Chevron Goes for Quality Over Price

20 Julio 2020 - 2:04PM

Noticias Dow Jones

By Jinjoo Lee

Low oil prices meant consolidation was bound to happen in the

energy sector. Chevron Corp. made the first move Monday morning,

announcing a $5 billion bid for Noble Energy in an all-stock

deal.

Chevron's shares fell 1.2%, while Noble Energy gained 5.5% by

midday.

The acquisition, expected to close in the fourth quarter, values

Noble at a 7.6% premium over Friday's closing price. That pales in

comparison to the 39% premium of Chevron's bid for Anadarko

Petroleum last year, which -- fortunately, as it turns out -- was

snatched by Occidental Petroleum.

The deal values Noble at eight times its expected earnings

before interest, taxes, depreciation and amortization in 2021,

according to an estimate by Raymond James -- a reasonable discount

to Chevron's current 9.5 times multiple.

Although the premium is relatively modest, Chevron's

shareholders might wonder whether this was the best deal the

company could strike, given the wave of distress hitting the energy

sector. By some estimates, more than 200 shale companies may file

for bankruptcy over the next two years. It is reasonable to suspect

there would have been better bargains if Chevron had waited to

scrape the bottom of the barrel.

Chief Executive Officer Michael Wirth stressed Monday morning

that quality was important, too. "Getting bigger isn't necessarily

the goal; getting better certainly is important," he said on an

investor call. Though Noble's shares were down almost 60%

year-to-date by Friday, its debt remained investment grade.

Absorbing Noble means Chevron will get additional exposure to

the prolific Permian Basin in West Texas, where it had tried to

expand last year through Anadarko. The combination also will add

acreage in the Eagle Ford in the southern part of Texas and the DJ

Basin in Colorado, which Chevron's chief executive said was more

mature and therefore less risky compared with other so-called

"unconventional" assets Chevron owns. It also will diversify

Chevron's overseas holdings: Noble's eastern Mediterranean assets

began production last December and feature contracts priced well

above U.S. natural gas prices with a low production decline rate,

according to a May 18 report from Moody's.

The deal certainly offers immediate perks for Noble Energy

shareholders, who will benefit from Chevron's 6% dividend yield, a

much more generous number than Noble's 0.8%. Modest synergies

aside, the immediate benefit to Chevron's shareholders is less

clear, but at a $13 billion enterprise value -- representing 8% of

Chevron's market capitalization -- it seems to be a risk they can

afford to take.

Write to Jinjoo Lee at jinjoo.lee@wsj.com

(END) Dow Jones Newswires

July 20, 2020 14:49 ET (18:49 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

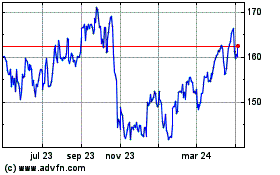

Chevron (NYSE:CVX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

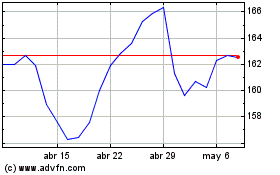

Chevron (NYSE:CVX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024