Dollar Falls On Weak Data, Vaccine Hopes

20 Agosto 2020 - 10:38PM

RTTF2

The U.S. dollar was lower against its major counterparts in the

Asian session on Friday, as U.S. weekly jobless claims rose back

above the 1 million mark last week and hopes for a coronavirus

vaccine underpinned sentiment.

Data from the Labor Department showed that U.S. weekly jobless

claims unexpectedly increased in the week ended August 15.

The report said initial jobless claims climbed to 1.106 million,

an increase of 135,000 from the previous week's revised level of

971,000.

Economists had expected a drop of 925,000.

Pfizer Inc. and BioNTech SE said the Covid-19 vaccine they are

jointly developing is on track to be submitted for regulatory

review as early as October, assuming clinical success.

Encouraging news on the US-China trade front also boosted

sentiment. On Thursday, China said that it has agreed to hold talks

with U.S. officials soon to review progress on their preliminary

deal.

The greenback slipped to 2-day lows of 1.3255 against the pound,

1.1883 against the euro and 105.55 against the yen, after rising to

1.3206, 1.1855 and 105.80, respectively in early deals. The

greenback is seen locating support around 1.34 against the pound,

1.20 against the euro and 104 against the yen.

The greenback also dropped to 0.7216 against the aussie and

1.3159 versus the loonie, setting 2-day lows. Should the greenback

slides further, it may find support around 0.75 against the aussie

and 1.29 versus the loonie.

The U.S. currency edged down to 0.6549 against the kiwi, off an

early high of 0.6526. On the downside, 0.68 is possibly seen as the

next support level for the greenback. The greenback, however,

recovered to 0.9083 against the franc, from a 2-day low of 0.9061

seen earlier in the session. The greenback is likely to locate

resistance around the 0.92 level.

Looking ahead, PMI reports from major European economies are due

out in the European session.

In the New York session, Canada retail sales for June and new

housing price index for July, as well as U.S. existing home sales

the same month will be featured.

At 10.00 am ET, European Commission is slated to issue Eurozone

flash consumer confidence survey results for August.

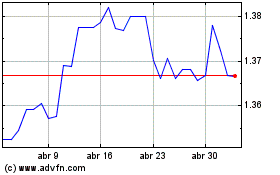

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Abr 2023 a Abr 2024