Macy’s, Inc. (NYSE: M) (“Macy’s”) announced today that its

wholly-owned subsidiary, Macy’s Retail Holdings, LLC (“MRH”), has

received the requisite number of consents to adopt certain proposed

amendments with respect to the Old Notes (as defined below) and is

extending the early tender date (the “Early Tender Date”) for its

previously announced offers to eligible holders to exchange (each,

an “Exchange Offer” and, collectively, the “Exchange Offers”) (i)

new 6.65% Senior Secured Debentures due 2024 (“New 2024 Notes”) to

be issued by MRH for validly tendered (and not validly withdrawn)

outstanding 6.65% Senior Debentures due 2024 issued by MRH (“Old

2024 Notes”), (ii) new 6.7% Senior Secured Debentures due 2028

(“New 2028 Notes”) to be issued by MRH for validly tendered (and

not validly withdrawn) outstanding 6.7% Senior Debentures due 2028

issued by MRH (“Old 2028 Notes”), (iii) new 8.75% Senior Secured

Debentures due 2029 (“New 2029 Notes”) to be issued by MRH for

validly tendered (and not validly withdrawn) outstanding 8.75%

Senior Debentures due 2029 issued by MRH (“Old 2029 Notes”), (iv)

new 7.875% Senior Secured Debentures due 2030 (“New 2030 Notes”) to

be issued by MRH for validly tendered (and not validly withdrawn)

outstanding 7.875% Senior Debentures due 2030 issued by MRH (“Old

2030 Notes”), (v) new 6.9% Senior Secured Debentures due 2032 (“New

2032 Notes”) to be issued by MRH for validly tendered (and not

validly withdrawn) outstanding 6.9% Senior Debentures due 2032

issued by MRH (“Old 2032 Notes”), and (vi) new 6.7% Senior Secured

Debentures due 2034 (“New 2034 Notes” and, together with the New

2024 Notes, New 2028 Notes, New 2029 Notes, New 2030 Notes and New

2032 Notes, the “New Notes” and each series, a “series of New

Notes”) to be issued by MRH for validly tendered (and not validly

withdrawn) outstanding 6.7% Senior Debentures due 2034 issued by

MRH (“Old 2034 Notes” and, together with the Old 2024 Notes, Old

2028 Notes, Old 2029 Notes, Old 2030 Notes and Old 2032 Notes, the

“Old Notes” and each series, a “series of Old Notes”).

MRH is extending the Early Tender Date for each of the Exchange

Offers to 11:59 p.m., New York City time, on July 24, 2020. The

withdrawal deadline with respect to each of the Exchange Offers has

expired. Notes tendered for exchange pursuant to any of the

Exchange Offers may not be validly withdrawn, unless MRH determines

in the future in its sole discretion to permit withdrawal, subject

to applicable law. The expiration date of each of the Exchange

Offers remains 11:59 p.m., New York City time, on July 24,

2020.

As of 5:00 p.m., New York City time, on July 10, 2020 (the

“Withdrawal Deadline”), which was the original early tender date

set forth in the in the confidential exchange offering memorandum

(the “Exchange Offering Memorandum”), pursuant to the Exchange

Offers, the Issuer had received from eligible holders valid and

unrevoked tenders and related consents of (i) $80,221,000 aggregate

principal amount of outstanding Old 2024 Notes, representing

approximately 65.98% of such notes, (ii) $73,754,000 aggregate

principal amount of outstanding Old 2028 Notes, representing

approximately 71.68% of such notes, (iii) $13,000,000 aggregate

principal amount of outstanding Old 2029 Notes, representing

approximately 98.85% of such notes, (iv) $4,634,000 aggregate

principal amount of outstanding Old 2030 Notes, representing

approximately 46.82% of such notes, (v) $4,609,000 aggregate

principal amount of outstanding Old 2032 Notes, representing

approximately 27.04% of such notes, and (vi) $179,658,000 aggregate

principal amount of outstanding Old 2034 Notes, representing

approximately 89.47% of such notes. As of the Withdrawal Deadline,

the aggregate principal amount of Old Notes and related consents

validly tendered and not validly withdrawn is $355,876,000,

representing approximately 76.47% of the Old Notes.

The Issuer intends to accept for exchange all such tendered Old

Notes in exchange for the same aggregate principal amount of the

corresponding series of New Notes on the final settlement date,

which is expected to occur on July 28, 2020, subject to the terms

of the relevant Exchange Offer.

In addition, MRH is extending the expiration time for its

previously announced solicitation of consents from holders of each

series of Old Notes (each, a “Consent Solicitation” and,

collectively, the “Consent Solicitations”) pursuant to the separate

Consent Solicitation Statement (as defined below) to adopt certain

proposed amendments to the indenture governing the Old Notes (the

“Existing Indenture”) to conform certain provisions in the negative

pledge covenant in the Existing Indenture to the provisions of the

negative pledge covenant in MRH’s most recent indenture (the

“Proposed Amendments”) to 11:59 p.m., New York City time, on July

24, 2020 (the “Extended Expiration Time”).

The original expiration time for MRH’s Consent Solicitations was

5:00 p.m., New York City time, on July 10, 2020, at which time MRH

had received consents from holders representing at least a majority

of the outstanding aggregate principal amount of the outstanding

Old Notes. Macy’s, MRH and the trustee under the Existing Indenture

have executed a supplemental indenture containing the Proposed

Amendments (the “Supplemental Indenture”). The Supplemental

Indenture is effective and consents delivered in the Consent

Solicitations may no longer be validly revoked. All holders of the

Old Notes are bound by the terms of the Supplemental Indenture,

even if they did not deliver consents to the Proposed Amendments.

However, the Supplemental Indenture will not be operative until the

previously announced consent fee has been paid and all other

conditions to the Consent Solicitations have been satisfied or

waived. The consent fee will be payable as promptly as practicable

following the Extended Expiration Time, or such later time and date

to which the Consent Solicitations may be extended, assuming that

all of the conditions have been satisfied or waived by such time or

date.

The Exchange Offers and Consent Solicitations are being made

pursuant to the terms and subject to the conditions set forth

Exchange Offering Memorandum and consent solicitation statement

(the “Consent Solicitation Statement”), as applicable, each dated

June 23, 2020, and the related letter of transmittal with respect

to the Exchange Offers, as amended by this press release

(collectively, with the Exchange Offering Memorandum and the

Consent Solicitation, the “Offering Documents”).

Documents relating to the Exchange Offers will be distributed

only to eligible holders of Old Notes who complete and return an

eligibility form confirming that they are either (i) a “qualified

institutional buyer” as defined in Rule 144A under the Securities

Act of 1933, as amended (the “Securities Act”), (ii) not a “U.S.

person” as defined in Rule 902 under the Securities Act and outside

the United States within the meaning of Regulation S under the

Securities Act, or (iii) an “accredited investor” as defined in

Rule 501 under the Securities Act. The complete terms and

conditions of the Exchange Offers are described in the Exchange

Offering Memorandum, copies of which may be obtained by contacting

Ipreo LLC and the exchange agent in connection with the Exchange

Offers, at (888) 593-9546 (U.S. toll-free) or (212) 849-3880 (banks

and brokers). The eligibility form is available electronically at:

Ipreo-ExchangeOffer@ihsmarkit.com. Holders of Old Notes that are

not eligible holders will not be able to receive such

documents.

Documents relating to the Consent Solicitations will be

distributed to any holders of Old Notes who requests a copy. The

complete terms and conditions of the Consent Solicitations are

described in the Consent Solicitation Statement, copies of which

may be obtained by contacting Ipreo LLC, the information agent in

connection with the Consent Solicitations, at (888) 593-9546 (U.S.

toll-free) or (212) 849-3880 (banks and brokers).

This news release does not constitute an offer to sell or

purchase, or a solicitation of an offer to sell or purchase, or the

solicitation of tenders or consents with respect to, any security.

No offer, solicitation, purchase or sale will be made in any

jurisdiction in which such an offer, solicitation or sale would be

unlawful. The Exchange Offers and Consent Solicitations are being

made solely pursuant to the Exchange Offering Memorandum and

Consent Solicitation Statement and letter of transmittal and only

to such persons and in such jurisdictions as are permitted under

applicable law.

The New Notes offered in the Exchange Offers have not been

registered under the Securities Act or any state securities laws.

Therefore, the New Notes may not be offered or sold in the United

States absent registration or an applicable exemption from the

registration requirements of the Securities Act and any applicable

state securities laws.

About Macy’s, Inc.

Macy’s, Inc. (NYSE: M) is one of the nation’s premier

omni-channel fashion retailers. The company comprises three retail

brands, Macy’s, Bloomingdales and Bluemercury. Macy’s, Inc. is

headquartered in New York, New York. For more information, please

visit www.macysinc.com.

Forward-Looking Statements

All statements in this press release that are not statements of

historical fact are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. Such

statements are based upon the current beliefs and expectations of

Macy’s management and are subject to significant risks and

uncertainties. Actual results could differ materially from those

expressed in or implied by the forward-looking statements contained

in this release because of a variety of factors, including the

effects of the novel coronavirus (COVID-19) on customer demand, its

supply chain as well as its consolidated results of operation,

financial position and cash flows, Macy’s ability to successfully

implement its Polaris strategy and restructuring, including the

ability to realize the anticipated benefits within the expected

time frame or at all, conditions to, or changes in the timing of

proposed real estate and other transactions, prevailing interest

rates and non-recurring charges, the effect of potential changes to

trade policies, store closings, competitive pressures from

specialty stores, general merchandise stores, off-price and

discount stores, manufacturers’ outlets, the Internet, catalogs and

television shopping and general consumer spending levels, including

the impact of the availability and level of consumer debt, possible

systems failures and/or security breaches, the potential for the

incurrence of charges in connection with the impairment of

intangible assets, including goodwill, Macy’s reliance on foreign

sources of production, including risks related to the disruption of

imports by labor disputes, regional or global health pandemics, and

regional political and economic conditions, the effect of weather

and other factors identified in documents filed by the company with

the Securities and Exchange Commission, including under the

captions “Forward-Looking Statements” and “Risk Factors” in the

Company’s Annual Report on Form 10-K for the year ended February 1,

2020 and “COVID-19 Risk Factor” in the Company’s Current Report on

Form 8-K filed on May 26, 2020. Macy’s disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200713005333/en/

Media media@macys.com

Investors – Mike McGuire investors@macys.com

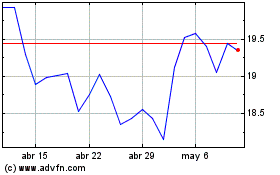

Macys (NYSE:M)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Macys (NYSE:M)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024