TIDMPCTN

23 June 2020

PICTON PROPERTY INCOME LIMITED

("Picton", the "Company" or the "Group")

LEI: 213800RYE59K9CKR4497

Preliminary Annual Results

Picton announces its annual results for the year ending 31 March 2020.

Financial highlights

* Profit after tax of GBP22.5 million

* Net assets of GBP509 million, or 93p per share

* Total return of 4.5%

* Earnings per share of 4.1p

* Dividend cover of 105%

Strengthened balance sheet

* 14% reduction in total debt outstanding to GBP167.5 million

* Loan to value ratio reduced to 22%

* Raised GBP7 million of non-dilutive equity

* New GBP50 million revolving credit facility completed post year end

* Further tax savings as result of REIT regime

Outperforming property portfolio

* Total property return of 5.3%, outperforming MSCI UK Quarterly Property

Index of -0.5%

* Portfolio top quartile outperformance against MSCI over one, three, five

and ten years

* Like-for-like valuation increase of 1.4%

* Like-for-like rental income increase of 1.2%

* Like-for-like estimated rental value increase of 1.3%

* Occupancy at 89%

* 104 asset management transactions completed including:

* 20 rent reviews, 10% ahead of ERV

* 31 lease renewals or regears, 12% ahead of ERV

* 35 lettings or agreements to lease, 2% ahead of ERV

* Two asset disposals for GBP34.1 million, 15% ahead of March 2019 valuations

* GBP9 million invested into refurbishment projects

Responsible stewardship

* Embedded sustainability into corporate strategy, completing materiality

assessment review

* Improved portfolio EPC ratings

* Incorporated energy efficiency measures into building refurbishments

* Further developed occupier and employee engagement programmes

Balance Sheet 31 March 31 March 31 March

2020 2019 2018

Property valuation GBP665m GBP685m GBP684m

Net assets GBP509m GBP499m GBP487m

EPRA NAV per share 93p 93p 90p

Income Statement Year ended Year ended Year ended

31 March 31 March 31 March

2020 2019 2018

Profit after tax GBP22.5m GBP31.0m GBP64.2m

EPRA earnings GBP19.9m GBP22.9m GBP22.6m

Earnings per share 4.1p 5.7p 11.9p

EPRA earnings per share 3.7p 4.3p 4.2p

Total return 4.5% 6.5% 14.9%

Total shareholder return 3.6% 10.1% 4.8%

Total dividend per share 3.5p 3.5p 3.4p

Dividend cover 105% 122% 122%

Post year end and Covid-19 update

91% of March 2020 rent has been collected or is subject to agreed payment

plans, with less than 1% currently subject to write off. We are continuing to

work with our occupiers to find appropriate solutions for the balance

outstanding as the lockdown starts to ease.

Post year end, we have concluded two new lettings in line with the March 2020

ERV; four lease extensions 13% above the March 2020 ERV; and two rent reviews

22% above the March 2020 ERV. Together these transactions add GBP0.3 million to

the annualised rent roll.

In terms of pipeline, a further six lettings (including four relocations), for

a combined annual rent of GBP0.5 million, and seven lease extensions, for a

combined annual rent of GBP1 million, are agreed in principle and subject to

legal documentation.

Picton Chairman, Nicholas Thompson, commented:

"Despite the challenges posed by Brexit and latterly the Covid-19 pandemic,

these are another solid set of results from Picton, showing an increase in net

asset value and upper quartile performance against the MSCI UK Quarterly

Property Index. As well as managing the portfolio, we have also focused this

year on sustainability, embedding this into our corporate strategy. Looking

ahead, we believe the business and the portfolio is well-positioned with low

gearing, a covered dividend and access to GBP50 million through our new revolving

credit facility."

Michael Morris, Chief Executive of Picton, commented:

"This year we have invested into the portfolio, upgrading assets and have

either completed or are well progressed on several important asset management

projects that will enable us to improve occupancy and rental income across the

portfolio. As lockdown restrictions are eased and the investment market reopens

we will also be focused on future opportunities. In the meantime, we will

continue to work in a collaborative way with our occupiers to best manage

current market conditions."

This announcement contains inside information.

For further information:

Tavistock

Jeremy Carey/James Verstringhe, 020 7920 3150,

james.verstringhe@tavistock.co.uk

Picton

Michael Morris, 020 7011 9980, michael.morris@picton.co.uk

Note to Editors

Picton, established in 2005, is a UK REIT. It owns and actively manages a GBP665

million diversified UK commercial property portfolio, invested across 47 assets

and with around 350 occupiers (as at 31 March 2020). Through an occupier

focused, opportunity led approach to asset management, Picton aims to be one of

the consistently best performing diversified UK focused property companies

listed on the main market of the London Stock Exchange.

For more information please visit: www.picton.co.uk

Chairman's Statement

I am pleased to report another successful year, delivering a profit after tax

of GBP23 million, despite the uncertain political and economic backdrop created

by Brexit and the effects of the Covid-19 pandemic.

Further to the actions taken last year, we are in a strong position with low

gearing of 22%, a healthy balance sheet and over 80% of the portfolio invested

in the industrial and office sectors which have been less impacted by the

lockdown.

Throughout the year we have been operating in a UK property market

characterised by fewer investment transactions and an occupational market where

activity has slowed. Many companies were already in 'wait and see' mode

awaiting an outcome on Brexit, and have now moved into temporary lockdown as a

result of Covid-19, although Government support has helped mitigate a very

difficult situation.

Covid-19 impact and response

The defensive positioning of the Company over the last 12 months has meant that

we are in a relatively strong position and able to withstand the unprecedented

shock of the Covid-19 pandemic. We have the lowest loan to value ratio since

the inception of the business, as well as fully undrawn loan facilities

totalling GBP50 million.

Our short-term targets are focused around reducing the impact on our business

and working with our occupiers to get through this difficult situation. We

recognise both the short and longer-term effects on the business and the

importance of adapting our strategy to reflect the changing habits and needs of

our occupiers. We have achieved good rent collection figures compared to the

market and have been working with occupiers as required to help them through

this crisis. Recognising the two components of property returns are not only

income but capital performance, we believe this is also the best approach to

achieving long-term value for shareholders.

As the lockdown starts to gradually ease, our attention is turning to the

reoccupation of our buildings, the restarting of refurbishment projects and

leasing space, ensuring all of these activities are managed safely.

Performance

The property portfolio has again delivered upper quartile performance against

the MSCI UK Quarterly Property Index over the year. Likewise, our shareholder

total return for the period was in the upper quartile range compared to our

peers.

Our total return was 4.5% over the year. Whilst this is relatively modest for

Picton, it compares favourably to the negative market return, as measured by

MSCI.

EPRA earnings were lower for the year, which is in part a reflection of the

operating environment that has hindered progress with our pipeline of lettings

and refurbishments. Equally, debt reduction through asset sales to protect the

longer-term income profile has also had a short-term impact on earnings.

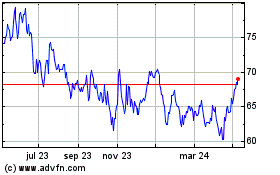

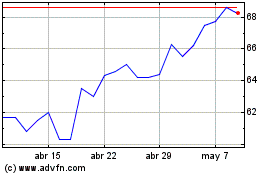

We are cognisant of the discount to net asset value that has emerged since the

year end and believe that there is a clear disconnect between the performance

of the Group and the share price. A focus of the Board will be to ensure that

we reduce this discount over the coming year.

Purpose and strategy

During the year, the Board has reviewed the purpose and strategy of the Group

to ensure Picton, as a UK REIT, continues to deliver attractive income and

capital returns to its shareholders over the long-term. As a result we have

redefined our purpose as:

"Through our occupier focused, opportunity led approach, we aim to be one of

the consistently best performing diversified UK REITs. To us this means being a

responsible owner of commercial real estate, helping our occupiers succeed and

being valued by all our stakeholders."

We have in place three distinct strategic pillars: Portfolio Performance,

Operational Excellence and Acting Responsibly. These will ensure we are able to

deliver on our purpose.

I think it is also important to highlight the progress we have been making on

sustainability and we have this year formally embedded this into our corporate

strategy.

Property portfolio

The outperformance of our property portfolio was driven by several factors. It

is well positioned with over 80% in the better performing industrial and office

sectors. The best performing subsector according to MSCI was South East

industrial, which is where over 35% of our portfolio is invested.

Key themes during the year were reinvestment into the portfolio and upgrading

of assets. This activity has delivered letting successes and retained occupiers

across the portfolio. We have achieved considerable success working with

existing occupiers to extend income. During the year we saw a significant

number of transactions aimed at mitigating income risk due to materialise in

2020/21. This included income with four of our largest occupiers.

We made two disposals at a healthy premium to the March 2019 valuation, which

enabled us to capture upside that had been created through asset management.

There were no acquisitions during the year.

While we have grown like-for-like passing rent over the period, we would have

liked to make further progress and have two key voids to fill: one in Rugby,

where the refurbishment completed in February, and another at Stanford Building

in Covent Garden, where the refurbishment has been delayed due to Government

lockdown restrictions. These, along with other vacancies, provide scope for us

to increase occupancy and income going forwards.

Capital structure

Our strategic approach in recent years has meant that we have entered the

Covid-19 crisis in a position of strength.

We further reduced our loan to value ratio over the course of the year through

a combination of asset sales, debt repayment and a small non-dilutive equity

raise last June.

Since the year end, we have completed a new single revolving credit facility

for an initial three-year term, replacing two existing facilities that were due

to expire in 2021. This gives the Company access to up to GBP50 million of

undrawn facilities, providing us with a lower cost of debt and even greater

headroom and flexibility.

Dividends

We are acutely aware that the provision of income is important to investors, so

our recent decision to reduce the dividend, even if temporary, was not taken

lightly. While Picton is in a much better place than most of its peers, we are

not immune to the impact that Covid-19 is having on our occupiers.

The additional flexibility that this extra headroom provides will enable us to

support our occupiers where appropriate, and will help us to protect as far as

possible both income and capital over the longer-term. This was a prudent

decision taken in the long-term interest of all our stakeholders.

Governance and Board composition

I had expected to write this report as Chairman for the last time as I was due

to retire from the Board in June of this year. Covid-19 has created all sorts

of unforeseen circumstances and my proposed successor, Nicholas Wiles, has had

to step down from the Board following his recent and unexpected appointment as

Chief Executive at PayPoint Plc, having previously been Chairman. We have

recommenced the process to find a suitable successor, but it is vitally

important in these times that continuity is provided, so at the request of the

Board I have agreed and confirmed my commitment to remain in position until a

new Chair is in place.

We have also started the process to appoint a successor for Roger Lewis,

currently Chair of the Property Valuation Committee, and we hope to be able to

make a further announcement in that regard shortly.

Outlook

Whilst our focus remains very much around short-term issues and mitigating the

impact of Covid-19, we recognise that we must also be thinking strategically

about the changing long-term trends and demand for commercial property. We

think these recent events have accelerated embedded trends in several areas,

including online retail, flexible working, digital and technological disruption

to name but a few. In addition, a growing sense of environmental impact and the

need for change has been self-evident in lockdown. We had already been

considering disruptive trends and whilst we believe the portfolio is well

positioned, this situation is evolving and continues to be kept under constant

review. I believe our purpose, strategy and business model ensure we are well

placed to respond to both the challenges and opportunities that lie ahead.

Nicholas Thompson

Chairman

Our Marketplace

Economic backdrop

For much of the year Brexit weighed heavily on the UK economy.

The lack of clarity surrounding the nature and timing of the UK's exit from the

European Union was responsible for widespread political and economic

uncertainty. Weaker productivity growth came as a result of reduced business

investment and the redirection of resources to prepare for possible Brexit

outcomes.

Despite Brexit, economic indicators remained reasonably robust. In 2019 Gross

Domestic Product (GDP) grew by 1.4%. To put this into an international context,

the G7 Major Advanced Economies had an average GDP growth of 1.6% per annum for

the group, with the UK in third place behind the USA and Canada.

For the three months leading up to March 2020, the UK's unemployment rate was

at a near record low of 3.9%, and annual growth in average weekly earnings was

2.4%. In real terms, annual pay growth has been positive since February 2018.

The 12-month Consumer Price Index (CPI) was 1.3% in December 2019, rising to

1.5% in March 2020.

Today, the Covid-19 global pandemic has changed priorities and the economic

outlook dramatically. Despite the UK easing the lockdown, social distancing

will change habits for some months to come, and uncertainty and volatility will

continue to impact the economy with potentially long-lasting consequences.

Recent data shows the dramatic impact the lockdown is having on the UK economy,

with GDP recording its weakest ever monthly decline at -20.4% in April.

Although the UK will be in recession in the second quarter of 2020 as the

lockdown eases, the magnitude of the economic impact and speed of recovery are

not easily gauged. The Office for Budget Responsibility has forecast an annual

decline of 12.8% for 2020, with unemployment rising from 4.0% to 7.3% in the

final three months of the year.

In response to the pandemic, the Bank of England dropped the bank rate twice in

March, from 0.75% to 0.25% and then again to 0.1%. The extent to which these

low interest rates can support consumer spending and jobs in the coming months

is yet to be determined.

UK property market

According to the MSCI UK Quarterly Property Index, commercial property

delivered a total return of -0.5% for the year ended March 2020. The negative

total return is attributable to the downturn experienced in the final quarter

ending March 2020. Until then, quarterly total returns were positive.

The reduction relative to last year was driven by capital value falls of -4.8%

and an income return of 4.5%. Capital growth was negative quarter-on-quarter

but worsened considerably in the three months to March 2020. By comparison, for

the year to March 2019, capital growth was 0.1% and the income return was 4.4%.

Industrial was the top performing sector for the year to March 2020, showing

good signs of rental and capital growth. The industrial sector 12-month total

return was 5.7%, comprising 1.3% capital growth and 4.3% income return.

Industrial ERV growth for the period was 2.7%, with a range of 1.7% to 4.2%

within subsectors. Capital growth ranged from -0.5% to 4.2% within subsectors.

Equivalent yields for industrial property now stand at 5.3%.

The office sector produced a total return of 3.3% for the year to March 2020,

comprising -0.5% capital growth and 3.8% income return. Whilst capital values

showed a decline in the final quarter, for the nine months to December 2019

MSCI capital growth for All Offices was 0.4%. For the year to March 2020,

central London and the South East office markets were the only subsectors to

produce positive capital growth. All Office annual rental growth was 1.4%,

ranging from 0.5% to 2.3% within subsectors. The range of capital growth by

subsector was from -3.2% to 1.8%. Equivalent yields for office property now

stand at 5.6%.

It was a very difficult year for the retail sector, with challenging trading

conditions leading to a high number of retail failures. The situation has been

significantly impacted by the Covid-19 lockdown starting in March 2020. The

retail sector produced a total return of -9.8% for the year to March 2020. This

comprised capital growth of -14.5% and income return of 5.4%. Rental values

fell -5.7% over the period and were negative across all subsectors, ranging

from -8.2% to -1.7%. Retail subsector capital growth ranged from -22.6% to

-1.0%. Equivalent yields for retail property now stand at 6.4%.

The impact of the Covid-19 pandemic is not fully reflected in the above

numbers. The MSCI UK Monthly Property Index showed for the two-month April -

May 2020 period, that overall capital values for All Property have declined

-2.9% and ERVs are down -0.6%.

For the same period, capital values in the industrial sector saw a decline of

-1.6% and ERVs grew by 0.1%. In the office sector capital values declined -2.1%

and ERVs -0.1%. The retail sector is the worst affected with capital values

showing a decline of -5.0% and ERVs down -2.0%.

According to Property Data, the total investment volume for the year to March

2020 was GBP56.5 billion, an 8.3% decrease from the year to March 2019. The

volume of investment by overseas investors in the year to March 2020 was GBP30.5

billion, accounting for 53.9% of all transactions. Illustrating the liquidity

issues within the retail sector, it had investment transactions of just GBP5.0

billion, accounting for only 8.9% of all transactions.

During the Covid-19 lockdown it has been extremely difficult to buy or sell

property and the impact on investment volumes and pricing is yet to be fully

realised. Despite lowering investment returns available elsewhere, the risk

premium attached to property looks set to increase, reflecting greater income

risk in the short-term.

Chief Executive's Review

Alongside running the business in these extraordinary market conditions, this

year we have also focused on reviewing our strategy to ensure it reflects

emerging trends.

The three key pillars of our strategy are Portfolio Performance, Operational

Excellence and Acting Responsibly. These do not dramatically change the

direction of the business, but better define our areas of focus through the

more detailed priorities and ensure we are best placed to deliver on our

purpose.

The impact of Covid-19 has in the short-term led to an almost complete shutdown

in both the commercial leasing and investment markets. This makes it harder

than usual for valuers to provide a valuation or estimates of market price when

there is no market itself.

This uncertainty has led to the suspension of open-ended property funds, and

significant volatility within listed property company shares. There is

currently a clear arbitrage between pricing listed and unlisted property

vehicles. We think there will be renewed selling pressure from these open-ended

structures when they reopen, which may in itself create opportunistic buying

opportunities for those that are well capitalised.

Looking back, the primary concern last year was about the impact of Brexit on

trade and occupational demand. The uncertainty created by the political process

led many companies to delay occupancy decisions and whilst these risks have not

yet gone away, in January we were starting to see positive signals and an

increase in occupational and investment demand following the General Election

result and the certainty that provided.

Last year we made no acquisitions and where we made disposals we used the

proceeds to repay debt and reduce our gearing. We are well positioned, with a

high exposure to industrial, warehouse and logistics, alongside the regional

office market. It is likely, however, that any prolonged lockdown will change

habits and occupational requirements. As the impact becomes clearer we will

have to ensure our portfolio approach remains relevant to maintain our track

record of outperformance.

Covid-19 response

We continue to operate effectively and all of our employees have been working

remotely since mid-March. We have not needed to furlough any members of our

team or access any form of Government support. The health and safety of our

employees, our occupiers and service providers is paramount and our actions to

date have been effective in ensuring this. This shutdown has affected our

occupiers to varying degrees, but it is encouraging to see buildings being

re-occupied, albeit in line with social distancing measures, and we are working

to establish proper protocols as the lockdown is gradually eased. Central

London, with its reliance on public transport, would appear less ready to

return to work than other parts of the UK, but a safe and steady approach is

sensible under the circumstances and this matches the feedback we are receiving

from our occupiers.

Whilst the March rent collection number stands at 82%, which is lower than last

year, we recognise that there will be a short-term impact as a result of the

lockdown. We think it is appropriate to look at individual circumstances and be

creative to protect value and also provide support to occupiers as required. We

do however have to strike the right balance between occupier and shareholder,

recognising these are difficult circumstances for all. We are fortunate to have

already established good relationships with our occupiers well ahead of this

crisis, so we have a good understanding of their business needs. We will look

at circumstances on a case-by-case basis and prioritise needs across the

portfolio. Equally, we need to find creative solutions to this problem and by

offering short-term cash flow assistance we may well be able to protect or

enhance capital values, by virtue of longer lease commitments, stepped rents or

agreeing future rent increases. The recently announced dividend reduction will

enable us to deliver the best outcomes in this regard.

Portfolio Performance

We have again continued to outperform the MSCI UK Quarterly Property Index. Our

track record now means we have outperformed that Index since inception and over

the last one, three, five and ten years. Recognising the diversified nature of

the portfolio, where there will always be outperforming and underperforming

elements, our positioning against the retail and leisure sector in favour of

industrial and regional offices has been advantageous for some time.

We have made significant progress in enhancing our assets this year. Our

refurbishment programme totalled GBP9 million, which is a substantial increase on

preceding years. We have also had considerable success working with our

occupiers, enabling them to have space that meets their needs. We have

undertaken some key transactions, extending income, de-risking our cash flow,

and these are detailed in the subsequent case studies. Although we have grown

the passing rent on a like-for-like basis, the strategy to keep gearing low

does have an impact on overall income, and with debt costs generally lower than

property yields, there is still a trade-off between capital and income returns.

It has been frustrating that we have not grown occupancy over the year, which

currently stands at 89%. Ultimately these vacancies provide a significant

element of the future income upside potential.

Against a difficult backdrop, the leasing markets have not been easy and a

number of refurbishment projects took longer to complete and consequently

delayed letting prospects. We also sold income producing assets to de-risk the

balance sheet which has had a negative impact on income and occupancy, but

equally have protected our capital position and crystallised gains.

Operational Excellence

We have undertaken and implemented several measures aimed at increasing the

efficiency within the business. During the year we introduced an asset

management system, Coyote, to better manage our assets, as well as a new IT

system. Both systems are working well as we continue to work remotely.

We have recruited a Head of Occupier Services to strengthen our property

management service delivery, a further commitment to our occupier focused

approach. We continue to have an agile and flexible business and the speed with

which we were able to adapt to remote working is testament to this.

From an income perspective our EPRA earnings are lower, reflecting activity

referred to in the Portfolio Performance section above. We have reduced our

gearing over the year, concerned about risks associated with Brexit, but this

has proved timely recognising the adverse impact of Covid-19.

Our net asset growth has been more muted than in previous years, but this is

not unexpected recognising market conditions. We believe our assets, our team

and our strategy will continue to drive our success. Growth, be that organic or

through acquisition, will be considered so long as it creates value for

shareholders.

Acting Responsibly

We have made significant progress strengthening relationships with occupiers

this year and this is borne out by the portfolio activity and projects we have

undertaken.

The work we have done this year to promote and deliver our Picton Promise -

focused on Action, Community, Technology, Support and Sustainability - has many

overlapping features and we believe our occupiers, and indeed future occupiers,

will want to work and engage with a landlord that shares similar values on not

only reducing emissions but a broader array of sustainability issues.

We provide regular shareholder updates and through Edison provide regular

updates and video interviews. Through our brokers JP Morgan, Stifel and

specifically in the regional wealth management community with Kepler, we have

regular engagement with both existing and prospective shareholders.

Whilst sustainability has been a focus of ours for many years, the introduction

of a Responsibility Committee in 2018 further integrated this within our

business model and sustainability now forms part of our corporate strategy. We

have engaged with occupiers and investors this year to review and better

understand material issues in order to progress our sustainability initiatives.

We were awarded EPRA Gold for our separate Sustainability Report last year and

we are part of GRESB.

We have maintained our company values, positive working culture and alignment

of the team throughout the year. We specifically undertook an employee survey

last year and the results of this were fed back to the Board via our

Non-Executive Director responsible for employee engagement.

Outlook

Recognising our newly defined purpose and that property returns are driven by

both income and capital, our focus is currently two-fold. In the short-term we

need to work through lockdown and help our occupiers get their businesses back

up and running. Workplace protocols, lease restructurings and financial

assistance are all aspects that will protect value for shareholders.

We are also focused on the future and how this short-term disruption may well

change future occupational requirements and consequently create opportunities.

We need to own assets where there is continued occupational demand, enabling a

growing income profile, and in turn capital appreciation.

There is significant embedded upside in the portfolio income profile from the

current occupancy level. Once markets reopen, finding occupiers for this vacant

space is an absolute priority.

Our strategy, which offers a diverse approach and allows us the flexibility to

adjust the portfolio to better performing sectors, ensures we are not

constrained to a single sector strategy, with limited ways to exit, as has been

the case for some of the REIT specialists in recent years. We continue to

manage the business through these events so we come out the other side in a

strong position. We will continue to provide updates as we make progress this

year.

Picton has low leverage and significant operational headroom against covenants.

The majority of the portfolio is invested in sectors that have been less

impacted through Covid-19, and likely to rebound more quickly. It is clear that

the digital transformation will continue apace, be that increased home working

or further spend online and our portfolio will need to continue to adapt to

these changes.

Our focus is to control what we can, manage risks and focus on future

opportunities.

Michael Morris

Chief Executive

Portfolio Review

Sector weightings

Industrial weighting 47.9%

South East 35.4%

Rest of UK 12.5%

Office weighting 33.8%

South East 17.4%

Rest of UK 12.2%

City & West End 4.2%

Retail and Leisure weighting 18.3%

Retail Warehouse 7.3%

High Street South East 5.2%

High Street Rest of UK 4.1%

Leisure 1.7%

We have had a number of considerable successes across the portfolio despite it

being such a difficult year in which to operate. We ended the year with a

like-for-like increase in the portfolio valuation, rental income and Estimated

Rental Value (ERV). We have had one of the busiest years in terms of portfolio

transactions, up 30% on the previous year.

We have invested heavily back into the portfolio enhancing the quality and

lettability of space, and we have been able to de-risk and extend our income

profile. We have further strengthened our relationships with occupiers and our

focus on our key commitments of Action, Community, Technology, Support and

Sustainability, appears increasingly helpful in light of the Covid-19 impact.

Performance

Our portfolio now comprises 47 assets, with around 350 occupiers, and is valued

at GBP664.6 million with a net initial yield of 4.9% and reversionary yield of

6.4%. Our asset allocation, with 48% in industrial, 34% in office and 18% in

retail and leisure, combined with investment disposals and transactional

activity, has enabled us again to outperform the MSCI UK Quarterly Property

Index on a total return basis over one, three, five and ten years.

Overall the like-for-like valuation was up 1.4%, with the industrial sector up

6%, offices delivering growth of 3% and retail and leisure declining -12%. This

compares with the MSCI index recording capital declines of -4.8% over the

period.

The industrial assets continue to perform better than the other sectors,

primarily due to our allocation to South East multi-let estates which account

for over 73% of our industrial exposure. In addition we have extended income

with three of our largest occupiers at three of our distribution warehouses.

Conversely, and despite active management to mitigate downside risk, our retail

assets have delivered negative returns. Pleasingly, rental transactions have

been generally very close to or higher than independent ERVs rather than

significantly below, which we understand is happening elsewhere in the market.

The overall passing rent is GBP36.2 million, an increase from the prior year of

1.2% on a like-for-like basis. This was a result of the industrial portfolio

rents growing by 6%, offset by the office and retail rents decreasing by 2% and

3% respectively. The regional offices saw growth of 1%, which was offset by

declines in London and in particular at Angel Gate, Islington which is being

adversely affected by the serviced office sector. We are countering the effect

by offering fully fitted suites and flexible leasing terms.

The March 2020 ERV of the portfolio is GBP45.2 million, with the positive growth

in the industrial sector of 4.4% and office sector of 3.5% offset by the

negative growth in the retail sector of -8.0%. We have set out the principal

activity in each of the sectors in which we are invested and believe our

strategy and proactive occupier engagement will continue to assist us in

managing the portfolio during the current business climate.

The industrial and regional office occupational markets have remained

resilient. Conversely, retail demand has not improved, and we expect it to

worsen over the next year, particularly recognising the additional impact

Covid-19 will have on occupational demand.

Activity

We have had an exceptionally good year in respect of active management

transactions. We completed 20 rent reviews, 10% ahead of ERV, 31 lease renewals

or regears, 12% ahead of ERV and 35 lettings or agreements to lease, 2% ahead

of ERV.

Two assets were sold for gross proceeds of GBP34.1 million, 15% ahead of the

March 2019 valuation. Citylink, Croydon was sold following the early surrender

of two leases, generating GBP0.6 million of additional income. The property was

sold for GBP18.2 million reflecting a net initial yield of 4.8%.

We also sold 3220 Magna Park, Lutterworth following active management where we

extended the lease by a further three years to December 2022 and settled a 2019

rent review securing an 11% uplift to GBP1 million per annum, achieving one of

the highest rents at the Park. The property was sold for GBP15.9 million

reflecting a net initial yield of 5.8%.

Both sales crystallise the upside from the active management activity and,

noting the age of the buildings and oversupply in these locations, avoid

potential future capital expenditure and extended void periods.

Over the year we have invested GBP9 million into the portfolio across 20 separate

projects. These have all been aimed at enhancing space to attract occupiers and

grow income. Whilst a number of key projects are still to be completed, we are

now well placed to attract occupiers and our refurbishment pipeline is

substantially reduced, having completed the majority of the projects.

Our largest void is Stanford Building on Long Acre in Covent Garden, accounting

for over a third of the total vacancy rate. Work on site paused due to the

lockdown and will now complete in the summer. The building will provide

best-in-class retail, office and residential accommodation.

This investment across the portfolio has enabled us to create high quality

space and help to future- proof assets from a sustainability perspective. We

have also worked with occupiers to achieve their occupational aims and thereby

create value through additional leasing or extending income.

Although no acquisitions were made, the net effect of the above is that the

average lot size of the portfolio was GBP14.1 million, in line with last year.

Outlook

If activity for most of the year was tempered by Brexit, towards the end of the

year it has been impacted by the Covid-19 pandemic and consequential lockdown

on 23 March 2020. This has led to a far more uncertain business environment and

our focus has been on delivering our Picton Promise, focusing particularly on

our commitments of Action, Community and Support to help our occupiers who need

assistance.

New requirements from potential occupiers have slowed and social distancing

measures make viewings difficult to conduct. We are, however, embracing new

technologies, creating virtual tours and thinking more laterally as to how we

can market our buildings.

Our focus remains on working with our occupiers during this period of business

uncertainty, whilst continuing to proactively manage the existing portfolio. At

31 March the portfolio has GBP9 million of reversionary upside, GBP5 million from

letting the void, GBP3 million from expiring rent free and GBP1 million from

reversionary leases.

We are seeing better demand for our industrial properties, which account for

48% of the total portfolio by value, and we believe this sector will continue

to outperform.

Businesses continue to seek best- in-class space in the office sector, hence

our investment over the year into nine buildings, and this, combined with our

flexible offering, makes our properties attractive to current and new

occupiers.

The retail and leisure sector will need to evolve, especially following the

current lockdown, but with this sector only making up 18% of our portfolio, we

will work with occupiers to ensure we can assist them where appropriate to

maintain income.

The work done over the year to lease space and extend income, together with our

portfolio weightings, has put us in a strong position to weather this storm. In

line with our occupier focused, opportunity led approach, we continue to

proactively engage with our occupiers, which we believe assists occupier

retention and adds value.

Top ten assets

The largest assets as at 31 March 2020, ranked by capital value, represent 54%

of the total portfolio valuation and are detailed below.

Assets Acquisition Property Tenure Approximate No. of Occupancy

date type area (sq occupiers rate (%)

ft)

Parkbury Industrial Estate, 03/2014 Industrial Freehold 336,700 21 100

Radlett, Herts.

River Way Industrial Estate, 12/2006 Industrial Freehold 454,800 10 98

Harlow, Essex

Angel Gate, City Road, London EC1 10/2005 Office Freehold 64,500 22 74

Stanford Building, Long Acre, 05/2010 Retail Freehold 19,700 0 0

London WC2

Tower Wharf, Cheese Lane, Bristol 08/2017 Office Freehold 70,800 5 83

50 Farringdon Road, London EC1 10/2005 Office Leasehold 31,000 5 100

Shipton Way, Rushden, Northants. 07/2014 Industrial Leasehold 312,900 1 100

Datapoint, Cody Road, London E16 05/2010 Industrial Leasehold 55,500 5 88

Lyon Business Park, Barking, 09/2013 Industrial Freehold 99,400 9 100

Essex

Colchester Business Park, 10/2005 Office Leasehold 150,700 22 99

Colchester

Top ten occupiers

The largest occupiers, based as a percentage of contracted rent, as at 31 March

2020, are as follows:

Occupier Contracted %

rent

(GBPm)

Public sector 1.7 4.3

Belkin Limited 1.7 4.2

B&Q Plc 1.2 3.1

The Random House Group Limited 1.2 3.0

Snorkel Europe Limited 1.1 2.8

XMA Limited 1.0 2.4

Portal Chatham LLP 0.8 2.0

TK Maxx 0.7 1.8

Canterbury Christ Church University 0.7 1.7

DHL Supply Chain Limited 0.6 1.5

Total 10.7 26.8

Longevity of income

As at 31 March 2020, expressed as a percentage of contracted rent, the average

length of the leases to the first termination was increased to 5.5 years (2019:

5.1 years). This is summarised as follows:

%

0 to 1 year 8.8

1 to 2 years 14.1

2 to 3 years 11.0

3 to 4 years 12.6

4 to 5 years 12.3

5 to 10 years 31.6

10 to 15 years 8.2

15 to 25 years 0.1

25 years and over 1.3

Total 100.0

Retention rates and occupancy

Over the year, total ERV at risk due to lease expiries or break options

totalled GBP6.6 million, compared to GBP6.9 million for the year to March 2019.

Excluding asset disposals, we retained 53% of total ERV at risk in the year to

March 2020. This comprised 32% on lease expiries and 21% on break options.

In addition to units at risk due to lease expiries or break options during the

year, a further GBP5.5 million of ERV was retained by either removing future

breaks or extending future lease expiries ahead of the lease event.

Occupancy has reduced slightly during the year, primarily reflecting the timing

of lease events, ongoing challenges in the retail sector and some specific

asset management surrenders we have initiated. At the year end 62% of our

vacant buildings were being refurbished, so only 38% were available to lease

immediately.

Occupancy has decreased from 90% to 89%, which is behind the MSCI IRIS

Benchmark of 93% at March 2020. On a look-through basis we have 57% of our

total void in offices, 28% in retail, primarily at a flagship store in Covent

Garden, and only 15% of our void is in industrial, reflecting the stronger

occupational market.

Industrial

Key metrics

2020 2019

Value GBP318.3m GBP312.8m

Internal area 2.6m sq ft 2.7m sq ft

Annual rental income GBP16.0m GBP16.0m

Estimated rental value GBP18.6m GBP18.7m

Occupancy 96% 98%

Number of assets 16 17

The industrial portfolio, which accounts for 48% of the portfolio, again

delivered the strongest sector performance of the year. This was the result of

active management extending income on our distribution assets, combined with

continued occupational demand for the smaller units, resulting in further

rental growth, especially in London and the South East.

Through asset management activity we have been able to capture rental growth

and extend income. This, combined with continued strength in the investment

market, has resulted in another strong year for this element of the portfolio.

On a like-for-like basis, our industrial portfolio value increased by GBP18.1

million or 6.0% to GBP318.3 million, and the annual rental income increased by GBP

0.9 million or 6.0% to GBP16.0 million. The portfolio has an average weighted

lease length of 5.1 years and GBP2.6 million of reversionary potential.

We have seen rental growth of 4.4% across the portfolio and are experiencing

demand across all of our estates. Occupancy is 96%, with the key void being our

unit in Rugby which has recently been refurbished. In respect of the multi-let

estates we only have three vacant units out of 127, one of which is under

offer.

We extended income on three of our distribution units, one of which we

subsequently sold, and we completed the refurbishment of our unit in Rugby,

which is now being marketed.

Portfolio activity

At Shipton Way, Rushden, in what would have been our largest single income risk

in 2020, we extended a lease with the existing occupier, Belkin, to facilitate

a pre-letting of the entire building to Whistl UK Limited. Whistl will take a

new ten-year lease, subject to break in 2025, at an annual rent of GBP1.6

million, in line with ERV, and become our largest single occupier from October

2020, when Belkin vacates.

At Parkbury, Radlett, we extended a lease with the largest occupier on the

estate which was due to expire in November 2020. This secures a new ten-year

reversionary lease, subject to break in 2025, with stepped rental increases to

GBP1.0 million per annum, 42% ahead of ERV. In addition, we let four units for a

combined GBP0.4 million per annum, 8% ahead of ERV, renewed one lease for GBP0.2

million per annum, 5% ahead of ERV, and settled four rent reviews achieving a GBP

0.3 million uplift in rent to GBP1 million per annum, 19% ahead of ERV.

At Trent Road, Grantham, we extended the lease that was due to expire in 2023

until 2029, subject to break in 2026, at GBP1.2 million per annum, in line with

ERV.

At 3220 Magna Park in Lutterworth, we restructured the lease and secured a

further three years term certain until an occupier break option in December

2022. As part of the same transaction, the December 2019 rent review was

settled, securing an 11% uplift to GBP1 million per annum, 6% ahead of ERV,

achieving one of the highest rents at the Park. The unit was subsequently sold

for GBP15.9 million.

At Datapoint in London E16, following the completion of a rent review, we

achieved a 98% uplift in rent to GBP0.1 million per annum, 15% ahead of ERV. Two

leases were surrendered on the estate, securing a premium of GBP0.2 million, and

were subsequently refurbished by March.

One has been let, two weeks after completion, for a minimum term of ten years

at a rent of GBP0.2 million per annum, 24% ahead of ERV and 82% ahead of the

previous passing rent. We have good interest in the other unit.

At Nonsuch Industrial Estate in Epsom, the active management strategy to

combine units resulted in a letting to Topps Tiles and we also completed three

further lettings during the period, for a combined GBP0.2 million per annum, 2%

ahead of ERV. Two leases were renewed, the passing rent increasing by 22% to a

combined GBP0.1 million per annum, 5% ahead of ERV.

Our largest void in the industrial portfolio is Swiftbox, the 99,500 sq ft unit

in Rugby, where we completed a comprehensive refurbishment in February. This is

one of the few cross-docked units available in the 'Golden Triangle' and we

expect good interest.

Outlook

The full impact of the Covid-19 pandemic remains to be seen, but Brexit

concerns have had a limited impact to date.

Demand remains strong for sub-100,000 sq ft units, with occupiers being more

discerning about the age and specification of the larger distribution units. We

see continued rental growth, albeit at a slower rate, in respect of the smaller

units especially in Greater London and the South East, where there remains a

lack of supply and a limited development pipeline. We do not expect rental

growth to come through on the larger units, due to a strong development

pipeline, although there is a short-term demand spike due to Covid-19 from

supermarkets and other retailers with increased storage requirements.

The focus going forward is the leasing of Rugby and both capturing the rental

growth on the smaller units and working proactively with our occupiers to

facilitate their business needs. We have 16 lease events in the coming year,

the overall ERV for these units is 16.5% higher than the current passing rent

of GBP0.7 million. This provides us with the opportunity to grow income further.

Office

Key metrics

2020 2019

Value GBP224.6m GBP235.0m

Internal area 0.8m sq ft 0.9m sq ft

Annual rental income GBP12.9m GBP14.2m

Estimated rental value GBP17.4m GBP18.1m

Occupancy 88% 88%

Number of assets 14 15

The office portfolio, which accounts for 34% of the portfolio, delivered the

second strongest performance of the year. This was a result of our investment

into the buildings to make them more attractive to existing and new occupiers,

combined with continued occupational demand, especially in the regions.

Through working with our occupiers and actively managing our properties, we

have been able to retain and attract occupiers, which in turn enables us to

capture rental growth, particularly in markets with a shortage of Grade A

space, such as Bristol and Milton Keynes.

On a like-for-like basis, our office portfolio value increased by GBP6.6 million

or 3.0% to GBP224.6 million, and the annual rental income decreased marginally by

GBP0.3 million or 2.2% to GBP12.9 million. The portfolio has an average weighted

lease length of 4.0 years and GBP4.5 million of reversionary potential.

Occupational demand has been stronger in the regions than in London. We have

seen rental growth of 3.5% across the portfolio and occupancy is 88%, primarily

due to key voids at Angel Gate, London and Pembroke Court, Chatham. We invested

GBP2.7 million into our office assets during the period and disposed of one

asset, detailed below.

Portfolio activity

At Tower Wharf, Bristol, following completion of works to upgrade the reception

and the installation of additional shower facilities, we agreed to upsize an

existing occupier and extended their lease which was due to expire in May 2020.

This increased their floor space by 73% and secured a new 15-year lease,

subject to break in 2030, at a rent of GBP0.5 million per annum, which was 5%

ahead of the ERV and GBP0.3 million ahead of the previous passing rent. In

addition, we moved out an occupier's break option by three years and settled a

rent review, achieving a 29% uplift to GBP0.4 million per annum, 4% ahead of ERV.

At Grafton Gate, Milton Keynes, we comprehensively refurbished the common areas

and, working with an occupier, upgraded their office, installing energy

efficient LED lighting and creating an up-to-date working environment. These

works meant the building's EPC rating improved from an E to a C,

future-proofing it in respect of the Minimum Energy Efficiency Standards. As

part of the office upgrade works, we settled a rent review, securing a 52%

uplift to GBP0.6 million per annum, 30% ahead of ERV.

At Metro, Salford Quays, where a lease event created a vacant floor, we

comprehensively refurbished the common areas for the benefit of our occupiers

and to make the building more attractive. The floor was let to HM Government

within six months of the refurbishment completing on a 20-year lease subject to

break in 2030, at GBP0.4 million per annum, which was 2% ahead of ERV.

At Waterside House, Leeds, following upgrade works, we upsized our existing

occupier, HM Government, into the whole building on a ten-year lease at a rent

of GBP0.3 million per annum, which was 16% ahead of ERV.

At Citylink, Croydon, we restructured two leases after occupiers actioned break

clauses. This resulted in an early surrender for a premium and a simultaneous

new short-term letting. The property was subsequently sold for GBP18.2 million.

Our largest office void is the office element at Stanford Building WC2 which is

classed as a retail property and is detailed in the retail section.

The offices will provide fibre-enabled Grade A accommodation with original

warehouse features, commissionaire, occupier amenities and environmental

improvements. We expect good interest due to the quality of the accommodation

on offer and size of the suites.

Occupancy remained stable over the period at 88%, with the letting activity

offset by space coming back in Chatham and London.

Outlook

Generally, the regions continue to outperform London with occupiers looking for

high specification buildings, which is why we have carried out significant

refurbishments at eight of our regional buildings, investing GBP2.5 million to

improve common areas, adding occupier amenity space and future-proofing them in

respect of sustainability.

The longer-term impact of the Covid-19 pandemic may well lead to more remote

working which is likely to change the way physical office space is used.

We have countered the impact of serviced offices by offering flexibility

through our 'rightsizing' approach as well as our high quality contemporary

space and occupier amenities, meaning our buildings remain attractive to

businesses who want control of their own space. Looking forward, we will build

on the upgrade work completed across the office portfolio to actively manage it

to attract occupiers.

We have 33 lease events in the coming year, the current ERV for these units is

13.2% higher than the current passing rent of GBP2.0 million and a 12% void. This

provides us with the opportunity to grow income further.

Retail and Leisure

Key metrics

2020 2019

Value GBP121.7m GBP137.5m

Internal area 0.8m sq ft 0.8m sq ft

Annual rental income GBP7.3m GBP7.5m

Estimated rental value GBP9.2m GBP10.0m

Occupancy 75% 77%

Number of assets 17 17

The retail and leisure portfolio, which accounts for 18% of the portfolio,

delivered the weakest performance of the year. This was a result of ongoing

changes in shopping patterns and weak occupational demand resulting in negative

rental growth in a lot of markets.

Stanford Building in Covent Garden, which has both retail and office use, is

our largest element of the retail portfolio at 28%, of the balance 40% is in

the retail warehouse sector, 22% in high street retail and 10% in hotel and

leisure assets.

Our investment into the retail parks in Bury and Swansea has enabled us to

retain and attract new occupiers.

By working with our occupiers and through active management, we have been able

to temper the declines in value over the period by extending income, letting

space and achieving rents overall very close to the ERV.

On a like-for-like basis, our retail and leisure portfolio value decreased by GBP

15.8 million or 11.5% to GBP121.7 million, and the annual rental income decreased

marginally by GBP0.2 million or 2.6% to GBP7.3 million. The portfolio has an

average weighted lease length of 8.9 years and GBP1.9 million of reversionary

potential to GBP9.2 million per annum.

Occupational demand has been weaker in the retail warehouse and restaurant

sector, with high street shops and London seeing slightly better demand. We

have seen negative rental growth of 8.0% across the portfolio and occupancy is

75%, primarily due to key voids at Stanford Building, London and Angouleme

Retail Park, Bury. We invested GBP3.3 million into the retail portfolio during

the period.

Portfolio activity

At Parc Tawe Retail Park, Swansea we carried out a comprehensive refurbishment

of the park to include new signage, modernisation of the units and

environmental improvements, for example changing to LED lighting. This has

created an improved shopping environment for customers and enabled us to

attract new occupiers. Once we completed enabling works, Lidl relocated to the

former Homebase unit and, following practical completion of refurbishment

works, we completed a new 15-year lease at their former unit to Farmfoods at a

stepped rent to GBP0.1 million per annum, 14% below ERV. We also agreed to extend

Pets at Home's lease, expiring in 2022, by a further five years and rebased

their rent to GBP0.1 million per annum from completion, a reduction of 18%, but

10% ahead of the preceding ERV. We have one unit available to lease, accounting

for 13% of the park by floor area.

At Angouleme Way Retail Park, Bury we carried out a comprehensive refurbishment

to update the park for customers and to enable us to attract new occupiers and

retain existing ones. Argos renewed on a ten-year lease at a rent of GBP0.2

million per annum, which was 16% ahead of ERV. Another unit was let to a

regional occupier on a five-year lease, subject to a break in three years, at a

stepped rent to GBP0.1 million per annum, in line with ERV. We have two units

available to lease, accounting for 40% of the park by floor area.

At the Crown & Mitre complex in Carlisle, we settled the hotel rent review,

securing a 42% uplift to GBP0.2 million per annum, 8% ahead of ERV. There is a

historic lane adjacent to the property, with small shops and local occupiers.

Working with our occupiers, we refurbished the lane to create a significantly

better environment in keeping with the Grade II property and attracting higher

footfall for our occupiers.

At Scots Corner, Birmingham we renewed HM Government's lease for a further ten

years, subject to break in 2024, at a rent of GBP0.1 million per annum, in line

with ERV. Towards the end of the year, we got two adjoining shop units back due

to insolvencies, securing a payment on one of them. These are currently being

reconfigured and one of the units is under offer.

Our largest retail void is the unit at Stanford Building WC2 where the

refurbishment of the whole building is currently underway and is due to

complete in the summer. The unit is in a prime location and provides unique

space arranged over three floors. It is the first time the unit has been

available to lease in over 100 years and we expect good interest in due course.

Outlook

The retail and leisure sector continues to undergo structural change due to

evolving shopping habits, which have resulted in an oversupply in most markets

with occupiers being able to negotiate lower rents and higher incentives. The

Covid-19 pandemic has considerably worsened the outlook, and it is likely that

a number of less resilient businesses will not survive, further increasing the

supply of floorspace.

We are working on a number of schemes where we envisage changing the use from

retail or leisure to other uses and we will resume with progressing these plans

once restrictions are lifted.

We are working with our occupiers to assist them where we can, by for example

postponing rental payments or providing upfront incentives to remove future

break options and/or extend leases. The lockdown has caused significant cash

flow issues to a lot of businesses in this sector and until shops, gyms, hotels

and restaurants are allowed to open we cannot see an improvement outside of the

supermarket sector. The full impact of the Covid-19 pandemic remains to be seen

and this reinforces our portfolio positioning.

Financial Review

In the context of uncertain and difficult market conditions, our results for

the year were positive. The total profit recorded was GBP22.5 million, compared

to GBP31.0 million for 2019, reduced due to lower valuation movements,

particularly in the final quarter of the year. Our EPRA earnings declined to GBP

19.9 million, and we maintained a covered dividend. Earnings per share were 4.1

pence overall (3.7 pence on an EPRA basis), and the total return based on these

results was 4.5% for the year.

The Covid-19 pandemic is having a significant impact on businesses throughout

the UK. For Picton, like many commercial landlords, the first tangible

consequence was on the March rent collection date. We received 82% of the rent

due, and this is discussed more fully below, along with the actions being

taken. We also experienced a decline in the portfolio valuation at the end of

March, principally on the retail assets. We expect these themes to continue

through the course of the pandemic.

Net asset value

The net assets of the Group increased to GBP509.3 million, largely following the

equity raise in the year. The chart below shows the components of this increase

over the year. The EPRA net asset value remained at 93 pence.

GBPm

March 2019 net asset value 499.4

Income profit 19.9

Valuation movement (0.9)

Profit on asset disposals 3.5

Issue of ordinary shares 7.0

Share-based awards 0.3

Purchase of shares (0.9)

Dividends paid (19.0)

March 2020 net asset value 509.3

The following table reconciles the net asset value calculated in accordance

with International Financial Reporting Standards (IFRS) with that of the

European Public Real Estate Association (EPRA).

2020 2019 2018

GBPm GBPm GBPm

Net asset value - EPRA and IFRS 509.3 499.4 487.4

Fair value of debt (29.6) (24.8) (21.1)

EPRA triple net asset value 479.7 474.6 466.3

Net asset value per share (pence) 93 93 90

EPRA net asset value per share (pence) 93 93 90

EPRA triple net asset value per share (pence) 88 88 87

Income statement

Total revenue from the property portfolio for the year was GBP45.7 million. On a

like-for-like basis, rental income on an EPRA basis has reduced compared to the

previous year. Throughout the year we have been carrying out a number of

refurbishment projects aimed at improving the quality of space at those assets

and so improving letting prospects. This is discussed further in the Portfolio

Review, but the impact on this year's results is lower net property income.

The table below sets out the rent collection statistics for the March quarter,

analysed by sector. The greatest impact, not unexpectedly, is in the retail

sector.

Rent due Industrial Office Retail Total

25 March to 1 April (%) (%) and (%)

Leisure

(%)

Collected 84 89 67 82

Moved to monthly 1 1 8 2

Deferred 6 5 8 6

Concessions agreed - 1 - -

Active management - - 4 1

Outstanding 9 4 13 9

The rent demanded on the March quarter day is in advance, up to the June 2020

quarter day. We have, however, made increased provisions against our tenant

debtors in this financial year, and this has impacted our rental income by GBP0.5

million.

Administrative expenses for the year were GBP5.6 million, so slightly lower than

the GBP5.8 million in 2019. These include the one-off costs of REIT conversion.

Realised and unrealised valuation gains on the portfolio were GBP2.6 million for

the year, lower than the gains of GBP11.3 million reported last year. This is

very much a reflection of the commercial property market, and particularly the

sentiment in the retail sector, where there have been well publicised issues of

retail failures.

Interest payable is lower this year compared to 2019, at GBP8.3 million. This

reflects a full year's saving following the Canada Life repayment in 2018, and

also the repayment of the current revolving credit facilities.

This is the first full year that we have reported as a UK REIT. All of the

profits from the property rental business are exempt from UK tax. We must, as a

REIT, distribute at least 90% of these profits to shareholders as Property

Income Distributions. Based on our initial submitted tax returns to date, we

have fully complied with this requirement. This year we have received a small

tax repayment, an adjustment arising from previous years.

EPRA earnings for the year were GBP19.9 million, lower than the GBP22.9 million

stated in 2019, principally for the reasons stated above.

Dividends

The annual dividend rate has remained at 3.5 pence, with total dividends paid

out of GBP19.0 million. Dividend cover for the full year was lower than last year

at 105%.

Following the year end we have announced a 29% reduction in the dividend rate,

which was applied to the dividend paid in May, due to the uncertainty caused by

the Covid-19 pandemic.

Investment properties

The appraised value of our investment property portfolio was GBP664.6 million at

31 March 2020, down from GBP685.3 million a year previously. This year we have

disposed of two buildings, for net proceeds of GBP33.1 million, realising a

combined gain of GBP3.5 million compared to last year's valuation. GBP8.9 million

of capital expenditure was invested back into the existing portfolio. The

overall revaluation movement was a small loss of GBP0.9 million, principally

arising in the final quarter of the year, as the impact of the Covid-19

pandemic was felt. With the reduction in investment market activity and less

evidence available, the independent valuers included a 'material uncertainty'

clause in the March valuation.

At 31 March 2020 the portfolio comprised 47 assets, with an average lot size of

GBP14.1 million.

A further analysis of capital expenditure, in accordance with EPRA Best

Practices Recommendations, is set out in the EPRA Disclosures section.

Borrowings

Total borrowings were GBP167.5 million at 31 March 2020, with the loan to value

ratio having reduced to 21.7%. The weighted average interest rate on our

borrowings has increased slightly to 4.2%, while the average loan duration is

now 9.9 years.

Our senior loan facility with Aviva reduced by the regular amortisation of GBP1.2

million in the year.

The Group remained fully compliant with the loan covenants throughout the year.

During the year we repaid all the outstanding amounts drawn under our revolving

credit facilities, leaving GBP49 million undrawn at the year end. The year-end

interest rate payable on these loans was around 2.7%.

Subsequent to the year end, we have completed a new single revolving credit

facility, replacing the two existing ones. The new GBP50 million facility is for

an initial term of three years, until May 2023, with two one-year extensions

available. Interest is payable at 150 basis points over LIBOR, which is at a

lower rate than the facilities it replaces.

Loan arrangement costs are capitalised and are amortised over the terms of the

respective loans. At 31 March 2020, the unamortised balance of these costs

across all facilities was GBP2.3 million.

The fair value of our borrowings at 31 March 2020 was GBP197.0 million, higher

than the book amount. Lending margins have remained broadly in line with the

previous year, but gilt rates have fallen in comparison.

A summary of our borrowings is set out below:

2020 2019 2018

Fixed rate loans (GBPm) 167.5 168.7 203.5

Drawn revolving facilities (GBPm) - 26.0 10.5

Total borrowings (GBPm) 167.5 194.7 214.0

Borrowings net of cash (GBPm) 143.9 169.5 182.5

Undrawn facilities (GBPm) 49.0 25.0 40.5

Loan to value ratio (%) 21.7 24.7 26.7

Weighted average interest rate (%) 4.2 4.0 4.1

Average duration (years) 9.9 9.8 10.3

Cash flow and liquidity

The cash flow from our operating activities was GBP13.5 million this year, down

from the 2019 figure. Proceeds from asset sales were used to finance the net

reduction in borrowings. Dividend payments of GBP19.0 million were made in the

year. Our cash balance at the year end stood at GBP23.6 million.

Share capital

During the year the Company issued 7,551,936 new ordinary shares of no par

value, for gross proceeds of GBP7.1 million, bringing the total shares in issue

to 547,605,596.

The Company's Employee Benefit Trust acquired a further 954,000 shares, at a

cost of GBP0.8 million, during the year to satisfy the future vesting of awards

made under the Long-term Incentive Plan, and now holds a total of 2,103,683

shares. As the Trust is consolidated into the Group's results, these shares are

effectively held in treasury and therefore have been excluded from the net

asset value and earnings per share calculations, from the date of purchase.

Andrew Dewhirst

Finance Director

22 June 2020

Principal Risks

Managing Risk

The Board recognises that there are risks and uncertainties that could have a

material impact on the Group's results.

Risk management provides a structured approach to the decision making process

such that the identified risks can be identified, measured, managed, mitigated

and reported and the uncertainty surrounding expected outcomes can be reduced.

The Board has developed a risk management policy which it reviews on a regular

basis.

The Audit and Risk Committee carries out a detailed assessment of all risks,

whether investment or operational, and considers the effectiveness of the risk

management and internal control processes.

The Executive Committee is responsible for implementing strategy within the

agreed risk management policy, as well as identifying and assessing risk in

day-to-day operational matters. The management committees support the Executive

Committee in these matters.

The small number of employees and relatively flat management structure allow

risks to be quickly identified and assessed.

The Group's risk appetite will vary over time and during the course of the

property cycle. The principal risks - those with potential to have a material

impact on performance and results - are set out below, together with mitigating

controls. The UK Corporate Governance Code requires the Board to make a

Viability Statement. This considers the Company's current position and

principal risks and uncertainties combined with an assessment of the future

prospects for the Company, in order that the Board can state that the Company

will be able to continue its operations over the period of their assessment.

The statement is set out below.

Covid-19

The current global Covid-19 pandemic is causing an unprecedented level of

disruption to the global economy. Many governments, including the UK, have

imposed lockdowns, giving rise to the closure of some businesses. It is not

clear how long the restrictions will last nor what the impact on the UK economy

will be. Some of our occupiers are facing financial difficulties and we are

working with them to find solutions that both help them and mitigates any

impact on our capital values and cash flow.

The risks associated with this pandemic fall across many of the principal risks

set out here, and in many cases increase the potential impact significantly.

There has already been an impact on the Group's cash flow, and it is considered

likely that this will continue in at least the short-term.

Picton has a diverse portfolio spread across the UK, with around 350 occupiers

in a wide range of businesses. The cash flow arising from our occupiers

underpins our business model. We are continuing to let space, although a number

of transactions have been put on hold since the pandemic began to affect the UK

economy. There are few investment transactions taking place to provide

comparable evidence for valuations, and as a result our external valuers have

added a material valuation uncertainty clause to their report as at 31 March

2020, in line with market practice.

We have considered in our Viability Statement the potential impact of various

scenarios resulting from Covid-19 on the business.

Brexit

Although the UK has now left the EU and is in the transition period, there is

still uncertainty regarding a future trading relationship. The transition

period ends on 31 December 2020 and in the absence of any agreement being

reached there could be further disruption to the UK economy.

We have considered the potential impact from a disruptive Brexit in a number of

scenarios included in our Viability Statement.

Emerging risks

During the year the Board has considered themes where emerging risks or

disrupting events may impact the business. These may arise from behavioural

changes, political or regulatory changes, advances in technology, environmental

factors, economic conditions or demographic changes. As noted above Covid-19

may also have an impact on a number of these themes. Some are already

considered to be principal risks in their own right such as the impact of

climate change, others are reviewed as part of the ongoing risk management

process.

Corporate Strategy

1

Political and economic Risk trend: Up

Risk Mitigation Commentary

Uncertainty in the UK The Board considers economic The risks around the UK

economy, whether arising from conditions and market economy have increased with

political events or uncertainty when setting the Covid-19 pandemic.

otherwise, brings risks to strategy, considering the Although there is more

the property market and to financial strategy of the certainty regarding Brexit,

occupiers' businesses. This business and in making no future deal with the EU

can result in lower investment decisions. has yet been agreed and this

shareholder returns, lower may lead to further

asset liquidity and increased uncertainty later in 2020.

occupier failure.

2

Market cycle Risk trend: Up

Risk Mitigation Commentary

The property market is The Board reviews the There may be increased

cyclical and returns can be Group's strategy and volatility in the property

volatile. There is an business objectives on a market as a result of the

ongoing risk that the regular basis and considers current economic

Company fails to react whether any change is restrictions. Official

appropriately to changing needed, in light of current forecasts indicate a

market conditions, resulting and forecast market substantial fall in UK GDP

in an adverse impact on conditions. this year. The impact of

shareholder returns. Covid-19 may also cause

businesses to review their

existing operating models

(e.g. future need for office

space).

3

Regulatory and tax Risk trend: Same

Risk Mitigation Commentary

The Group could fail to The Board and senior There are no significant

comply with legal, fiscal, management receive regular changes expected to the

health and safety or updates on relevant laws and regulatory environment in

regulatory matters which regulations. which the Group operates.

could lead to financial loss,

reputational damage or loss The Group is a member of the

of REIT status. BPF and EPRA, and management

attend industry briefings.

4

Climate change Risk trend: Up

Risk Mitigation Commentary

Failure to react to climate Sustainability is embedded Climate change is now

change could lead to the within the Group's business considered to be a principal

Group's assets becoming model and strategy. risk given its increasing

obsolete and unable to importance and the impact of

attract occupiers. All refurbishment projects real estate on the

include environmental environment.

considerations to ensure

buildings are maintained to

current standards.

Property

5

Portfolio strategy Risk trend: Up

Risk Mitigation Commentary

The Group has an The Group maintains a Continued divergence of

inappropriate portfolio diversified portfolio in returns across sectors,

strategy, as a result of poor order to minimise exposure coupled with the impact of

sector or geographical to any one geographical area Covid-19 particularly on

allocations, or holding or market sector. retail and leisure assets,

obsolete assets, leading to have increased this risk.

lower shareholder returns.

6

Investment Risk trend: Same

Risk Mitigation Commentary

Investment decisions may be The Executive Committee must There is no change to this

flawed as a result of approve all investment risk.

incorrect assumptions, poor transactions over a

research or incomplete due threshold level, and

diligence, leading to significant transactions

financial loss. require Board approval.

A formal appraisal and due

diligence process is carried