TIDMURU

RNS Number : 3198X

URU Metals Limited

27 August 2020

URU Metals Limited

("URU Metals" or "the Company")

Plan to drill on upgrading of Class 1 nickel sulphide deposit

for potential supply of battery-grade nickel

URU Metals is pleased to announce that geological exploration

work is intended to shortly recommence on URU's flagship Zebediela

Project ("Project"), targeting battery and higher grade

nickel-sulphide mineralisation to the east of the Zebediela

nickel-sulphide resource.

The Zebediela Nickel Project contains an NI43-101 compliant

nickel sulphide resource of over 1,600 million tons running at

0.245% Nickel, with the ability to produce over 500,000 tons of

nickel using an open-pit mining method, ranking it amongst the top

ten largest nickel sulphide resources globally.

Nickel sulphide deposits are the primary source for Class 1

nickel and represent approximately 40% of current known nickel

resources. The remaining 60% is found in nickel laterite deposits,

which are the primary source for Class 2 nickel (U.S. Geological

Survey, Mineral Commodity Summaries, January 2020). Class 1 nickel

is sought after for use in electric vehicle (EV) lithium-ion

batteries, whilst Class 2 nickel is mainly used in nickel pig iron

and the steel industry.

The Zebediela Project is located on the Northern Limb of the

Bushveld Complex, South Africa, which hosts an estimated 11.9

million tons of nickel, and ranks third in terms of nickel sulphide

content globally. The project is immediately adjacent to, and

up-dip from, Ivanhoe Mines $1.5 billion Platreef Project, and about

15 km along strike from Anglo Platinum's flagship Mogalakwena

Mining Complex. Ivanhoe Mines' Platreef Project contains a total

resource of 852 million tons at 0.31% nickel, 0.16% copper and 3.5

g/t 3PGE+Au (platinum + palladium + rhodium + gold). Mogalakwena

has an estimated resource of 3.8 billion tons at 0.18% nickel,

0.10% copper and 2.4 g/t 3PGE+Au.

The Company has identified a target geological zone directly

east and adjacent to the existing Zebediela resource that has

produced results of 0.56% nickel over a width of greater than 4 m

from exploration drilling, with significant cobalt and PGE credits,

resulting in a nickel equivalent grade of 3.01% nickel (metal

prices as at 25 August 2020 using nickel, copper, 3PGE+Au; assumes

100% recovery for all metals). Drillhole Z017 intersected 1.7% Ni

and 0.7 g/t 3PGE+Au over a width of 2.25 m, 20 m below the existing

NI43-101 complaint resource.

Further exploration drilling will test this target, estimated to

be approximately 5,000 metres in strike length and varying in

thickness between 1.8 and 10m, from depths of 30 m below surface

down to depths of greater than 400 m below surface, and the project

team is confident that this drilling will result in increasing the

overall grade of the project. Drilling is planned to commence in Q4

2020, subject to the Company securing the funding required for this

programme.

Due to the COVID-19 lockdown in South Africa, an extension to

the final submission date of the Environmental Impact Assessment

(EIA) and Environmental Management Program (EMPR) was granted by

the South African Department of Mineral Resources and Energy

(DMRE), and these reports are to be submitted on 15 January 2021.

The EIA is currently underway in order to ensure that future mining

on the project is done in the most environmentally friendly manner

possible, in order to share the Company's vision of a "green nickel

development".

Next Steps

A 12-hole drill programme is expected to commence in October

2020, and is expected to be completed in March 2021, subject to

funding. The results of this drilling program will allow the

company to estimate the amount of infill drilling required to

update the project resource statement.

In parallel to the exploration drilling, EIA studies continue,

and the submission of the EIA to the DMRE will be made in Q1 2021,

and is a crucial step in allowing the DMRE to award a mining right

to the Company.

John Zorbas, CEO of URU Metals, commented:

With the current trend of increasing demand for Class 1 nickel

in battery technologies, we see a tremendous long-term growth

potential for the nickel market. URU's Zebediela nickel sulphide

deposit, located in a burgeoning nickel-PGE mining belt, is

potentially an important future source of Class 1 nickel due to a

lack of major nickel sulphide mines coming online in recent years.

URU is looking to improve the current project economics by

targeting a higher-grade nickel resource, and ultimately develop

the project in an environmentally friendly manner, eventually

contributing towards green energy and helping to meet the

increasing demand for battery-grade nickel products for use in the

electric vehicle markets.

Competent Person Statement

The information in this release has been compiled and reviewed

by Richard Montjoie, the Exploration Manager for the Zebediela

Project. Mr. Montjoie holds a M.Sc. Honours in Economic Geology

from the University of Witwatersrand, South Africa, and is fellow

of the Geological Society of South Africa (GSSA) and a registered

member of the South African Council for Natural Scientific

Professions (SACNASP). He has over 17 years' experience in mineral

project development globally. Richard has been involved in several

exploration programs in South Africa and Northern Canada, including

various Ni-PGE, diamond, coal, coal bed methane and gold

exploration and mining projects. Richard provides sound

geoscientific input in development planning to ensure effective

data acquisition, management and project execution. Richard

successfully acted as Project Manager for a 39 million ounce

platinum feasibility study, advancing the project from exploration

stage to a completed bankable feasibility study with proven and

probable reserves, on time and under budget, managing all aspects

of the programme, from exploration programme design to various

licencing applications. Mr. Montjoie is a Qualified Person for the

purposes of the AIM Note for Mining and Oil & Gas

Companies.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

For further information, please contact:

URU Metals Limited

John Zorbas

(Chief Executive Officer) +1 416 504 3978

SP Angel Corporate Finance LLP

(Nominated Adviser and Broker)

Ewan Leggat & Charlie Bouverat + 44 (0) 203 470 05470

SVS Securities Plc

(Joint Broker)

Tom Curran +44 (0) 203 700 0093

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDKKOBKOBKKKFB

(END) Dow Jones Newswires

August 27, 2020 03:02 ET (07:02 GMT)

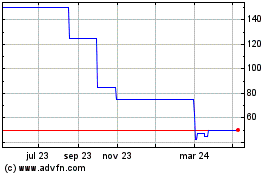

Uru Metals (LSE:URU)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Uru Metals (LSE:URU)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024