SNB Says Expansionary Policy Necessary As It Sees Worst Swiss Economic Contraction Since 1970s

18 Junio 2020 - 4:43AM

RTTF2

Switzerland's central bank kept its expansionary monetary policy

stance as it expects the economy to contract the most in over five

decades and inflation to remain more negative than forecast

earlier, this year due to the impact of the coronavirus, or

Covid-19, and the lockdown restrictions imposed to slow the

pandemic. The Swiss National Bank left the key interest rate

unchanged at -0.75 percent, in line with economists' expectations,

and said it remains willing to intervene more strongly in the

foreign exchange market due to the high valuation for the Swiss

franc. "The SNB's expansionary monetary policy remains necessary to

ensure appropriate monetary conditions in Switzerland," the central

bank said in a statement. The central bank has provided banks with

around CHF 10 billion in liquidity at the policy rate since the

launch of the Covid-19 refinancing facility.

SNB Governing Board Chairman Thomas Jordan said the bank's

expansionary policy has proved its worth and remains necessary. He

hoped that the worst phase of the Covid-19 pandemic is over, but

said a difficult phase of recovery lies ahead. Governor Jordan also

said that the SNB has made substantial interventions in the forex

market since its March policy session and these have helped to ease

the upward pressure on the Swiss franc somewhat. "We believe that

it will try to wait until the crisis passes and the uncertainty

dissipates with a broadly unchanged monetary policy," ING economist

Charlotte de Montepellier said. "For the time being, however, the

SNB believes that the current situation is manageable and will

therefore continue to rely on its usual instruments," the economist

added.

The bank cut its inflation forecast for this year to -0.7

percent from -0.3 percent seen in March, citing weaker growth

prospects and lower oil prices. The central bank said the economy

is set to shrink around 6 percent this year, which would be worst

decline since the oil crisis of 1970s. The SNB hopes that any

second wave of the coronavirus pandemic will be successfully

prevented globally. The Swiss economy is in a sharp recession and

the slump in economic output will be even more severe in the second

quarter, the SNB said. The recent signals suggest that the economic

activity again picked up somewhat since May, the bank said.

However, the bank sees only a partial recovery for now and said the

GDP will not return quickly to its pre-crisis level. The economic

revival seen for the second half of this year is likely to be

reflected in clearly positive growth in 2021, the bank said. Fritz

Zurbrugg, vice-chairman of the Governing Board, said the two

globally-focussed Swiss banks - Credit Suisse and UBS, are well

placed to deal with the challenges posed by the economic crisis

triggered by the coronavirus pandemic. He also said that the

domestically-focussed Swiss banks' resilience is adequate overall.

Andrea Maechler, a Governing Board member, said the financial

market situation and the currency market situation have improved

since March, but the uncertainty remains high.

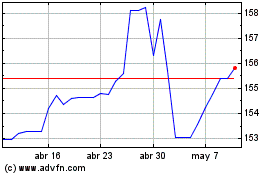

US Dollar vs Yen (FX:USDJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

US Dollar vs Yen (FX:USDJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024