Clear Leisure Plc Business Update

17 Agosto 2020 - 1:00AM

UK Regulatory

TIDMCLP

17 August 2020

Clear Leisure Plc

("Clear Leisure" or "the Company")

Business Update

The board of Clear Leisure (AIM: CLP) is pleased to give shareholders a

business update on its investment portfolio, new initiatives and the ongoing

claims relating to its historical assets.

Sipiem SpA ("Sipiem")

The second court hearing in respect of the legal action against the former

directors of Sipiem, scheduled for 6 May 2020 in the Venice Court, has been

postponed to 30 September 2020, due to delays in the court system brought about

by Covid-19. The Company's lawyers have filed additional documentary evidence

to support the claim on 29 June 2020.

As previously reported, legal representatives of all parties involved in the EUR

10.8m claim, as referred to in the RNS of 10 September 2019, will by present

when the court case is convened next month, including legal representatives of

the two insurance companies, (which are among the largest operating in Europe)

and which provided the professional indemnity cover to the majority of the

eight defendants, as reported in the RNS of 10 February 2020.

The Company remains confident on the strong foundations of the claim.

Forcrowd srl ("Forcrowd")

On 18 July 2020, Forcrowd, in which Clear Leisure has a 20% interest and is one

of Italy's newest crowdfunding platforms, launched its second crowdfunding

campaign, for an Italian technology company, Meta Wellness Srl.

Meta Wellness has developed a proprietary communications "wearable" bracelet

for sport and wellness. During the early days of the Covid-19 pandemic, Meta

Wellness began converting its existing wearable bracelet into a distancing

monitor bracelet and has begun to sign a number of contracts with companies

within Italy and across the world.

Meta Wellness has a current capital raising target of up to EUR1.5m, with the

campaign closing on 31 October 2020. Clear Leisure will be paid 1 per cent. of

any funds raised by Meta Wellness on Forcrowd as part of the existing

shareholder agreement with Forcrowd.

The Company has identified a number of innovative technology start-ups as

potential candidates for new campaigns to be launched on Forcrowd's platform in

the Autumn. With regards to the companies which applied to launch a capital

raise on the platform, and which the Company referred to in its announcement

dated 28 January 2020, only B4TECH was approved by Forcrowd's Scientific

Committee and board of directors and has, to date, raised EUR50,000 out of its

target of EUR250,000. The B4TECH fundraise will close on 23 August 2020 and it

will be up to the Company and the investors to decide, at the end of the

campaign, whether to close at a potentially lower amount, or to extend the

deadline or cancel the campaign.

PBV Monitor srl ("PBV")

PBV, in which Clear Leisure has a 10% interest, having secured (as per RNS of

28 January) additional funding, intends to launch its new Intelligence Search

online service in September 2020, while continuing its editorial and seminars

activity.

Bitcoin Mining

The Company continues to monitor trends in the cryptocurrency market, while

waiting for the right time to relocate the data mining facility from Serbia and

resume profitable cryptocurrency extraction. As the Bitcoin price has recovered

this year to nearly $12,000, arrangements are being put in place to transfer

the data mining "container" to Italy. Previous plans in March for a similar

move were delayed due to the restrictions brought about by Covid-19.

New Technology Investment Initiative

Clear Leisure is in the early stages of launching a new investment initiative

focused on high growth technology companies. The Company has engaged Sapphire

Capital Partners LLP, (https://www.sapphirecapitalpartners.co.uk/) a London and

Belfast-based FCA approved and regulated investment management partnership, to

act as the Investment Manager to establish and manage an EIS fund aimed at

professional and qualifying retail investors. Sapphire currently manages 33

funds with approximately GBP60 million under management.

The proposed fund will seek to invest in companies which focus on the

integration of biological and digital systems.

Clear Leisure will scout, source, analyse and perform due diligence on

innovative startups within this industry and mainly in the UK, while the final

investment decision will be approved by Sapphire Capital. The target

fundraising for the fund is GBP10m, with an initial round of GBP3m. No dilution

will take place of shareholders in Clear Leisure.

Once the Fund Information Memorandum is finalised and FCA approval granted,

which could take several months, potential investors will be approached to

commence fund raising.

At this stage there is no certainty that the fund will be granted FCA approval

or that it will be successful in reaching its target fundraising.

Mediapolis SA ("Mediapolis")

The Company has now received EUR1,480,932, being the first tranche (89%) of the

court approved settlement.

In respect of the administrative claim filed against the Piedmont Region in

February 2015 by Mediapolis' previous management team, for the amount of EUR

39.65m, the Receiver of Mediapolis has continued to pursue the case through the

Italian courts. The Company has been informed that the claim has now reached

the final stages of court trials (which commenced in February 2020), with the

latest hearing being held on 6 July 2020. The ruling is expected within 60 days

of this date.

The Company is no longer involved in any court proceedings which involve

Mediapolis following the final settlement with the Receiver of Mediapolis and

has therefore little knowledge as to the likely success or failure of the

ongoing action against Piedmont Region. The Company understands, however, that

83% of any proceeds from this case in excess of EUR3m (this being the amount owed

to existing creditors), would be payable to the Company as a shareholder of

Mediapolis.

Geosim

The Israeli portfolio company has delivered on its project in Asia to build a

Digital Twin model of an international airport, despite the inevitable delays

due to Covid-19.

The Milan and London Digital Twin projects, as announced on 16 December 2019,

are currently on hold, waiting for general market conditions to return to more

normal levels. These delays are necessary in order to avoid the risk of

interrupting data acquisition which could be a possibility should further

lock-down restrictions be reestablished. There is also currently limited

mobility of the staff needed onsite.

Eufingest loans

Following receipt of the Mediapolis funds referred to above, EUR550,000 plus

interest of EUR11,157, has been repaid to Eufingest.

Delay to the notification of Interim Results for the six months ended 30 June

2020

The Company also wishes to notify shareholders that pursuant to the guidance

published by the London Stock Exchange in respect of the temporary measures for

the publication of half-yearly reports for AIM companies pursuant to AIM Rule

18 of the AIM Rules for Companies, Clear Leisure intends to utilise the

additional one month period to prepare and notify shareholders of the Company's

interim results for the six months ended 30 June 2020. As such the Company will

release its Interim Results no later than 30 October 2020.

Francesco Gardin, Executive Chairman and CEO of Clear Leisure, commented, "We

are particularly excited with the new technology investment initiative, which

we hope will receive all the necessary approvals and be able to start raising

funds within the next six months. We will be investing in only the most

innovative companies in the new frontier area of the merger of biological and

digital systems. This new frontier industry has been the focus of extensive

research work carried out between myself and a former colleague at the Milan

University during the last two years, under a formal cooperation agreement with

the Medical School of the same university."

"Finally, we have specifically chosen to make these proposed investments via a

stand-alone investment vehicle, rather than to raise funds directly through

Clear Leisure, in order to limit the dilution of our shareholder base."

This announcement contains inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014.

For further information please contact:

Clear Leisure Plc

+39 335 296573

Francesco Gardin, CEO and Executive Chairman

SP Angel Corporate Finance (Nominated Adviser & Broker) +44 (0)20 3470

0470

Jeff Keating

Leander (Financial PR)

+44 (0) 7795

168 157

Christian Taylor-Wilkinson

About Clear Leisure Plc

Clear Leisure plc (AIM: CLP) is an AIM listed investment company which has

recently realigned its strategic focus to technology related investments, with

special regard to interactive media, blockchain and AI sectors. The Company

also owns shareholdings in a number of historical investments primarily in the

Italian real estate companies, which it is currently seeking compensation

through court action.

For further information, please visit, www.clearleisure.co.uk

END

(END) Dow Jones Newswires

August 17, 2020 02:00 ET (06:00 GMT)

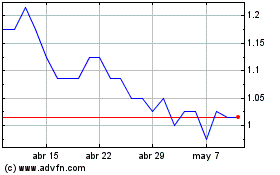

Quantum Blockchain Techn... (LSE:QBT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Quantum Blockchain Techn... (LSE:QBT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024