TIDMPHTM

RNS Number : 4587P

Photo-Me International PLC

10 June 2020

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

10 June 2020

Photo-Me International plc

("Photo-Me" or "the Group")

Trading Update

Photo-Me International plc (PHTM.L), the instant-service

equipment group, announces an update on the Group's trading for the

12 months ended 30 April 2020 and its cash position.

Trading Update

As previously announced, the COVID-19 pandemic has severely

impacted all the Group's end markets, and the majority of expected

Group revenue in March and April did not materialise. Trading has

also been weaker in Asia (especially China) since the second part

of January to date.

Consequently, the Group's overall trading performance for the

four months ended 30 April 2020 was significantly affected. Total

Group revenue is now expected to be 5.5% lower than in the previous

12 months to 30 April 2019. Profit before tax before deduction of

the provisions detailed below is expected to be approximately GBP28

million, compared with GBP42.6 million for the 12 months to 30

April 2019, with a similar reduction in operating cash flows.

The Board has acted (and continues to act) to mitigate the

impact of the current environment on the business and to preserve

cash. Steps taken to date include reducing capital expenditure;

utilising governmental support schemes available to the Group, such

as furloughing employees through job retention schemes, deferring

repayment of loans and withdrawal of the interim dividend payment

to shareholders. All members of the Board will take a voluntary 20%

reduction in salary, from 1 July 2020 to at least the end of

December 2020, and bonus payments for all management are being

reviewed.

Nevertheless, the Group has decided to include provisions of

GBP14 million to GBP18 million, which mainly relates to impairment

of goodwill and write down of the carrying value of non-profitable

machines due to the disruption caused by the unprecedented COVID-19

situation. This also includes a provision for the anticipated cost

of a major reorganisation of Photo-Me's UK business which has

experienced a significant loss in identification revenue, due to

reduced consumer activity. The Government's policy to accept photos

taken at home for passport identification, has taken a significant

part of Photo-Me's market share for ID photos. In response to this

and the challenging COVID-19 trading environment, the Group plans

to restructure its UK operations. The Group also plans to

restructure its operations in China and South Korea. In addition,

there are provisions for receivables from customer defection, and

installation of security tools in the photobooths.

Profit before tax for the 12 months ended 30 April 2020

(including the provision of GBP14 million to GBP18 million) is now

expected to be in the range of GBP10 million to GBP14 million.

Update on funding and liquidity

As at 30 April 2020, the Group had gross cash of GBP66.5

million, drawn debt facilities of GBP58.5 million (to be repaid by

April 2025), resulting in a net cash balance of GBP8 million.

Since the end of April 2020, the Group has obtained additional

debt funding to ensure that it has sufficient liquidity during this

uncertain period. A EUR30 million loan was secured with three

French banks participating under the French government-backed "PGE"

scheme. The Group has the right to make the loan repayment after

one and within five years without penalty.

The Group continues to comply with all its banking covenants

.

With this additional funding in place, the Board believes that

the Group has the financial resources to ensure it has sufficient

liquidity available and anticipates it will continue to operate

within its banking covenants, subject to a modest improvement in

trading conditions over the coming months.

Looking forward

As previously announced on 27 March 2020, the Board has

withdrawn current market guidance until more clarity is known

around the outlook of the business becomes clearer.

Since the period end, total Group revenue has remained at the

lower levels seen in March and April. The ongoing governmental

travel bans and restrictions on the movement of people continue to

reduce demand significantly for photo ID via photobooths as well as

the use of children's rides, which together account for

approximately 63% of Group revenue. The Board is reasonably

confident that as lockdown restrictions are eased, consumer demand

will return; however, it is likely it will take time to recover to

pre-COVID-19 levels. The Group continues to diversity its

operations through its Laundry and KIS Food business areas.

The Board continues to closely monitor the COVID-19 situation as

lockdown measures are eased and will review its options and take

further action where possible to restructure the business and align

operations to the current market conditions and consumer activity

levels.

As announced, the Board has extended the Group's current

financial year end to 31 October 2020. The Group intends to

announce an interim statement from 1 May 2019 to April 2020 on 7

July 2020.

ENQUIRIES

Photo-Me International plc +44 (0) 1372 453 399

Serge Crasnianski, CEO

Stéphane Gibon, CFO

Hudson Sandler +44 (0) 20 7796 4133

Wendy Baker/ Emily Dillon/ Nick Moore photo-me@hudsonsandler.com

NOTES TO EDITORS

Photo-Me International plc (LSE: PHTM) operates, sells and

services a wide range of instant-service vending equipment,

primarily aimed at the consumer market.

The Group operates vending units across 18 countries and its

technological innovation is focused on three principal areas:

-- Identification: photobooths and integrated biometric identification solutions

-- Laundry: unattended laundry services, launderettes, B2B services

-- Kiosks: high-quality digital printing

The Group entered the self-service fresh fruit juice equipment

market in April 2019, with the acquisition of Sempa. T his will

become a key business area ('KIS Food') alongside Identification,

Laundry and Kiosks, and will be a significant part of the Group's

future growth strategy.

In addition, the Group operates vending equipment such as

children's rides, amusement machines and business service

equipment.

Whilst the Group both sells and services this equipment, the

vast majority of units are operated and maintained by Photo-Me.

Photo-Me pays the site owner a commission based on turnover, which

varies depending on the country and location of the machine.

The Group has built long-term relationships with major site

owners and its equipment is generally sited in prime locations in

areas of high footfall such as supermarkets, shopping malls

(indoors and outdoors) and public transport venues. The equipment

is maintained and serviced by an established network of 700 field

engineers.

The Company's shares have been listed on the London Stock

Exchange since 1962.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTEAPKNEDSEEFA

(END) Dow Jones Newswires

June 10, 2020 02:00 ET (06:00 GMT)

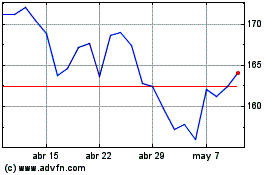

Me (LSE:MEGP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

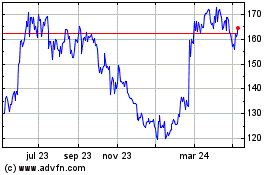

Me (LSE:MEGP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024