TIDMHTG

RNS Number : 2754R

Hunting PLC

29 June 2020

For Immediate Release 29 June 2020

Hunting PLC

("Hunting" or "the Company" or "the Group")

H1 2020 Trading Update

Hunting PLC (LSE:HTG), the international energy services group,

today issues a pre-close trading update, ahead of its Half Year

Results to be issued on Thursday 27 August 2020.

Highlights

-- Rapid action to address cost base implemented, with

annualised savings of circa.$60m captured;

-- Robust balance sheet retained with net cash, before lease

liabilities, of circa.$44m to $46m anticipated at 30 June 2020;

and

-- Offshore market position strengthened, following acquisition

of Enpro Subsea Limited in February 2020 and asset acquisition of

RTI Energy Systems in August 2019.

Group Summary

As a consequence of the reduction in the WTI oil price in March

2020 caused by the COVID-19 pandemic, coupled with a market share

battle within the OPEC+ group, trading within most of the Group's

businesses has reported a decline during Q2 2020, following modest

trading results in Q1 2020. Underlying EBITDA in the year to date

is expected to be in the range of $22m to $23m, if trading for June

2020 performs in line with expectations.

Management actions to address the Group's cost structure, based

on this trading environment, have included:

i. closure of three distribution centres in North America and

two manufacturing facilities, including Hunting Titan's facility in

Oklahoma City and the US Manufacturing facility at Ramsey Road,

Houston, Texas;

ii. immediate actions to reduce working capital, with a focus on inventory management;

iii. over 50% cut in budgeted capital expenditure with

circa.$22m projected for the full year; and

iv. a 25% reduction in the Group's workforce, as compared to the

end of 2019, with the restructuring largely completed by June. Most

contract workers across the Group's global operations have been

released in the period, with a number of facilities adjusting the

number of daily shifts in accordance with the short to medium term

operating outlook.

Annualised cost savings of these actions are estimated to be

circa.$60m.

Balance Sheet, Funding and Liquidity

The Group's balance sheet remains strong with an expected net

cash position at 30 June 2020, before lease liabilities, in the

region of $44m to $46m. As noted above, reductions to working

capital are underway to generate cash.

Capital expenditure has remained modest with approximately

$11.0m incurred up to the end of June 2020, primarily for projects

started in 2019. Additionally, $11.1m was absorbed on share

purchase related transactions completed in Q1 2020 and $4.9m was

absorbed paying the interim dividend on 15 May 2020. In February

2020, the Group also purchased Enpro Subsea Limited in cash for

$33.0m, excluding costs of $1.2m.

Given the Group's healthy cash position, and current

expectations for the balance of the year, management does not

anticipate drawing down on the Company's $160.0m secured revolving

credit facility at this time. Should the economic downturn

resulting from COVID-19 be protracted and place additional pressure

on liquidity, Hunting continues to have access to this facility, as

and when required, subject to the limits and restrictions imposed

by the existing covenant regime. The facility agreement runs until

December 2022, with an option to extend until December 2023.

COVID-19

The health and safety of the Group's employees is our number one

priority. The global spread of COVID-19 during H1 2020 has provided

many challenges to our operations globally, and led to the

implementation of a range of measures to allow the Group's

facilities to continue operating across the period. As an essential

industry, oilfield service companies have been allowed to remain

open, albeit with social distancing and reduced utilisation levels

to protect the Group's employees. Working from home measures have

also been adopted for personnel who are able to work remotely.

Across the Group's Hunting Titan, US, Canada and EMEA operating

segments, facilities have remained operational throughout H1 2020.

In Asia Pacific, the Group's China facility was shut for five days

in Q1 2020 and in Singapore and Indonesia Hunting's facilities were

subject to reduced utilisation levels where maximum employee

attendance was circa.25%. During Q2 2020, the Group's Singapore,

Indonesia and China facilities returned to utilisation levels of

between 50% and 70%. In June 2020, the Group's US based facilities

also eased a number of operating restrictions to facilitate more

normal shift patterns.

It is anticipated that all of the Group's facilities will be

operating in a more normalised manner for the balance of 2020,

albeit with revised working practices being in place.

Segmental Highlights

Hunting Titan has seen a sales decline of circa.40% during H1

2020 compared to H2 2019, as a result of reduced US onshore

activity levels. Actions to align the business with the lower

outlook for the US onshore market have included headcount

reductions as well as closing a number of manufacturing and

distribution facilities. The business remains focused on developing

technologies that will assist in lowering operating costs for

customers. In the period, Hunting Titan has launched a number of

variants to its perforating systems product portfolio. The segment

reports an increase in the adoption of the EQUA-Frac(TM) shaped

charge system, which continues to report period-on-period increases

in sales. Hunting Titan has also commissioned its detonation cord

manufacturing line located at the Group's Milford Facility during

June 2020, which will increase sales and reduce our costs.

The Group's US segment reported positive results for the first

half of the year, though a decline in trading in June 2020 is

anticipated. The Group's Premium Connections business has reported

continued demand for its major product lines, with offshore focused

products showing some resilience throughout Q2 2020. Within the

Advanced Manufacturing Group, the Hunting Electronics business has

reported a good performance in H1 2020, supported by an increasing

level of non-oil and gas work. Hunting Dearborn has reported stable

results in the period, with aerospace and military work supporting

the business as oil and gas orders declined. The Group's Drilling

Tools and Specialty businesses have been impacted by the decline in

US onshore activity following the record lows in the US rig count.

Hunting's Subsea technologies group, which comprises the Stafford,

RTI and Enpro businesses, have reported positive trading momentum

in the year to date with new offshore orders continuing to be

placed. Highlighting this trend, $20m of new orders have been

received by the RTI business in the year to date for the Gulf of

Mexico.

Hunting's Canada business continues to be impacted by difficult

market conditions, following the decline in the global oil price.

The business has reduced its operations to a two-shift pattern

since March 2020 and reduced contract staff in the period to save

further costs.

Across the Group's EMEA operations, Hunting's UK and Netherlands

OCTG businesses have traded well for the majority of the period, as

demand for chrome-based OCTG remained steady. As the segment

reached the half-year point clients have begun to defer or cancel

orders, given the general market outlook. In the Middle East, the

response to the reduced oil price has led to mixed results with

projects in Oman continuing, and some orders in Iraq being

cancelled.

Hunting's Asia Pacific business was impacted by COVID-19 early

in Q1 2020. The segment has continued to complete orders for Middle

East and Asia Pacific customers and has seen a steady improvement

in sales through Q2 2020 as COVID-19 lock-down measures were

eased.

Commenting on the Group's trading, Jim Johnson, Chief Executive

said:

"I am proud of the performance of our team in what has been an

unprecedented decline in oilfield activity, coupled with the

challenges of COVID-19. We have reacted quickly to the changes in

our market, which has unfortunately resulted in a significant

reduction in the global workforce.

"The continued opening of economies around the world will

support oil prices going forward, which should lead to an improving

financial position for our clients, and spur increased demand for

our products as drilling activity recovers. Depletion rates

continue unabated, and with a growing number of

drilled-but-uncompleted wells, the onshore US region should see

improved activity later in the year."

"We have continued to address the needs of our customers with

the launch of more innovative technology that lower drilling and

completion costs and increase safe operations. Our business is

likely to continue to see volatile trading throughout Q3 2020, but

the Group's cost base has now been recalibrated to current market

conditions, and the strength of our balance sheet ensures we are

well positioned to remain resilient through these challenging

market conditions."

For further information, please contact:

Hunting PLC Tel: +44 (0) 20 7321 0123

Jim Johnson, Chief Executive

Bruce Ferguson, Finance Director

Tarryn Riley, Investor Relations

Buchanan Tel: +44 (0) 20 7466 5000

Ben Romney

Chris Judd

Notes to Editors:

About Hunting PLC

Hunting PLC is an international energy services provider to the

world's leading upstream oil and gas companies. Established in

1874, it is a premium listed public company traded on the London

Stock Exchange. The Company maintains a corporate office in Houston

and is headquartered in London. As well as the United Kingdom, the

Company has operations in Canada, China, Indonesia, Mexico,

Netherlands, Norway, Saudi Arabia, Singapore, United Arab Emirates

and the United States of America.

The Group reports in US dollars across five operating segments:

Hunting Titan; US; Canada; Europe, Middle East and Africa ("EMEA")

and Asia Pacific.

Hunting PLC's Legal Entity Identifier is

2138008S5FL78ITZRN66.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTPPUBPQUPUGAQ

(END) Dow Jones Newswires

June 29, 2020 02:00 ET (06:00 GMT)

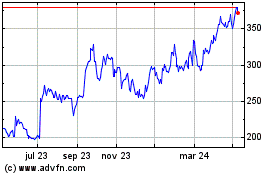

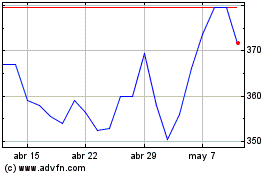

Hunting (LSE:HTG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Hunting (LSE:HTG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024