Canadian Dollar Climbs Amid Risk Appetite

17 Agosto 2020 - 1:41AM

RTTF2

The Canadian dollar advanced against its major rivals in the

European session on Monday, as European shares rose after the

People's Bank of China injected liquidity into the financial system

to help lenders manage upcoming government bond sales.

Investors also looked to the Fed minutes from last month's

meeting, due to be released on Wednesday, for more clues on the

thinking inside the U.S. central bank.

News that China planned to buy more U.S. crude oil in the coming

months cheered investors.

Chinese state-owned oil firms have booked tankers to transport

about 20 million barrels of crude oil during this month and the

next.

The news eased investor worries that China will not stick to its

purchase commitments under phase one trade deal.

The loonie rose to 1.3225 against the greenback and 1.5665

against the euro, from its early low of 1.3264 and a 1-week low of

1.5722, respectively. The next possible resistance for the loonie

is seen around 1.29 against the greenback and 1.55 against the

euro.

The loonie recovered to 80.49 against the yen, up from a 5-day

low of 80.29 seen at 9:30 pm ET. Next key resistance for the loonie

is seen around the 82.00 region.

After falling to a 6-day low of 0.9541 in the Asian session, the

loonie moved up to 0.9497 against the aussie. If the loonie rises

further, 0.93 is possibly seen as its next resistance level.

Looking ahead, New York Fed's empire manufacturing data and NAHB

housing market index for August are scheduled for release in the

New York session.

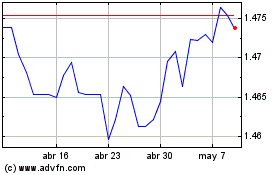

Euro vs CAD (FX:EURCAD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs CAD (FX:EURCAD)

Gráfica de Divisa

De Abr 2023 a Abr 2024