Princess Private Equity Holding Ltd NAV increases by 2.9% in June (9471T)

24 Julio 2020 - 1:00AM

UK Regulatory

TIDMPEY TIDMPEYS

RNS Number : 9471T

Princess Private Equity Holding Ltd

24 July 2020

News Release

Guernsey, 24 July 2020

NAV increases by 2.9% in June

-- Princess Private Equity Holding Limited's (Princess) net

asset value increased by 2.9% to EUR 11.99 per share

-- Portfolio developments were positive (+3.2%) and currency movements were negative (-0.2%)

-- Princess invested EUR 3.3 million during the month and

received distributions of EUR 93.2 million

In June, Princess' NAV increased in value by 2.9%. The largest

contributor to the favorable performance was PCI Pharma Services, a

US-based provider of outsourced pharmaceutical services. The

company was written-up on the back of an increase in EBITDA, as

well as positive valuation multiple development, driven by market

comparables. During the COVID-19 crisis, PCI has proven itself as

an essential provider in the pharma supply chain, capable of

responding with a high degree of flexibility to urgent client

demands and fast evolving projects.

EUR 2.9 million of additional capital was provided to KinderCare

Education, the largest for-profit provider of early childhood

education and care services in the US. KinderCare operates

approximately 1'500 centers nationwide. Following the COVID-19

outbreak, the company faced operational and financial disruptions

in March and April due to the closure of many of its centers,

additional withdrawals by parents and stay-home orders. To mitigate

the financial impact, KinderCare implemented a range of cost and

liquidity management measures. The capital infusion supports the

company's expected liquidity requirements for the remainder of

2020. With stay-at-home orders being lifted, KinderCare will reopen

its remaining centers on a state-by-state basis, strictly adhering

to all necessary regulations and guidelines. Approximately 1'400

centers were open as of the end of June. The long-term outlook for

the business remains positive with utilization rates expected to

increase as states re-open and families return to the

workforce.

Princess received distributions of EUR 93.2 million during the

month, of which EUR 90.0 million was received from the sale of its

stake in Action . The proceeds were used to fully repay the

Company's EUR 80 million credit facility. EUR 1.6 million was

received from the ongoing sale of shares in Ceridian HCM, following

the company's listing on the New York Stock Exchange in April

2018.

Princess will hold its quarterly investor conference call on 7

August 2020 at 10:00 BST / 11:00 CET and will provide a detailed

update on the recent portfolio developments. Please find the

dial-in details on the Company's webpage.

Further information is available in the monthly report, which

can be accessed via:

http://www.princess-privateequity.net/financialreports .

Ends.

About Princess

Princess is an investment holding company founded in 1999 and

domiciled in Guernsey. It invests, inter alia, in private equity

and private debt investments. Princess is advised in its investment

activities by Partners Group, a global private markets investment

management firm with USD 96 billion in investment programs under

management in private equity, private debt, private real estate and

private infrastructure. Princess aims to provide shareholders with

long-term capital growth and an attractive dividend yield. Princess

is traded on the Main Market of the London Stock Exchange (ticker:

PEY for the Euro Quote; PEYS for the Sterling Quote).

Contacts

Princess Private Equity Holding Limited:

princess@partnersgroup.com

www.princess-privateequity.net

Registered Number: 35241

LEI: 54930038LU8RDPFFVJ57

Investor relations contact

George Crowe

Phone: +44 (0)20 7575 2771

Email: george.crowe@partnersgroup.com

Media relations contact

Jenny Blinch

Phone: +44 207 575 2571

Email: jenny.blinch@partnersgroup.com

www.partnersgroup.com

This document does not constitute an offer to sell or a

solicitation of an offer to buy or subscribe for any securities and

neither is it intended to be an investment advertisement or sales

instrument of Princess. The distribution of this document may be

restricted by law in certain jurisdictions. Persons into whose

possession this document comes must inform themselves about and

observe any such restrictions on the distribution of this document.

In particular, this document and the information contained therein

are not for distribution or publication, neither directly nor

indirectly, in or into the United States of America, Canada,

Australia or Japan.

This document may have been prepared using financial information

contained in the books and records of the product described herein

as of the reporting date. This information is believed to be

accurate but has not been audited by any third party. This document

may describe past performance, which may not be indicative of

future results. No liability is accepted for any actions taken on

the basis of the information provided in this document. Neither the

contents of Princess' website nor the contents of any website

accessible from hyperlinks on Princess' website (or any other

website) is incorporated into, or forms part of, this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NAVRJMRTMTTTBBM

(END) Dow Jones Newswires

July 24, 2020 02:00 ET (06:00 GMT)

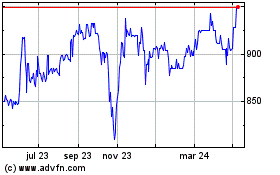

Princess Private Equity (LSE:PEYS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

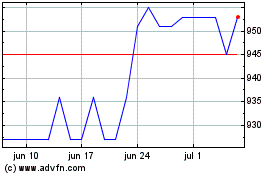

Princess Private Equity (LSE:PEYS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024