TIDMMSMN

RNS Number : 9323Q

Mosman Oil and Gas Limited

24 June 2020

24 June 2020

Mosman Oil and Gas Limited

("Mosman" or the "Company")

Corporate and Operations Update

Mosman Oil and Gas Limited (AIM: MSMN) the oil exploration,

development and production company, provides an update to current

and planned operations.

Global Events and Corporate Review

As previously stated, Mosman's business is not immune to the

recent exceptional external events including Covid-19 and the

fluctuating oil price. Production, however, continues with a

current emphasis on margins and cashflow, rather than maximising

volumes at this point in time.

Growth opportunities including Stanley and Greater Stanley in

Texas have been prioritised and all activities are being operated

on the basis of minimising both operating and capital costs.

With the WTI oil price having recovered and currently around USD

40 per barrel, Mosman's operations are underpinned by low operating

and development costs and the Board is now considering how best to

grow the business over the next year given the improved oil price

backdrop.

Business Plan

Mosman continues to pursue its Refocussed Corporate Strategy

detailed in the Company's announcement of 14 February 2020, which

includes growth in core areas with potential for a near term

increased production and the farmout or sale of other assets.

In furtherance of this strategy and as previously announced,

Mosman has contracted to sell its Welch Project in Texas for USD

300,000 and has received a USD 60,000 non-refundable deposit.

Completion is due in early July 2020.

Mosman also farmed out EPA 155 in NT, Australia, and has

received the first payment of AUD 15,000.

In line with its strategy, the Company continues to pursue the

sale of its other non-core assets while evaluating opportunities

which fit its strategy and growth criteria.

Production Operations

Ahead of its six monthly production update for the period to 30

June 2020, Mosman provides the following update in respect of its

principal projects and operations.

1. At Stanley the Operator's focus has been on minimising

operational costs while oil prices were low. Stanley continues to

produce positive cashflow at the operating level, and oil

inventories and sales are being carefully managed including through

the use of onsite storage tanks, as previously advised. The

Operator at Stanley has advised that , in its opinion , recent

operational improvements including to the central processing

facilities and reworking and upgrading the salt-water disposal

system , have materially lowered Stanley's operating costs with the

resultant low cost structure allowing Stanley to operate profitably

with oil prices at the mid-teens .

Stanley-1 has been shut-in for several weeks pending

recompletion of the well. An AFE for this workover has recently

been issued, approved and paid for by Mosman. This temporary

shut-in at Stanley-1 has resulted in a reduction in daily

production until the well is back on production. The future

production rate depends on the results of the Stanley-1

re-completion.

Mosman anticipates that once the Operator has completed the

workover at Stanley-1 (expected July 2020), its attention will turn

to drilling the proposed Stanley-4 well. With reduced drilling

activity, more rigs are available, and this is expected to result

in lower drilling costs.

2. At Greater Stanley, the plan remains to increase production

by workovers on one of the the existing producing wells in the Duff

lease. Based on experience in the adjacent Stanley lease, there may

be potential to produce at higher rates from zones not yet produced

in this lease. This workover is now planned and as soon approvals

are obtained it should proceed with this currently expected to

occur in July 2020.

3. At the Arkoma project in Oklahoma which has been identified

as non-core, production operations continue. Mosman is awaiting

full production information from the Operator. Mosman has not

contributed any additional cash funding to the Arkoma project this

year and does not anticipate the need to do so.

4. At the Welch Project, no equipment breakdowns or new

workovers occurred during May, resulting in steady production.

Daily average production for the six month period ending 30 June

2020 is expected to be broadly similar to the daily average for the

6 month period ended 31 December 2019. Mosman will receive all

production at Welch up until the date the sale is concluded,

including the oil inventory at that time.

5. In NT, Australia, ground operations are delayed due to the

Covid-19 pandemic.

Whilst cost control and margins have been the main focus in

recent months, future shorter term production rates will depend on

the results of the already planned recompletions at Stanley-1 and

at Greater Stanley in the Duff lease. Mosman also looks forward to

the Operator at Stanley progressing renewed plans for the drilling

at Stanley-4.

One of the additional growth opportunities being considered is

drilling the Falcon well. Whilst oil and gas prices are lower than

last year, rig costs are also lower, and the Falcon well has

significant oil and gas potential. Any success would enhance the

prospectively of similar targets in this lease, and the adjacent

lease that includes the Galaxie well.

The drilling of a well at Falcon is currently subject to an

ongoing in-house review, and any activity will be subject to

funding.

Other Matters

The Legal action Mosman had instigated with the aim to recover

funds from Blackstone Oil and Gas Inc remains ongoing but has been

delayed by the Covid-19 pandemic.

Mosman owns shares in Norseman Capital Limited, which has

recently announced a transaction in Canada. This should facilitate

Norseman's shares moving to trading on the TSXV exchange. The

Mosman Board considers these shares as an asset for sale and is

reviewing the sale of the Norseman shares in an orderly manner. As

part of that process Mosman's Chairman has recused himself from the

sale process, as he is a Director and shareholder, of both

companies.

John W Barr, Chairman of Mosman commented : "The Mosman Board

acted quickly and decisively in March in order to manage costs. We

are pleased to be able to move from a position of tight cashflow

control to the careful consideration of growth options. We are now

evaluating potential opportunities which include being involved in

two workovers and one or two new wells in the coming months."

Competent Person's Statement

The information contained in this announcement has been reviewed

and approved by Andy Carroll, Technical Director for Mosman, who

has over 35 years of relevant experience in the oil industry

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

Enquiries:

Mosman Oil & Gas Limited NOMAD and Joint Broker

John W Barr, Executive Chairman SP Angel Corporate Finance LLP

Andy Carroll, Technical Director Stuart Gledhill / Richard Hail

jwbarr@mosmanoilandgas.com / Soltan Tagiev

acarroll@mosmanoilandgas.com +44 (0) 20 3470 0470

Alma PR Joint Broker

Justine James Monecor (London) Ltd

+44 (0) 20 3405 0205 trading as ETX Capital

+44 (0) 7525 324431 Thomas Smith

mosman@almapr.co.uk +44 (0) 20 7392 1432

Updates on the Company's activities are regularly posted on its

website: www.mosmanoilandgas.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDGZGZVRDNGGZG

(END) Dow Jones Newswires

June 24, 2020 04:09 ET (08:09 GMT)

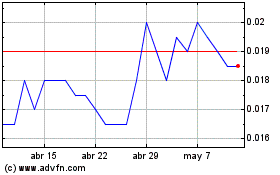

Mosman Oil And Gas (LSE:MSMN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Mosman Oil And Gas (LSE:MSMN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024