BHP Group PLC Director/PDMR Shareholding (8541W)

21 Agosto 2020 - 5:38AM

UK Regulatory

TIDMBHP

RNS Number : 8541W

BHP Group PLC

21 August 2020

BHP GROUP PLC and BHP GROUP LIMITED

Notification and public disclosure of transactions by

Persons Discharging Managerial Responsibilities

1 Details of the person discharging managerial responsibilities

/ persons closely associated

a) Name Mike Henry

------------------------------- ---------------------------------------------------

2 Reason for the notification

------------------------------------------------------------------------------------

a) Position/status PDMR (Chief Executive Officer)

------------------------------- ---------------------------------------------------

b) Initial notification/Amendment Initial notification

------------------------------- ---------------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

------------------------------------------------------------------------------------

a) Name BHP Group Plc

------------------------------- ---------------------------------------------------

b) LEI 549300C116EOWV835768

------------------------------- ---------------------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted.

------------------------------------------------------------------------------------

a) Description of BHP Group Limited ordinary shares

the financial ISIN: AU000000BHP4

instrument, type

of instrument

Identification

code

------------------------------- ---------------------------------------------------

b) Nature of the 1. The acquisition of 30,692 ordinary shares

transaction in BHP Group Limited following the vesting

of Deferred Shares under the FY2018 Short

Term Incentive Plan and 3,897 ordinary

shares in BHP Group Limited in accordance

with the Group's policy on Dividend Equivalent

Payments.

2. The acquisition of 92,333 ordinary shares

in BHP Group Limited following the vesting

of the Long Term Incentive Plan 2015 awards

and 19,150 ordinary shares in BHP Group

Limited in accordance with the Group's

policy on Dividend Equivalent Payments.

(The lapse of 100,027 Long Term Incentive

Plan 2015 awards.) *

3. The on-market sale of 67,162 ordinary

shares in BHP Group Limited made in order

to meet expected tax obligations arising

from the transactions described in 1 and

2.

* The five-year performance period for

the 2015 Long Term Incentive Plan ended

on 30 June 2020. Mike Henry's 2015 Long

Term Incentive Plan award comprised 192,360

awards (awarded prior to his appointment

as CEO), subject to achievement of the

relative Total Shareholder Return performance

conditions and a holistic "look back" review

of performance over the five-year period

by the Remuneration Committee. For the

award to vest in full, Total Shareholder

Return must exceed a Peer Group Total Shareholder

Return (for 67 per cent of the award) and

an Index Total Shareholder Return (for

33 per cent of the award) by an average

of 5.5 per cent per year for five years,

being 30.7 per cent in total compounded

over the performance period from 1 July

2015 to 30 June 2020. Total Shareholder

Return includes returns to BHP shareholders

in the form of share price movements along

with dividends paid and reinvested in BHP

(including cash and in-specie dividends).

BHP's Total Shareholder Return performance

was positive 29.0 per cent over the five-year

period from 1 July 2015 to 30 June 2020.

This is above the weighted median Peer

Group Total Shareholder Return of positive

9.6 per cent and below the Index Total

Shareholder Return of positive 38.5 per

cent over the same period. This level of

performance results in 48 per cent vesting

for the 2015 Long Term Incentive Plan awards.

The Remuneration Committee reviewed performance

holistically over the five-year period,

and determined that it was appropriate

to allow 48 per cent of the 2015 Long Term

Incentive Plan awards to vest.

------------------------------- ---------------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

1. Nil 34,589

---------- ----------

2. Nil 111,483

---------- ----------

3. AUD 39.32 67,162

---------- ----------

------------------------------- ---------------------------------------------------

d) Aggregated information N/A

- Aggregated volume

- Price

------------------------------- ---------------------------------------------------

e) Date of the transaction 1. 2020-08-19

2. 2020-08-19

3. 2020-08-19

------------------------------- ---------------------------------------------------

f) Place of the transaction 1. Outside a trading venue

2. Outside a trading venue

3. Australian Securities Exchange (XASX)

------------------------------- ---------------------------------------------------

1 Details of the person discharging managerial responsibilities

/ persons closely associated

a) Name Peter Beaven

------------------------------- ------------------------------------------------

2 Reason for the notification

---------------------------------------------------------------------------------

a) Position/status PDMR (Chief Financial Officer)

------------------------------- ------------------------------------------------

b) Initial notification/Amendment Initial notification

------------------------------- ------------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

---------------------------------------------------------------------------------

a) Name BHP Group Plc

------------------------------- ------------------------------------------------

b) LEI 549300C116EOWV835768

------------------------------- ------------------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted.

---------------------------------------------------------------------------------

a) Description of BHP Group Limited ordinary shares

the financial ISIN: AU000000BHP4

instrument, type

of instrument

Identification

code

------------------------------- ------------------------------------------------

b) Nature of the 4. The acquisition of 30,964 ordinary

transaction shares in BHP Group Limited following

the vesting of Deferred Shares under

the FY2018 Short Term Incentive Plan

and 3,931 ordinary shares in BHP Group

Limited in accordance with the Group's

policy on Dividend Equivalent Payments.

5. The acquisition of 83,940 ordinary

shares in BHP Group Limited following

the vesting of the Long Term Incentive

Plan 2015 awards and 17,409 ordinary

shares in BHP Group Limited in accordance

with the Group's policy on Dividend Equivalent

Payments. (The lapse of 90,933 Long Term

Incentive Plan 2015 awards.) *

6. The on-market sale of 65,424 ordinary

shares in BHP Group Limited made in order

to meet expected tax obligations arising

from the transactions described in 1

and 2.

* The five-year performance period for

the 2015 Long Term Incentive Plan ended

on 30 June 2020. Peter Beaven's 2015

Long Term Incentive Plan award comprised

174,873 awards, subject to achievement

of the relative Total Shareholder Return

performance conditions and a holistic

"look back" review of performance over

the five-year period by the Remuneration

Committee. For the award to vest in full,

Total Shareholder Return must exceed

a Peer Group Total Shareholder Return

(for 67 per cent of the award) and an

Index Total Shareholder Return (for 33

per cent of the award) by an average

of 5.5 per cent per year for five years,

being 30.7 per cent in total compounded

over the performance period from 1 July

2015 to 30 June 2020. Total Shareholder

Return includes returns to BHP shareholders

in the form of share price movements

along with dividends paid and reinvested

in BHP (including cash and in-specie

dividends). BHP's Total Shareholder Return

performance was positive 29.0 per cent

over the five-year period from 1 July

2015 to 30 June 2020. This is above the

weighted median Peer Group Total Shareholder

Return of positive 9.6 per cent and below

the Index Total Shareholder Return of

positive 38.5 per cent over the same

period. This level of performance results

in 48 per cent vesting for the 2015 Long

Term Incentive Plan awards. The Remuneration

Committee reviewed performance holistically

over the five-year period, and determined

that it was appropriate to allow 48 per

cent of the 2015 Long Term Incentive

Plan awards to vest.

------------------------------- ------------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

1. Nil 34,895

---------- ----------

2. Nil 101,349

---------- ----------

3. AUD 39.32 65,424

---------- ----------

------------------------------- ------------------------------------------------

d) Aggregated information N/A

- Aggregated volume

- Price

------------------------------- ------------------------------------------------

e) Date of the transaction 4. 2020-08-19

5. 2020-08-19

6. 2020-08-19

------------------------------- ------------------------------------------------

f) Place of the transaction 1. Outside a trading venue

2. Outside a trading venue

3. Australian Securities Exchange (XASX)

------------------------------- ------------------------------------------------

1 Details of the person discharging managerial responsibilities

/ persons closely associated

a) Name Daniel Malchuk

------------------------------- ------------------------------------------------

2 Reason for the notification

---------------------------------------------------------------------------------

a) Position/status PDMR (President Minerals Americas)

------------------------------- ------------------------------------------------

b) Initial notification/Amendment Initial notification

------------------------------- ------------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

---------------------------------------------------------------------------------

a) Name BHP Group Plc

------------------------------- ------------------------------------------------

b) LEI 549300C116EOWV835768

------------------------------- ------------------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted.

---------------------------------------------------------------------------------

a) Description of BHP Group Limited ordinary shares

the financial ISIN: AU000000BHP4

instrument, type

of instrument

Identification

code

------------------------------- ------------------------------------------------

b) Nature of the 7. The acquisition of 33,686 ordinary

transaction shares in BHP Group Limited following

the vesting of Deferred Shares under

the FY2018 Short Term Incentive Plan

and 4,277 ordinary shares in BHP Group

Limited in accordance with the Group's

policy on Dividend Equivalent Payments.

8. The acquisition of 83,940 ordinary

shares in BHP Group Limited following

the vesting of the Long Term Incentive

Plan 2015 awards and 17,409 ordinary

shares in BHP Group Limited in accordance

with the Group's policy on Dividend Equivalent

Payments. (The lapse of 90,933 Long Term

Incentive Plan 2015 awards.) *

9. The on-market sale of 56,934 ordinary

shares in BHP Group Limited made in order

to meet expected tax obligations arising

from the transactions described in 1

and 2.

* The five-year performance period for

the 2015 Long Term Incentive Plan ended

on 30 June 2020. Daniel Malchuk's 2015

Long Term Incentive Plan award comprised

174,873 awards, subject to achievement

of the relative Total Shareholder Return

performance conditions and a holistic

"look back" review of performance over

the five-year period by the Remuneration

Committee. For the award to vest in full,

Total Shareholder Return must exceed

a Peer Group Total Shareholder Return

(for 67 per cent of the award) and an

Index Total Shareholder Return (for 33

per cent of the award) by an average

of 5.5 per cent per year for five years,

being 30.7 per cent in total compounded

over the performance period from 1 July

2015 to 30 June 2020. Total Shareholder

Return includes returns to BHP shareholders

in the form of share price movements

along with dividends paid and reinvested

in BHP (including cash and in-specie

dividends). BHP's Total Shareholder Return

performance was positive 29.0 per cent

over the five-year period from 1 July

2015 to 30 June 2020. This is above the

weighted median Peer Group Total Shareholder

Return of positive 9.6 per cent and below

the Index Total Shareholder Return of

positive 38.5 per cent over the same

period. This level of performance results

in 48 per cent vesting for the 2015 Long

Term Incentive Plan awards. The Remuneration

Committee reviewed performance holistically

over the five-year period, and determined

that it was appropriate to allow 48 per

cent of the 2015 Long Term Incentive

Plan awards to vest.

------------------------------- ------------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

1. Nil 37,963

---------- ----------

2. Nil 101,349

---------- ----------

3. AUD 39.32 56,934

---------- ----------

------------------------------- ------------------------------------------------

d) Aggregated information N/A

- Aggregated volume

- Price

------------------------------- ------------------------------------------------

e) Date of the transaction 7. 2020-08-19

8. 2020-08-19

9. 2020-08-19

------------------------------- ------------------------------------------------

f) Place of the transaction 1. Outside a trading venue

2. Outside a trading venue

3. Australian Securities Exchange (XASX)

------------------------------- ------------------------------------------------

1 Details of the person discharging managerial responsibilities

/ persons closely associated

a) Name Edgar Basto-Baez

------------------------------- -------------------------------------------

2 Reason for the notification

----------------------------------------------------------------------------

a) Position/status PDMR (President Minerals Australia)

------------------------------- -------------------------------------------

b) Initial notification/Amendment Initial notification

------------------------------- -------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

----------------------------------------------------------------------------

a) Name BHP Group Plc

------------------------------- -------------------------------------------

b) LEI 549300C116EOWV835768

------------------------------- -------------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted.

----------------------------------------------------------------------------

a) Description of 1. BHP Group Limited ordinary shares

the financial ISIN: AU000000BHP4

instrument, type

of instrument

Identification

code

------------------------------- -------------------------------------------

b) Nature of the 1. The acquisition of 33,828 ordinary

transaction shares in BHP Group Limited following

the vesting of Restricted Shares under

the FY2018 Management Award Plan.

2. The on-market sale of 16,244 ordinary

shares in BHP Group Limited made in order

to meet expected tax obligations arising

from the transactions described in 1.

------------------------------- -------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

1 Nil 33,828

---------- ----------

2 AUD 39.32 16,244

---------- ----------

------------------------------- -------------------------------------------

d) Aggregated information N/A

- Aggregated volume

- Price

------------------------------- -------------------------------------------

e) Date of the transaction 1. 2020-08-19

2. 2020-08-19

------------------------------- -------------------------------------------

f) Place of the transaction 1. Outside a trading venue

2. Australian Securities Exchange (XASX)

------------------------------- -------------------------------------------

1 Details of the person discharging managerial responsibilities

/ persons closely associated

a) Name Geraldine Slattery

------------------------------- -------------------------------------------

2 Reason for the notification

----------------------------------------------------------------------------

a) Position/status PDMR (President Petroleum)

------------------------------- -------------------------------------------

b) Initial notification/Amendment Initial notification

------------------------------- -------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

----------------------------------------------------------------------------

a) Name BHP Group Plc

------------------------------- -------------------------------------------

b) LEI 549300C116EOWV835768

------------------------------- -------------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted.

----------------------------------------------------------------------------

a) Description of BHP Group Limited ordinary shares

the financial ISIN: AU000000BHP4

instrument, type

of instrument

Identification

code

------------------------------- -------------------------------------------

b) Nature of the 1. The acquisition of 34,349 ordinary

transaction shares in BHP Group Limited following

the vesting of Restricted Shares under

the FY2018 Management Award Plan.

2. The on-market sale of 8,544 ordinary

shares in BHP Group Limited made in order

to meet expected tax obligations arising

from the transactions described in 1.

------------------------------- -------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

1 Nil 34,349

---------- ----------

2 AUD 39.32 8,544

---------- ----------

------------------------------- -------------------------------------------

d) Aggregated information N/A

- Aggregated volume

- Price

------------------------------- -------------------------------------------

e) Date of the transaction 1. 2020-08-19

2. 2020-08-19

------------------------------- -------------------------------------------

f) Place of the transaction 1. Outside a trading venue

2. Australian Securities Exchange (XASX)

------------------------------- -------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DSHEAEPFADKEEFA

(END) Dow Jones Newswires

August 21, 2020 06:38 ET (10:38 GMT)

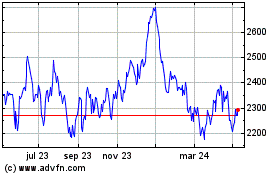

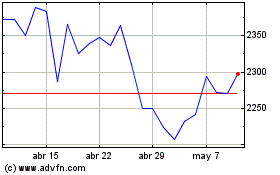

Bhp (LSE:BHP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Bhp (LSE:BHP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024