Warehouse REIT PLC TWO LOGISTICS ACQUISITIONS FOR GBP82 MILLION (9221X)

03 Septiembre 2020 - 1:00AM

UK Regulatory

TIDMWHR

RNS Number : 9221X

Warehouse REIT PLC

03 September 2020

3 September 2020

Warehouse REIT plc

(the 'Company' or 'Warehouse REIT')

WAREHOUSE REIT INCREASES E-COMMERCE EXPOSURE WITH TWO LOGISTICS

ACQUISITIONS FOR GBP82 MILLION

- Separate transactions, totalling 875,000 sq ft; good progress

being made investing funds from recent fundraise -

Warehouse REIT, the AIM-listed company that invests in

e-commerce urban and last-mile industrial warehouse assets in the

UK, announces that it has completed the acquisition of two

single-let warehouse assets located in the East Midlands and

Cheshire, occupied by Amazon and Wincanton respectively. The assets

have been purchased in two separate transactions for a total

consideration of GBP82 million, reflecting a blended net initial

yield of 5.4% and provide a combined WAULT of 9 years. These latest

additions to the Company's portfolio follow its successful equity

raise that completed last month, delivering equity of circa GBP153

million and over GBP200 million of investment firepower.

The East Midlands property is strategically located just off the

M1 motorway, the key logistics spine of the UK, outside the town of

Chesterfield. The prime 500,000 sq ft fulfilment centre is let to

Amazon UK on a full repairing and insuring lease with over 13 years

remaining, benefitting from five-yearly upward only rent reviews

with no breaks. The Company has acquired the asset for cash

consideration of GBP57 million from Tritax Big Box REIT plc and

when combined with the other Amazon-occupied properties in

Warehouse REIT's portfolio, at just over GBP4m rent per annum as a

result of this acquisition, the e-commerce giant is now the largest

tenant on the Company's rent roll.

The second acquisition comprises a 374,000 sq ft single-let

warehouse located adjacent to the 29 acre multi-let estate at

Midpoint 18 in Middlewich, Cheshire, which was acquired by the

Company last year and increases Warehouse REIT's total holding at

this location to over 550,000 sq ft. The asset, acquired for cash

consideration of GBP25 million, is occupied by Wincanton Holdings

Limited, the UK's largest third party logistics operator, and has

3.5 years remaining on its lease off a low passing rent of cGBP5

psf, which compares favourably to lettings that the Company has

recently achieved on the wider estate. New-build development

activity locally reinforces the strength of the Midpoint Estate's

distribution location, which sits within two miles of Junction 18

of the M6 motorway and approximately 26 miles south of

Manchester.

Andrew Bird, Managing Director of the Investment Advisor,

Tilstone Partners Limited, commented: "Following the successful

equity raise completed in July, it is pleasing to be able to

deliver these high quality acquisitions, which show good progress

with Warehouse REIT deploying the proceeds raised into high quality

e-commerce focussed assets, both identified as part of the

fundraise pipeline. The properties make a significant contribution

to enhancing the overall portfolio quality and with the continued

acceleration of the global ecommerce market, we are pleased that

Amazon becomes the REIT's largest tenant. The Cheshire asset

provides both short and longer-term value-enhancing asset

management opportunities and increases our footprint in what has

proved itself to be a prime North West logistics location.

"We look forward to integrating these assets into the wider

portfolio, while we continue to work through our pipeline of

identified opportunities for the REIT to deploy the remaining

proceeds from the recent equity raise ahead of schedule and allow

the targeted scale to be achieved, whilst driving shareholder

returns."

-ENDS-

Enquiries: via FTI Consulting

Warehouse REIT plc

Tilstone Partners Limited +44 (0) 1244 470

Andrew Bird, Paul Makin 090

FTI Consulting (Financial PR & IR Adviser

to the Company) +44 (0) 20 3727

Dido Laurimore, Ellie Sweeney, Richard Gotla 1000

G10 Capital Limited (part of the IQEQ Group),

AIFM

Maria Glew +44 (0) 20 3696

1302

Peel Hunt (Financial Adviser, Nominated Adviser

and Broker)

Capel Irwin, Carl Gough, Harry Nicholas +44 (0)20 7418 8900

Further information on Warehouse REIT is available on its

website:

http://www.warehousereit.co.uk

Notes to editors:

Warehouse REIT is an AIM listed UK Real Estate Investment Trust

that invests in and manages e-commerce urban and 'last-mile'

industrial warehouse assets in strategic locations in the UK.

Occupier demand for urban warehouse space is increasing as the

structural growth in e-commerce has driven the rise in internet

shopping and investment by retailers in the "last mile" delivery

sector, yet supply remains constrained giving rise to rental

growth.

The Company is an alternative investment fund ("AIF") for the

purposes of the AIFM Directive and as such is required to have an

investment manager who is duly authorised to undertake the role of

an alternative investment fund manager. The Investment Manager is

currently G10 Capital Limited.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQLJMATMTAMMLM

(END) Dow Jones Newswires

September 03, 2020 02:00 ET (06:00 GMT)

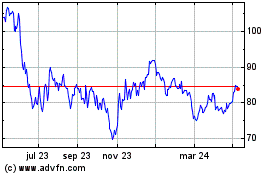

Warehouse Reit (LSE:WHR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

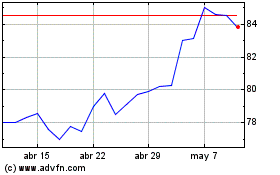

Warehouse Reit (LSE:WHR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024