Initial Statement of Beneficial Ownership (3)

07 Agosto 2020 - 3:09PM

Edgar (US Regulatory)

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Mellen John F |

2. Date of Event Requiring Statement (MM/DD/YYYY)

8/1/2020

|

3. Issuer Name and Ticker or Trading Symbol

FORD MOTOR CO [F]

|

|

(Last)

(First)

(Middle)

ONE AMERICAN ROAD |

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

_____ Director _____ 10% Owner

___X___ Officer (give title below) _____ Other (specify below)

General Counsel / |

|

(Street)

DEARBORN, MI 48126

(City)

(State)

(Zip)

| 5. If Amendment, Date Original Filed(MM/DD/YYYY)

| 6. Individual or Joint/Group Filing(Check Applicable Line)

_X_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4) | 2. Amount of Securities Beneficially Owned

(Instr. 4) | 3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5) | 4. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Common Stock, $0.01 par value | 12475 | D | |

| Common Stock, $0.01 par value | 8012 | I | By Company Plan |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4) | 2. Date Exercisable and Expiration Date

(MM/DD/YYYY) | 3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4) | 4. Conversion or Exercise Price of Derivative Security | 5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5) | 6. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| BEP Ford Stock Fund Units | (1) | (1) | Common Stock, $0.01 par value | 6 | (1) | D | |

| Employee Stock Option (Right to Buy) | (2) | 3/3/2024 | Common Stock, $0.01 par value | 16202 | $15.37 | D | |

| Employee Stock Option (Right to Buy) | (3) | 3/3/2023 | Common Stock, $0.01 par value | 17713 | $12.75 | D | |

| Employee Stock Option (Right to Buy) | (4) | 3/4/2022 | Common Stock, $0.01 par value | 11879 | $12.46 | D | |

| Employee Stock Option (Right to Buy) | (5) | 3/2/2021 | Common Stock, $0.01 par value | 8203 | $14.76 | D | |

| Ford Stock Units | (6) | (6) | Common Stock, $0.01 par value | 4843 | (6) | D | |

| Ford Stock Units | (7) | (7) | Common Stock, $0.01 par value | 10594 | (7) | D | |

| Ford Stock Units | (8) | (8) | Common Stock, $0.01 par value | 7842 | (8) | D | |

| Explanation of Responses: |

| (1) | These Ford Stock Fund Units were credited to my account by the Company, without payment by me, in transactions exempt under Rule 16b-3(c), under the Company's Benefit Equalization Plan, and included in my most recent plan statement. In general, these Ford Stock Fund Units will be converted and distributed to me, without payment, in cash, following termination of employment, based on the then current price of a Ford Stock Fund Unit and the then current market value of a share of Common Stock. |

| (2) | This option became exercisable to the extent of 33% of the shares optioned after one year from the date of grant (03/04/2014), 66% after two years, and in full after three years. |

| (3) | This option became exercisable to the extent of 33% of the shares optioned after one year from the date of grant (03/04/2013), 66% after two years, and in full after three years. |

| (4) | This option became exercisable to the extent of 33% of the shares optioned after one year from the date of grant (03/05/2012), 66% after two years, and in full after three years. |

| (5) | This option became exercisable to the extent of 33% of the shares optioned after one year from the date of grant (03/03/2011), 66% after two years, and in full after three years. |

| (6) | These Ford Restricted Stock Units were acquired under the Company's Long-Term Incentive Plan without payment by me. These Ford Restricted Stock Units will be converted and distributed to me, without payment, in shares of Common Stock on March 2, 2021. |

| (7) | These Ford Restricted Stock Units were acquired under the Company's Long-Term Incentive Plan without payment by me. These Ford Restricted Stock Units will be converted and distributed to me, without payment, to the extent of 5,217 on March 4, 2021 and 5,377 on March 4, 2022. |

| (8) | These Ford Restricted Stock Units were acquired under the Company's Long-Term Incentive Plan without payment by me. These Ford Restricted Stock Units will be converted and distributed to me, without payment, in shares of Common Stock on August 15, 2020. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Mellen John F

ONE AMERICAN ROAD

DEARBORN, MI 48126 |

|

| General Counsel |

|

Signatures

|

| Jerome F. Zaremba,

Attorney-in-Fact | | 8/7/2020 |

| **Signature of Reporting Person | Date |

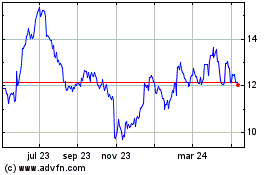

Ford Motor (NYSE:F)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

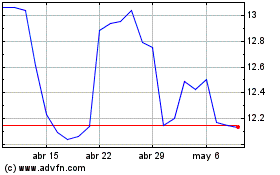

Ford Motor (NYSE:F)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024