Princess Private Equity Holding Ltd Princess publishes Half-Year Report 2020 (2512W)

17 Agosto 2020 - 1:00AM

UK Regulatory

TIDMPEY TIDMPEYS

RNS Number : 2512W

Princess Private Equity Holding Ltd

17 August 2020

News Release

Guernsey, 17 August 2020

Princess publishes Half-Year Report 2020

Princess Private Equity Holding Limited ("Princess" or "the

Company") today published its Half-Year Report for 2020. The key

items were:

-- In the first half of 2020, Princess reported a NAV total

return of -4.6% closing the period at EUR 11.99 per share. NAV

performance was mainly attributable to movements in the valuation

multiples of comparable companies used to value Princess' portfolio

companies.

-- NAV total return for the first quarter was -14.8%, reflecting

the correction observed in public markets during March. NAV

performance then partially recovered in the second quarter (+11.9%)

as public markets rallied.

-- Share price total return over the same period was -12.8%,

with share price lagging the recovery in NAV.

-- The Company provided revised guidance that it intended to pay

a reduced dividend of not less than EUR 0.29 per share in 2020

(2019: EUR 0.58 per share) in order to preserve sufficient

liquidity to ensure its ability to support portfolio companies that

may be negatively affected by the crisis.

-- On 23 June the Board of Directors declared a first interim

dividend of EUR 0.145 per share, which was paid to shareholders on

7 August. The Company intends to pay a second interim dividend in

December.

-- Princess invested a total of EUR 48.8 million during the

first half of 2020. Three new investments (EyeCare Partners,

eResearch Technology and Allied Universal) were completed in the

first quarter of 2020 before the onset of the COVID-19 crisis lead

to processes being put on hold.

-- Princess received distributions amounting to EUR 128.4

million during the first half of 2020. EUR 111.1 million stemmed

from direct investments, including a dividend payment and

subsequent full exit of Action as well as the ongoing sale of

shares in Ceridian.

-- Princess' net liquidity stood at EUR 34.3 million as of 30

June. A further EUR 80 million was available to draw under the

Company's committed credit facility, which was fully repaid during

the first half of the year following receipt of proceeds from the

sale of the Company's stake in Action.

Richard Battey, Chairman comments: "In the first six months of

2020 we have experienced the outbreak of a global pandemic. The

impact of COVID-19 remains unprecedented and Princess' portfolio as

well as public markets have seen a sharp decline in valuations

followed by a partial recovery. In order to preserve sufficient

liquidity to ensure Princess is able to support portfolio companies

that may be negatively affected by the crisis, the Company provided

revised guidance that it intended to pay a reduced dividend of not

less than EUR 0.29 per share in 2020. With Princess' robust balance

sheet and the exposure to a global portfolio of leading private

companies operating in sub-sectors benefitting from long-term,

structural growth drivers, the Board believes that the portfolio

remains well-positioned to generate further value for shareholders.

My fellow Directors and I thank you for the continued trust you

have shown in Princess even during these unprecedented times. We

believe that Princess continues to represent an attractive

investment opportunity, providing shareholders with exposure to a

global portfolio of leading private companies."

A detailed analysis and commentary on the developments of

Princess over the first half of 2020 is presented in the Half-Year

Report published today, which can be accessed via:

http://www.princess-privateequity.net/en/investor_relations/reports.php

A copy of the above document has been submitted to the National

Storage Mechanism and will shortly be available for inspection at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

Ends.

About Princess

Princess is an investment holding company founded in 1999 and

domiciled in Guernsey. It invests, inter alia, in private equity

and private debt investments. Princess is managed in its investment

activities by Partners Group, a global private markets investment

management firm with USD 96 billion in investment programs under

management in private equity, private debt, private real estate and

private infrastructure. Princess aims to provide shareholders with

long-term capital growth and an attractive dividend yield. Princess

is traded on the Main Market of the London Stock Exchange (ticker:

PEY for the Euro Quote; PEYS for the Sterling Quote).

Contacts

Princess Private Equity Holding Limited:

princess@partnersgroup.com

www.princess-privateequity.net

Registered Number: 35241

LEI: 54930038LU8RDPFFVJ57

Investor relations contact

George Crowe

Phone: +44 (0)20 7575 2771

Email: george.crowe@partnersgroup.com

Media relations contact

Jenny Blinch

Phone: +44 207 575 2571

Email: jenny.blinch@partnersgroup.com

www.partnersgroup.com

This document does not constitute an offer to sell or a

solicitation of an offer to buy or subscribe for any securities and

neither is it intended to be an investment advertisement or sales

instrument of Princess. The distribution of this document may be

restricted by law in certain jurisdictions. Persons into whose

possession this document comes must inform themselves about and

observe any such restrictions on the distribution of this document.

In particular, this document and the information contained therein

are not for distribution or publication, neither directly nor

indirectly, in or into the United States of America, Canada,

Australia or Japan.

This document may have been prepared using financial information

contained in the books and records of the product described herein

as of the reporting date. This information is believed to be

accurate but has not been audited by any third party. This document

may describe past performance, which may not be indicative of

future results. No liability is accepted for any actions taken on

the basis of the information provided in this document. Neither the

contents of Princess' website nor the contents of any website

accessible from hyperlinks on Princess' website (or any other

website) is incorporated into, or forms part of, this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR UNUSRRAUWAAR

(END) Dow Jones Newswires

August 17, 2020 02:00 ET (06:00 GMT)

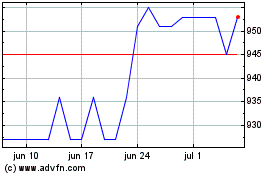

Princess Private Equity (LSE:PEYS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

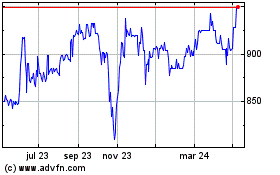

Princess Private Equity (LSE:PEYS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024