TIDMBREE

RNS Number : 3875U

Breedon Group PLC

29 July 2020

29 July 2020

Breedon Group plc

("Breedon" or "the Group")

Interim results (unaudited) for the six months ended 30 June

2020

Breedon Group plc, a leading construction materials group in

Great Britain and Ireland, announces its unaudited interim results

for the six months ended 30 June 2020.

30 June 2020 30 June 2019 Change

Revenue GBP335.3 million GBP447.4 million -25%

Underlying EBIT GBP(0.6) million GBP49.5 million -101%

(Loss)/profit before GBP(10.1)

tax million GBP39.5 million -126%

Underlying basic EPS (0.65) pence 2.03 pence -132%

Net debt GBP253.6 million GBP343.7 million

Underlying results are stated before acquisition-related

expenses, redundancy and reorganisation costs, property items,

amortisation of acquisition intangibles and related tax items.

References to an underlying profit measure throughout this

announcement are defined on this basis.

8.0 million tonnes of aggregates sold (30 June 2019: 9.9 million

tonnes)

1.0 million tonnes of asphalt sold (30 June 2019: 1.4 million

tonnes)

1.0 million cubic metres of ready-mixed concrete sold (30 June

2019: 1.5 million cubic metres)

0.8 million tonnes of cement sold (30 June 2019: 1.0 million

tonnes)

Highlights

-- Encouraging performance in first 12 weeks of the year

-- COVID-19 lockdown at end of March prompted immediate fall in

demand and managed shutdown of most operations

-- Early and decisive action taken to keep colleagues safe and preserve liquidity

-- Site reopenings commenced in early May as demand improved

-- Recovery led by RoI, underlining the benefit of Breedon's geographical spread

-- June revenues recovered to 99 per cent of June 2019

-- Strong balance sheet, with net debt reduced to GBP253.6 million: Leverage of 1.9x

-- Financial headroom of GBP344.0 million at 30 June

-- Acquisition of CEMEX assets expected to complete imminently

-- Recovery well underway and outlook remains positive

Pat Ward, Group Chief Executive, commented:

"Following the encouraging performance of our businesses in the

first 12 weeks of the year, the move into lockdown and immediate

fall in demand in the latter part of March led us into a swift and

managed shutdown of the majority of our operations, leaving open

only those which were servicing critical needs. This decisive

action ensured the protection of our employees, left our sites in a

safe condition and also positioned us to return quickly to

production when demand began to return in early May.

"The recovery in our markets now appears to be well underway,

and we have seen continued improvement into July. The great

majority of our sites are now open, including both our cement

plants. While near-term uncertainty remains, there is significant

pent-up demand to be satisfied in both housing and infrastructure,

reinforced by the substantial programme of investment confirmed by

the Chancellor earlier this month. Looking to the longer-term, we

believe the outlook for our markets remains positive, supporting

our confidence in the prospects for the Group."

- ends -

The full text of the Group's interim statement is attached,

together with detailed financial results.

Breedon will host a virtual meeting for invited analysts at

9.00am today and there will be a simultaneous webcast of the

meeting. Please use this link to join the webcast:

https://webcasting.brrmedia.co.uk/broadcast/5f1555164c167c1215797e87

The webcast will also be available to view on our website later

today at www.breedongroup.com/investors .

Enquiries Tel: 01332 694010

Breedon Group plc

Pat Ward, Group Chief Executive

Rob Wood, Group Finance Director

Stephen Jacobs, Head of Communications Tel: 07831 764592

Cenkos Securities plc (Nomad and joint broker) Tel: 020 7397 8900

Max Hartley

Numis Securities (Joint broker) Tel: 020 7260 1000

Heraclis Economides/Ben Stoop

Teneo (Public relations adviser to Tel: 020 7420 3180

Breedon)

Matt Denham

Rachel Miller

Note to Editors

Breedon Group plc is a leading construction materials group in

Great Britain and Ireland. It operates two cement plants and an

extensive network of quarries, asphalt plants and ready-mixed

concrete plants, together with slate production, concrete and clay

products manufacturing, contract surfacing and highway maintenance

operations. The Group employs nearly 3,000 people and has nearly

900 million tonnes of mineral reserves and resources.

Breedon Group plc

Interim results (unaudited) for the six months ended 30 June

2020

Overview

We are reporting on an unprecedented period in Breedon's

history, during which the economy and our industry faced their

greatest challenge for many years. We are immensely proud of all

our colleagues, who confronted the challenge with great

determination. Some of them continued to work providing essential

services during the lockdown, for which we owe them a great debt of

gratitude. Our overriding priority throughout was to ensure that

all our colleagues and customers, together with the communities we

serve, remained safe and unharmed, and we are pleased that the

rigorous safety protocols we put in place at all our sites enabled

this to happen. We continue to adapt and evolve these protocols in

line with government guidance.

Following the encouraging performance of our businesses in the

first 12 weeks of the year, the move into lockdown and immediate

fall in demand in the latter part of March led us into a swift and

managed shutdown of the majority of our operations. Thanks to the

high levels of investment in the Group in recent years, we were

able immediately to restrict capital expenditure to committed and

critical projects without compromising the longer-term performance

of our operations. In addition, we halted all discretionary

expenditure and applied robust discipline to our management of

working capital.

We moved quickly to furlough more than 80 per cent of our

colleagues, topping up their wages to 100 per cent, and immediately

embarked on a comprehensive review of safety measures at all our

sites, preparing detailed COVID-19 protection protocols and

back-to-work induction programmes to ensure that as our colleagues

returned they could do so safely and confidently.

As demand recovered, we were able to swiftly reopen our sites in

early May and this process gathered pace throughout the ensuing two

months. By the end of June, over 90 per cent of our sites were

open, including both our cement plants, with 82 per cent of our

colleagues back at work.

The pace of reopening differed from division to division,

determined in part by the needs of our customers and in part by the

differing timelines by which the various governments and devolved

administrations eased restrictions on movement. The timing of the

recovery accordingly varied across the Group, with our operations

in RoI recovering strongly from late May onwards, while volumes in

England, Wales and NI also showed a steady improvement. Scotland

remained subdued until well into June as a result of the delayed

lifting of restrictions by the Scottish Parliament.

Group results

Trading in the first quarter was progressing broadly in line

with our expectations until the latter part of March when the

pandemic began to take hold. The impact on demand and consequently

on our business was immediate and significant.

Our revenues in April fell to 19 per cent of those recorded in

the same month of 2019, followed by 45 per cent in May, before

improving to 99 per cent in June as the recovery began to gather

pace.

Group aggregates volumes for the half-year totalled 8.0 million

tonnes (2019: 9.9 million tonnes), asphalt volumes stood at 1.0

million tonnes (2019: 1.4 million tonnes), ready-mixed concrete

volumes totalled 1.0 million cubic metres (2019: 1.5 million cubic

metres) and cement volumes stood at 0.8 million tonnes (2019: 1.0

million tonnes).

Revenue for the half-year was GBP335.3 million (2019: GBP447.4

million) and Underlying EBIT was a loss of GBP0.6 million (2019:

profit of GBP49.5 million).

We have also reflected the UK Government's decision to cancel

the planned reduction in the corporation tax rate in 2020 from 19

per cent to 17 per cent. This has resulted in an increase of GBP5.5

million in the Group's deferred tax liabilities.

Financial highlights

Six months Six months

ended ended

30 June 30 June

2020 2019

GBPm GBPm Variance

Revenue

Great Britain 214.9 298.1 -28%

Ireland 69.2 93.5 -26%

Cement 75.6 93.4 -19%

Eliminations (24.4) (37.6)

Total 335.3 447.4 -25%

--------------------------------------- ----------- ----------- ---------

Underlying EBIT

Great Britain (1.4) 30.8 -105%

Ireland 1.8 8.9 -80%

Cement 6.1 15.8 -61%

Central administration (7.0) (6.8)

Share of associate and joint ventures (0.1) 0.8

Total (0.6) 49.5 -101%

--------------------------------------- ----------- ----------- ---------

Underlying EBIT margin (0.2)% 11.1%

Balance sheet and cash flow

Net assets at 30 June 2020 were GBP842.7 million, compared to

GBP839.1 million at 31 December 2019 and GBP805.9 million at 30

June 2019.

Net cash from operating activities was GBP55.2 million,

benefiting from tax deferrals and the absence of the usual seasonal

increase in working capital. Net cash used in investing activities

was GBP15.1 million, after capital expenditure of GBP16.1 million.

Finally, net cash generated from financing activities was GBP60.2

million, including the exercise of an accordion option to increase

our existing banking facilities by GBP80 million in anticipation of

the imminent completion of the acquisition of certain UK assets

from CEMEX.

Net debt at 30 June 2020 was GBP253.6 million, compared to

GBP290.3 million at 31 December 2019 and GBP343.7 million at 30

June 2019, and Leverage was 1.9 times. This clearly demonstrates

how well the Group has managed its cash flow in these very

challenging circumstances.

Liquidity management

As we moved into lockdown, immediate action was taken to

maximise liquidity through restricting capital expenditure to

committed and critical projects, halting all discretionary

expenditure and applying robust discipline to our management of

working capital, including obtaining deferrals for tax payments

where available.

Although the recovery in May and June allowed us to remain

comfortably within our original covenants, in April we agreed with

our banks a relaxation of our 30 June 2020 covenants and a deferral

of GBP35 million of loan amortisation to April 2022. Our banks have

also indicated their intention to agree a relaxation of covenants

for December 2020 if required. Additionally, in May we were

confirmed as being eligible for the Covid Corporate Financing

Facility (CCFF), with an issuer limit of GBP300 million, although

we have no current intention of utilising this facility.

This meant that as at 30 June 2020 we had GBP124.6 million of

cash and an undrawn committed bank facility of GBP219.4 million,

combining to give headroom of GBP344.0 million excluding the

CCFF.

Sustainability

Following our commitment last year to the Sustainability Charter

of the Global Cement & Concrete Association, we increased our

engagement with shareholders on the Group's plans to ensure a

positive environmental, social and economic impact in the coming

years.

In June we appointed our first Group Head of Sustainability, who

is now working closely with our management teams, our functional

teams and our wider stakeholders to develop and embed a

sustainability vision and strategy with clear performance criteria

and targets across the full range of our businesses.

We look forward to reporting our progress and our contribution

to creating a sustainable built environment in our 2020 Annual

Report.

CEMEX acquisition

We are looking forward to the completion of our acquisition of

certain of CEMEX's UK assets, which we expect to take place

imminently. Following completion, these assets will be held

separate from Breedon pending completion of the Competition and

Markets Authority's investigation, which could take several more

months.

This acquisition will strengthen our regional footprint in the

UK and also provide a platform for organic expansion and future

acquisitions in areas of the country where we do not currently have

a presence.

These assets are high-quality, well-located, with a great team,

and bring us a further 170 million tonnes of mineral reserves and

resources. Whilst they have inevitably been impacted by the

protracted transaction process, compounded by the effects of

COVID-19, they are fundamentally strong operations whose

performance we believe we can substantially improve in the future,

as we have demonstrated with previous acquisitions.

Outlook

The near-term outlook for our business is clearly dependent on

the speed at which demand from our customers recovers and we return

to more normal levels of activity. We are encouraged by recent

announcements from a number of contractors, housebuilders and

merchants which broadly point to a steady improvement in trading

conditions in the UK, whilst in RoI the market has returned to near

pre-COVID-19 levels of demand. We have demonstrated that we can

reopen sites very quickly in line with increased demand, enabling

us to continue responding almost instantaneously as our markets

recover.

We have a fundamentally robust and diversified business. Our

balance sheet remains strong, we have more than adequate liquidity

and our strong cashflow will enable us to continue to quickly pay

down our debt as trading improves. Although COVID-19 has been

challenging, it has given us the opportunity to revisit a number of

self-help measures and we are confident that we will emerge from

this pandemic more efficient than we entered it.

We would like to take this opportunity once again to thank all

our colleagues, who have so readily risen to the challenge over the

last few months.

Given the uncertainties we still face, we remain unable at this

stage to provide market guidance. However, we will update the

market as soon as we have sufficiently robust information to be

able to do so.

The recovery in our markets now appears to be well underway, and

we have seen continued improvement into July. The great majority of

our sites are now open, including both our cement plants. While

near-term uncertainty remains, there is significant pent-up demand

to be satisfied in both housing and infrastructure, reinforced by

the substantial programme of investment confirmed by the Chancellor

earlier this month. Looking to the longer-term, we believe the

outlook for our markets remains positive, supporting our confidence

in the prospects for the Group.

Pat Ward Rob Wood

Group Chief Executive Group Finance Director

Breedon Group plc

Interim results (unaudited) for the six months ended 30 June

2020

Condensed Consolidated Income Statement

for the six months ended 30 June 2020

Six months ended 30 Six months ended 30 Year ended 31 December

June 2020 June 2019 2019

Underlying Non-underlying* Total Underlying Non- Total Underlying Non- Total

(note underlying* underlying*

6) (note (note

6) 6)

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

Revenue 335.3 - 335.3 447.4 - 447.4 929.6 - 929.6

Cost of sales (243.9) - (243.9) (294.9) - (294.9) (587.2) - (587.2)

-----------------

Gross profit 91.4 - 91.4 152.5 - 152.5 342.4 - 342.4

Distribution

expenses (58.6) - (58.6) (70.6) - (70.6) (163.8) - (163.8)

Administrative

expenses (33.3) (3.1) (36.4) (33.2) (2.6) (35.8) (63.6) (8.0) (71.6)

Group operating

(loss)/profit (0.5) (3.1) (3.6) 48.7 (2.6) 46.1 115.0 (8.0) 107.0

Share of

(loss)/profit

of associate

and joint

ventures (0.1) - (0.1) 0.8 - 0.8 1.6 - 1.6

----------------- ---------- --------------- ------------ -------------- ------------------ ------------ ------------------ ----------------- ------------

(Loss)/profit

from operations (0.6) (3.1) (3.7) 49.5 (2.6) 46.9 116.6 (8.0) 108.6

Financial expense (6.4) - (6.4) (7.4) - (7.4) (14.0) - (14.0)

-----------------

(Loss)/profit

before taxation (7.0) (3.1) (10.1) 42.1 (2.6) 39.5 102.6 (8.0) 94.6

Taxation - at

effective rate 1.5 0.3 1.8 (7.9) 0.4 (7.5) (17.3) 0.7 (16.6)

Taxation - change

in deferred

tax rate (5.5) - (5.5) - - - - - -

----------------- ---------- --------------- ------------ -------------- ------------------ ------------ ------------------ ----------------- ------------

(Loss)/profit

for the period (11.0) (2.8) (13.8) 34.2 (2.2) 32.0 85.3 (7.3) 78.0

----------------- ---------- --------------- ------------ -------------- ------------------ ------------ ------------------ ----------------- ------------

Attributable

to:

Equity holders

of the parent (11.0) (2.8) (13.8) 34.1 (2.2) 31.9 85.2 (7.3) 77.9

Non-controlling

interests - - - 0.1 - 0.1 0.1 - 0.1

-----------------

(Loss)/profit

for the period (11.0) (2.8) (13.8) 34.2 (2.2) 32.0 85.3 (7.3) 78.0

----------------- ---------- --------------- ------------ -------------- ------------------ ------------ ------------------ ----------------- ------------

Basic earnings

per ordinary

share (0.65p) (0.82p) 2.03p 1.90p 5.08p 4.64p

Diluted earnings

per ordinary

share (0.65p) (0.82p) 2.03p 1.90p 5.07p 4.63p

----------------- ---------- --------------- ------------ -------------- ------------------ ------------ ------------------ ----------------- ------------

* Non-underlying items represent acquisition-related expenses,

redundancy and reorganisation costs, property items, amortisation

of acquisition intangibles and related tax items.

Breedon Group plc

Interim results (unaudited) for the six months ended 30 June

2020

Condensed Consolidated Statement of Comprehensive Income

for the six months ended 30 June 2020

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2020 2019 2019

GBPm GBPm GBPm

(Loss)/profit for the period (13.8) 32.0 78.0

Other comprehensive income/(expense)

Items which may be reclassified

subsequently to profit and loss

:

Foreign exchange differences on

translation of foreign operations,

net of hedging 15.6 (0.8) (13.3)

Effective portion of changes in

fair value of cash flow hedges 0.5 - (1.5)

Taxation on items taken directly

to other comprehensive income (0.1) - 0.2

Other comprehensive income/(expense)

for the period 16.0 (0.8) (14.6)

------------------------------------- ---------- ---------- ------------

Total comprehensive income for

the period 2.2 31.2 63.4

------------------------------------- ---------- ---------- ------------

Total comprehensive income for

the period is attributable to:

Equity holders of the parent 2.2 31.1 63.3

Non-controlling interests - 0.1 0.1

------------------------------------- ---------- ---------- ------------

2.2 31.2 63.4

------------------------------------- ---------- ---------- ------------

Breedon Group plc

Interim results (unaudited) for the six months ended 30 June

2020

Condensed Consolidated Statement of Financial Position

at 30 June 2020

30 June 30 June 31 December

2020 2019 2019

GBPm GBPm GBPm

Non-current assets

Property, plant and equipment 690.3 699.9 698.6

Intangible assets 472.2 461.6 464.2

Investment in associate and

joint ventures 10.3 7.1 10.8

---------------------------------------

Total non-current assets 1,172.8 1,168.6 1,173.6

--------------------------------------- -------- -------- ------------

Current assets

Inventories 51.1 59.6 58.5

Trade and other receivables 146.2 195.3 164.7

Current tax receivable 4.3 - -

Cash and cash equivalents 124.6 23.5 23.8

Total current assets 326.2 278.4 247.0

--------------------------------------- -------- -------- ------------

Total assets 1,499.0 1,447.0 1,420.6

---------------------------------------

Current liabilities

Interest-bearing loans and borrowings (61.6) (45.3) (43.9)

Trade and other payables (189.1) (182.9) (177.9)

Current tax payable - (6.9) (7.6)

Provisions (2.2) (2.7) (2.5)

--------------------------------------- -------- -------- ------------

Total current liabilities (252.9) (237.8) (231.9)

---------------------------------------

Non-current liabilities

Interest-bearing loans and borrowings (316.6) (321.9) (270.2)

Provisions (33.4) (34.7) (32.2)

Deferred tax liabilities (53.4) (46.7) (47.2)

--------------------------------------- -------- -------- ------------

Total non-current liabilities (403.4) (403.3) (349.6)

--------------------------------------- -------- -------- ------------

Total liabilities (656.3) (641.1) (581.5)

--------------------------------------- -------- -------- ------------

Net assets 842.7 805.9 839.1

--------------------------------------- -------- -------- ------------

Equity attributable to equity

holders of the parent

Stated capital 551.0 549.9 550.0

Hedging reserve (0.9) - (1.3)

Translation reserve 8.9 5.8 (6.7)

Retained earnings 283.6 250.0 297.0

---------------------------------------

Total equity attributable to

equity holders of the parent 842.6 805.7 839.0

Non-controlling interests 0.1 0.2 0.1

--------------------------------------- -------- -------- ------------

Total equity 842.7 805.9 839.1

--------------------------------------- -------- -------- ------------

Breedon Group plc

Interim results (unaudited) for the six months ended 30 June

2020

Condensed Consolidated Statement of Changes in Equity

for the six months ended 30 June 2020

For the six months ended

30 June 2020

Attributable

to equity Non-controlling

Stated Hedging Translation Retained holders interests Total

capital reserve reserve earnings of parent equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

Balance at 31

December

2019 550.0 (1.3) (6.7) 297.0 839.0 0.1 839.1

Shares issued 1.0 - - - 1.0 - 1.0

Dividend to - - - - - - -

non-controlling

interests

Total

comprehensive

income for the

period - 0.4 15.6 (13.8) 2.2 - 2.2

Share-based

payments - - - 0.4 0.4 - 0.4

Balance at 30

June

2020 551.0 (0.9) 8.9 283.6 842.6 0.1 842.7

----------------- ----------- --------- -------------------- -------------- -------------------- ----------------- --------

For the six months ended

30 June 2019

Stated Attributable Non-controlling

capital Hedging Translation Retained to equity interests Total

reserve reserve earnings holders equity

of parent

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

Balance at 31

December

2018 549.0 - 6.6 217.5 773.1 0.2 773.3

Shares issued 0.9 - - - 0.9 - 0.9

Dividend to

non-controlling

interests - - - - - (0.1) (0.1)

Total

comprehensive

income for the

period - - (0.8) 31.9 31.1 0.1 31.2

Share-based

payments - - - 0.6 0.6 - 0.6

Balance at 30 June

2019 549.9 - 5.8 250.0 805.7 0.2 805.9

------------------- ------------ ---------- -------------- ----------- ------------- ---------------- ---------

For the year ended 31 December 2019

Attributable Non-controlling

Stated Hedging Translation Retained to equity interests Total

capital reserve reserve earnings holders equity

of parent

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

Balance at 31

December

2018 549.0 - 6.6 217.5 773.1 0.2 773.3

Shares issued 1.0 - - - 1.0 - 1.0

Dividend to

non-controlling

interests - - - - - (0.2) (0.2)

Total

comprehensive

income for the

year - (1.3) (13.3) 77.9 63.3 0.1 63.4

Share-based

payments - - - 1.6 1.6 - 1.6

Balance at 31

December

2019 550.0 (1.3) (6.7) 297.0 839.0 0.1 839.1

------------------ ----------- ----------- -------------- ----------- ------------- ---------------- ---------

Breedon Group plc

Interim results (unaudited) for the six months ended 30 June

2020

Condensed Consolidated Statement of Cash Flows

for the six months ended 30 June 2020

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2020 2019 2019

GBPm GBPm GBPm

Cash flows from operating activities

(Loss)/profit for the period (13.8) 32.0 78.0

Adjustments for:

Depreciation 33.1 32.4 65.2

Amortisation 1.8 1.5 3.1

Financial expense 6.4 7.4 14.0

Share of loss/(profit) of associate

and joint ventures 0.1 (0.8) (1.6)

Net gain on sale of property, plant

and equipment (0.1) (0.7) (0.8)

Share-based payments 0.4 0.6 1.6

Taxation 3.7 7.5 16.6

------------------------------------------ ----------- ----------- -------------

Operating cash flow before changes

in working capital and provisions 31.6 79.9 176.1

Decrease/(increase) in trade and

other receivables 20.2 (34.5) (0.8)

Decrease/(increase) in inventories 8.3 (4.8) (5.7)

Increase/(decrease) in trade and

other payables 10.0 8.1 (1.8)

Decrease in provisions (0.1) (1.7) (2.0)

------------------------------------------ ----------- ----------- -------------

Cash generated from operating activities 70.0 47.0 165.8

Interest paid (3.7) (4.7) (8.4)

Interest element of lease payments (1.1) (1.4) (2.6)

Dividend paid to non-controlling

interests - (0.1) (0.2)

Income taxes paid (10.0) (8.7) (18.1)

------------------------------------------

Net cash from operating activities 55.2 32.1 136.5

------------------------------------------ ----------- ----------- -------------

Cash flows used in investing activities

Acquisition of businesses - - (8.9)

Purchase of share in joint venture - - (3.0)

Purchase of property, plant and

equipment (16.1) (19.3) (56.3)

Proceeds from sale of property,

plant and equipment 0.5 2.2 3.3

Issue of loan to joint ventures - - (4.0)

Dividends from associate and joint

ventures 0.5 - 0.8

------------------------------------------ ----------- ----------- -------------

Net cash used in investing activities (15.1) (17.1) (68.1)

------------------------------------------ ----------- ----------- -------------

Cash flows from/(used in) financing

activities

Proceeds from the issue of shares

(net of costs) 1.0 0.9 1.0

Proceeds from new interest-bearing 143.7 -

loans (net of costs) -

Repayment of interest-bearing loans (80.0) (23.9) (69.2)

Repayment of lease obligations (4.5) (6.6) (12.9)

Net cash from/(used in) financing

activities 60.2 (29.6) (81.1)

------------------------------------------ ----------- ----------- -------------

Net increase/(decrease) in cash

and cash equivalents 100.3 (14.6) (12.7)

Cash and cash equivalents at beginning

of period 23.8 37.6 37.6

Foreign exchange differences 0.5 0.5 (1.1)

------------------------------------------ ----------- ----------- -------------

Cash and cash equivalents at end

of period 124.6 23.5 23.8

------------------------------------------ ----------- ----------- -------------

Breedon Group plc

Interim results (unaudited) for the six months ended 30 June

2020

Notes to the Condensed Consolidated Interim Financial

Statements

1 Basis of preparation

Breedon Group plc is a company domiciled in Jersey. These

Condensed Consolidated Interim Financial Statements (the "Interim

Financial Statements") consolidate the results of the Company and

its subsidiary undertakings (collectively the "Group").

These Interim Financial Statements have been prepared in

accordance with IAS 34 - Interim Financial Reporting, as adopted by

the EU. The Interim Financial Statements have been prepared under

the historical cost convention except where the measurement of

balances at fair value is required. The Interim Financial

Statements have been prepared applying the accounting policies and

presentation that were applied in the presentation of the Company's

Consolidated Financial Statements for the year ended 31 December

2019.

These Interim Financial Statements have not been audited or

reviewed by auditors pursuant to the Auditing Practices Board's

guidance on the review of interim financial information. These

statements do not include all of the information required for full

annual financial statements and should be read in conjunction with

the full Annual Report for the year ended 31 December 2019.

The comparative figures for the financial year ended 31 December

2019 have been extracted from the Company's statutory accounts for

that financial year. Those accounts have been reported on by the

Company's auditor. The report of the auditor (i) was unqualified

and (ii) did not include a reference to any matters to which the

auditor drew attention by way of emphasis without qualifying their

report.

New IFRS Standards and Interpretations

The Group has adopted the following standards from 1 January

2020:

- Amendments to References to Conceptual Framework in IFRS Standards

- Amendments to IAS 1 and IAS 8 - Definition of material

- Amendments to IFRS 9, IAS 39 and IFRS 7 - Interest Rate Benchmark Reform

The adoption of these standards has not had a material impact on

the Interim Financial Statements.

2 Going concern

The Interim Financial Statements have been prepared on a going

concern basis.

As a result of the COVID - 19 lockdown, the Group suffered an

immediate fall in demand for its products and services at the end

of March 2020, resulting in the temporary closure of most

operations. The Group's operations began to resume in early May as

demand improved, with revenues in June recovering to 99 per cent of

the same month in 2019. The adverse impact of COVID-19 on trading

in the first half of 2020 has been significant, and the near-term

outlook is clearly dependent on the speed at which demand from our

customers recovers and we return to more normal levels of

activity.

The directors have prepared updated cash flow forecasts for a

period of at least 12 months from the date of approval of these

Interim Financial Statements which indicate that, taking account of

severe but plausible downsides, the Group will have sufficient

funds, through its banking facilities, to meet its liabilities as

they fall due for that period. In addition, the Group has confirmed

its eligibility to access an additional GBP300m of liquidity under

the UK Governments Covid Corporate Financing Facility scheme,

although it has no current plan to utilise this facility.The

Group's banking facilities require compliance with bank covenants

which are measured against the Group's trading performance at June

and December each year. At June 2020, the Group remained

comfortably within these covenants. However, the limited clarity

over the near-term future results in uncertainty as to whether the

Group will be able to continue to comply with its banking covenants

at December 2020.

The Group's lenders remain highly supportive and have indicated

their intention to agree a relaxation of covenants for December

2020 if required. Whilst the directors acknowledge there can be no

certainty without a legal agreement in place, they have no reason

to believe the Group's covenants will not be relaxed for the

December 2020 assessment and therefore have concluded that it

remains appropriate to prepare the Interim Financial Statements on

a going concern basis.

3 Accounting estimates and judgements

In preparing these Interim Financial Statements, management have

been required to make assumptions, estimates and judgements that

affect the application of accounting policies and the reported

amounts of assets and liabilities and income and expense. Actual

results may differ from estimates. There have been no material

additional significant judgements made by management in applying

the Group's accounting policies, nor key sources of estimation

uncertainty compared to those applicable to the Consolidated

Financial Statements for the year ended 31 December 2019 as set out

in note 27 of the Annual Report for that year.

Breedon Group plc

Interim results (unaudited) for the six months ended 30 June

2020

Notes to the Condensed Consolidated Interim Financial Statements

(continued)

4 Principal risks

The Group's principal risks in alphabetical order are:

-- Acquisitions

-- Competition and margins

-- Environment and climate change

-- Financing, liquidity and currency

-- Health and safety

-- IT and cyber security

-- Legal and regulatory

-- Market conditions

-- People

Impact of COVID-19

The Group's Annual Report for the year ended 31 December 2019

noted that the UK and Ireland had reported initial cases of

COVID-19, but that it was too soon to be able to quantify the

extent of the risk. Subsequent events rapidly provided additional

clarity and the Board has recently completed a review of the

principal risks.

The Group does not consider that COVID-19 presents a principal

risk in isolation, but instead impacts on a number of the existing

principal risks as follows:

Competition and margins Health and safety measures put in place

at the Group's production sites in

response to COVID-19 may negatively

impact efficiency and profitability.

Financing, liquidity and The COVID-19 pandemic has placed additional

currency strain on the Group's financial resources,

which may negatively impact the Group's

liquidity or ability to comply with

banking covenants.

---------------------------------------------

Health and safety Failure to successfully adapt workplaces

to prevent the spread of COVID-19,

in line with government guidance, could

cause further disruption to operations.

---------------------------------------------

IT and cyber security Failure to maintain systems and hardware

which are able to be securely accessed

remotely could impact the Group's ability

to service the increased demand for

remote working caused by the COVID-19

pandemic.

---------------------------------------------

Market conditions The forecast recession in the economies

in which the Group operates increases

the level of risk that adverse market

conditions could suppress demand for

the Group's products.

This could be further impacted by any

subsequent peaks of the virus or delay

in lifting existing government restrictions

which have a negative impact on the

macro-economic environment.

---------------------------------------------

People A second wave of COVID-19 may result

in higher levels of staff absence.

---------------------------------------------

Impact of Brexit

The Group also continues to manage the potential impacts Brexit

could have on it. Brexit is not presented as an additional

principal risk but adds an additional level of uncertainty that

increases the overall risk profile of the Group. There have been no

significant changes in the Group's assessment of Brexit risk

subsequent to publication of the Group's Annual Report for the year

ended 31 December 2019.

Further details of the main risks for the year ended 31 December

2019 are set out on pages 24 - 27 of the Group's Annual Report for

the year ended 31 December 2019. The directors consider that these

are the risks that could impact the performance of the Group in the

remaining six months of the current financial year. They continue

to manage these risks and to mitigate their anticipated impact.

Breedon Group plc

Interim results (unaudited) for the six months ended 30 June

2020

Notes to the Condensed Consolidated Interim Financial Statements

(continued)

5 Segmental analysis

Segmental information is presented in line with IFRS 8 -

Operating Segments. The Group is split into the same reportable

units as it was for the Consolidated Financial Statements for the

year ended 31 December 2019, which are as follows:

Great Britain comprising our construction materials and

contracting services businesses in Great Britain.

Ireland comprising our construction materials and contracting

services businesses on the Island of Ireland.

Cement comprising our cementitious operations in Great Britain

and Ireland.

Six months ended Six months ended Year ended

30 June 30 June 31 December

2020 2019 2019

Revenue Underlying Revenue Underlying Revenue Underlying

EBITDA* EBITDA* EBITDA*

Income statement GBPm GBPm GBPm GBPm GBPm GBPm

Great Britain 214.9 15.9 298.1 48.6 615.1 98.4

Ireland 69.2 5.6 93.5 12.4 202.0 33.8

Cement 75.6 18.0 93.4 26.9 186.4 58.8

Central administration - (6.9) - (6.8) - (10.8)

Eliminations (24.4) - (37.6) - (73.9) -

------------------------- -------- ---------- -------- ---------- ------- ----------

Group 335.3 32.6 447.4 81.1 929.6 180.2

------------------------- -------- ---------- -------- ---------- ------- ----------

*Underlying EBITDA is earnings before interest, tax, depreciation,

amortisation, non-underlying items (note 6) and before our share

of (loss)/profit from associate and joint ventures.

Reconciliation to statutory

(loss)/profit

Group Underlying EBITDA

as above 32.6 81.1 180.2

Depreciation and mineral

depletion (33.1) (32.4) (65.2)

Underlying operating

(loss)/profit

---------- ---------- ----------

Great Britain (1.4) 30.8 62.8

Ireland 1.8 8.9 26.8

Cement 6.1 15.8 36.3

Central administration (7.0) (6.8) (10.9)

---------- ---------- ----------

(0.5) 48.7 115.0

Share of (loss)/profit

of associate and joint

ventures (0.1) 0.8 1.6

Underlying (loss)/profit

from operations (EBIT) (0.6) 49.5 116.6

Non-underlying items

(note 6) (3.1) (2.6) (8.0)

(Loss)/profit from

operations (3.7) 46.9 108.6

Financial expense (6.4) (7.4) (14.0)

(Loss)/profit before

taxation (10.1) 39.5 94.6

Taxation - at effective

rate 1.8 (7.5) (16.6)

Taxation - change

in deferred tax rate (5.5) - -

------------------------- -------- ---------- -------- ---------- ------- ----------

(Loss)/profit for

the period (13.8) 32.0 78.0

------------------------- -------- ---------- -------- ---------- ------- ----------

Breedon Group plc

Interim results (unaudited) for the six months ended 30 June

2020

Notes to the Condensed Consolidated Interim Financial Statements

(continued)

6 Non-underlying items

Non-underlying items are those which are either unlikely to

recur in future periods or which distort the underlying performance

of the business, including non-cash items. In the opinion of the

directors, this presentation aids understanding of the underlying

business performance and references to underlying earnings measures

throughout this report are made on this basis. Underlying measures

are presented on a consistent basis over time to assist in the

comparison of performance.

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2020 2019 2019

GBPm GBPm GBPm

Included in administrative expenses

:

Redundancy and reorganisation costs 0.2 0.6 1.1

Acquisition costs 0.8 - 3.3

Loss on property disposals 0.3 0.5 0.5

Amortisation of acquired intangible

assets 1.8 1.5 3.1

Total non-underlying items (pre-tax) 3.1 2.6 8.0

Non-underlying taxation (0.3) (0.4) (0.7)

-------------------------------------- ------------------- ---------- ------------

Total non-underlying items (post-tax) 2.8 2.2 7.3

-------------------------------------- ------------------- ---------- ------------

7 Financial expense

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2020 2019 2019

GBPm GBPm GBPm

Bank loans and overdrafts 3.7 4.7 8.4

Amortisation of prepaid bank arrangement

fee 0.7 0.6 1.2

Lease liabilities 1.1 1.4 2.6

Unwinding of discount on provisions 0.9 0.7 1.8

-----------------------------------------

Financial expense 6.4 7.4 14.0

----------------------------------------- ---------- ---------- ------------

8 Taxation

Recognised in the Condensed Consolidated Statement of

Comprehensive Income

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2020 2019 2019

GBPm GBPm GBPm

Taxation - at effective rate (1.8) 7.5 16.6

Taxation - change in deferred tax

rate 5.5 - -

Total tax charge 3.7 7.5 16.6

---------------------------------- ---------- ---------- ------------

Breedon Group plc

Interim results (unaudited) for the six months ended 30 June

2020

Notes to the Condensed Consolidated Interim Financial Statements

(continued)

8 Taxation (continued)

The tax charge at effective rate for the six months ended 30

June 2020 has been based on the estimated effective weighted

average rate applicable for existing operations for the full year.

This is based on a combined effective rate of 18 per cent on

profits arising in the Group's UK and Irish subsidiary

undertakings.

In addition, legislation was passed on 17 March 2020 which

substantially enacted a cancellation of the planned reduction in

the UK corporation tax rate from 19 per cent to 17 per cent. A

deferred tax charge of GBP5.5m has been recognised to remeasure the

Group's UK deferred tax liabilities at 30 June 2020 at this higher

rate.

9 Interest-bearing loans and borrowings

Net Debt

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2020 2019 2019

GBPm GBPm GBPm

Net debt comprises the following items:

Cash and cash equivalents 124.6 23.5 23.8

Current borrowings (61.6) (45.3) (43.9)

Non-current borrowings (316.6) (321.9) (270.2)

---------------------------------------- ---------- ---------- ------------

Statutory net debt (253.6) (343.7) (290.3)

---------------------------------------- ---------- ---------- ------------

IFRS 16 adjustments 42.2 45.9 43.6

---------------------------------------- ---------- ---------- ------------

Net debt excluding the impact of IFRS

16 (211.4) (297.8) (246.7)

---------------------------------------- ---------- ---------- ------------

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2020 2019 2019

GBPm GBPm GBPm

Current borrowings

Secured bank loans 55.0 35.0 35.0

Lease liabilities 6.6 10.3 8.9

----------------------- ---------- ---------- ------------

61.6 45.3 43.9

----------------------- ---------- ---------- ------------

Non-current borrowings

Secured bank loans 278.1 278.1 230.6

Lease liabilities 38.5 43.8 39.6

----------------------- ---------- ---------- ------------

316.6 321.9 270.2

----------------------- ---------- ---------- ------------

In the first half of 2020, the Group exercised an accordion

option to increase its existing banking facilities by GBP80m in

anticipation of the completion of the acquisition of certain UK

assets from CEMEX (see note 13).

At 30 June 2020, the Group's banking facilities comprise a term

loan of GBP205m (30 June 2019 and 31 December 2019: GBP125m) and a

multi-currency revolving credit facility of GBP350m (30 June 2019

and 31 December 2019: GBP350m). Interest was paid on the facilities

during the period at a margin of between 1.30 per cent and 1.95 per

cent above LIBOR or EURIBOR according to the currency of

borrowings. The facility is secured by a floating charge over the

assets of the Company and its subsidiary undertakings. The term

loan is repayable in two further annual instalments up to April

2022. The revolving credit facility is repayable in April 2022.

Breedon Group plc

Interim results (unaudited) for the six months ended 30 June

2020

Notes to the Condensed Consolidated Interim Financial Statements

(continued)

10 Earnings per share

The calculation of earnings per share is based on the loss for

the period attributable to ordinary shareholders of GBP13.8m (30

June 2019: profit of GBP31.9m, 31 December 2019: profit of

GBP77.9m) and on the weighted average number of ordinary shares in

issue during the period of 1,683,650,088 (30 June 2019:

1,680,338,704, 31 December 2019: 1,681,584,352).

The calculation of underlying earnings per share is based on the

underlying loss for the period attributable to ordinary

shareholders of GBP11.0m (30 June 2019: profit of GBP34.1m, 31

December 2019: profit of GBP85.2m) and on the weighted average

number of ordinary shares in issue during the period as above.

Diluted earnings per ordinary share is based on 1,685,991,560

shares (30 June 2019: 1,683,917,318, 31 December 2019:

1,684,825,454) and reflects the effect of all dilutive potential

ordinary shares.

11 Related party transactions

The nature of related party transactions is consistent with

those disclosed in the Group's Annual Report for the year ended 31

December 2019. All related party transactions are on an arm's

length basis.

12 Stated capital

Number of Ordinary Shares (m)

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2020 2019 2019

Issued ordinary shares at the beginning

of period 1,682.9 1,679.2 1,679.2

Issued in connection with:

Exercise of savings-related share

options 1.8 1.8 2.1

Vesting of Performance Share Plan

awards 1.8 1.6 1.6

1,686.5 1,682.6 1,682.9

---------------------------------------- ---------- ---------- ------------

During the period, the Company issued 1,801,130 ordinary shares

of no par value raising GBP1.0m in connection with the exercise of

certain savings-related share options. The Company also issued

1,757,078 ordinary shares of no par value raising GBPnil in

connection with the vesting of awards under the Performance Share

Plans.

13 Acquisitions

On 8 January 2020 the Group entered into a conditional agreement

with CEMEX to acquire certain assets and operations in the UK for a

total consideration of GBP178m on a cash and debt free basis.

Completion of the transaction is anticipated imminently. The cash

consideration is due on completion and will be financed by the

Group's existing bank facility (see note 9).

Breedon Group plc

Interim results (unaudited) for the six months ended 30 June

2020

Notes to the Condensed Consolidated Interim Financial Statements

(continued)

14 Reconciliation to non-GAAP measures

A number of non-GAAP performance measures are used throughout

this Interim Report and these Interim Financial Statements. This

note provides a reconciliation between these alternative

performance measures to the most directly related statutory

measures.

Reconciliation of earnings based alternative performance

measures

Six months ended Central Share of

30 June 2020 administration loss of associate

and and joint

Great Britain Ireland Cement eliminations ventures Total

GBPm GBPm GBPm GBPm GBPm GBPm

Loss from operations (3.7)

Non-underlying items

(note 6) 3.1

--------------------- -------------- --------- ------ -------------------------- ------------------------ ------

Underlying EBIT (1.4) 1.8 6.1 (7.0) (0.1) (0.6)

Underlying EBIT

margin* (0.7%) 2.6% 8.1% (0.2%)

--------------------- -------------- --------- ------ -------------------------- ------------------------ ------

Underlying EBIT (1.4) 1.8 6.1 (7.0) (0.1) (0.6)

Share of loss of

associate

and joint ventures - - - - 0.1 0.1

Depreciation and

depletion 17.3 3.8 11.9 0.1 - 33.1

--------------------- -------------- --------- ------ -------------------------- ------------------------ ------

Underlying EBITDA 15.9 5.6 18.0 (6.9) - 32.6

--------------------- -------------- --------- ------ -------------------------- ------------------------ ------

Six months ended Share of

30 June 2019 Central profit of

administration associate

and and joint

Great Britain Ireland Cement eliminations ventures Total

GBPm GBPm GBPm GBPm GBPm GBPm

Profit from operations 46.9

Non-underlying items

(note 6) 2.6

----------------------- ------------- --------- ------ -------------------------- --------------- -----

Underlying EBIT 30.8 8.9 15.8 (6.8) 0.8 49.5

Underlying EBIT

margin* 10.3% 9.5% 16.9% 11.1%

----------------------- ------------- --------- ------ -------------------------- --------------- -----

Underlying EBIT 30.8 8.9 15.8 (6.8) 0.8 49.5

Share of profit

of associate

and joint ventures - - - - (0.8) (0.8)

Depreciation and

depletion 17.8 3.5 11.1 - - 32.4

----------------------- ------------- --------- ------ -------------------------- --------------- -----

Underlying EBITDA 48.6 12.4 26.9 (6.8) - 81.1

----------------------- ------------- --------- ------ -------------------------- --------------- -----

Year ended Share of

31 December 2019 Central profit of

administration associate

and and joint

Great Britain Ireland Cement eliminations ventures Total

GBPm GBPm GBPm GBPm GBPm GBPm

Profit from operations 108.6

Non-underlying items

(note 6) 8.0

----------------------- ------------- --------- ------ -------------------------- --------------- -----

Underlying EBIT 62.8 26.8 36.3 (10.9) 1.6 116.6

Underlying EBIT

margin* 10.2% 13.3% 19.5% 12.5%

----------------------- ------------- --------- ------ -------------------------- --------------- -----

Underlying EBIT 62.8 26.8 36.3 (10.9) 1.6 116.6

Share of profit

of associate

and joint ventures - - - - (1.6) (1.6)

Depreciation and

depletion 35.6 7.0 22.5 0.1 - 65.2

----------------------- ------------- --------- ------ -------------------------- --------------- -----

Underlying EBITDA 98.4 33.8 58.8 (10.8) - 180.2

----------------------- ------------- --------- ------ -------------------------- --------------- -----

* Underlying EBIT margin is calculated as Underlying EBIT

divided by revenue

Breedon Group plc

Interim results (unaudited) for the six months ended 30 June

2020

Notes to the Condensed Consolidated Interim Financial Statements

(continued)

Cautionary Statement

This announcement contains forward looking statements which are

made in good faith based on the information available at the time

of its approval. It is believed that the expectations reflected in

these statements are reasonable but they may be affected by a

number of risks and uncertainties that are inherent in any forward

looking statement which could cause actual results to differ from

those currently anticipated.

Glossary

The following definitions apply throughout both this

announcement and the 2019 Annual Report, unless the context

requires otherwise.

Adopted IFRS International Financial Reporting Standards as

adopted by the EU

AGM Annual General Meeting

AIM Alternative Investment Market of the London Stock

Exchange

Alpha Resource Management Alpha Resource Management Limited

BEAR Scotland BEAR Scotland Limited

Breedon Breedon Group plc

Breedon Whitemountain Breedon Whitemountain Ltd

CGU Cash Generating Units

CI Channel Islands

CIF Construction Industry Federation

CITB Construction Industry Training Board

CMDO Cement Market Data Order 2016

CPA Construction Products Association

EBIT Earnings before interest and tax

EBITDA Earnings before interest, tax, depreciation and

amortisation and before our share of profit from associate and

joint ventures

EPS Earnings per share

EU ETS European Union Emissions Trading System

EURIBOR Euro Inter-bank Offered Rate

FCA Financial Conduct Authority

FRC Financial Reporting Council

GAAP Generally Accepted Accounting Principles

GB Great Britain

HMRC Her Majesty's Revenue & Customs in the UK

IAS International Accounting Standards

IFRS International Financial Reporting Standard

Invested Capital Net assets plus net debt

Ireland The Island of Ireland

ISO International Organisation for Standardization

KPI Key Performance Indicator

Lagan Lagan Group (Holdings) Limited

The construction materials and contracting services

brand under which Breedon now trades in the Republic of

Ireland

Leverage Net debt expressed as a multiple of LTM Underlying

EBITDA

LIBOR London Inter-bank Offered Rate

LTIFR Lost Time Injury Frequency Rate

LTM Last twelve months

MPA Mineral Products Association

MPQC Mineral Products Qualifications Council

NI Northern Ireland

NISRA Northern Ireland Statistics Research Agency

OHSAS Occupational Health and Safety Assessment Standard

QCA Quoted Companies Alliance

the Revenue Office of the Revenue Commissioners in Ireland

RoI Republic of Ireland

ROIC Post-tax Return on Invested Capital

Sterling Pounds sterling

UK United Kingdom (GB & NI)

Underlying Stated before acquisition-related expenses,

redundancy and reorganisation costs, property items, amortisation

of acquisition intangibles and related tax items

Whitemountain Whitemountain Quarries Limited

The construction materials and contracting services brand under

which Breedon now trades in NI

WTO World Trade Organisation

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR SEWFMAESSEEW

(END) Dow Jones Newswires

July 29, 2020 02:00 ET (06:00 GMT)

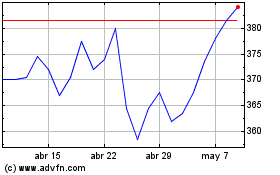

Breedon (LSE:BREE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Breedon (LSE:BREE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024