TIDMSPT

RNS Number : 2666V

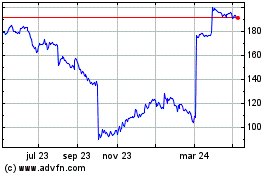

Spirent Communications PLC

06 August 2020

SPIRENT COMMUNICATIONS PLC

Results for the six months ended 30 June 2020

First half First half Change

$ million 2020 2019 (%)

----------------------------------- ------------ ------------ ---------

Order intake(1) 232.1 219.5 +6

Revenue 233.7 217.4 +7

Gross margin (%) 73.4 72.0 +1.4

Adjusted operating profit(2) 39.5 20.7 +91

Adjusted operating margin(3)

(%) 16.9 9.5 +7.4

Reported operating profit 35.6 18.1 +97

Reported profit before tax 36.0 18.7 +93

Adjusted basic earnings per

share(4) (cents) 5.70 3.03 +88

Basic earnings per share (cents) 5.28 2.72 +94

Closing cash 221.4 141.8 +$79.6m

Interim dividend per share(5)

(cents) 2.17 1.94 +12

----------------------------------- ------------ ------------ ---------

Strong H1 performance

-- Good result despite challenging Q2 environment, order intake

growth of 6 per cent.

-- Revenue up 7 per cent driven by strong uptick in 400G Ethernet

test solutions and continued 5G acceleration, particularly

in APAC.

-- Strong orders and revenue growth from our Lifecycle Service

Assurance business.

-- Gross margin improvement as software content grew.

-- Cost benefit from some deferred discretionary investment

into H2.

-- Material increase in adjusted operating profit to $39.5

million (H1 2019: $20.7 million).

-- Interim dividend up 12 per cent to 2.17 cents.

-- Continued strong cash conversion, cash closed at $221.4

million.

Operational highlights

-- Resilient supply chain and agile assembly planning with

no disruption to customer shipments.

-- Business operations carefully managed during challenging

environment with no staff reduction or furlough.

-- Secured more than 250 5G-related wins from across the portfolio

to support the market's acceleration.

-- Released a number of new products and solutions, increasing

our R&D investment and its effectiveness.

-- Our strategic initiatives are gaining traction:

Further strengthened senior leadership team.

Expanded the customer Key Account programme and sales leadership

skillset.

Reorganised our Global marketing function to develop stronger

go to market channels.

Networks & Security

-- Strong uptick in 400G Ethernet test performance, driven

by 5G, Cloud, IoT and internet traffic growth.

-- Significant wins at service providers and leading network

equipment manufacturers (NEMs) in North America, China

and India.

-- We benefited from the expansion of SD-WAN as the exclusive

partner of the industry consortium for certification testing

to its new global SD-WAN standard.

-- Our Security Solutions business focused on important areas

of threat growth, including 5G, critical infrastructure

and emergency services.

-- Whilst we benefited from continued revenue growth in our

Positioning business in the second quarter, we also started

to experience some slowing of order placement from US government

related customers.

Lifecycle Service Assurance

-- Landslide (lab-based 5G network testing) continued its

industry leadership, growing strongly as service providers

in multiple regions and the world's leading NEMs invested

to validate 5G core networks in the lab.

-- Landslide was chosen by Japan's Rakuten Mobile for core

testing of the world's first fully-virtualised, cloud-native

mobile network.

-- Our VisionWorks (live network testing) operational network

assurance solutions saw good growth in the period, including

a large probe order from a tier-1 US service provider.

-- We continued our transition to an outcome-driven service

delivery model, delivering on existing commitments and

developing multiple new opportunities.

Connected Devices

-- Demand for our device test services on live networks in

North America remained robust.

-- 5G device launch delays by our customers impacted our test

growth plans.

-- We were selected by Amazon as one of only two Authorised

Test Labs in the US for Alexa Built-in devices, leveraging

our deep audio and acoustic test expertise.

Outlook

We had a strong start to the year in Q1, while in early Q2 we

did experience some softness in order intake which rebounded in

June. Overall, the first six month's trading resulted in continued

top line growth and significantly increased profitability, driven

by prudent discretionary cost management. As we look forward, we

remain vigilant about the impact COVID-19 may have on customer

spending.

Our performance is expected to be weighted to the second half of

the year. The Board remains confident of continued progress and the

outlook for the year remains unchanged . As an evolving

organisation, Spirent maintains a relentless focus on its

customers. We continue to innovate for growth by investing across

our portfolio and maintain an acute focus on driving operational

excellence.

Eric Updyke, Chief Executive Officer, commented:

"Spirent has demonstrated a resilient business model at a time

when remote connectivity is critical. We delivered progress across

the portfolio and materially improved our profitability.

"Since the crisis began, our talented, agile staff have

seamlessly fulfilled customer demand with no disruption or supply

chain issues. I would like to recognise their excellent service to

our customers.

"While there is much to deliver in the second half, our

fundamentals, operational platform and balance sheet remain strong.

Spirent will continue to manage through the crisis, executing on

our strategy, with a relentless focus on customer centricity,

innovation for growth and operational excellence."

Notes

1. Order intake represents commitments from customers to purchase

goods and/or services that will ultimately result in recognised

revenue.

2. Adjusted operating profit is before charging exceptional items,

acquisition related costs, acquired intangible asset amortisation

and share-based payment amounting to $3.9 million in total

(first half 2019: $2.6 million).

3. Adjusted operating profit as a percentage of revenue in the

period.

4. Adjusted basic earnings per share is based on adjusted earnings

as set out in note 6 of Notes to the half year condensed consolidated

financial statements.

5. Dividends are determined in US dollars and paid in sterling

at the exchange rate prevailing when the dividend is proposed.

The interim dividend proposed for 2020 of 2.17 cents per Ordinary

Share is equivalent to 1.67 pence per Ordinary Share (first

half 2019: 1.59 pence).

- ends -

Enquiries

Eric Updyke, Chief Executive Spirent Communications

Officer plc +44 (0)1293 767676

Paula Bell, Chief Financial &

Operations Officer

James Melville-Ross/Dwight Burden/Emma +44 (0)20 3727

Hall FTI Consulting Limited 1000

The Company will publish a recorded presentation today at 7.00am

UK time on its website. The Company will also host a live, virtual

results Q&A session for the analyst community today at 12.30pm

UK time. A recording of the presentation will be available in the

Investors section of the Spirent Communications plc website

https://corporate.spirent.com/.

About Spirent Communications plc

Spirent Communications plc (LSE: SPT) offers test, measurement,

analytics and assurance solutions for next-generation devices and

networks. Spirent provides products, services and information

solutions for high-speed Ethernet, positioning, and network

infrastructure markets, with expanding focus on service assurance,

cybersecurity and 5G. Spirent is accelerating the transition of

connected devices, network equipment and applications from

development labs to the operational network, as it continues to

innovate toward fully-automated testing and autonomous service

assurance solutions. Further information about Spirent

Communications plc can be found at

https://corporate.spirent.com/.

Spirent Communications plc Ordinary Shares are traded on the

London Stock Exchange (ticker: SPT; LEI: 213800HKCUNWP1916L38). The

Company operates a Level 1 American Depositary Receipt (ADR)

programme with each ADR representing four Spirent Communications

plc Ordinary Shares. The ADRs trade in the US over-the-counter

(OTC) market under the symbol SPMYY and the CUSIP number is

84856M209. Spirent ADRs are quoted on the Pink OTC Markets

electronic quotation service which can be found at

http://www/otcmarkets.com/marketplaces/otc-pink.

Spirent and the Spirent logo are trademarks or registered

trademarks of Spirent Communications plc. All other trademarks or

registered trademarks mentioned herein are held by their respective

companies. All rights reserved.

Cautionary statement regarding forward-looking statements

This document may contain forward-looking statements which are

made in good faith and are based on current expectations or

beliefs, as well as assumptions about future events. You can

sometimes, but not always, identify these statements by the use of

a date in the future or such words as "will", "anticipate",

"estimate", "expect", "project", "intend", "plan", "should", "may",

"assume" and other similar words. By their nature, forward-looking

statements are inherently predictive and speculative and involve

risk and uncertainty because they relate to events and depend on

circumstances that will occur in the future. You should not place

undue reliance on these forward-looking statements, which are not a

guarantee of future performance and are subject to factors that

could cause our actual results to differ materially from those

expressed or implied by these statements. The Company undertakes no

obligation to update any forward-looking statements contained in

this document, whether as a result of new information, future

events or otherwise.

Chief Executive Officer review

Spirent has a resilient business that supports critical

infrastructure. Our fundamental drivers remain the same despite the

global disruption due to COVID-19. In fact, the reliance on

technology to stay connected has only increased and our testing

solutions remain mission critical, enabling businesses to connect

remotely and seamlessly. I'm proud of the job that we have done in

the face of such turmoil.

COVID-19 Update

During the period we have taken a number of actions in light of

COVID-19. Employee safety remains our number one priority and at

the beginning of March we took swift action to move over 95 per

cent of our employees to full-time remote work. At Spirent, we

benefited from our strong, agile supply chain management and

financial discipline and have been fortunate to avoid furloughs or

lay-offs due to COVID-19. Our talented team quickly innovated the

way we work, sell and collaborate remotely. Strategic initiatives

underway to evolve our sales team to a more solutions-based mindset

have enabled us to engage in deeper conversations and strengthen

relationships with our customers. We continue to monitor the

situation closely and have a phased plan for our return to onsite

work.

Market Overview

The COVID-19 crisis has created uncertainty and unforeseen

challenges for all industries, including for our customers.

Customer spending patterns remain uncertain, particularly for our

lab and government markets. The unprecedented impact on society has

forced many people to stay at home, to virtually work, learn and

connect with friends and family. The need for connectivity has

highlighted the essential services and infrastructure that we

support.

Despite this disruption, our major drivers for growth remain

unchanged, including 5G Momentum, High-Speed Ethernet, Cloud and

Network Virtualization, Cybersecurity Threats and Connected Devices

Proliferation.

Although we have seen some customer 5G device launch delays, the

5G market remains robust, with China and the US accelerating their

5G plans. We are seeing new opportunities for government and

private network applications, with organisations increasingly

adopting SD-WAN to support their work-from-home workforce. Spirent

has again been nominated as a finalist for the Leading Lights

Awards 2020 in the "Outstanding Test & Measurement Vendor"

category due to our 5G business. We have won the award the last two

years in a row.

To seize these market opportunities, our strategy is focused

around three pillars: Customer Centricity, Innovation for Growth

and Operational Excellence.

Customer Centricity

We strive to create a more agile collaborative organisation,

capable of solving bigger business problems for our customers.

Deepening and expanding our customer reach is a key focus. Due

to our understanding and connection to our customers, we are

expanding Spirent's footprint by diversifying our customers as well

as increasing our share with existing customers. Our end-to-end

solutions supporting the entire customer lifecycle continue to

deliver competitive wins across regions.

To strengthen customer relationships, the team has worked hard

to refresh and instil a solutions-based selling mindset. Within the

North American market, we have seen progress across the Canadian

service providers, and in the US, we are making important inroads

with the large cable and multiple-system operators ( MSOs). We

performed well and drove solid growth in the Asia-Pacific region,

despite the global pandemic and turmoil in international trade. As

Asian countries, especially China, begin to rebound from COVID-19,

we are seeing heavy investment in 5G by our customers. Going

forward, we will continue to manage a dynamic, challenging

geopolitical landscape. In the European market, we continued to win

in 5G wireless and SD-WAN at service providers and network

equipment manufacturers (NEMs). We enhanced our digital outreach

across all regions, as we continue to broaden and deepen our

customer engagements.

To increase our customer reach, targeting new geographies and

market segments, we are expanding into more enterprise customers

while increasing share of wallet with our key service provider and

NEM accounts. To ensure Spirent makes a broader impact, our Key

Account Management Programme continues to deliver excellent results

as we strengthen our relationships with key accounts and

strategically partner with them.

By focusing on solutions and services, we are delivering value

across the customer lifecycle. We established a cross-company

services approach to formalise and govern our strategic services

offerings.

Innovation for Growth

We continue to invest in product innovation, making our products

even easier for customers to use and our leading 5G portfolio

continues to be a winning advantage across our business. The market

for 5G continues to be robust, with China and the US accelerating

deployments. Our investment in 5G is reaping rewards as we continue

to win new business, with strong growth in 5G orders over last

year. From 5G device testing and accelerating time-to-market, to

assuring and securing live networks, our portfolio offers

award-winning solutions to customer challenges.

Through our leading Position, Navigation and Timing (PNT)

solutions, Spirent enables innovation and development in global

navigation satellite system (GNSS) technologies that are

influencing more and more areas of our lives. From the development

of new satellites to positioning and navigation systems for

miniature drones, Spirent solutions are working behind the scenes

to improve accuracy, reliability, and robustness. Our PNT business

maintained growth and in the first half of 2020, released the

innovative SimHIL, an integrated software for realistic testing of

the scenarios that power advanced automotive systems. We are

growing from our leadership to expand into new markets, focused on

the next evolution of PNT simulation and assurance.

Our service assurance solutions are making good progress in the

transition to an outcome-driven service delivery model. Our

innovative collaboration with Rakuten Mobile in Japan will support

the rollout of 5G non-standalone and standalone, for Rakuten's

world-first fully virtualized, cloud-native mobile network. In

addition to an ongoing, large Testing-as-a-Service (TaaS) project

at a tier-1 provider, we are managing several additional service

delivery opportunities.

Our innovation in cloud and our CloudSure solution is driving

opportunities across a spectrum of customers. Continued investments

into the CloudSure platform will enable us to grow into new

customer segments including enterprise private and hybrid clouds

and the emerging edge cloud market.

Spirent was the first to launch a WiFi6 test solution, which

enables us to tap into the planned mass-deployments of WiFi6

networks for traditional network access as well as 5G hand-off.

In addition to technology innovation, we are establishing new

business models to grow recurring revenues, including services and

software, providing the Group with enhanced visibility.

Operational Excellence

Operational excellence is vital to support Spirent's growth. We

maintained our operational and financial strength during the global

pandemic due to our operational discipline, supply chain management

and strong balance sheet. We closed out the first half of 2020 with

a cash balance of $221.4 million.

Throughout the pandemic, the resilience of our supply chain

operations underpinned our success and helped ensure all customer

shipments were made during a very challenging environment. The

agility and proactiveness of the team was exemplary.

Our leadership team has stayed connected with our employees.

Communicating through email updates, video messages and townhalls,

we strive to keep our staff constantly up to date on the latest

safety guidelines and state of the business. In May, we completed

an employee engagement survey and, with over 92 per cent of

employees responding, we received an improved score of highly

engaged.

We continue to invest in talent and to develop our processes and

business systems to support our continued growth.

In the period, as part of evolving our sales and marketing

structure to pivot to a more customer-centric organisation, we

benchmarked our global marketing function and established a new

operating model to increase the effectiveness of our routes to

market and to improve focus on our strategic growth priorities.

We are working hard to improve the overall efficiency and

effectiveness of our global teams. We have further strengthened our

sales team during the period and continue to evolve our salesforce,

expanding our key account programme where we are engaging on bigger

business problems with our customers.

We have built a new central services team which will enable us

to drive more cross-company service offerings. As we look to

enhance security across our portfolio, we have appointed a new

leader for our Security Solutions business. In addition, we

continue to drive our corporate development activities as we

continue to explore opportunities to grow our portfolio both

organically and inorganically to seize market opportunities and

have appointed a new leader for this vital area.

Sustainability and corporate responsibility are fundamental to

our operational excellence and the overall success of our business.

As we continue to innovate and grow, our ESG programme,

FuturePositive, focuses on embedding sustainability across our

products, procurement, people and property. We continue to look for

new ways to embed sustainable thinking across Spirent and have

reduced our total energy usage by 19 per cent over the last five

years, sourcing 90 per cent of our electricity from renewable

sources. In addition, our Global STEM Ambassador Programme is

focused on bridging the skills gaps in the STEM world and aims to

inspire, support and encourage students of all ages in their

learning and development of STEM subjects.

Business review

Spirent focuses on three strategic business segments: Networks

& Security, Lifecycle Service Assurance and Connected Devices.

This structure positions the Group to meet the needs and

expectations of our customers and to capitalise on the business

opportunities created as they:

-- develop innovative devices, applications, network equipment and networks; and

-- operate those networks and services.

We improve network performance and end user experience in our

connected world and help create our smarter future.

Networks & Security - 61% of Group revenue

Networks & Security is a world leader in high-speed

Ethernet/IP performance testing, in Wi-Fi and automotive Ethernet,

and develops test methodologies, tools and services for virtualised

networks and cloud. We provide consulting services, test tools,

methodologies and proactive security validation solutions. We

continue to be the world leader for global navigation satellite

system (GNSS) simulation products and tailored solutions as we

expand into the Position, Navigation and Timing (PNT) market.

First half First half

$ million 2020 2019

----------------------------------- ------------ ------------

Revenue 142.0 131.0

Adjusted operating profit(1) 25.5 16.0

Adjusted operating margin(1) (%) 18.0 12.2

----------------------------------- ------------ ------------

Note

1. Before exceptional items of $0.7 million charged in the first half of 2020.

Networks & Security delivered revenue growth of $11.0

million or 8.4 per cent over the first half of 2019, primarily

driven by 400G Ethernet test and Positioning business. Adjusted

operating profit increased by $9.5 million, benefiting from both

the higher revenue and improved gross margin, with adjusted

operating margin up 5.8 percentage points to 18.0 per cent.

Performance highlights

-- Against a background of strong half-on-half growth in our

400G Ethernet test business, Spirent partnered with H3C

to assure that large-scale data centres can confidently

transition to 400G Ethernet connections triggered by 5G,

cloud computing, IoT and the explosive growth in internet

traffic. With 72 ports of 400GE, this collaboration became

the industry's largest-scale 400G test with SRv6 (segment

routing over IPv6 data plane) capabilities;

-- Spirent has certified multiple vendors and service providers

for MEF 3.0 SD-WAN services since the introduction of the

MEF 3.0 SD-WAN Certification Program in November 2019. As

MEF's SD-WAN Authorised Certified Test Partner, Spirent

certified the SD-WAN products and managed services to validate

their conformance to the industry-leading SD-WAN Service

Attributes and Services (MEF 70) global standard;

-- Our Security Solutions business focused on supporting proactive

security concerns with critical infrastructure and emergency

services. We spoke at RSA 2020 on "SCADA/ICS Inherited Insecurity:

From Nuclear Power Plants to Oil Rigs". We also tested the

security of more than two dozen devices for critical infrastructure

and emergency service systems;

-- We applied our 5G security expertise to engagements with

the UK and US governments in an advisory capacity on key

5G security issues such as secure supply chains, and we

opened several new 5G security consulting services engagements

with leading service providers;

-- The Positioning business continued to show good progress

despite orders from US government contractors softening

in the second quarter; and

-- In the Positioning businesses commercial segments, its mid-range

simulation platform (GSS7000) and record playback solution

(GSS6450) all saw half-on-half sales growth. The latter

was the result of a successful transfer of technology acquired

in late 2019. The business also continued to operate a full

manufacturing capability throughout the COVID-19 pandemic

to ensure all customers were engaged and served.

Lifecycle Service Assurance - 25% of Group revenue

Our Lifecycle Service Assurance solutions radically reduce the

time and cost to turn-up new services and to rapidly diagnose,

troubleshoot and resolve issues with production networks and

services. We lead the market in pre-deployment testing of mobile

core networks, and our cloud-native active test and assurance

solutions automate service turn-up, monitoring and troubleshooting

of 5G, LTE, Ethernet, SD-WAN and cloud networks in NetDevOps

environments.

First half First half

$ million 2020 2019

----------------------------------- ------------ ------------

Revenue 58.5 51.0

Adjusted operating profit(1) 12.8 4.0

Adjusted operating margin(1) (%) 21.9 7.8

----------------------------------- ------------ ------------

Note

1. Before exceptional items of $0.7 million charged in the first half of 2020.

Lifecycle Service Assurance grew revenue by $7.5 million or 14.7

per cent over the first half of 2019, with strong demand for our

mobility, automation and service assurance test solutions. Adjusted

operating profit benefited from the higher revenue, improved gross

margin and lower operating costs, coming in $8.8 million higher

than over the same period last year. The increased sales volume

drove an adjusted operating margin increase to 21.9 per cent.

Performance highlights

-- We continue to set the pace for 5G verification and assurance

in the lab. Customer demand for our Landslide lab solution

remained strong in the Americas, with an increasing opportunity

landscape in the APAC region;

-- We saw good half-on-half orders growth for our VisionWorks

live network solution in the first half, especially in top-tier

accounts in the Americas;

-- We made good progress in our transition from a vendor of

traditional test tools to an outcome-driven service delivery

model. In addition to an ongoing large Testing-as-a-Service

(TaaS) project at a tier-1 provider in the Americas, Lifecycle

Service Assurance is currently managing several additional

service delivery opportunities;

-- We revealed our extensive collaboration with Japan's Rakuten

Mobile in support of current LTE services, as well as planned

5G non-standalone and standalone rollouts, for the world's

first fully virtualized cloud native mobile network. Rakuten

selected Spirent Landslide for its demanding core network

test needs; and

-- We announced our work with China Telecom on system-wide performance

verification and assessment efforts for 5G standalone network

equipment. China Telecom used Spirent Landslide to rapidly

test 5G core network commercial equipment from four vendors,

conducting end-to-end system function verification and interoperability.

Connected Devices - 14% of Group revenue

Connected Devices helps those who build wireless devices and

networks to meet their promise of delivering the very best end-user

experience. Our automated test systems and services offerings test

mobile devices and supported voice, video and location services in

the lab or on operational networks. Our solutions for 5G air

interface technology testing and digital twins for network and

radio systems let manufacturers and service providers get to market

faster with peak performance.

First half First half

$ million 2020 2019

----------------------------------- ------------ ------------

Revenue 33.2 35.4

Adjusted operating profit(1) 4.5 5.2

Adjusted operating margin(1) (%) 13.6 14.7

----------------------------------- ------------ ------------

Note

1. Before exceptional items of $0.2 million charged in the first half of 2020.

Revenue at Connected Devices was down marginally half-on-half,

however effective management of the cost base almost mitigated the

impact on adjusted operating profit. Adjusted operating margin was

broadly maintained, coming in at 13.6 per cent in the first half of

2020, compared to 14.7 per cent over the same period last year.

Performance highlights

-- While demand for our device test capabilities on live networks

remained robust in the first half, we saw softness in lab

solutions at some key chipset and device customers as a

result of program delays which we expect to return later

this year;

-- 5G device launch delays by our customers impacted our test

growth plans;

-- We won new 5G device testing business at tier-1 accounts,

spanning chipset vendors, device manufacturers and test

labs, and we saw continued expansion in demand for 5G device

testing on live networks as 5G deployment ramps and 5G standalone

networks go into service;

-- We expanded into new addressable markets with wins into

the automotive ecosystem for development of next-generation

Cellular Vehicle-to-Everything communication technology;

and

-- Connected Devices was approved by Amazon as an Authorised

Test Lab for Alexa Built-in devices, with our state-of-the-art

lab providing a range of audio and acoustic test services

for devices seeking Amazon certification.

Financial review

Group financial performance

Spirent delivered a strong financial performance in the first

half of 2020, despite the global impact of COVID-19, with order

intake growth of 6 per cent and revenue growth of 7 per cent.

Adjusted operating profit almost doubled, from $20.7 million in the

first half of 2019 to $39.5 million in first half 2020, an increase

of $18.8 million. The strong operating profit performance was due

to a number of factors; we not only benefited from good revenue

growth but increased software content continued, driving our 1.4

percentage point increase in gross margin; and we carefully managed

our cost base, deferring discretionary expenditure to later in the

year, when we may have improved visibility. These benefits had the

result of delivering a strong operating margin at the end of the

first half, and as we make investment into our operational plans in

the second half of the year, the full year operating margin outlook

remains unchanged as 'high teens'.

The increment in adjusted operating profit was reflected in

profit before tax, which increased by $17.3 million, to $36.0

million. With the effective tax rate unchanged at 13.0 per cent,

adjusted basic earnings per share came in at 5.70 cents, up from

3.03 cents in first half 2019. Cash conversion continued to be

robust, resulting in closing cash of $221.4 million.

As in previous years, our usual trading performance seasonality

is expected to be weighted to the second half of the financial year

but this year it is particularly difficult to predict the impact of

COVID-19 on customer spending over the rest of the year.

The following table shows the summary financial performance for

the Group:

First half First half Change

$ million 2020 2019 (%)

---------------------------------- ------------ ------------ ------------

Order intake(1) 232.1 219.5 +5.7

Revenue 233.7 217.4 +7.5

Gross profit 171.5 156.5 +9.6

Gross margin (%) 73.4 72.0 +1.4

Adjusted operating costs(2) 132.0 135.8 * 2.8

Adjusted operating profit(2) 39.5 20.7 +90.8

Adjusted operating margin(3)

(%) 16.9 9.5 +7.4

Reported operating profit 35.6 18.1 +96.7

Effective tax rate(4) (%) 13.0 13.1 * 0.1

Reported profit before tax 36.0 18.7 +92.5

Adjusted basic earnings per

share(5) (cents) 5.70 3.03 +88.1

Basic earnings per share (cents) 5.28 2.72 +94.1

Free cash flow(6) 65.5 44.6 +46.9

Closing cash 221.4 141.8 +79.6m

Interim dividend per share(7)

(cents) 2.17 1.94 +12.0

---------------------------------- ------------ ------------ ------------

Notes

1. Order intake represents commitments from customers to purchase

goods and/or services that will ultimately result in recognised

revenue.

2. Before charging exceptional items, acquisition related costs,

acquired intangible asset amortisation and share-based payment

amounting to $3.9 million in total (first half 2019: $2.6

million).

3. Adjusted operating profit as a percentage of revenue in the

period.

4. Effective tax rate is the adjusted tax charge, before tax

on adjusting items, expressed as a percentage of adjusted

profit before tax.

5. Adjusted basic earnings per share is based on adjusted earnings

as set out in note 6 of Notes to the half year condensed consolidated

financial statements.

6. Cash flow generated from operations, less tax and net capital

expenditure, after interest paid and/or received, payment

of lease liabilities and finance lease payments received.

7. Dividends are determined in US dollars and paid in sterling

at the exchange rate prevailing when the dividend is proposed.

The interim dividend proposed for 2020 of 2.17 cents per Ordinary

Share is equivalent to 1.67 pence per Ordinary Share (first

half 2019: 1.59 pence).

Note on Alternative Performance Measures (APM)

The performance of the Group is assessed using a variety of

performance measures, including APMs which are presented to provide

users with additional financial information that is regularly

reviewed by management. These APMs are not defined under IFRS and

therefore may not be directly comparable with similarly identified

measures used by other companies.

The APMs adopted by the Group are defined in the appendix. The

APMs which relate to adjusted income statement lines are presented

and reconciled to GAAP measures using a columnar approach on the

face of the income statement and can be identified by the prefix

'adjusted' in the commentary. All APMs are clearly identified as

such, with explanatory footnotes to the tables of financial

information provided, and reconciled to reported GAAP measures in

the Financial Review or Notes to the consolidated financial

statements.

Revenue

First First

half half

$ million 2020 % 2019 %

--------------------------------- ------- ------- ------- -------

Revenue by segment

Networks & Security 142.0 60.8 131.0 60.2

Lifecycle Service Assurance 58.5 25.0 51.0 23.5

Connected Devices 33.2 14.2 35.4 16.3

--------------------------------- ------- ------- ------- -------

233.7 100.0 217.4 100.0

--------------------------------- ------- ------- ------- -------

Revenue by geography

Americas 119.9 51.3 117.3 54.0

Asia Pacific 90.3 38.6 75.7 34.8

Europe, Middle East and Africa 23.5 10.1 24.4 11.2

--------------------------------- ------- ------- ------- -------

233.7 100.0 217.4 100.0

--------------------------------- ------- ------- ------- -------

Overall Group revenue increased by 7.5 per cent, with Networks

& Security and Lifecycle Service Assurance up 8.4 and 14.7 per

cent, respectively, and Connected Devices 6.2 per cent lower,

compared to the same period last year. The growth in Networks &

Security primarily came from strong demand for 400G Ethernet test

driven by 5G roll out, particularly in APAC, and continuing demand

for satellite simulators provided by our Positioning business.

Lifecycle Service Assurance revenue growth was driven by demand for

both our Landslide lab solution and VisionWorks live network

solution offerings, as customers invested to verify and assure 5G.

Connected Devices experienced some softness as our customers

delayed their launches of 5G devices.

Regionally we experienced strong growth in APAC, particularly

China, driven by investment in 5G. Revenues generated in the

Americas and EMEA remained essentially flat, despite the impact of

COVID-19 in these regions

Gross margin

First First

half half

$ million 2020 % 2019 %

------------------------------ ------- ------ ------- ------

Networks & Security 103.9 73.2 93.8 71.6

Lifecycle Service Assurance 45.5 77.8 38.9 76.3

Connected Devices 22.1 66.6 23.8 67.2

------------------------------ ------- ------ ------- ------

171.5 73.4 156.5 72.0

------------------------------ ------- ------ ------- ------

Gross margin for the total Group increased by 1.4 percentage

points, compared to the same period last year, due to product mix

and the continuing trend of growth in software content.

Adjusted operating costs

First half First half

$ million 2020 2019

------------------------------ ------------ ------------

Product development 50.7 48.5

Selling and marketing 56.7 63.1

Administration(1) 24.6 24.2

------------------------------ ------------ ------------

Adjusted operating costs(1) 132.0 135.8

------------------------------ ------------ ------------

Networks & Security 78.4 77.8

Lifecycle Service Assurance 32.7 34.9

Connected Devices 17.6 18.6

Corporate 3.3 4.5

------------------------------ ------------ ------------

Adjusted operating costs(1) 132.0 135.8

------------------------------ ------------ ------------

Note

1. Before charging exceptional items, acquisition related costs,

acquired intangible asset amortisation and share-based payment

amounting to $3.9 million in total (first half 2019: $2.6 million).

Adjusted operating costs in the first half of 2020 decreased by

$3.8 million compared to the same period last year, benefiting in

the main from timing of discretionary type expenditure which is

deferred to the second half year. This benefit is primarily

reflected in selling and marketing costs in the above table.

Investment into product development has increased across all of our

operating segments and overall by more than inflation, as we

continue to invest in 5G. Administration costs reflect an

inflationary increase. We expect a catch up in expenditure in the

second half of the year as we continue to invest to underpin our

growth agenda.

Operating profit and other items

Adjusted Adjusted

operating operating

First half margin(1) First half margin(1)

$ million 2020 (%) 2019 (%)

--------------------------------- ------------ ------------ ------------ ------------

Networks & Security 25.5 18.0 16.0 12.2

Lifecycle Service Assurance 12.8 21.9 4.0 7.8

Connected Devices 4.5 13.6 5.2 14.7

Corporate (3.3) (4.5)

--------------------------------- ------------ ------------ ------------ ------------

Adjusted operating profit(1) 39.5 16.9 20.7 9.5

--------------------------------- ------------ ------------ ------------ ------------

Other items charged in arriving

at operating profit:

Exceptional items (2.0) -

Acquisition related costs - (0.1)

Acquired intangible asset

amortisation (0.2) (0.8)

Share-based payment (1.7) (1.7)

--------------------------------- ------------ ------------ ------------ ------------

Reported operating profit 35.6 18.1

--------------------------------- ------------ ------------ ------------ ------------

Note

1. Before charging exceptional items, acquisition related costs,

acquired intangible asset amortisation and share-based payment

amounting to $3.9 million in total (first half 2019: $2.6 million).

Adjusted operating margin for first half 2020, based on adjusted

operating profit, increased by 7.4 percentage points to 16.9 per

cent, from 9.5 per cent over the same period last year.

Other items charged in arriving at operating profit, being

exceptional items, acquired intangible asset amortisation and

share-based payment, amounted to $3.9 million in total (first half

2019: $2.6 million, including acquisition related costs of $0.1

million).

Exceptional costs charged in the first half of 2020 of $2.0

million (first half 2019: nil) were associated with the

continuation of the CEO strategic review initiated in the second

half of 2019 (second half 2019: $1.8 million). This program

involves a number of initiatives designed to evolve the strategic

direction of Spirent to maximise market opportunities by creating a

more agile, customer-focused organisation, including a strategic

focus on recurring revenue streams over time; a strengthened

leadership team and development of our sales and marketing

structure to drive improved effectiveness to exploit our leading

technologies. See note 4 to Notes to the half year condensed

consolidated financial statements on page 29 for more information

on exceptional items.

The acquired intangible asset amortisation charge continues to

reduce because more of the assets have reached the end of their

useful economic lives and are no longer being amortised.

Reported operating profit for the first half of 2020 increased

by $17.5 million to $35.6 million, from $18.1 million in the first

half of 2019.

Currency impact

The Group's revenue and costs are primarily denominated in US

dollars or US dollar-linked currencies. Currency exposures arise

from trading transactions undertaken by the Group in foreign

currencies and on the retranslation of the operating results and

net assets of overseas subsidiaries.

In the first half year, the Group's income statement included a

foreign exchange loss of $0.1 million arising from transactional

exposure, reflected in administration costs, compared to a $0.4

million loss over the same period in 2019.

Finance income and costs

Finance income in the first half of 2020 comprised bank interest

received of $1.0 million (first half 2019: $1.4 million) and $0.1

million (first half 2019: $0.1 million) of interest income in

relation to the UK defined benefit pension plans. The decrease in

bank interest received half-on-half reflected the decrease in US

dollar fixed term deposit rates.

Finance costs in the first half were $0.7 million (first half

2019: $0.9 million), being interest on lease liabilities.

Tax

The reported tax charge for the Group for the first half of 2020

was $3.8 million (first half 2019: $2.1 million). The normalised

tax charge, excluding the tax credit on the adjusting items of $0.6

million and the credit in respect of adjustments to prior year tax

of $0.8 million, was $5.2 million (first half 2019: $2.8 million),

resulting in an effective tax rate of 13.0 per cent of adjusted

pre-tax profit. This compared with an effective tax rate of 13.1

per cent for the first half of 2019. For the full year 2020 it is

expected that the effective tax rate will be in the region of 13-14

per cent.

Earnings per share

Adjusted basic earnings per share was 5.70 cents, compared with

3.03 cents for the first half of 2019, reflecting the significant

improvement in trading performance. There were 609.3 million

weighted average shares in issue (first half 2019: 609.9 million).

Basic earnings per share was 5.28 cents compared with 2.72 cents

for the first half of 2019. See note 6 to Notes to the half year

condensed consolidated financial statements on page 30 for the

calculation of earnings per share.

Financing and cash flow

Cash generated from operations in the first half year of 2020

was $74.8 million, compared to $57.2 million in the first half of

2019. The increase was primarily due to the higher operating

profit, as the net change in working capital in both half years was

similar. We continue to benefit from a focus on debt collection and

are pleased to report that we have seen no significant impact from

COVID-19 on our ability to collect trade receivables on a timely

basis. To a small extent we have built inventory to mitigate any

potential supply chain risk as a result of COVID-19. Payables

naturally unwind during the first half year, following the increase

in activity levels at year end, and in the first half of 2020 we

sought to ensure our suppliers continued to be paid on a timely

basis to support them and lessen the impact of COVID-19 on their

businesses.

Free cash flow is set out below:

First half First half

$ million 2020 2019

------------------------------------------ ------------ ------------

Cash flow from operations 74.8 57.2

Tax paid (1.2) (2.7)

------------------------------------------ ------------ ------------

Cash inflow from operating activities 73.6 54.5

Interest received 1.1 1.2

Net capital expenditure (4.4) (6.2)

Payment of lease liabilities, principal

and interest(1) (4.8) (4.9)

------------------------------------------ ------------ ------------

65.5 44.6

------------------------------------------ ------------ ------------

Note

1. Net of lease payments received from finance leases of $0.2

million (first half 2019: nil).

Free cash flow includes a cash outflow in respect of exceptional

items charged in the first half of 2020 and the second half of 2019

of $1.9 million in total (first half 2019: nil).

Net capital expenditure of $4.4 million was marginally lower

than over the same period last year due to the timing of investment

in 5G.

In the first half of 2020, the final dividend for 2019 of $20.5

million was paid (first half 2019: $16.7 million) and 2.0 million

shares were purchased and placed into the Employee Share Ownership

Trust (ESOT) at a cost of $4.7 million (first half 2019: 3.0

million shares at a cost of $6.1 million).

Following these payments, cash and cash equivalents closed at

$221.4 million at 30 June 2020, compared with $183.2 million at 31

December 2019. There continues to be no bank debt.

Defined benefit pension plans

The Group operates two funded defined benefit pension plans in

the United Kingdom which are closed to new entrants.

The accounting valuation of the funded defined benefit pension

plans at 30 June 2020 gave rise to a net surplus of $8.6 million,

compared with a net surplus of $11.6 million at 31 December 2019.

The 30 June 2020 position reflects the fact that positive

investment returns have substantially offset an increase in

liabilities due to a reduction in the rate used to discount those

liabilities. S ee note 8 to Notes to the half year condensed

consolidated financial statements on page 32 for more information

on the defined benefit pension plans and key financial assumptions.

In addition, c ontributions to the plans paid under the deficit

reduction plan put in place following the latest triennial

valuation at 31 March 2018, were $3.3 million during the first half

of 2020 (first half 2019: $3.3 million).

There is also a liability for an unfunded plan in the UK of $0.6

million (31 December 2019: $0.7 million).

The Group operates a deferred compensation plan for employees in

the United States. At 30 June 2020, the deficit on this deferred

compensation plan amounted to $5.0 million (31 December 2019: $4.8

million).

Balance sheet and dividend

The Board currently intends to maintain a cash positive balance

sheet over the medium to long-term. This should allow the Company

to maintain a strong capital position in the face of business

risks, trading fluctuations and working capital demands. In

addition, the Board wishes to maintain flexibility to invest in the

business organically and inorganically. Where appropriate, the

Company may take on modest gearing to fund inorganic

investments.

The Board continues to regularly review the Company's balance

sheet in light of current and expected trading performance and cash

generation, working capital requirements and expected investments,

and COVID-19 related risks. To the extent the Company has excess

cash, it will consider returning such cash to shareholders. The

Board will consider from time to time the appropriate mechanism for

returning surplus cash to shareholders.

The Board has declared an interim dividend of 2.17 cents per

Ordinary Share, a 12 per cent increase over the dividend declared

for the first half 2019 of 1.94 cents. This is equivalent to 1.67

pence per Ordinary Share at an exchange rate of $1.30:GBP1 (first

half 2019: 1.59 pence). The payment will be approximately $13.3

million. The dividend will be paid to Ordinary shareholders on 11

September 2020 and to ADR holders on 18 September 2020. The

dividend is payable to all shareholders on the Register of Members

at the close of business on 14 August 2020.

The Board is continuing to pursue a progressive dividend policy

targeting cover of 2 to 2.5 times adjusted earnings.

Risks and uncertainties

The principal risks and uncertainties affecting the Spirent

Communications Group in respect of the remaining six months of the

year to 31 December 2020 remain those as identified on pages 40 to

45 of the Annual Report 2019. A copy of the Annual Report 2019 is

available on the Company's website at

https://corporate.spirent.com/. In addition, the Group continues to

monitor the impact of the COVID-19 virus outbreak and has conducted

an assessment of the potential impacts of COVID-19 on the principal

risks and uncertainties. In summary, the principal risks and

uncertainties are as follows:

Risk Description

Macro-economic change Spirent is a global business exposed to current

world economic conditions and political and

trade embargo uncertainties over which it has

no control. The business is also exposed to

government spending priorities, principally

in the United States.

The COVID-19 crisis has created uncertainty

to current world economic conditions and government

spending priorities. The Group continues to

monitor the impact to the global economy.

-----------------------------------------------------------

Technology change Spirent sells complex solutions in industries

that can be subject to rapid technological

changes. Testing new technologies drives our

business, but the opportunity also brings high

risk since keeping at the forefront of these

key future technologies is critical to our

success and to ensuring that we remain competitive

in our markets.

It is critical that our product development

investment is directed at the right areas in

order to deliver the solutions that our customers

need, when they need them.

Spirent's success is dependent in part on proprietary

technology which may be infringed by others.

Open-source tools become more prevalent providing

some of the functionality of our products.

Due to COVID-19, there is an increased risk

that technology changes may take longer to

occur.

-----------------------------------------------------------

Customer dependence The Group sells its products and services to

/ customer investment a wide range of companies and continually seeks

plans to expand its customer base. In 2019, no one

customer accounted for more than 10 per cent

of Group revenue, although the top ten customers

represented 42 per cent of Group revenue (2018:

40 per cent).

In some of our markets certain customers have

a dominant market share, which makes doing

business with these customers and their suppliers

critical to the success of our business.

In addition, many of the companies with which

we do business are some of the largest global

telecommunications corporations. Therefore

meeting our development obligations, producing

high quality products and being on time are

vital to Spirent's reputation and success.

Changes in our major customers' priorities

in technology investments can also have a significant

impact on their spending on Spirent products

and on those in the customers' supply chain.

The industry continues to experience consolidation

which does disrupt the spending patterns of

affected customers.

As a result of COVID-19, customer spending

patterns remain uncertain, particularly for

lab and government markets. The Group has taken

steps to evolve the sales team in order to

strengthen relationships with customers.

-----------------------------------------------------------

Business continuity Operational risks are present in the Group's

businesses, including the risk of failed internal

and external processes and systems, human error

and external events, such as a natural disaster,

a global pandemic or cybersecurity attacks.

For example, a significant portion of our communications

operations are located in California which

has in the past experienced natural disasters,

including earthquakes and wildfires.

Contract manufacturers are used for the manufacture

of a substantial amount of Spirent's products.

Spirent's major contract manufacturer is located

in Thailand.

The incidence of cybercrime continues to rise.

Spirent is dependent on its information technology

systems for both internal and external communications

as well as for its day-to-day operations.

The Group has taken steps to manage the increase

to business continuity risk as a result of

the COVID-19 pandemic, including invoking business

continuity plans in each location, closely

monitoring the impact to the supply chain with

additional inventory procured on key components

and by adding secondary suppliers, and by boosting

the global Spirent information technology systems

to enable the workforce to work remotely.

-----------------------------------------------------------

Competition Spirent operates in a range of highly competitive

niche markets which experience rapid technological

change. In order to compete effectively, it

is necessary to establish and maintain technological

differentiation in our solutions.

The Group faces competition from new market

start-ups as well as more established and well-resourced

companies.

Industry consolidation amongst our direct competitors

may bring about a shift in competitive advantage.

-----------------------------------------------------------

Acquisitions A key emerging element of Spirent's strategy

is to develop new capabilities and technologies,

sometimes through acquisition.

Integration of acquisitions can be a complex

process and the results expected from acquisitions

may not be achieved due to problems encountered

in integration, changes in market conditions,

the rate of adoption of new technologies, or

sometimes deficiencies arising in the due diligence

processes.

-----------------------------------------------------------

Employee skill base Employees are crucial to the success of our

business. Attracting and retaining highly qualified

and skilled employees is essential to enable

the Group to deliver on its strategy and to

the success of the business.

-----------------------------------------------------------

Condensed consolidated income statement

First half 2020 First half 2019

----------------------------------- -----------------------------------

Adjusting Adjusting

$ million Notes Adjusted items(1) Reported Adjusted items(1) Reported

Revenue 3 233.7 - 233.7 217.4 - 217.4

Cost of sales (62.2) - (62.2) (60.9) - (60.9)

----------------------------------- ------- ---------- ----------- ---------- ---------- ----------- ----------

Gross profit 171.5 - 171.5 156.5 - 156.5

Product development 3 (50.7) - (50.7) (48.5) - (48.5)

Selling and marketing (56.7) - (56.7) (63.1) - (63.1)

Administration (24.6) - (24.6) (24.2) - (24.2)

Other items - (3.9) (3.9) - (2.6) (2.6)

----------------------------------- ------- ---------- ----------- ---------- ---------- ----------- ----------

Operating profit 39.5 (3.9) 35.6 20.7 (2.6) 18.1

Other items charged in arriving

at operating profit:

Exceptional items 4 - (2.0) (2.0) - - -

Acquisition related costs 9 - - - - (0.1) (0.1)

Acquired intangible asset

amortisation - (0.2) (0.2) - (0.8) (0.8)

Share-based payment - (1.7) (1.7) - (1.7) (1.7)

----------------------------------- ------- ---------- ----------- ---------- ---------- ----------- ----------

Other items - (3.9) (3.9) - (2.6) (2.6)

----------------------------------- ------- ---------- ----------- ---------- ---------- ----------- ----------

Finance income 1.1 - 1.1 1.5 - 1.5

Finance costs (0.7) - (0.7) (0.9) - (0.9)

----------------------------------- ------- ---------- ----------- ---------- ---------- ----------- ----------

Profit before tax 39.9 (3.9) 36.0 21.3 (2.6) 18.7

Tax 5 (5.2) 1.4 (3.8) (2.8) 0.7 (2.1)

----------------------------------- ------- ---------- ----------- ---------- ---------- ----------- ----------

Profit for the period attributable

to owners of the parent Company 34.7 (2.5) 32.2 18.5 (1.9) 16.6

----------------------------------- ------- ---------- ----------- ---------- ---------- ----------- ----------

Earnings per share (cents) 6

Basic 5.70 5.28 3.03 2.72

Diluted 5.63 5.23 3.00 2.69

----------------------------------- ------- ---------- ----------- ---------- ---------- ----------- ----------

Note

1. Adjusting items comprise exceptional items, acquisition

related costs, amortisation of acquired intangible assets,

share-based payment, tax on adjusting items and adjustments in

respect of prior year tax.

The performance of the Group is assessed using a variety of non

GAAP alternative performance measures which are presented to

provide additional financial information that is regularly reviewed

by management. Adjusting items are identified and excluded by

virtue of their size, nature or incidence as they do not reflect

management's evaluation of the underlying trading performance of

the Group. The alternative performance measures are presented in

the appendix.

Condensed consolidated statement of comprehensive income

First half First half

$ million Note 2020 2019

-------------------------------------------------------------- ------ ------------ ------------

Profit for the period attributable to owners

of the parent Company 32.2 16.6

-------------------------------------------------------------- ------ ------------ ------------

Other comprehensive (loss)/income

Items that may subsequently be reclassified

to profit or loss:

* Exchange differences on retranslation of foreign

operations (3.6) 0.7

-------------------------------------------------------------- ------ ------------ ------------

Items that will not subsequently be reclassified

to profit or loss:

* Re-measurement of the net defined benefit pension

asset (5.5) 5.4

* Income tax effect of re-measurement of the net

defined benefit pension asset 1.0 (1.0)

* Re-measurement of the deferred compensation liability 8 - (0.4)

* Income tax effect of re-measurement of the deferred

compensation liability - 0.1

-------------------------------------------------------------- ------ ------------ ------------

(4.5) 4.1

-------------------------------------------------------------- ------ ------------ ------------

Other comprehensive (loss)/income (8.1) 4.8

-------------------------------------------------------------- ------ ------------ ------------

Total comprehensive income for the period attributable

to owners of the parent Company 24.1 21.4

-------------------------------------------------------------- ------ ------------ ------------

Condensed consolidated balance sheet

Audited

30 June 30 June 31 December

$ million Note 2020 2019 2019

----------------------------------------- ------ --------- --------- --------------

Assets

Non-current assets

Intangible assets 159.0 159.5 160.3

Property, plant and equipment 27.4 32.6 29.5

Right-of-use assets 22.3 24.9 26.0

Trade and other receivables 7.0 7.3 6.9

Assets recognised from costs to obtain

a contract 0.2 0.3 0.3

Defined benefit pension plan surplus 8 8.6 10.9 11.6

Deferred tax asset 22.3 21.2 22.4

----------------------------------------- ------ --------- --------- --------------

246.8 256.7 257.0

----------------------------------------- ------ --------- --------- --------------

Current assets

Inventories 30.1 28.0 20.6

Trade and other receivables 89.2 105.8 142.8

Assets recognised from costs to obtain

a contract 0.4 0.5 0.5

Other financial assets - - 0.1

Current tax asset 2.6 2.3 0.5

Cash and cash equivalents 221.4 141.8 183.2

----------------------------------------- ------ --------- --------- --------------

343.7 278.4 347.7

----------------------------------------- ------ --------- --------- --------------

Total assets 590.5 535.1 604.7

----------------------------------------- ------ --------- --------- --------------

Liabilities

Current liabilities

Trade and other payables (59.4) (56.3) (81.8)

Contract liabilities (58.4) (57.8) (55.5)

Lease liabilities (8.3) (9.2) (8.5)

Current tax liability (7.2) (0.4) (3.8)

Provisions (5.7) (10.4) (4.8)

----------------------------------------- ------ --------- --------- --------------

(139.0) (134.1) (154.4)

----------------------------------------- ------ --------- --------- --------------

Non-current liabilities

Trade and other payables (1.5) (2.7) (1.0)

Contract liabilities (17.3) (14.5) (13.6)

Lease liabilities (20.5) (23.7) (24.5)

Defined benefit pension plan deficit 8 (5.6) (4.9) (5.5)

Provisions (3.4) (2.8) (3.4)

----------------------------------------- ------ --------- --------- --------------

(48.3) (48.6) (48.0)

----------------------------------------- ------ --------- --------- --------------

Total liabilities (187.3) (182.7) (202.4)

----------------------------------------- ------ --------- --------- --------------

Net assets 403.2 352.4 402.3

----------------------------------------- ------ --------- --------- --------------

Capital and reserves

Share capital 25.0 25.9 26.8

Share premium account 24.8 25.7 26.6

Capital redemption reserve 16.2 16.7 17.4

Other reserves 20.0 17.7 15.2

Translation reserve 6.5 8.9 10.1

Retained earnings 310.7 257.5 306.2

----------------------------------------- ------ --------- --------- --------------

Total equity attributable to owners

of the parent Company 403.2 352.4 402.3

----------------------------------------- ------ --------- --------- --------------

Condensed consolidated statement of changes in equity

Share Capital

Share premium redemption Other Translation Retained Total

$ million Notes capital account reserve reserves reserve earnings equity

------------------ ------- ---------- ---------- ------------- ----------- ------------- ----------- ---------

At 1 January 2019

(audited) 26.0 25.7 16.8 17.5 8.2 257.7 351.9

------------------ ------- ---------- ---------- ------------- ----------- ------------- ----------- ---------

Profit for the

period - - - - - 16.6 16.6

Other

comprehensive

income - - - - 0.7 4.1 4.8

------------------ ------- ---------- ---------- ------------- ----------- ------------- ----------- ---------

Total

comprehensive

income - - - - 0.7 20.7 21.4

------------------ ------- ---------- ---------- ------------- ----------- ------------- ----------- ---------

Share-based

payment - - - - - 1.7 1.7

Tax credit on

share

incentives - - - - - 0.2 0.2

Equity dividends 7 - - - - - (16.7) (16.7)

Employee Share

Ownership

Trust 12 - - - - - (6.1) (6.1)

Exchange

adjustment (0.1) - (0.1) 0.2 - - -

------------------ ------- ---------- ---------- ------------- ----------- ------------- ----------- ---------

At 30 June 2019 25.9 25.7 16.7 17.7 8.9 257.5 352.4

------------------ ------- ---------- ---------- ------------- ----------- ------------- ----------- ---------

At 1 January 2020

(audited) 26.8 26.6 17.4 15.2 10.1 306.2 402.3

------------------ ------- ---------- ---------- ------------- ----------- ------------- ----------- ---------

Profit for the

period - - - - - 32.2 32.2

Other

comprehensive

loss - - - - (3.6) (4.5) (8.1)

------------------ ------- ---------- ---------- ------------- ----------- ------------- ----------- ---------

Total

comprehensive

(loss)/income - - - - (3.6) 27.7 24.1

------------------ ------- ---------- ---------- ------------- ----------- ------------- ----------- ---------

Share-based

payment(1) - - - - - 1.9 1.9

Tax credit on

share

incentives - - - - - 0.1 0.1

Equity dividends 7 - - - - - (20.5) (20.5)

Employee Share

Ownership

Trust 12 - - - - - (4.7) (4.7)

Exchange

adjustment (1.8) (1.8) (1.2) 4.8 - - -

------------------ ------- ---------- ---------- ------------- ----------- ------------- ----------- ---------

At 30 June 2020 25.0 24.8 16.2 20.0 6.5 310.7 403.2

------------------ ------- ---------- ---------- ------------- ----------- ------------- ----------- ---------

Note

1. Includes $0.2 million in respect of deferred shares for Executive

Directors' Annual Incentive which is charged to administration

expenses in the income statement.

Condensed consolidated cash flow statement

First half First half

$ million Notes 2020 2019

----------------------------------------------- ------- ------------ ------------

Cash flows from operating activities

Cash flow from operations 10 74.8 57.2

Tax paid (1.2) (2.7)

----------------------------------------------- ------- ------------ ------------

Net cash inflow from operating activities 73.6 54.5

----------------------------------------------- ------- ------------ ------------

Cash flows from investing activities

Interest received 1.1 1.2

Purchase of intangible assets - (0.3)

Purchase of property, plant and equipment (4.7) (6.1)

Proceeds from sale of property, plant

and equipment 0.3 0.2

Lease payments received from finance leases 0.2 -

Acquisition of business 9 - (1.9)

----------------------------------------------- ------- ------------ ------------

Net cash used in investing activities (3.1) (6.9)

----------------------------------------------- ------- ------------ ------------

Cash flows from financing activities

Lease liability principal repayments (4.3) (4.1)

Lease liability interest paid (0.7) (0.8)

Dividend paid 7 (20.5) (16.7)

Share purchase into Employee Share Ownership

Trust 12 (4.7) (6.1)

----------------------------------------------- ------- ------------ ------------

Net cash used in financing activities (30.2) (27.7)

----------------------------------------------- ------- ------------ ------------

Net increase in cash and cash equivalents 40.3 19.9

Cash and cash equivalents at the beginning

of the period 183.2 121.6

Effect of foreign exchange rate changes (2.1) 0.3

----------------------------------------------- ------- ------------ ------------

Cash and cash equivalents at the end of

the period 221.4 141.8

----------------------------------------------- ------- ------------ ------------

Notes to the half year condensed consolidated financial

statements

1 General information

The half year condensed consolidated financial statements do not

constitute statutory accounts within the meaning of the Companies

Act 2006. The statutory accounts for the year ended 31 December

2019 were approved by the Board of Directors on 5 March 2020 and

have been delivered to the Registrar of Companies. The auditor's

report on those accounts was unqualified, did not draw attention to

any matters by way of emphasis and did not contain a statement made

under Section 498(2) or (3) of the Companies Act 2006.

The half year condensed consolidated financial statements have

been reviewed, not audited, by the Group's auditor pursuant to the

Auditing Practices Board guidance on Review of Interim Financial

Information. A copy of their review report is included at the end

of this report.

The half year condensed consolidated financial statements for

the period ended 30 June 2020 were approved by the directors on 6

August 2020.

2 Accounting policies

The accounting policies adopted and methods of computation used

are consistent with those applied in the consolidated financial

statements for the year ended 31 December 2019. The annual

financial statements of the Group are prepared in accordance with

International Financial Reporting Standards as adopted by the

EU.

Basis of preparation

The half year condensed consolidated financial statements have

been prepared in accordance with IAS 34 'Interim Financial

Reporting' as issued by the International Accounting Standards

Board and endorsed by and adopted for use in the EU. This condensed

set of half year financial statements has also been prepared in

accordance with the Disclosure and Transparency Rules of the

Financial Conduct Authority.

Presentation

A new line item, 'Contract liabilities', has been added to the

Group's balance sheet in order to present the Group's contract

liabilities arising under IFRS 15 'Revenue from Contracts with

Customers'. Deferred income, a separate line item in the Group's

balance sheet, has been reclassified to 'Contract liabilities'

together with the 'Payments received on account' balance from

'Trade and other payables - current'. The presentation of the

comparative amounts in the Group's balance sheet has also been

amended to reflect this change. The impact of the reclassifications

is set out below.

Decrease/(increase)

Decrease/(increase) at Decrease/(increase)

at 31 December at 1 January

$ million 30 June 2019 2019 2019

--------------------------- --------------------- --------------------- ---------------------

Current liabilities

Deferred income 54.8 53.2 55.2

Trade and other payables 3.0 2.3 1.0

Contract liabilities (57.8) (55.5) (56.2)

--------------------------- --------------------- --------------------- ---------------------

- - -

--------------------------- --------------------- --------------------- ---------------------

Non-current liabilities

Deferred income 14.5 13.6 14.4

Contract liabilities (14.5) (13.6) (14.4)

--------------------------- --------------------- --------------------- ---------------------

- - -

--------------------------- --------------------- --------------------- ---------------------

The related cash flow movement in the first half of 2019 was

also reclassified using the appropriate corresponding line item

within the 'Cash flow from operating activities' category in the

Group's condensed consolidated cash flow statement. This

reclassification had no impact on the Group's net assets, income

statement or net cash flow from operating activities reported in

2019.

As at 31 December 2019, the Group reclassified its deferred

costs balance from 'Trade and other receivables - current' to

'Inventories' as this classification more appropriately represented

the nature of the balance. Accordingly, the presentation of the

comparative amounts in the Group's condensed consolidated balance

sheet was also amended to reflect this change. This resulted in a

reclassification of $0.7 million at 30 June 2019. The related cash

flow movement in the first half of 2019 was also reclassified using

the appropriate corresponding line item within the 'Cash flow from

operating activities' category in the Group's condensed

consolidated cash flow statement. This reclassification had no

impact on the Group's net assets, income statement or net cash flow

from operating activities reported in 2019.

Critical accounting estimates and judgements

The preparation of the half year financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates.

In preparing these half year condensed financial statements, the

significant judgements made by management in applying the Group's

accounting policies and the key sources of estimation uncertainty

were the same as those that applied to the consolidated financial

statements for the year ended 31 December 2019.

The Group is required to perform an impairment review on

goodwill annually and where there are indicators of impairment. The

Group has an annual impairment testing date of 30 November. At 30

June 2020, management have reviewed the goodwill for indicators of

impairment and have considered the trading performance, the Group's

principal risks and uncertainties, the impact of the COVID-19

pandemic on the Group's cash flow forecasts and the other

assumptions used in the value in use calculations. Management have

also considered sensitivities in respect of potential downside

scenarios. There are no indicators of impairment at any of the cash

generating units.

Going concern

In adopting the going concern basis for preparing the half year

condensed financial statements, the directors have considered the

Group's principal risks and uncertainties as set out on page 17,

including the potential impact of the COVID-19 pandemic on the

Group and any longer-term impact to the global economy. In the

first half of 2020, the COVID-19 pandemic has not had a significant

impact on the Group's trading performance and the Group has

continued to operate effectively.

The directors have also considered sensitivities in respect of

potential downside scenarios, including stress testing the latest

cash flow projections that cover a period of 18 months from the

date of these half year condensed financial statements. In these

scenarios, the Group has more than sufficient headroom in its

available resources.

At 30 June 2020, the Group had cash balances of $221.4 million

and external debt only in relation to its lease liabilities.

Having assessed and considered the principal risks faced by the

Group, the potential impact of COVID-19, the sensitivity analysis

and the Group's significant financial headroom, the directors are

satisfied that the Group has adequate financial resources to