopt a three year period to assess the

Group's viability, a period in which we believe our principal risks

tend to develop, in what is a dynamic industry sector. This time

horizon is also in line with the structure of long-term management

incentives and the outputs from the long range business planning

cycle.

For 2020, as a result of the increased pressures on the global

financial markets as a result of the COVID-19 pandemic, we

conducted additional financial stress testing and sensitivity

analysis, considering revenues at risk as well as the impact of our

response plan to the crisis.

The assessment of viability started with the available headroom

as of 31 March 2020 and considered the plans and projections

prepared as part of the forecasting cycle, which include the

Group's cash flows, planned commitments, required funding and other

key financial ratios. We also assumed that debt refinance will

remain available in all plausible market conditions.

Finally, we estimated the impact of severe but plausible

scenarios for all our principal risks on the three year plan and,

in addition, stress tested a combined scenario taking into account

the risk interdependencies as defined on the diagram on page 63,

where the following risks were modelled as materialising in

parallel over the three year period:

- Global economic disruption: Global events, such as the

COVID-19 pandemic, put pressure on our financial performance and

liquidity.

- Cyber threat and information security: An external

cyber-attack exploits vulnerabilities and leads to a GDPR fine.

- Geo-political risk in supply chain : Increase in trade wars

leads to decisions that may affect our supply chain and restricts

our ability to use critical suppliers.

- Adverse political and regulatory measures : Governments in

financial struggle look to other sources to raise revenues, such as

spectrum auctions.

Assessment of long-term prospects

Each year the Board conducts a strategy session, reviewing the

internal and external environment as well as significant threats

and opportunities to the sustainable creation of long-term

shareholder value (note that known emerging threats related to each

principal risk are described in pages 8 and 9).

As an input to the strategy discussion, the Board considers the

principal risks that are longer term in nature (including adverse

political and regulatory measures, market disruption and

disintermediation), with the focus on identifying underlying

opportunities and setting the Group's future strategy. The output

from this session is reflected in the strategic section of the

Annual Report (pages 20 to 25), which provides a view of the

Group's long-term prospects.

Conclusions

The Board assessed the prospects and viability of the Group in

accordance with provision 31 of the UK Corporate Governance Code,

considering the Group's strategy and business model, and the

principal risks to the Group's future performance, solvency,

liquidity and reputation. The assessment takes into account

possible mitigating actions available to management where any risk

or combination of risks materialise.

Total cash and cash equivalents available of EUR13.3 billion

(page 188) as of 31 March 2020, along with options available to

reduce cash outgoings over the period considered, provide the Group

with sufficient positive headroom in all scenarios tested. Reverse

stress testing on revenue and EBITDA over the review period

confirmed that the Group has sufficient headroom available to face

uncertainty. The Board deemed the stress test conducted to be

adequate and therefore confirm that they have a reasonable

expectation that the Group will remain in operation and be able to

meet its liabilities as they fall due up to 31 March 2023.

RELATED PARTY TRANSACTIONS

The Group has a number of related parties including joint

arrangements and associates, pension schemes and Directors and

Executive Committee members (see note 12 "Investments in associates

and joint arrangements", note 25 "Post employment benefits" and

note 23 "Directors and key management compensation").

Transactions with joint arrangements and associates

Related party transactions with the Group's joint arrangements

and associates primarily comprise fees for the use of products and

services including network airtime and access charges, fees for the

provision of network infrastructure and cash pooling arrangements.

No related party transactions have been entered into during the

year which might reasonably affect any decisions made by the users

of these consolidated financial statements except as disclosed

below.

2020 2019 2018

EURm EURm EURm

----------------------------------------------------- -------- ------ --------

Sales of goods and services to associates 32 27 19

Purchase of goods and services from associates 4 3 1

Sales of goods and services to joint arrangements 305 242 194

Purchase of goods and services from joint

arrangements 97 192 199

Net interest income receivable from joint

arrangements (1) 71 196 120

----------------------------------------------------- -------- ------ --------

Trade balances owed:

by associates 4 1 4

to associates 4 3 2

by joint arrangements 157 193 107

to joint arrangements 37 25 28

Other balances owed by joint arrangements(1) 1,083 997 1,328

Other balances owed to joint arrangements

(2) 2,017 169 150

----------------------------------------------------- -------- ------ --------

Notes:

1 Amounts arise primarily through VodafoneZiggo, Vodafone

Hutchison Australia and Inwit S.p.A.. Interest is paid in line with

market rates.

2 Amounts for the year ended 31 March 2020 are primarily in

relation to leases of tower space from INWIT S.p.A (see note

20).

Dividends received from associates and joint ventures are

disclosed in the consolidated statement of cash flows.

Transactions with Directors other than compensation

During the three years ended 31 March 2020, and as of 28 May

2020, no Director nor any other executive officer, nor any

associate of any Director or any other executive officer, was

indebted to the Company. During the three years ended 31 March 2020

and as of 28 May 2020, the Company has not been a party to any

other material transaction, or proposed transactions, in which any

member of the key management personnel (including Directors, any

other executive officer, senior manager, any spouse or relative of

any of the foregoing or any relative of such spouse) had or was to

have a direct or indirect material interest.

DIRECTORS' RESPONSIBILITY STATEMENT

As set out above, this statement is repeated here solely for the

purposes of complying with Disclosure Guidance and Transparency

Rule 6.3.5. This statement relates to and is extracted from the

2020 Annual Report.

Responsibility is for the full 2020 Annual Report not the

extracted information presented in this announcement and the final

results announcement.

Each of the Directors, whose names and functions are listed on

pages 76 and 77 confirms that, to the best of his or her

knowledge:

- the consolidated financial statements, prepared in accordance

with IFRS as issued by the IASB and IFRS as adopted by the EU, give

a true and fair view of the assets, liabilities, financial position

and profit of the Group;

- the parent company financial statements, prepared in

accordance with United Kingdom generally accepted accounting

practice, give a true and fair view of the assets, liabilities,

financial position and profit of the Company; and

- the Strategic Report includes a fair review of the development

and performance of the business and the position of the Group,

together with a description and robust assessment of the principal

risks and uncertainties that it faces.

The Directors are also responsible under section 172 of the

Companies Act 2006 to promote the success of the Company for the

benefit of its members as a whole and in doing so have regard for

the needs of wider society and stakeholders, including customers,

consistent with the Group's core and sustainable business

objectives.

Having taken advice from the Audit and Risk Committee, the Board

considers the report and accounts, taken as a whole, is fair,

balanced and understandable and that it provides the information

necessary for shareholders to assess the Company's position and

performance, business model and strategy.

Neither the Company nor the Directors accept any liability to

any person in relation to the Annual Report except to the extent

that such liability could arise under English law. Accordingly, any

liability to a person who has demonstrated reliance on any untrue

or misleading statement or omission shall be determined in

accordance with section 90A and schedule 10A of the Financial

Services and Markets Act 2000.

By Order of the Board

Rosemary Martin

Group General Counsel and Company Secretary

28 May 2020

This document contains "forward-looking statements" within the

meaning of the US Private Securities Litigation Reform Act of 1995

with respect to the Group's financial condition, results of

operations and businesses and certain of the Group's plans and

objectives. Forward-looking statements are sometimes, but not

always, identified by their use of a date in the future or such

words as "will", "anticipates", "aims", "could", "may", "should",

"expects", "believes", "intends", "plans", "prepares" or "targets"

(including in their negative form or other variations). By their

nature, forward-looking statements are inherently predictive,

speculative and involve risk and uncertainty because they relate to

events and depend on circumstances that will occur in the future.

There are a number of factors that could cause actual results and

developments to differ materially from those expressed or implied

by these forward-looking statements. A review of the reasons why

actual results and developments may differ materially from the

expectations disclosed or implied within forward-looking statements

can be found under "Forward-looking statements" and "Risk

management" in the Group's annual report for the financial year

ended 31 March 2020. The annual report can be found on the Group's

website (vodafone.com/investor). All subsequent written or oral

forward-looking statements attributable to the Company or any

member of the Group or any persons acting on their behalf are

expressly qualified in their entirety by the factors referred to

above. No assurances can be given that the forward-looking

statements in this document will be realised. Any forward-looking

statements are made of the date of this presentation. Subject to

compliance with applicable law and regulations, Vodafone does not

intend to update these forward-looking statements and does not

undertake any obligation to do so.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACSBFLFBBQLXBBE

(END) Dow Jones Newswires

June 01, 2020 07:00 ET (11:00 GMT)

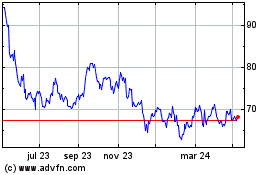

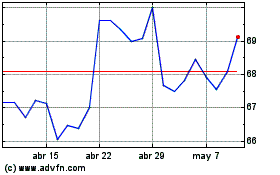

Vodafone (LSE:VOD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Vodafone (LSE:VOD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024