TIDMBAF

British & American Investment Trust PLC

Annual Financial Report

for the year ended 31 December 2019

Registered number: 00433137

Directors Registered office

David G Seligman (Chairman) Wessex House

Jonathan C Woolf (Managing Director) 1 Chesham Street

Dominic G Dreyfus (Non-executive and Chairman of the Audit Telephone: 020 7201

Committee) 3100

Alex Tamlyn (Non-executive) Registered in

England

No.00433137

29 June 2020

This is the Annual Financial Report as required to be published under DTR 4 of

the UKLA Listing Rules.

Financial Highlights

For the year ended 31 December 2019

2019 2018

Revenue Capital Total Revenue Capital Total

return return return return

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Profit/(loss) before tax - 862 (599) 2,489 (502)

realised (1,461) (2,991)

Profit/(loss) before tax - - 1,657 1,657 - (4,644) (4,644)

unrealised

__________ __________ __________ __________ __________ __________

Profit/(loss) before tax - 862 196 1,058 2,489 (7,635) (5,146)

total

__________ __________ __________ __________ __________ __________

Earnings per GBP1 ordinary

share - basic 2.26p 0.78p 3.04p 8.68p (30.54)p (21.86)p

__________ __________ __________ __________ __________ __________

Earnings per GBP1 ordinary

share - diluted 2.61p 0.56p 3.17p 7.20p (21.81)p (14.61)p

__________ _________ __________ __________ _________ __________

Net assets 6,504 7,919

__________ __________

Net assets per ordinary

share

- deducting preference

shares 19p 23p

at fully diluted net

asset value*

__________ __________

- diluted 19p 23p

__________ __________

22p

Diluted net asset value per

ordinary share at 22 June

2020

__________

Dividends declared or

proposed for the period

per ordinary share

- interim paid 2.7p 2.7p

- final proposed 0.0p 6.0p

per preference share 1.75p 3.5p

*Basic net assets are calculated using a value of fully diluted net asset value

for the preference shares. Basic net assets per ordinary share at 31 December

2018 have been restated using a value of fully diluted net asset value for the

preference shares instead of using a value of par for the preference shares.

Chairman's Statement

I report our results for the year ended 31 December 2019.

As announced on 7th April, we have delayed the release of these results by two

months in response to the Coronavirus (COVID-19) pandemic which broke out in

the UK in March, at which time the Financial Conduct Authority (FCA) put in

place extensions to listed company reporting deadlines.

This delay has allowed us to reduce as much as possible employee exposure to

the virus through reduced work travel and professional adviser contact, and to

minimise onward transmission at a time when maximum pressure on hospitals and

the NHS was expected.

This later reporting date also enables us to report to shareholders in a fuller

and more informed way when more has become known about the progression and

effects of the pandemic and the impact on the markets and our portfolio of the

government's unprecedented social and financial response to the pandemic.

To complement the extension to the deadline for reporting listed company annual

results, regulations have also been put in place to extend the deadlines for

the filing of Annual Returns at Companies House, the holding of AGMs and the

release of interim results during the current year. Accordingly, our Annual

General Meeting will now be held on 24th September 2020 and our interim results

to 30th June 2020 will be published by end-October 2020.

Revenue

The return on the revenue account before tax amounted to GBP0.9 million (2018: GBP

2.5 million), a decrease of 65 percent. This decrease was due a reduction in

income received from subsidiary companies and from external investments. The

reduced rate of subsidiary company income was a function of the lower asset

prices and sales in those companies which reduced available distributable

reserves in those companies.

Gross revenues totalled GBP1.2 million (2018: GBP3.1 million). In addition, film

income of GBP106,000 (2018: GBP92,000) and property unit trust income of GBP14,000

(2018: GBP14,000) was received in our subsidiary companies. In accordance with

IFRS10, these income streams are not included within the revenue figures noted

above.

The total return before tax amounted to a profit of GBP1.1 million (2018: GBP5.1

million loss), which comprised net revenue of GBP0.9 million, a realised loss of

GBP1.1 million and an unrealised gain of GBP1.7 million. The revenue return per

ordinary share was 2.3p (2018: 8.7p) on an undiluted basis and 2.6p (2018:

7.2p) on a diluted basis.

Net Assets and Performance

Net assets at the year end were GBP6.5 million (2018: GBP7.9 million), a decrease

of 18.0 percent and reflects the payment of GBP2.5 million in dividends to

shareholders during the year. This compares to increases in the FTSE 100 and

All Share indices of 12.1 percent and 14.2 percent, respectively, over the

period. On a total return basis, after adding back dividends paid during the

year, our net assets increased by 14.0 percent compared to 16.5 percent and

18.0 percent increases in the FTSE 100 and All Share indices, respectively.

At the half year, we reported substantial outperformance against the benchmark

indices on a total return basis by approximately 12 percent. This was

principally the result of solid gains of 40 percent in sterling terms in the

value of our largest US investment, Geron Corporation. By year end, however,

that increase had reduced somewhat to a gain of 30 percent, reflecting also a

weakening of the US dollar over the period, and as a result our total return

for the full year registered a modest underperformance against the benchmark

indices on the same basis.

The growth in Geron Corporation's share price over the year reflected the

beginning of a recovery in market perception of the company following the

sudden and unexpected withdrawal of its partner Johnson & Johnson in September

2018. This had precipitated a collapse of over 80 percent in Geron's stock

price in the fourth quarter of that year. It was the shock of this withdrawal

and not any underlying problem with Geron's haematological cancer drug,

Imetelstat, or the ongoing clinical trial programmes which engendered this

decline in market value. As this shock began to dissipate in 2019 and

encouraging results of the clinical trials were released during the year, the

share price began to recover accordingly. Further important developments in

Geron's business have occurred recently, including a major fundraising, the

addition of a second Phase 3 clinical trial to its programme and further high

level technical personnel hires from leading pharma companies. These have added

to the continued recovery in Geron's share price and are discussed in more

detail in the managing director's report below.

More generally, there was no absence of major themes and events driving

investment sentiment in the UK and USA in 2019, many of them with competing

effects on investment and markets. In the USA, these included the economic and

market stimulating effects of the Trump administration's fiscal stimulus

programme through corporate tax reductions, the contrastingly depressing

effects of the ever developing and vacillating trade war with China, changes in

the direction in the Federal Reserve's US dollar interest rate policy as

economic growth prospects varied with each new and erratic White House policy

initiative, and large movements in US dollar exchange rates as interest rates

across the maturity spectrum tumbled to historic lows, presaging the advent of

recession.

In the UK, these themes included the difficult and protracted Brexit

negotiations, with missed and extended deadlines and the prospect of a no-deal

exit from the European Union, dysfunction in parliament with the opposition

taking control of the order paper and an unprecedented series of heavy

government defeats, the end of the 10 year economic growth cycle which had been

in place since the financial crisis of 2008 and finally the resignation of the

prime minister as the impasse in Brexit overwhelmed the parliamentary process

leading to the appointment of Boris Johnson who brought some order to the

process at the last moment at the end of the year.

Not surprisingly, all these competing events resulted in multiple swings in

sentiment and direction in equity markets and currencies during the year. The

rising trend of the first half of the year, itself a recovery from the falls of

the previous year and based on the provision of central bank liquidity through

substantial interest rate reductions, dissipated in the second half of the year

as investors' resilience to the events noted above evaporated. Investors'

appetite was also finally further constrained by other worrying global

developments which had been growing over time, including the mass and

uncontrolled migration of peoples from Africa/the Middle East into Europe and

from Central America in to the USA, the rising and increasingly domineering

assertiveness of China politically and economically, the interference by Russia

in the elections, sovereignty and security of other countries and the gradual

erosion of norms relating to the international rules based system through

popularism.

Notwithstanding all of the above, equity markets finished the year with

sizeable gains as high liquidity levels continued to provide support in the

absence of acceptable alternative yield-generating investments.

Dividend

As announced on 7th April, we do not to recommend the payment of a final

dividend for the 2019 financial year.

In December 2019, we paid a half-year interim dividend on our ordinary shares

of 2.70 pence, representing a yield of approximately 5.6 percent on the

ordinary share price at the time of announcement and of approximately 6.5

percent averaged over the year as a whole.

This decision is made in the context of the economic and investment realities

arising out of the COVID-19 pandemic, as explained in more detail in the

managing director's report below. Additionally, however, as already announced

in our 2019 interim statement and 2018 annual report, the continuation of our

progressive dividend policy, which had been in place for over twenty years,

would depend on a return in the share price of our major investment, Geron

Corporation, to levels closer to those seen in 2018 to enable us to generate

distributable income internally within our group. To date this has not

occurred, although the recent improvements in the share price and in the

company's general prospects as already noted bode well for a return to those

former price levels at a date hopefully in the not too distant future.

Within these constraints and although the generation of reliable dividend

income from external sources has now been placed in doubt for a time due to the

COVID-19 pandemic, it is our intention to resume our dividend payments as soon

as possible, as and when circumstances permit, potentially through ad hoc

interim payments not necessarily on our normal dividend timetable, and

eventually to catch up when and if possible on with-held or reduced payments.

In the first instance, we intend to pay an initial interim dividend of at least

1.75 pence per share in respect of the six months to 30th June 2020.

Recent events and outlook

The COVID-19 pandemic and the social, financial and economic policy responses

put in place to minimise infections and deaths around the world have dominated

the first six months of this year in a way which has been completely

unimaginable to people, companies and governments.

With infection rates and deaths having finally plateaued and started to fall

towards the end of the second quarter, the immediate and dramatic effect on

equity markets seen in March, when markets fell by over 30 percent over 10

days, has now stabilised and a recovery of over 50 percent of those falls has

now been seen.

Now the difficult task for governments of managing the safe release from

lockdown and other social and work constraints is underway, together with plans

to start reducing the many and unprecedented financial and fiscal support

programmes which governments have put in place in most leading economies.

The long term effect of the pandemic in terms of damage to businesses and jobs

and the prospects for economic recovery will not be evident for some time and

will depend in part on whether a second wave of infections materialises this

year, together with the success and timing of the development of vaccines or

treatments to combat the disease.

With the current partial recovery in markets noted above, investors have been

taking a relatively optimistic view of prospects for recovery, particularly

given the high market levels seen just prior to the outbreak of the pandemic,

despite the accumulation of worrying economic and political trends over the

past two years.

Having divested the portfolio out of some of our general sterling-based fund

investments over the past two years, our increased exposure to US biopharma

investments which do not tend track general market movements so closely, should

provide some element of protection against the continued anticipated volatility

in equity markets over the coming period in what will hopefully be the wake of

the COVID-19 pandemic. In the meantime, we pursue the aims of our investment

programme to capture capital growth from the continued market re-rating of

those biopharma company investments as they progress steadily towards

commercialisation of their ground-breaking and valuable technologies.

As at 22 June 2020, our net assets had increased to GBP7.7 million, an increase

of 18.0 percent since the beginning of the calendar year due principally to the

43.4 percent increase in the share price of Geron Corporation over this period.

This is equivalent to 21.9 pence per share (prior charges deducted at fully

diluted value) and 21.9 pence per share on a diluted basis. Over the same

period the FTSE 100 decreased 17.2 percent and the All Share Index decreased

17.5 percent.

David Seligman

29 June 2020

Managing Director's report

With most of the world's largest economies effectively closed down for months

in the second quarter of 2020 and possibly longer due to the medical emergency

caused by the COVID-19 pandemic, the economic trends and themes which had been

in place since the financial crisis of 2008 have been suddenly and violently

interrupted.

In 2019, the 10 year recovery in equity and financial markets was still

continuing, fuelled latterly by substantial corporate tax cuts in the USA and

the maintenance of multi-year liquidity provision by central banks to keep an

anaemic and slow recovery from the 2008 Great Recession in place, despite ever

increasing economic and geo-political concerns which have been referred to here

over the last two years.

At this point, with no effective treatments or vaccines available or in

immediate prospect, the short term and unprecedented hit to jobs, business and

economic growth will no doubt extend into the medium term to a greater or

lesser extent, as the massive financial and fiscal support measures put in

place by governments in recent months can only be sustained for a limited

period of time. Most leading economies are likely to suffer larger and swifter

declines in GDP in the current year than they experienced in 2008 and it is not

yet clear when and in what form the eventual recovery can begin.

As noted above, our portfolio outperformed the benchmarks in the first half of

2019, principally due to a recovery in the value of our largest US investment,

Geron Corporation, from its large fall at the end of 2018, but slightly

underperformed by year end as Geron's recovery weakened somewhat while the US

dollar strengthened by 7 percent. With Geron and our other US biopharma

investments now representing a larger percentage of our portfolio (60 percent

at 31st December 2019) following a reduction in our UK denominated fund

investments over the past two years, the portfolio's exposure to movements in

the US dollar exchange rate is somewhat greater than hitherto, although it is

partly offset by a US dollar cash hedge.

In terms of income, our policy over the past few years of generating income

from external investments and profitable asset sales in our subsidiary

companies has become more difficult over time. Paying ever higher levels of

dividend each year out of a shrinking asset base, due both to shareholder

payments and asset values which have not performed in line with expectations,

has become an increasing strain.

Additionally and recently in respect of our externally received income, a new

constraint on corporate dividend payments has now arisen out of the COVID-19

pandemic. In late March, the major UK banks announced the cancellation of

their 2020 dividends in the face of government pressure. This measure was to

ensure the conservation of bank resources in furtherance of the government's

emergency financial support programmes to companies and individuals. Since

then, many other leading companies have similarly cancelled or suspended their

dividend payments to protect their balance sheets and conserve cash resources,

particularly in those industries with operations or revenues badly disrupted by

the pandemic's effects, including transport, leisure, hospitality, energy,

manufacturing and utilities. These have included many FTSE 100 index stocks and

hitherto decades-long dividend paying companies. Currently, around 50 percent

of FTSE index companies have now cut or cancelled their dividends, covering

over GBP30 billion of dividends and representing more than 40 percent of the

annual FTSE 100 and FTSE 250 dividend payment, with more cuts expected as the

year progresses.

This systemic reduction in dividend payments will have a significant effect in

the short to medium term on those savings institutions relying on investment

income generation for their operations, including pension funds, assurance and

other investment vehicles, such as ourselves. It is partly for this reason

that we have judged it prudent not to pay a final dividend this year.

In relation to income generated internally from our subsidiaries, the level of

distributable reserves in those subsidiaries is now insufficient to continue

the quantum of distributions seen in earlier years, due principally to the

disappointing performance of our US biopharma investments over the recent

period. As and when these values return to expected and previously achieved

levels, we will be able to recommence the generation of internal income for

onward distribution to shareholders.

In this context, an appraisal of the current circumstances and prospects of our

largest such holding, Geron Corporation, is set out below.

Geron Corporation

We are hopeful that our long-held and sometimes difficult strategic investment

in Geron Corporation may soon reach a level of maturity. Although this seemed

to be the case in 2018 when its five year collaboration with Johnson & Johnson

was yielding encouraging Phase 2 trial results in the run-up to a contractual

continuation point and the share price had increased by over 200 percent in

anticipation of this in the first part of the year, it was not to be the case

when Johnson & Johnson withdrew unexpectedly in September of that year.

In the time since, Geron Corporation has worked steadily to prove that Johnson

& Johnson's withdrawal was not related to any underlying problem with its

oncology drug or the clinical trials by continuing to publish ever improving

trial results. This culminated in a successful Phase 2 clinical trial

conclusion at the end of 2019 with excellent results in terms of blood

transfusion free periods and patient life extension, outperforming all other

available treatment options for the two haematological cancer conditions under

investigation, Myelodysplastic Syndrome (MDS) and Myelofibrosis (MF).

Furthermore, Geron has recently announced FDA agreement for its second Phase 3

trial (in MF) which is another important milestone and most significantly has

raised US$150 million through an equity issue which will provide sufficient

funds to take it through both of its Phase 3 trials. Three large institutional

investors, including two leading biotech sector investment funds, took

significant positions in the issue which was very well received by the market

with the share price since trading well above the issue price. Latterly, all

of the major market analysts covering Geron have re-iterated the stock as a buy

with a price target of 150 percent of its current level.

It is hoped, therefore, that this sufficiency of funding and the support of

these large funds will deter further activity by professional short sellers of

Geron stock, which through their large positions held over many years and which

have regularly exceeded over 35 percent of total shares issued, have for so

long prevented the true underlying value and future prospects of Geron being

fairly recognised in the market. Instructively, regulatory reporting since the

share issue last month shows a significant reduction in the outstanding short

position of almost 50 percent to the lowest level seen for over 10 years.

Industries such as biotech, which by their nature in their early stages

generate little income and whose futures depend entirely on the binary and

time-consuming outcome of their drug development and clinical testing

programmes, can be the victim of concerted and often unscrupulous short selling

activities by professional traders and funds. They struggle as a result to

make progress and to raise funds for their development over the long term in

the face of these market activities. It is highly regrettable that potentially

very successful enterprises, and particularly in a sector devoted to the

development of life improving or saving medicines which are designed to benefit

us all, should be faced with these additional and unnecessary challenges to

their success.

Jonathan Woolf

29 June 2020

Income statement

For the year ended 31 December 2019

2019 2018

Revenue Capital Total Revenue Capital Total

return return return return

GBP 000 GBP 000 GBP 000 GBP 000 GBP 000 GBP 000

Investment income (note 2) 1,243 - 1,243 3,056 - 3,056

Holding gains/(losses) on 1,657 1,657 (4,644) (4,644)

investments at fair value - -

through profit or loss

Losses on disposal of

investments at fair value - (1,113) (1,113) - (2,647) (2,647)

through profit or loss*

Foreign exchange (losses)/ 53 (57) (4) (61) (62) (123)

gains

Expenses (381) (242) (623) (457) (237) (694)

________ ________ ________ ________ ________ ________

Profit/(loss) before finance 915 245 1,160 2,538 (7,590) (5,052)

costs and tax

Finance costs (53) (49) (102) (49) (45) (94)

________ ________ ________ ________ ________ ________

Profit/(loss) before tax 862 196 1,058 2,489 (7,635) (5,146)

Tax 52 - 52 31 - 31

________ ________ ________ ________ ________ ________

Profit/(loss) for the year 914 196 1,110 2,520 (7,635) (5,115)

________ ________ ________ ________ ________ ________

Earnings per share

Basic - ordinary shares 2.26p 0.78p 3.04p 8.68p (30.54)p (21.86)p

________ ________ ________ ________ ________ ________

Diluted - ordinary shares 2.61p 0.56p 3.17p 7.20p (21.81)p (14.61)p

________ ________ ________ ________ ________ ________

The company does not have any income or expense that is not included in the

profit/(loss) for the year. Accordingly, the 'Profit/(loss) for the year' is

also the 'Total Comprehensive Income for the year' as defined in IAS 1

(revised) and no separate Statement of Comprehensive Income has been presented.

The total column of this statement represents the Income Statement, prepared in

accordance with IFRS. The supplementary revenue return and capital return

columns are both prepared under guidance published by the Association of

Investment Companies. All items in the above statement derive from continuing

operations.

All profit and total comprehensive income is attributable to the equity holders

of the company.

*Losses on disposal of investments at fair value through profit or loss include

Losses on sales of GBP1,274,000 (2018 - GBP917,000 losses) and Gains on provision

for liabilities and charges of GBP161,000 (2018 - GBP1,730,000 losses).

Statement of changes in equity

For the year ended 31 December 2019

Share Capital Retained Total

capital reserve earnings

GBP 000 GBP 000 GBP 000 GBP 000

Balance at 31 December 2017 35,000 (21,167) 1,701 15,534

Changes in equity for 2018

(Loss)/profit for the period - (7,635) 2,520 (5,115)

Ordinary dividend paid (note 4) - - (2,150) (2,150)

Preference dividend paid (note 4) - - (350) (350)

________ ________ ________ ________

Balance at 31 December 2018 35,000 (28,802) 1,721 7,919

Changes in equity for 2019

Profit for the period - 196 914 1,110

Ordinary dividend paid (note 4) - - (2,175) (2,175)

Preference dividend paid (note 4) - - (350) (350)

________ ________ ________ ________

Balance at 31 December 2019 35,000 (28,606) 110 6,504

________ ________ ________ ________

Registered number: 00433137

Balance Sheet

At 31 December 2019

2019 2018

GBP 000 GBP 000

Non-current assets

Investments - fair value through 6,704 8,722

profit or loss

Subsidiaries - fair value through 5,335 5,269

profit or loss

__________ __________

12,039 13,991

Current assets

Receivables 1,588 3,417

Cash and cash equivalents 2,504 244

__________ __________

4,092 3,661

__________ __________

Total assets 16,131 17,652

__________ __________

Current liabilities

Trade and other payables 3,617 547

Bank loan 2,635 2,790

__________ __________

(6,252) (3,337)

__________ __________

Total assets less current liabilities 9,879 14,315

__________ __________

Non - current liabilities (3,375) (6,396)

__________ __________

Net assets 6,504 7,919

__________ __________

Equity attributable to equity holders

Ordinary share capital 25,000 25,000

Convertible preference share capital 10,000 10,000

Capital reserve (28,606) (28,802)

Retained revenue earnings 110 1,721

__________ __________

Total equity 6,504 7,919

__________ __________

Approved: 29 June 2020

Cash flow statement

For the year ended 31 December 2019

Year ended Year ended

2019 2018

GBP 000 GBP 000

Cash flows from operating activities

Profit/(loss) before tax 1,058 (5,146)

Adjustments for:

(Gains)/losses on investments (544) 7,291

Dividends in specie - (290)

Proceeds on disposal of investments at fair 16,316 13,635

value through profit and loss

Purchases of investments at fair value through (14,521) (12,335)

profit and loss

Finance costs 102 94

__________ __________

Operating cash flows before movements in working 2,411 3,249

capital

Decrease/(increase) in receivables 2,417 (712)

Decrease in payables (363) (773)

__________ __________

Net cash from operating activities before 4,465 1,764

interest

Interest paid (97) (90)

__________ __________

Net cash from operating activities 4,368 1,674

Cash flows from financing activities

Dividends paid on ordinary shares (1,778) (1,839)

Dividends paid on preference shares (175) (350)

Bank loan (155) (1,454)

__________ __________

Net cash used in financing activities (2,108) (3,643)

__________ __________

Net increase/(decrease) in cash and cash 2,260 (1,969)

equivalents

Cash and cash equivalents at beginning of year

244 2,213

__________ __________

Cash and cash equivalents at end of year

2,504 244

__________ __________

Purchases and sales of investments are considered to be operating activities of

the company, given its purpose, rather than investing activities.

1 Basis of preparation and going concern

The financial information set out above contains the financial information of

the company for the year ended 31 December 2019. The company has prepared its

financial statements under IFRS. The financial statements have been prepared on

a going concern basis adopting the historical cost convention except for the

measurement at fair value of investments, derivative financial instruments and

subsidiaries.

The information for the year ended 31 December 2019 is an extract from the

statutory accounts to that date. Statutory company accounts for 2018, which

were prepared under IFRS as adopted by the EU, have been delivered to the

registrar of companies and company statutory accounts for 2019, prepared under

IFRS as adopted by the EU, will be delivered in due course.

The auditors have reported on the 31 December 2019 year end accounts and their

reports were unqualified and did not include references to any matters to which

the auditors drew attention by way of emphasis without qualifying their reports

and did not contain statements under section 498(2) or (3) of the Companies Act

2006.

The directors, having made enquiries, consider that the company has adequate

financial resources to enable it to continue in operational existence for the

foreseeable future. Accordingly, the directors believe that it is appropriate

to continue to adopt the going concern basis in preparing the company's

accounts.

2 Income

2019 2018

GBP 000 GBP 000

Income from investments

UK dividends 938 1,180

Overseas dividends 173 92

Scrip and in specie dividends - 290

Dividend from subsidiary 74 1,445

Interest on fixed income securities - 1

__________ __________

1,185 3,008

__________ __________

Other income 58 48

__________ __________

Total income 1,243 3,056

__________ __________

Total income comprises:

Dividends 1,185 3,007

Interest - 1

Other interest 58 48

__________ __________

1,243 3,056

__________ __________

Dividends from investments

Listed investments 1,111 1,562

Unlisted investments 74 1,445

__________ __________

1,185 3,007

__________ __________

Of the GBP1,185,000 (2018 - GBP3,007,000) dividends received, GBP879,000 (2018 - GBP

997,000) related to special and other dividends received from investee

companies that were bought after the dividend announcement. There was a

corresponding capital loss of GBP1,027,000 (2018 - GBP1,007,000), on these

investments.

Under IFRS 10 the income analysis is for the parent company only rather than

that of the consolidated group. Thus film revenues of GBP106,000 (2018 - GBP92,000)

received by the subsidiary British and American Films Limited and property unit

trust income of GBP14,000 (2018 - GBP14,000) received by the subsidiary BritAm

Investments Limited are shown separately in this paragraph.

3 Earnings per ordinary share

The calculation of the basic (after deduction of preference dividend) and

diluted earnings per share is based on the following data:

2019 2018

Revenue Capital Total Revenue Capital Total

return return return return

GBP 000 GBP 000 GBP 000 GBP 000 GBP 000

GBP 000

Earnings:

Basic 564 196 760 2,170 (7,635) (5,465)

Preference

dividend 350 - 350 350 - 350

__________ __________ __________ __________ __________ __________

Diluted 914 196 1,110 2,520 (7,635) (5,115)

__________ __________ __________ __________ __________ __________

Basic revenue, capital and total return per ordinary share is based on the net

revenue, capital and total return for the period after tax and after deduction

of dividends in respect of preference shares and on 25 million (2018: 25

million) ordinary shares in issue.

The diluted revenue, capital and total return is based on the net revenue,

capital and total return for the period after tax and on 35 million (2018: 35

million) ordinary and preference shares in issue.

4 Dividends

2019 2018

GBP 000 GBP 000

Amounts recognised as distributions to equity

holders in the period:

Dividends on ordinary shares:

Final dividend for the year ended 31 December 2018

of 6.0p (2017:5.9p) per share 1,500 1,475

Interim dividend for the year ended 31 December

2019 of 2.7p 675 675

(2018:2.7p) per share

__________ __________

2,175 2,150

__________ __________

Proposed final dividend for the year ended 31

December 2019 of 0.0p (2018:6.0p) per share - 1,500

__________ __________

Dividends on 3.5% cumulative convertible

preference shares:

Preference dividend for the 6 months ended 31

December 2018 of 1.75p (2017:1.75p) per share 175 175

Preference dividend for the 6 months ended 30 June

2019 of 1.75p (2018:1.75p) per share 175 175

__________ __________

350 350

__________ __________

Proposed preference dividend for the 6 months

ended 31 December 2019 of 0.00p (2018:1.75p) per - 175

share

__________ __________

We have set out below the total dividend payable in respect of the financial

year, which is the basis on which the retention requirements of Section 1158 of

the Corporation Tax Act 2010 are considered.

Dividends proposed for the period

2019 2018

GBP 000 GBP 000

Dividends on ordinary shares:

Interim dividend for the year ended 31 December

2019 of 2.7p (2018:2.7p) per share 675 675

Proposed final dividend for the year ended 31

December 2019 of 0.0p (2018:6.0p) per share - 1,500

__________ __________

675 2,175

__________ __________

Dividends on 3.5% cumulative convertible

preference shares:

Preference dividend for the year ended 31 December

2019 of 1.75p (2018:1.75p) per share 175 175

Proposed preference dividend for the year ended 31

December 2019 of 0.00p (2018:1.75p) per share - 175

__________ __________

175 350

__________ __________

5 Net asset values

Net asset

value per share

2019 2018

GBP GBP

Ordinary shares restated

Diluted 0.19 0.23

Undiluted 0.19 0.23*

Net asset

attributable

2019 2018

GBP 000 GBP 000

restated

Total net assets 6,504 7,919

Less convertible preference shares at (1,858) (2,263)

fully diluted value

__________ __________

Net assets attributable to ordinary 4,646 5,656*

shareholders

__________ __________

The undiluted and diluted net asset values per GBP1 ordinary share are based on

net assets at the year end and 25 million (undiluted) ordinary and 35 million

(diluted) ordinary and preference shares in issue.

*Net assets attributable to ordinary shareholders at 31 December 2018 have been

restated using a value of fully diluted net asset value for the preference

shares instead of using a value of par for the preference shares.

Principal risks and uncertainties

The principal risks facing the company relate to its investment activities and

include market risk (other price risk, interest rate risk and currency risk),

liquidity risk and credit risk. The other principal risks to the company are

loss of investment trust status and operational risk. These will be explained

in more detail in the notes to the 2019 Annual Report and Accounts, but remain

unchanged from those published in the 2018 Annual Report and Accounts.

Related party transactions

The company rents its offices from Romulus Films Limited, and is also charged

for its office overheads.

The salaries and pensions of the company's employees, except for the three

non-executive directors and one employee are paid by Remus Films Limited and

Romulus Films Limited and are recharged to the company.

During the year the company entered into the investment transactions to sell

stock for GBPnil (2018 - GBP346,709) to Second BritAm Investments Limited, for GBP

540,141 (2018 - GBPnil) to British & American Films Limited and for GBPnil (2018 -

GBP2,472) to BritAm Investments Limited.

There have been no other related party transactions during the period, which

have materially affected the financial position or performance of the company.

Capital Structure

The company's capital comprises GBP35,000,000 (2018 - GBP35,000,000) being

25,000,000 ordinary shares of GBP1 (2018 - 25,000,000) and 10,000,000 non-voting

convertible preference shares of GBP1 each (2018 - 10,000,000). The rights

attaching to the shares will be explained in more detail in the notes to the

2019 Annual Report and Accounts, but remain unchanged from those published in

the 2018 Annual Report and Accounts.

Directors' responsibility statement

The directors are responsible for preparing the financial statements in

accordance with applicable law and regulations. The directors confirm that to

the best of their knowledge the financial statements prepared in accordance

with the applicable set of accounting standards, give a true and fair view of

the assets, liabilities, financial position and the (loss)/profit of the

company and that the Chairman's Statement, Managing Director's Report and the

Directors' report include a fair review of the information required by rules

4.1.8R to 4.2.11R of the FSA's Disclosure and Transparency Rules, together with

a description of the principal risks and uncertainties that the company faces.

Annual General Meeting

This year's Annual General Meeting has been convened for Thursday 24 September

2020 at 12.15pm at Wessex House, 1 Chesham Street, London SW1X 8ND.

END

(END) Dow Jones Newswires

June 29, 2020 10:15 ET (14:15 GMT)

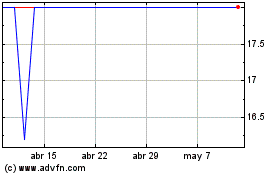

British & American Inves... (LSE:BAF)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

British & American Inves... (LSE:BAF)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024