TIDMGTC

RNS Number : 0427P

GETECH Group plc

05 June 2020

Getech Group plc

("Getech" or the "Company" and with its subsidiaries the

"Group")

Final Results for the 12 months ended 31 December 2019

The Getech Group (AIM; GTC) announces its Final Results for the

12 months ended 31 December 2019.

Covid-19 and oil price update

-- The move to home working has been smooth, with projects

continuing to be delivered on time and to cost

-- Actions have been taken to preserve capital, with monthly Group costs lowered by c26%

-- We retain further flexibility and have maintained the

capacity to both deliver our orderbook and the resources we need to

maximise the impact of our sales conversations and new business

activities.

-- The current business environment is challenging but Q1 2020

revenue, new sales and profitability were all ahead of Q1 2019, and

year-to-date there have been no negative orderbook revisions.

-- As might be expected, April and May have been quieter in

terms of new sales closed but we have remained busy across a wide

range of sales conversations.

2019 financial highlights

-- Revenue GBP6.1 million (2018: GBP8.0 million), with new

forward sales up 41% to cGBP2.4 million (2018: GBP1.7 million), a

significant portion of which will unwind to revenue in 2020

-- Orderbook increased by 48% to GBP3.1 million at 31 December

2019 (31 December 2018: GBP2.1 million)

-- Annualised Recurring Revenue GBP2.3 million at 31 December

2019 (31 December 2018: GBP2.3 million)

-- Total cost base 16% below 2018 (2019: GBP6.4 million; 2018: GBP7.6 million)

-- Adjusted* EBITDA GBP0.9 million (2018: GBP1.3 million),

before exceptional items totalling GBP2.8 million

-- Adjusted(*) earnings per share (0.75)p (2018: 1.88p)

-- Net cash GBP2.7 million at 31 December 2019 (31 December

2018: GBP0.5 million), with the Group generating free cash in

H2-19

(* Adjusted for exceptional items as detailed in the financial

review)

Operational highlights

-- Gravity & Magnetic Solutions - Continued demand for our

expertise and data, underlining our market leading position in this

domain

-- Geoinformation Products - Globe 2019 released on schedule and

to budget, providing innovative new analytic tools and content. New

super-major customers added in Q4 2019 and Q1 2020

-- GIS Software - Unconventionals Analyst software released on

ArcGIS Pro, high subscription renewal rates, product suite awarded

Esri's "Release Ready Specialty" designation

-- GIS Services - Super-major support contract wins, further

diversification into new markets, service team awarded Esri's

"ArcGIS Online Specialty" designation

-- Geoscience Services - Restructured, relocated, integrated

-- Innovation - New team established to lead cross-discipline

R&D, with early success in hydrocarbon micro-seep detection

service

Chairman and Chief Executive's review

Getech provides products and services that commercialise our

expertise in the development, application and deployment of the

earth sciences and geospatial technology. To date we have

principally used these skills to build and sell data, knowledge and

analytical products that address specific petroleum market

workflows and data management challenges. Our customers use these

products and services to de-risk exploration programmes and improve

the management of their assets and resources.

We have also been successful in diversifying into new markets.

Getech sells data products and geoscience services to mining

companies, and we have utilised our geospatial skills in the water,

transportation, nuclear, pipeline and electricity infrastructure

sectors. Whilst these end markets are not yet material in the

context of the Group, we have the expertise and technologies to

create significant value in these new markets.

Covid-19 - global economic disruption and Getech's response

Since 31 December 2019, the Covid-19 pandemic has led to

unprecedented restrictions on social and business activity. These

have deeply disrupted the global economy, and, in the face of sharp

falls in oil demand, a relatively short-lived but untimely

OPEC-Russia supply war added unwelcome complexity.

Oil prices have touched 20-year lows, and although production

cuts are growing and evidence builds that demand is now recovering,

significant uncertainty remains. In response, petroleum companies

have cut c$178bln from their budgets, including a c35% reduction in

2020 capex.

2020 will undoubtedly be a very challenging and uncertain year

but the combination of a strong balance sheet, a significantly

enhanced orderbook and sustained recurring revenues will help

Getech navigate this. Net cash at 31 December 2019 totalled GBP2.7

million. Our debt levels are low, and the repayment profile is

back-end-loaded with an October 2023 maturity. We own a property

asset with an 'in use' carrying value of GBP2.4 million. We have

continued to close new sales in the current year and there have

been no negative orderbook revisions. This has resulted in Q1 2020

revenue, forward sales and profitability all ahead of Q1 2019 and

in April an important global software license was renewed.

Operationally, the move to home working has been smooth, with

projects remaining on schedule - both in terms of time and cost.

Having established solid remote communication practices early, we

have also enhanced our ability to deliver online trials of our

products. The uptake in product training from home working

customers across our customer and contact base has been strong, and

having expanded our programme of digital marketing, webinar

attendance has increased significantly. Together, this creates a

unique opportunity to both increase our profile and reach deeper

into our customers' organisations and we have reshaped our sales

and marketing activities to capture the benefit of this. We have

also accelerated new business activities, focusing on the value

that our transferable skills and technologies can deliver in new

energy and infrastructure settings.

Like all businesses however, we do not know how long Covid-19

disruption and oil price weakness will last, and so to preserve

capital we implemented a range of actions that have lowered Group

monthly costs by c26%. Getech retains additional cost flexibility,

but, importantly, we have also maintained our capacity to deliver

our contracted orderbook and to maximise the impact of our sales

and new business conversations.

We believe Getech is now well positioned to rapidly adjust to

any further deterioration, or improvement, in our core markets.

This flexibility, and our balance sheet strength, will underpin

Getech throughout 2020 and 2021.

12 months to 31 December 2019

In 2019 customer budgets remained constrained, a position that

has continued since the oil price slump of 2014. The steps that we

have taken in recent years to manage this longer-term environment

have made Getech more robust against the current market

uncertainty.

Key to this has been to strategically drive orderbook growth,

with a focus on annually recurring revenue. This has increased

Getech's earnings visibility, and it is progressively lessening our

exposure to 'lumpy' data transactions. We have also strengthened

our financial and operational controls, we are disciplined in our

capital spending, and our customers' needs are central to

everything we do.

The importance of these initiatives is highlighted in our 2019

financial results, where, against a volatile and uncertain

commercial environment, with oil prices and drilling activity down

year-on-year, Getech closed 41% more forward sales compared to the

prior year. These forward sales expanded our orderbook of committed

revenue, which grew by 48%, and most of the value of this orderbook

will unwind to revenue in 2020. Getech grew its cash balance across

2019; first half growth of GBP1.6 million driven by working

capital, second half growth of GBP0.6 million driven by operational

free cash flow. We closed 2019 with a net cash balance of GBP2.7

million (31 December 2018: GBP0.5 million). As previously

announced, negotiations on several substantial transactions did not

close by 31 December 2019, total revenue (GBP6.1 million) therefore

fell below our earlier expectations for the year (2018: GBP8.0

million).

Current market conditions mean these delayed transactions have

not since materialised, but in 2019 the profitability impact of

this revenue shortfall was mitigated by lower total cash costs. In

2019, the adjusted gross margin* of our activities increased; and

our service division, which made a loss in 2018, grew its revenue

contribution and returned to profit. Across the year, Getech

generated an adjusted EBITDA(*) of GBP0.9 million (2018: GBP1.3

million).

(*Adjusted for exceptional items as detailed in the financial

review.)

Redoubling our focus on diversified growth

Getech retains significant profit leverage to growth and we are

focused on continuing to diversify our revenue by growing the

materiality of the Group's activities further along the energy

value chain.

In 2019, we expanded our work in two focus areas - petroleum

production operations, and hydrocarbon and electricity

infrastructure. We also continue to explore new opportunities

relevant to the energy transition and the low carbon economy. What

drives our focus on these specific business sectors is that we see

clear customer needs in areas where we can use our existing skills

and technologies to add value. We also see potential to extend our

skills and add complementary technologies and services.

Each focus area is of a scale that would enable significant

growth and we see potential to accelerate our expansion into these

markets through M&A that would be accretive to both profit and

cash generation, either directly or via a quick path to shareholder

value creation (synergies, technology acceleration etc).

Conclusion and Outlook

The pace at which the Covid-19 pandemic has reshaped the global

business environment is unprecedented. In energy markets the speed

at which demand has fallen has triggered cuts to capital investment

and, in oil and gas specifically, these have been faster and deeper

than followed either the 2008 or 2014 oil price falls and our

customers have placed many regional 'project-based' investment

plans on hold. Although it remains too early to estimate how deep

or long the downturn in our core markets will be, our orderbook is

larger and our sales pipeline remains diverse and continues to

benefit from 2019 campaigns in new regions, with new potential

customers.

We expect May's sharp rebound in oil prices, which has continued

into June, to take time to filter through to our customer

conversations. Getech's revenue is normally weighted 40:60 between

H1 and H2 and there is the likelihood this weighting becomes

accentuated into H2 in 2020. In H1 2020 we have focused on the

replenishment of our orderbook and protecting annually recurring

revenue. Year-to-date, we are cautiously encouraged by the renewal

rate across our software products and we have won service

extensions that deliver monthly revenue to year-end. We are also

negotiating various licence renewals to our Globe knowledge

product. These discussions would normally conclude in June and

July. Globe contracts are an important part of our orderbook, and

they set the shape and scale of our H2 2020 investment. As we plan

this investment, we are confident that Getech's financial strength,

our flexibility and the transferable nature of our skills and

technologies give us the toolkit to successfully navigate what are

exceptional commercial conditions. We also see an opportunity to

accelerate our diversification and growth plans - both through

organic expansion and acquisition.

Navigating this extreme operational environment will require an

unwavering focus on customer needs, continued operational delivery,

and creativity in our thinking. In what are exceptionally

challenging times, we thank our staff for their dedication,

adaptability, and inspirational teamwork. We also thank our

shareholders for their time, advice and continued support.

Dr Stuart Paton Dr Jonathan Copus

Chairman Chief Executive

Getech Group plc Tel: 0113 322 2200

Jonathan Copus, Chief Executive

Cenkos Securities plc Tel: 0207 397 8900

Neil McDonald / Pete Lynch / Pearl Kellie

(Corporate Finance)

Michael Johnson / Julian Morse (Sales)

Operations review

The core skills at the heart of Getech's products and services

offerings are Earth Science and Geospatial in nature. To date, we

have principally combined these skills to develop solutions for the

oil and gas market, but we also operate in other energy and natural

resources sectors.

-- Our Earth Science staff are experts in geology, potential

fields geophysics, seismic geophysics, geochemistry, structural

geology, plate tectonics & geodynamics, palaeoclimate modelling

and remote sensing.

-- Our Geospatial staff are experts in designing, implementing,

and managing geographical interpretation systems (GIS) technology

that is used to spatially integrate and analyse business data in

order to derive unique insights.

In line with UK Government Covid-19 guidance, all Getech staff

moved to home working in early March. This move was completed

smoothly, and projects are operating to time and on cost.

Our Gravity and Magnetic Solutions team performed solidly in

2019, underscoring our market leading position in this domain

despite the challenges posed by the continuing tough exploration

market. Aside from the disappointment that several larger data

sales did not close by their expected date in December, the

underlying performance of the team was strong and their expertise

in the science of potential fields data and processing was once

again recognised by a steady-stream of bespoke Gravity and Magnetic

service contracts. In addition, key projects were undertaken to

research, update and enhance strategically important data products

in order to bring new products to market for 2020/21. Included in

these was Getech's unique Multi-Sat data product.

In 2019 we further enhanced our flagship Globe product,

developed by our Geoscience Information Products team. The "Globe

2019" release was delivered to customers on time and within budget,

and featured enhancements that leveraged skills from across the

Group - with Getech's geoscience, geospatial and software expertise

once again combining to deliver new information, analytic tools and

additional usability for Globe customers. Following its release, we

held two successful Globe User Group Meetings in the autumn - in

London and Houston. These scientific, workflow and demo focussed

sessions stimulated excellent customer feedback about product use,

features and opportunities for future product enhancements. Our

ongoing efforts around re-positioning of Globe for the current

exploration market were further rewarded in 2019 securing a new

super-major customer and high renewal rates for existing

subscribers and those on multi-year licence agreements.

The focus for our GIS Software team has been to migrate our

software products to ArcGIS Pro, Esri's new desktop GIS application

and ArcMap replacement. In June 2019, these migration efforts

completed with the full commercial release of the Unconventionals

Analyst extension for ArcGIS Pro, providing significant

enhancements to its onshore shale gas/oil well pad & lateral

planning capabilities. In April 2019, our software team was

commended by Esri by being awarded its "Release Ready Specialty"

designation in recognition of adopting and continually supporting

the latest versions of the ArcGIS product suite. As with Globe,

software renewal rates through 2019 remained high and we were able

to add several new customers through the year.

Our GIS Services team continues to be recognised as experts in

the use of Esri technology within the petroleum and natural

resources sectors, which in 2019 was further demonstrated by being

awarded the "ArcGIS Online Specialty" designation by Esri. This

award was in recognition of the team's expertise in designing,

delivering, and deploying web-based GIS technology and associated

components of the ArcGIS platform. Through the year our GIS

Services team remained highly utilised, and we renewed several

strategic long-term GIS support contracts, including agreeing a

three-year support contract renewal with an international joint

venture organisation focussed on a GIS managing above ground

operations. In addition, the team successfully delivered a wide

variety of GIS services and training projects, including our first

significant GIS implementation project in the pipeline sector.

The market for our Geoscience Services has remained challenging

throughout the industry downturn, and we have responded by

continuing to focus on profitability by managing our operational

costs and re-positioning our geoscience services. In parallel, our

work with governments also continued in 2019, and we worked in

partnership with the Sierra Leone government on its Fourth

Licensing Round.

A new group-wide Innovation team was established in Q1 2019 with

the remit to research and develop cross-discipline opportunities

for new capabilities, partnerships, products, and services. An

early success for the team in 2019 resulted in delivering

revenue-generating services projects for onshore hydrocarbon

micro-seep detection.

Chris Jepps

Chief Operating Officer

Financial review

Since 31 December 2019, the Covid-19 pandemic has cast a shadow

over the global economy and Getech's response is detailed in the

Chairman and Chief Executive's Review in this Annual Report.

These events build on an already challenging business

environment, which in 2019 saw a continuation of the macroeconomic

and investment themes that led to volatility and uncertainty in

both oil prices and the levels of exploration spending by our

petroleum customers. The impact of climate change also moved up the

social agenda, and this placed the Energy Transition firmly on the

strategic roadmap of Getech and our customers.

Brent averaged $64/bbl (2018: $71/bbl) and long-dated crude

prices traded around the mid-$50/bbl, down from above $60/bbl in

2018. In step with lower prices, exploration spending fell, and the

number of exploration wells drilled fell faster. However, the

resource replacement ratio was the highest since 2015 - driven by a

small number of high-volume, high-value conventional deep-water

discoveries.

More encouragingly for Getech, a stronger focus on capital

discipline and economic returns drove a rotation out of onshore

'unconventional' settings (principally US shale) and back into

'conventional' offshore opportunities. This rebalancing plays to

the strengths of Getech's products and services.

We remained close to our customers, focusing on their most

pressing needs and targeting product and service renewals that

increase revenue visibility and lower the Group's reliance on

'lumpy' transactions. The importance of this strategy was

highlighted in Q4 2019, when several substantial data transactions

failed to close, and revenue fell year-on-year to GBP6.0 million

(2018: GBP8.0 million). In the same period, Getech grew its

orderbook by 48% and held annualised recurring revenue flat on

2018. In addition, profitability was protected by lower total

costs. Getech closed 2019 with a cash balance of GBP3.6 million (31

December 2018: GBP1.4 million).

In accordance with our accounting policies we perform periodic

reviews of Getech's assets and liabilities. This includes, but is

not limited to, identifying potential indicators of impairment of

assets, annual impairment reviews of intangible assets, and regular

review of significant accounting judgements and estimates. An

important element of Getech's 2019 total cost base management were

the steps taken to relocate and reshape our Geoscience Services

team, which in 2018 made a significant loss. Bought through the

acquisition of ERCL in April 2015, the Board now considers it

prudent to fully impair the goodwill relating to this acquisition.

In addition, with there being reduced interest in Regional Reports

during 2019, the Board also believes it is prudent to fully impair

the value previously attributed to the Group's library of Reports.

Whilst we may make further Report sales in the future, the

near-term path to market is unclear. Getech reports three

exceptional items: in Cost of Sales, an impairment of the carrying

value of Regional Reports, offset by a one-off adjustment to direct

cost accruals and in Administrative expenses, an impairment to

goodwill.

To aid in the analysis of Getech's underlying financial

performance, the table below sets out key reported figures from the

financial statements and the equivalent figure adjusted for these

exceptional items, detailed in footnotes 1 and 2.

Table 1 - Financial summary 2019 2018

==============================

Reported Adjusted (1) (2) (unaudited) Reported Adjusted (1) (2) (unaudited)

(audited) GBP'000 (audited) GBP'000

GBP'000 GBP'000

============================== =========== ============================= =========== =============================

Revenue 6,058 6,058 8,019 8,019

EBITDA (1,935) 872 1,071 1,268

Operating (loss)/profit (3,091) (284) 250 447

(Loss)/profit after tax (3,088) (281) 508 705

Earnings per share (8.22)p (0.75)p 1.35p 1.88p

Cash inflow from operations

(before W/C adjustments) 935 935 1,073 1,270

Development costs (1,108) (1,108) (861) (861)

Net increase/(decrease) in

cash 2,154 2,154 (1,040) (843)

Cash and cash equivalents 3,554 1,400

Net cash 2,700 468

============================== =========== ============================= =========== =============================

(1) Exceptional cost of sales

Exceptional cost of sales total a GBP325,000 credit (2018:

GBPnil). This adjustment is the net impact of an impairment of

Getech's library of Reports (GBP621,000 debit), together with a

reduction to direct cost accruals (GBP946,000 credit). The direct

cost accruals credit results from updated information that became

available during 2019 around the contractual liability position

relating to previously accrued balances. On the Statement of

Financial Position, the impairment of Reports impacts intangible

assets and the reduction to direct cost accruals impacts trade and

other payables. These accounting adjustments are non-cash in nature

and so there are no corresponding adjustments to cash flows.

(2) Exceptional administrative expenses

Exceptional administrative expenses total GBP3,132,000 (2018:

GBP197,000). In 2019, this is a write down of GBP3,132,000 to the

carrying value of Goodwill relating to the acquisition of ERCL.

This is a non-cash adjustment and so there is no corresponding

adjustment to cash flows. In Q4 2018, the Group combined its

activities in London and Henley into one new London office, and

restructured the Geoscience Services team (previously based in

Henley) to address its declining revenues and profitability. This

resulted in one-off costs of GBP197,000 during 2018.

Operating results

Revenue

Revenue for 2019 totalled GBP6,058,000, a decrease of

GBP1,961,000 from GBP8,019,000 in 2018. The drop in revenue

resulted when several substantial transactions did not close as

expected at the year-end. For the same reasons, Products revenue

fell by 33%. Whilst the Services market remained challenging,

revenue grew by 3% - growth from Gravity & Magnetic Services

and Geospatial Services, more than offsetting a contraction in

Geoscience Service income.

During 2019 Getech also closed GBP2.4 million in new forward

sales; relating to projects, services and subscriptions for which

revenue will be recognised in 2020 and beyond. As a result, at 31

December 2019, Getech's orderbook had grown to GBP3.1 million

(2018: GBP2.1 million).

The Group's Annualised Recurring Revenue from product

subscriptions and recurring services was maintained at GBP2.3

million (2018: GBP2.3 million).

Gross margins before exceptional items

Gross margin before exceptional items was 58%, an increase from

47% in 2018. This reflects improved margins in both Products and

Services divisions. The products margin improved from 62% in 2018

to 76% in 2019, this reflected a movement in Product sales mix

between 2019 and 2018 and increased product investment.

Following restructuring of our Geoscience Service offering in

late 2018, and an expansion in the activity in our Gravity &

Magnetic and Geospatial Services teams in 2019, Getech's Services

division returned to profit with a gross margin of 8% (2018: 14%

negative margin). Getech continues to target a return to a 25%

margin for the Services division in the mid-term.

Table 2 - Gross margin by reporting segment (before exceptional items) 2019 2018

Products Services Products Services

Revenue 4,324 1,636 6,434 1,585

Cost of sales (1,025) (1,506) (2,421) (1,810)

======================================================================== ========= ========= ========= =========

Gross profit 3,299 130 4,013 (225)

======================================================================== ========= ========= ========= =========

Gross margin 76% 8% 62% (14)%

======================================================================== ========= ========= ========= =========

Administrative costs

Administrative expenses include GBP1,124,000 of depreciation and

amortisation charges. Excluding these charges and exceptional

items, administrative expenses totalled GBP2,684,000; a 5% increase

(2018: GBP2,553,000). This reflects the Group returning all staff

to a progressive rate of pay, whilst also strengthening our project

management, marketing and sales teams, and expanding our innovation

programme. Such steps reflect Getech's strategic repositioning,

which has also reshaped the structure of our cost base.

Cost base analysis

As a result of merging the London and Henley offices and

reducing headcount in the Geoscience Services team in Q4 2018,

Getech benefited from a lower fixed cost base in 2019, in addition

to lower variable costs due to differing products sales mix. The

Group cost base, excluding exceptional items, for 2019 was 16%

lower than the prior year at GBP6,362,000 (2018: GBP7,607,000).

In 2019 we also began to apportion for the environmental cost of

our activities. Getech has contributed to the funding of a Verified

Carbon Standard UK tree planting initiative that fully offsets

carbon dioxide emissions from heating and lighting its offices, and

international travel.

The table below reconciles our cost base to the financial

statements.

Table 3 - Cost base reconciliation % variance 2019 2018

Cost of sales 2,532 4,231

Development costs capitalised 1,108 861

Capitalised cost of building Reports - 13

Administrative costs 3,809 3,341

Payment of lease liabilities 71 -

Depreciation and amortisation charges (1,156) (821)

Exchange adjustments (2) 16

Movement on provisions - (34)

======================================== =========== ======== ======

Cost base, excluding exceptional items (16)% 6,362 7,607

======================================== =========== ======== ======

Cost base is measured as: cost of sales, administrative costs,

development costs capitalised and payment of lease liabilities,

less depreciation and amortisation, and adjusted for movement in

work in progress, non-cash foreign exchange adjustments.

EBITDA

A lower cost base and continued investment in the drivers of

recurring revenue has limited the impact of lower revenue on

EBITDA. EBITDA excluding exceptional items totalled GBP872,000

(2018: GBP1,268,000).

Depreciation and Amortisation

Depreciation of non-current assets amounted to GBP216,000 and

were allocated to administrative costs in the income statement

(2018: GBP131,000). The increase relates to the IFRS 16 accounting

treatment of the London office lease, which commenced in Q4

2018.

Amortisation of intangible assets totalled GBP940,000 (2018:

GBP689,000). This charge is allocated to administrative costs in

the income statement, except for 'Reports' where the charge is

allocated to cost of sales. Following an annual impairment review

Reports were impaired by GBP621,000 and is allocated to exceptional

cost of sales in the income statement.

Impairment of goodwill relating to the acquisition of ERCL

totalling GBP3,132,000 is allocated to exceptional administrative

costs on the income statement.

Operating profit

The Group reported an operating loss of GBP287,000 excluding

exceptional items (2018: GBP447,000 profit). As noted above, the

impact of a fall in revenue on profitability was limited through a

lower cost base and continued investment in our Products.

Income tax

To help our customers understand and resolve their exploration

and operational challenges requires Getech undertaking pioneering

research and development. Against the cost of this work we obtained

corporation tax relief, and subsequently realised a tax credit

relating to the current year for 2019 of GBP38,000 (2018:

GBP57,000).

Getech reported a loss after tax, adjusted for exceptional items

of GBP281,000 (2018: GBP705,000 profit).

Operating cash flows

In 2018 Getech refinanced its loan, continued to invest in its

products, benefited from significant cash tax receipts and had a

large negative movement in working capital due to significant

outstanding receivables at the year end. This year Getech continued

to repay its loan, increase investment in its products, grew its

orderbook, benefited from smaller tax receipts (partially offset by

foreign taxation payments) and had a large positive movement in

working capital due to collection of the significant prior year

receivables.

Before working capital adjustments Getech generated GBP935,000

in cash from operations (2018: GBP1,073,000). In 2018 this included

restructuring costs of GBP197,000.

Changes in working capital

During the past two years there were significant movements in

working capital (2019: GBP2,612,000 positive movement, 2018:

GBP1,919,000 negative movement). A large proportion of this

movement was due to the timing of a high value sale of data and

products towards the end of 2018, for which cash was received in

early 2019.

Cash taxation

Getech received net cash tax credits totalling GBP37,000 (2018:

GBP514,000). Tax credits were significantly lower in 2019 due to

foreign taxation payments made in the year and the Group's

increased profitability in 2018. Getech's current tax asset

provision at 31 December 2019 is GBP136,000 (31 December 2018:

GBP104,000).

Investment and Capital Expenditure

In line with the Group's strategy to invest and enhance its

product offering, development expenditure on Globe and Software

increased to GBP1,108,000 (2018: GBP861,000). Getech expects to

continue with this level of investment in its products throughout

2020.

Financing

During the year Getech made repayments against a loan facility

of GBP78,000. In 2018 Getech refinanced its borrowings by repaying

the balance of its outstanding loan (GBP652,000) and drawing down

on a new loan facility (GBP950,000).

Repayment of lease liabilities totalled GBP71,000 (2018:

GBP29,000) and relate to the new London office to which Getech

relocated in Q4 2018.

Post balance sheet events

We do not know how long Covid-19 disruption and oil price

weakness will last but there is certainty that when the world

emerges from lockdown it will be in a deep recession. To manage the

risk that is associated with this Getech has taken steps that

deliver a c26% reduction in monthly Group costs.

This has been achieved through overhead cost management, a loan

capital repayment holiday, use of the UK Government Job Retention

Scheme, US Government Paycheck Protection Program, and group-wide

salary reductions. Reductions to staff pay have been led by the

Board and Getech's senior management, and range from 20% for

Getech's Board, 15% to 12% for senior staff and c8% for most other

employees.

Whilst revenue uncertainty exists, Getech retains additional

cost flexibility, and the benefits of the actions already taken

combine with our strong balance sheet and orderbook to provide

significant financial capacity. This will underpin Getech

throughout 2020 and 2021.

Liquidity and Going Concern

At the end of 2019, Getech held GBP3,554,000 in cash and cash

equivalents (2018: GBP1,400,000). Net of borrowings, Getech's cash

balance was GBP2,700,000 (2018: GBP468,000).

Getech's business activities and the factors likely to affect

its future development, performance and position are set out in the

Chairman's and Chief Executive's Review. The financial position of

the Group, its cash flows and its liquidity position are described

in the financial statements.

In making the going concern assessment, the Board of Directors

has considered Group budgets and detailed cash flow forecasts to 31

December 2021. The Board has considered the sensitivity of these

forecasts with regards to different assumptions about future income

and costs, and various scenarios have been run on the potential

impact of Covid-19.

These cash flow projections, when considered in conjunction with

Getech's existing cash balances, and the cost saving measures

implemented, demonstrate that the Group has sufficient working

capital for the foreseeable future. Consequently, the Directors are

fully satisfied that Getech is a going concern.

Andrew Darbyshire

Chief Financial Officer

Consolidated Statement of Comprehensive Income

for the year ended 31 December 2019

2019 2018

GBP'000 GBP'000

Sales revenue 6,058 8,019

Cost of sales (2,533) (4,231)

Gross profit before exceptional items 3,525 3,788

Exceptional cost of sales 325 -

====================================================================================== ========= =========

Gross profit 3,850 3,788

Administrative expenses (3,809) (3,341)

======================================================================================= ========= =========

Operating profit before exceptional administrative costs 41 447

Exceptional administrative expenses (3,132) (197)

Operating (loss)/profit (3,091) 250

Finance revenue 14 -

Finance costs (64) (25)

======================================================================================= ========= =========

(Loss)/profit before tax (3,141) 225

Tax credit 53 283

======================================================================================= ========= =========

(Loss)/profit for the year (3,088) 508

Other comprehensive income

Currency translation differences on translation of foreign operations 6 36

======================================================================================= ========= =========

Total comprehensive income for the year attributable to owners of the Parent Company (3,082) 544

======================================================================================= ========= =========

Earnings per ordinary share (EPS)

Basic EPS (8.22)p 1.35p

Diluted EPS (8.22)p 1.33p

======================================================================================= ========= =========

All activities relate to continuing operations.

Consolidated Statement of Financial Position

as at 31 December 2019

2019 2018

GBP'000 GBP'000

Non-current assets

Goodwill 296 3,428

Intangible assets 3,568 4,018

Property, plant and equipment 2,906 3,086

Deferred tax asset 346 305

==================================== ========= =========

7,116 10,837

=================================== ========= =========

Current assets

Trade and other receivables 1,994 4,941

Tax receivable 136 104

Cash and cash equivalents 3,554 1,400

==================================== ========= =========

5,684 6,445

=================================== ========= =========

Total assets 12,800 17,282

==================================== ========= =========

Current liabilities

Short-term borrowings 78 113

Trade and other payables 1,697 2,906

==================================== ========= =========

1,775 3,019

=================================== ========= =========

Net current assets 3,909 3,426

==================================== ========= =========

Non-current liabilities

Long-term borrowings 776 819

Trade and other payables 421 565

Deferred tax liabilities 109 137

==================================== ========= =========

1,306 1,521

=================================== ========= =========

Total liabilities 3,081 4,540

==================================== ========= =========

Net assets 9,719 12,742

==================================== ========= =========

Share capital 94 94

Share premium 3,053 3,053

Merger reserve 2,407 2,407

Share-based payment (SBP) reserve 242 183

Currency translation reserve 31 25

Retained earnings 3,892 6,980

==================================== ========= =========

Total equity 9,719 12,742

==================================== ========= =========

The financial statements of Getech Group plc (company number:

02891368) were approved by the Board of Directors and authorised

for issue on 4 June 2020.

Andrew Darbyshire

Chief Financial Officer

Consolidated Statement of Changes in Equity

for the year ended 31 December 2019

Currency

Share Share Merger translation Retained

capital premium reserve SBP reserve reserve earnings Total equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

1 January 2018 94 3,053 2,407 164 (11) 6,472 12,179

Profit for the

year - - - - - 508 508

Other

comprehensive

income - - - - 36 - 36

=============== ============= ============= ============= ============ ============ ============= =============

Total

comprehensive

income - - - - 36 508 544

Transactions

with owners:

Share based

payment

charge - - - 19 - - 19

=============== ============= ============= ============= ============ ============ ============= =============

31 December

2018 94 3,053 2,407 183 25 6,980 12,742

=============== ============= ============= ============= ============ ============ ============= =============

Loss for the

year - - - - - (3,088) (3,088)

Other

comprehensive

income - - - - 6 - 6

=============== ============= ============= ============= ============ ============ ============= =============

Total

comprehensive

income - - - - 6 (3,088) (3,082)

Transactions

with owners:

Share based

payment

charge - - - 59 - - 59

=============== ============= ============= ============= ============ ============ ============= =============

31 December

2019 94 3,053 2,407 242 31 3,892 9,719

=============== ============= ============= ============= ============ ============ ============= =============

Consolidated Statement of Cash Flows

for the year ended 31 December 2019

2019 2018

GBP'000 GBP'000

Cash flows from operating activities

(Loss)/profit before tax (3,141) 225

Finance income (14) -

Finance costs 64 25

Depreciation charge 216 131

Amortisation of intangible assets 940 689

Impairment of goodwill 3,132 -

Impairment of intangible assets 621 -

Adjustment to direct cost accruals (946) -

Share-based payment charge 59 19

Foreign exchange adjustments 3 (16)

============================================================ ========= =========

Cash inflow from operating activities 934 1,073

Movements in working capital:

(Increase)/decrease in trade and other receivables 2,861 (2,820)

Increase/(decrease) in trade and other payables (336) 901

============================================================ ========= =========

Cash generated from operations 3,459 (846)

Tax (paid)/received 37 514

============================================================ ========= =========

Net cash inflow/(outflow) from operating activities 3,496 (332)

============================================================ ========= =========

Cash flows from investing activities

Purchase of property, plant and equipment (30) (78)

Purchase of intangible assets (5) -

Development costs capitalised (1,108) (861)

Capitalised cost of reports - (13)

Interest received 14 -

=========================================================== ========= =========

Net cash outflow from investing activities (1,129) (952)

============================================================ ========= =========

Cash flows from financing activities

Drawdown of loan - 950

Repayment of loan (78) (652)

Repayment of lease liabilities (71) (29)

Interest paid (64) (25)

============================================================ ========= =========

Net cash (outflow)/inflow from financing activities (213) 244

============================================================ ========= =========

(Decrease)/increase in net cash and cash equivalents 2,154 (1,040)

Cash and cash equivalents at the beginning of the year 1,400 2,393

Foreign exchange adjustments to cash and cash equivalents - 47

Cash and cash equivalents at the end of the year 3,554 1,400

============================================================ ========= =========

Notes to the Consolidated Financial Statements

for the year ended 31 December 2019

Basis of preparation

The financial statements set out in this preliminary

announcement do not constitute statutory accounts as defined by

section 434 of the Companies Act 2006. It has been prepared in

accordance with the recognition and measurement principles of

International Financial Reporting Standards (IFRS) adopted for use

in the European Union, including IFRIC interpretations issued by

the International Accounting Standards Board, and in accordance

with the AIM rules and is not therefore in full compliance with

IFRS. The principal accounting policies of the Group have remained

unchanged from those set out in the Group's 2018 annual report. The

financial statements have been prepared under the historical cost

convention and are presented in sterling.

Statutory accounts for the years ended 31 December 2019 and 31

December 2018 have been reported on by the Independent Auditor. The

Independent Auditor's Reports on the Annual Report and Financial

Statements for the periods ended 31 December 2019 and 31 December

2018 were unqualified, did not draw attention to any matters by way

of emphasis, and did not contain a statement under 498(2) or 498(3)

of the Companies Act 2006.

The statutory accounts for the year ended 31 December 2019 were

approved by the board on 4 June 2020 and the information included

in this preliminary announcement was extracted therefrom.

The Directors have performed regular reviews of trading and cash

flow forecasts and have considered the sensitivity of these

forecasts with regards to different assumptions about future income

and costs. Various scenarios have been run on the potential impact

of Covid-19. These include an assessment of the orderbook -

customer contractual commitments and Getech's ability to deliver

this work; the drivers of license renewals; and the modelling of

extreme and hypothetical 'zero new revenue' downside scenarios,

these extending across multiple years. Additional cost actions have

also been modelled, including a bottom up restructuring of the

Group's overhead, offices, technical staff and commercial

activities.

In addition to the sensitivity models of future income and

costs, we have made various assumptions to model cash flow

forecasts: It has been assumed that the UK Government Job Retention

Scheme will continue to be available until the end of September

2019 and that current social distancing measures, which impact our

ability to meet clients in person, will also be in place until the

end of September. We have also not relied on the availability of

additional sources of cash in our forecast assumptions.

These cash flow projections, when considered in conjunction with

Getech's existing cash balances, and the cost saving measures

implemented, demonstrate that the Group has sufficient working

capital for the foreseeable future. Consequently, the Directors are

fully satisfied that Getech is a going concern.

Earnings per share (EPS)

Basic EPS is calculated by dividing the profit attributable to

equity holders of the parent by the weighted average number of

ordinary shares outstanding during the year.

Diluted EPS is calculated by dividing the profit attributable to

equity holders of the parent by the weighted average number of

ordinary shares outstanding plus the weighted average number of

shares that would be issued on conversion of all the dilutive share

options into ordinary shares.

2019 2018

GBP'000 GBP'000

(Loss)/profit attributable to equity holders of the parent (3,088) 508

(Loss)/profit attributable to equity holders of the parent adjusted for dilution (3,088) 508

================================================================================== ========= =========

2019 2018

Thousands Thousands

Weighted average number of ordinary shares for basic EPS 37,564 37,564

Effects of dilution from share options 979 739

Weighted average number of ordinary shares adjusted for dilution 38,543 38,303

================================================================== =========== ===========

2019 2018

pence pence

Basic EPS (8.22) 1.35

Diluted EPS (8.22) 1.33

============= ======= =======

There have been no other transactions involving ordinary shares

or share options between the reporting date and the date of

authorisation of these financial statements.

Notice of Annual General Meeting

The Annual Report and Accounts, and notice convening the Annual

General Meeting of the Company will be posted to shareholders on 23

June 2020 and will be available from the Company's website

www.getech.com, from that date. The Annual General Meeting of

Getech Group plc will be held on 23 July 2020 at 12 noon.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR EAFKLEALEEAA

(END) Dow Jones Newswires

June 05, 2020 02:00 ET (06:00 GMT)

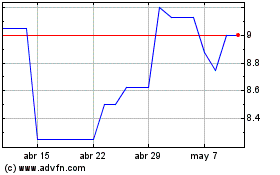

Getech (LSE:GTC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Getech (LSE:GTC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024