TIDMREAT

RNS Number : 2892R

React Group PLC

29 June 2020

REACT Group plc

("REACT", the "Group" or the "Company")

Half Year Results FY 2020

REACT Group plc, (AIM:REAT.L) the leading specialist cleaning,

hygiene and decontamination company announces its unaudited results

for the six-month period ended 31 March 2020 ("Interim

Report").

Financial Highlights

for the six months ended 31 March 2020

Continuing operations HY 2020 HY 2019 Change

--------------------------- -------- -------- ---------

Revenue (GBP'000) 2,091 1,588 32%

Gross profit (GBP'000) 695 419 66%

Gross profit margin 33.2% 26.4% +683 bps

EBITDA (GBP'000) 85 (30) 379%

Net profit/(loss) for the

period (GBP'000) 50 (59) 184%

Earnings/(loss) per share

(basic) (pence) 0.01 (0.01) 184%

Earnings/(loss) per share

(adjusted) (pence) 0.02 (0.01) 379%

Net cash (GBP'000) 306 446 (31%)

-- Group revenue up 32% to GBP2,091,000

-- Gross profit up 66% to GBP695,000

-- Gross profit margins increased by 683 basis points to over 33%

-- Net profit of GBP50,000 and basic EPS of 0.01p, the Company's

first period of operating profit

-- Adjusted EPS of 0.02p (see Note 4 for details)

-- Net cash decreased in the period as we supported an

incremental large contract win with a Tier 1 customer in the rail

sector that started in January, with cash collection beginning only

in the final week of the half-year period

-- Cash balances have improved since the interim period as the

Group has continued to benefit from improved quality of business

and disciplined cash collection processes

-- Successful, over-subscribed placing to raise c.GBP1.25m completed 9 June 2020

-- Several post-period new contract wins announced

Commenting on the results Shaun Doak, CEO said:

"We are delighted to report the Company's first period of

operating profit, the culmination of work across the business to

redefine the business model, strengthen business processes and

engage with customers in a more consistent manner.

As a people-orientated business we have not been immune to the

challenges brought about by COVID-19, however the Company has

experienced an increase in demand for professional deep cleaning

and decontamination services as we strive to help organisations in

the UK reduce risk and return their properties to safe commercial

use.

The second half of the year has started well, with good trading

across key sectors, especially healthcare, rail and facilities

management. We remain confident of delivering a performance ahead

of management expectations for the year to 30 September 2020

including a full year maiden profit."

For more information:

REACT Group Plc.

Shaun Doak, Chief Executive Of cer Tel: +44 (0) 1283 550

Andrea Pankhurst, Chief Financial Officer 503

SPARK Advisory Partners Limited

(Nominated Adviser)

Neil Baldwin / Henry Todd Tel: +44 (0) 113 370

8974

Allenby Capital Limited

(Broker)

Amrit Nahal / Tony Quirke (Broking) Tel: +44 (0) 203 328

Nick Athanas / Liz Kirchner (Corporate 5656

Finance)

MB Associates

(Strategic Adviser)

Mark Braund Tel: +44 (0) 798 222

0001

RESULTS SUMMARY & STRATEGY

The REACT business performed strongly during the first half of

the year, increasing revenue and delivering further improvements to

gross margins and operational efficiencies to deliver the Group's

maiden operating profit.

Performance was especially strong in the healthcare, rail and

facilities management sectors, augmented by one month of COVID-19

related services.

The REACT Group is a specialist cleaning, hygiene and

decontamination company that tackles extreme cleaning challenges

that non-specialists are unqualified or inexperienced to resolve.

REACT operate across many industries in both the public and private

sector, where hygiene and safety are critical components. We

provide our services on both a regular maintenance and project

defined basis.

Growth and resilience in our markets is underpinned by

regulatory requirements and the associated enforcement burden,

alongside an increasing public and commercial expectation for

quality hygiene.

Nearly 75% of our revenue comes from contract agreements where

REACT is providing regular maintenance or is the first responder to

emergencies. The vast majority of the work we carry out is

non-discretionary to our Customers, providing REACT with increasing

visibility of future earnings.

Our activities are not capital intensive and, on an underlying

basis, are cash generative. When augmented by the recent GBP1.25

million fund-raise, REACT has a strong platform to fund continued

organic growth from internally generated cash in line with our

disciplined approach to cash management and capital allocation.

Our strategy is to grow business in specialist markets that

attract higher margins. We have a number of customers and prospects

from both the private and public sectors who value the quality of

service REACT Group provides; and they represent an opportunity for

greater volumes of business geographically and via the additional

services we provide.

We believe there is opportunity for material growth amongst a

number of both large and medium sized organisations, many of whom

are already customers. The sales and business development efforts

of REACT are now focused on these opportunities, whilst at the same

time we are continuing to improve operational quality and cost

control.

IMPACT OF COVID-19

As a people-orientated business we have not been immune to the

challenges brought about by COVID-19, however the Company has

experienced an increase in demand for professional deep cleaning

and decontamination services as we strive to help organisations in

the UK reduce risk and return their properties to safe commercial

use.

One month (March) of COVID-19 related activity is included in

these unaudited half year results.

PEOPLE

The continued dedication of people across the Group, including

our network of REACT-approved specialist sub-contractors has been

impressive. Our services are provided by people who are experts in

their field, supported by office-based staff who adapted rapidly

and effectively to the new working from home arrangements since

March. As we build our business we rely on these people and the

strength of our results reflects their contribution. On behalf of

the Board and shareholders, I wish to thank our entire team for

their hard work, resilience and dedication.

OUTLOOK

Through restructuring and strategic focus REACT has positioned

itself well for future development. With an experienced management

team in place and the funding necessary to properly address the

potential, our focus is to deliver growth, produce profits and

generate cash.

The second half of the year has started well and, taking into

account trading across each sector of our business, we are

confident of delivering both a 'maiden profit' and a full year

performance ahead of management expectations.

Shaun Doak

Chief Executive Officer

29 June 2020

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 31 March 2020

Unaudited Unaudited Audited

6 months 6 months Year ended

ended ended 30 September

31 March 31 March 2019

2020 2019

Note GBP'000 GBP'000 GBP'000

Continuing Operations

Revenue 2,091 1,588 3,103

Cost of Sales (1,396) (1,169) (2,218)

---------- ---------- --------------

Gross Profit 695 419 885

Administrative expenses (632) (478) (1,068)

Exceptional (costs)/income

included in administrative

expenses - 107 (5)

---------------------------------- ----- ---------- ---------- --------------

Operating profit/(loss) 63 (59) (183)

Income tax credit - - -

Finance cost (13) - -

---------- ---------- --------------

Profit/(Loss) for the period 50 (59) (183)

Other comprehensive Income - - -

Profit /(Loss) for the financial

period attributable to equity

holders of the company 50 (59) (183)

========== ========== ==============

Basic and diluted profit/(loss)

per share 4

Basic earnings/(loss) per share 0.01p (0.01p) (0.04p)

========== ========== ==============

Diluted earnings/(loss) per

share 0.01p (0.01p) (0.04p)

========== ========== ==============

Adjusted basic earnings/(loss)

per share 0.02p (0.01p) (0.03p)

========== ========== ==============

Adjusted diluted earnings/(loss)

per share 0.02p (0.01p) (0.03p)

========== ========== ==============

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 31 March 2020

Unaudited Unaudited Audited

As at 31 As at 31 As at 30

March March 2019 September

2020 2019

Assets GBP'000 GBP'000 GBP'000

Non-current assets

Intangibles 174 174 174

Property, plant and equipment 71 80 81

Right-of-use assets 34 - -

---------- ------------ -----------

279 254 255

---------- ------------ -----------

Current assets

Trade and other receivables 1,112 994 718

Cash and cash equivalents 306 446 440

1,418 1,440 1,158

Total assets 1,697 1,694 1,413

========== ============ ===========

Equity

Shareholders' Equity

Called-up equity share capital 1,039 1,039 1,039

Share premium account 4,926 4,926 4,926

Reverse acquisition reserve (5,726) (5,726) (5,726)

Capital redemption reserve 3,337 3,337 3,337

Merger relief reserve 1,328 1,328 1,328

Share based payments 14 20 12

Accumulated losses (3,999) (3,922) (4,038)

Total Equity 919 1,002 878

---------- ------------ -----------

Liabilities

Current liabilities

Trade and other payables 730 692 535

Lease liabilities within one

year 11 - -

---------- ------------ -----------

741 692 535

---------- ------------ -----------

Non-current liabilities

Lease liabilities after one

year 37 - -

---------- ------------ -----------

37 - -

---------- ------------ -----------

Total liabilities 778 692 535

---------- ------------ -----------

Total Liabilities and Equity 1,697 1,694 1,413

========== ============ ===========

CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended 31 March 2020

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

31 March 31 March 30 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

Net cash (utilised)/generated

by operations (112) 14 34

Cash flows from financing activities - - -

Lease liability payments (15) - -

Net cash outflow from financing

activities (15) - -

---------- ---------- --------------

Net cash from investing activities

Disposal of fixed assets 2 - 8

Capital expenditure (9) 9 (25)

Net cash outflow from investing

activities (7) 9 (17)

---------- ---------- --------------

Net (decrease)/increase in

cash, cash

equivalents and overdrafts (134) 23 17

Cash, cash equivalents and

overdrafts at

beginning of period 440 423 423

Cash, cash equivalents and

overdrafts at end of period 306 446 440

========== ---------- --------------

Reconciliation of profit for the period to cash outflow from operations

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

31 March 31 March 30 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

Profit/(loss) for the period 50 (59) (183)

(Increase)/decrease in receivables (394) 165 441

Increase/(decrease) in payables 195 (118) (275)

Depreciation and amortisation

charges 22 29 52

Finance costs 13 - -

Profit on disposal of fixed

assets - (3) (3)

Share based payment 2 - 2

---------- ---------- ------------------

Net cash (outflow)/inflow

from operations (112) 14 34

========== ========== ==================

Consolidated Statement of Changes in Equity

For the six months ended 31 March 2020

Share

Merger Capital Reverse Based

Share Share Relief Redemption Acquisition Payments Accumulated Total

Capital Premium Reserve Reserve Reserve Reserve Deficit Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 30 September

2018 1,039 4,926 1,328 3,337 (5,726) 20 (3,863) 1,061

--------- --------- --------- ----------- ------------ ---------- ------------ --------

Loss for the

period - - - - - - (59) (59)

At 31 March

2019 1,039 4,926 1,328 3,337 (5,726) 20 (3,922) 1,002

--------- --------- --------- ----------- ------------ ---------- ------------ --------

Share based

payments - - - - - 2 (2) -

On surrender of

warrants - - - - - (10) 10 -

Loss for the

period - - - - - - (124) (124)

At 30 September

2019 1,039 4,926 1,328 3,337 (5,726) 12 (4,038) 878

--------- --------- --------- ----------- ------------ ---------- ------------ --------

Share based

payments - - - - - 2 - 2

Effect of

adoption

of IFRS 16 - - - - - - (11) (11)

Profit for the

period - - - - - - 50 50

At 31 March

2020 1,039 4,926 1,328 3,337 (5,726) 14 (3,999) 919

--------- --------- --------- ----------- ------------ ---------- ------------ --------

Notes to the interim financial statements

1. Basis of preparation

These consolidated interim financial statements have been

prepared in accordance with International Financial Reporting

Standards ("IFRS") as adopted by the European Union and on a

historical basis, using the accounting policies which are

consistent with those set out in the Group's annual report and

accounts for the year ended 30 September 2019, with the exception

of the adoption of IFRS 16 Leases, which is effective for

accounting periods beginning on or after 1 January 2019. The

interim financial information for the six months ended 31 March

2020, which complies with IAS 34 'Interim Financial Reporting' were

approved by the Board of Directors on 29 June 2020.

The unaudited interim financial information for the six months

ended 31 March 2020 does not constitute statutory accounts within

the meaning of Section 435 of the Companies Act 2006. The

comparative figures for the year ended 30 September 2019 are

extracted from the statutory financial statements which have been

filed with the Registrar of Companies and contain an unqualified

audit report and did not contain statements under Section 498 to

502 of the Companies Act 2006.

2. Principal Accounting Policies

The principal accounting policies adopted are consistent with

those of the annual financial statements for the year ended 30

September 2019, with the exception of IFRS 16 Leases, which has

been adopted for the first time in these interim statements, and

are those expected to be applied for the year ending 30 September

2020.

-- IFRS 16 Leases

The Group has adopted IFRS 16 Leases using the modified

retrospective approach with recognition of transitional adjustments

on the date of initial application (1 October 2019), without

re-statement of comparative figures. As a lessee, the Group

previously classified leases as operating leases or finance leases.

Under IFRS 16, the Group recognises right-of-use assets and lease

liabilities for leases that meet the recognition criteria.

3. Segmental Reporting

In the opinion of the directors, the Group has one class of

business, being that of specialist cleaning and decontamination

services. The Group's primary reporting format is determined by the

geographical segment according to the location of its

establishments. There is currently only one geographic reporting

segment, which is the UK. All costs are derived from the single

segment.

4. Earnings/(Loss) per Share (basic and adjusted)

The calculations of earnings/(loss) per share (basic and

adjusted) are based on the net profit/(loss) and adjusted

profit/(loss) respectively and the ordinary shares in issue during

the period. The adjusted profit/(loss) represents the EBITDA for

the period.

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

31 March 31 March 30 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

Net profit/(loss) for period 50 (59) (183)

============ ============ ==============

Adjustments:

Interest 13 - -

Depreciation 22 29 52

Adjusted profit/(loss) for

the period 85 (30) (131)

============ ============ ==============

Number Number Number

Weighted average shares in

issue for basic earnings/(loss)

per share 415,407,753 415,407,753 415,407,753

Weighted average dilutive

share options and warrants 65,065,130 * *

------------ ------------ --------------

Average number of shares

used for dilutive earnings/(loss)

per share 480,472,883 415,407,753 415,407,753

============ ============ ==============

pence pence pence

Basic earnings/(loss) per

share 0.01p (0.01p) (0.04p)

============ ============ ==============

Diluted earnings/(loss) per

share 0.01p (0.01p) (0.04p)

============ ============ ==============

Adjusted basic earnings/(loss)

per share 0.02p (0.01p) (0.03p)

============ ============ ==============

Adjusted diluted earnings/(loss)

per share 0.02p (0.01p) (0.03p)

============ ============ ==============

* Where a loss is incurred, the effect of outstanding share

options and warrants is considered anti-dilutive.

Copies of this Interim Report are available from the Company

Secretary, 115 Hearthcote Road, Swadlincote, Derbyshire DE11 9DU

and on the Company's website www.reactsc.co.uk/react-group-plc

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR UBVURRWUNUAR

(END) Dow Jones Newswires

June 29, 2020 02:00 ET (06:00 GMT)

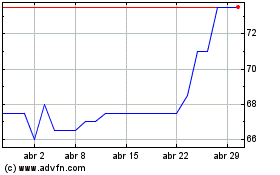

React (LSE:REAT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

React (LSE:REAT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024