Bank Of England Boosts QE; Holds Record Low Rate

18 Junio 2020 - 4:51AM

RTTF2

The Bank of England announced additional quantitative easing and

left its interest rate unchanged at a record low to combat the

sharp recession triggered by the coronavirus pandemic.

The Monetary Policy Committee, headed by BoE Governor Andrew

Bailey, decided to raise the size of the asset purchase programme

by GBP 100 billion to GBP 745 billion.

Eight members including Bailey voted to raise the QE as they

judged that a further easing of monetary policy is warranted to

meet its statutory objectives, while Chief Economist Andrew Haldane

preferred to maintain the programme at GBP 645 billion.

The MPC expects the programme to reach GBP 745 billion, around

the turn of the year.

The nine-member committee unanimously decided to hold the

interest rate at 0.10 percent, as widely expected. The bank had

altogether reduced the rate by 65 basis points at two unscheduled

meetings in March.

The need to continue supporting the economy will undoubtedly

fuel further discussion about whether negative rates are on the

horizon, ING economist James Smith said.

"We certainly wouldn't rule out negative rates further down the

line, particularly if the economic recovery does prove to be more

turbulent," the economist added.

Policymakers said they are ready to take further action as

required to support the economy and ensure a sustained return of

inflation to the 2 percent target. Inflation has fallen to 0.8

percent in April, triggering the explanatory letter from the BoE

Governor to the Chancellor alongside this monetary policy

announcement. Inflation then fell further to a four-year low of 0.5

percent in May.

The below-target inflation was largely driven by the effects of

the pandemic. Lower oil prices and the sharp drop in domestic

activity added downward pressure on inflation through increased

spare capacity.

Recent data suggested that the fall in the second quarter GDP

will be less severe than previously estimated, but cautioned about

a risk of higher and more persistent unemployment.

The economy and the labor market will take some time to recover

towards its previous path, the bank said. Inflation is projected to

fall further in coming quarter, reflecting weak demand.

The MPC noted that there are greater risks around the potential

for longer lasting damage to the economy from the pandemic.

The economy had contracted at a record pace of 20.4 percent in

April from March, as the pandemic hit all areas of the economy.

The Organisation for Economic Cooperation and Development, last

week, projected the UK economy to shrink sharply by 14 percent in

2020, if there is a second virus outbreak later in the year. An

equally likely single-hit scenario would still see GDP fall sharply

by 11.5 percent, the think tank said.

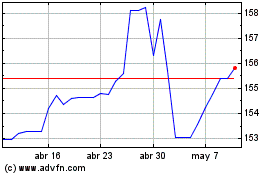

US Dollar vs Yen (FX:USDJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

US Dollar vs Yen (FX:USDJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024