Dollar Drops On U.S.-China Trade Hopes

24 Agosto 2020 - 10:35PM

RTTF2

The U.S. dollar depreciated against its major counterparts in

the Asian session on Tuesday, as indications of progress in

U.S.-China trade negotiations underpinned investor sentiment.

Top Chinese and U.S. negotiators held a telephonic conversation

and agreed to "push forward" their Phase 1 trade deal reached

between the two countries in January.

Washington said the parties "addressed steps that China has

taken to effectuate structural changes called for by the

agreement".

Beijing said the two sides had a "constructive dialogue" on

creating conditions and atmosphere to continue to push forward the

implementation of the Phase one agreement.

Economic reports on U.S. home prices, consumer confidence and

new home sales are due later in the session.

Investors looked ahead to the U.S. Federal Reserve's annual

Jackson Hole meeting later in the week for further cues on U.S.

monetary policy.

The greenback dropped to 1.3116 against the pound and 1.1815

against the euro, from its early highs of 1.3054 and 1.1784,

respectively. If the greenback falls further, 1.35 and 1.20 are

likely seen as its next support levels against the pound and the

euro, respectively.

The greenback edged down to 0.9105 against the franc early in

the session and held steady afterwards. The pair had ended Monday's

trading at 0.9118.

The greenback pulled back to 1.3212 against the loonie, from a

5-day high of 1.3239 set at 1:10 am ET. The greenback is poised to

locate support around the 1.31 level.

After falling to 0.7183 against the aussie at 10:00 pm ET, the

greenback moved sideways in subsequent deals. At yesterday's close,

the pair was worth 0.7161.

In contrast, the greenback appreciated to a 5-day high of 106.17

against the yen, after a brief drop to 105.87 at 10:00 pm ET. The

next likely resistance for the greenback is seen around the 110.00

level.

Erasing its early fall, the greenback rose back to 0.6520

against the kiwi. This may be compared to a 5-day high of 0.6515

seen at 8:15 pm ET. The greenback is likely to challenge resistance

around the 0.62 level.

Looking ahead, German Ifo business sentiment index for August is

due in the European session.

U.S. consumer sentiment index for August, new home sales for

July, Federal Housing Finance Agency's house price index and

S&P/Case-Shiller home price index for June are scheduled for

release in the New York session.

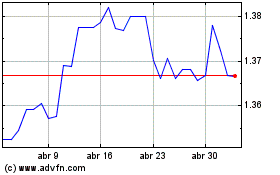

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Abr 2023 a Abr 2024