TIDMWKOF

WEISS KOREA OPPORTUNITY FUND LTD.

LEI 213800GXKGJVWN3BF511

(Classified Regulated Information, under DTR 6 Annex 1 section 1.2)

HALF-YEARLY FINANCIAL REPORT

FOR THE PERIODED 30 JUNE 2020

Weiss Korea Opportunity Fund Ltd. (the "Company") has today, released its

Half-Yearly Financial Report for the period ended 30 June 2020. The Report will

shortly be available for inspection via the

Company's website www.weisskoreaopportunityfund.com.

For further information, please contact:

N+1 Singer

James Maxwell/Justin McKeegan - Nominated +44 20 7496 3000

Adviser

James Waterlow - Sales

Northern Trust International Fund

Administration Services (Guernsey) Limited

Samuel Walden +44 1481 745385

Summary Information

The Company

Weiss Korea Opportunity Fund Ltd. ("WKOF" or the "Company") was incorporated

with limited liability in Guernsey, as a closed-ended investment company on 12

April 2013. The Company's Shares were admitted to trading on the Alternative

Investment Market ("AIM") of the London Stock Exchange (the "LSE") on

14 May 2013.

The Company is managed by Weiss Asset Management LP (the "Investment Manager"),

a Boston-based investment management company registered as an investment

adviser with the Securities and Exchange Commission in the United States of

America.

Investment Objective and Dividend Policy

The Company's investment objective is to provide Shareholders with an

attractive return on their investment, predominantly through long-term capital

appreciation. The Company is geographically focussed on South Korean companies.

Specifically, the Company invests primarily in listed preferred shares issued

by companies incorporated in South Korea, which in many cases trade at a

discount to the corresponding common shares of the same companies. Since the

Company's Admission to AIM, the Investment Manager has assembled a portfolio of

South Korean preferred shares that it believes are undervalued and could

appreciate based on the criteria that it selects. The Company may, in

accordance with its investment policy, also invest some portion of its assets

in other securities, including exchange-traded funds, futures contracts,

options, swaps and derivatives related to Korean equities, and cash and cash

equivalents. The Company does not have any concentration limits.

The Company intends to return to Shareholders all dividends received, net of

withholding tax, on an annual basis.

Investment Policy

The Company is geographically focused on South Korean companies. Some of the

considerations that affect the Investment Manager's choice of securities to buy

and sell may include the discount at which a preferred share is trading

relative to its respective common share, its dividend yield, its liquidity, and

the weighting of its common share (if any) in the MSCI Korea 25/50 Net Total

Return Index (the "Korea Index"), among other factors. Not all of these factors

will necessarily be satisfied for particular investments. The Investment

Manager does not generally make decisions based on corporate fundamentals or

its view of the commercial prospects of an issuer. Preferred shares are

selected by the Investment Manager at its sole discretion, subject to the

overall control of the board of directors of the Company (the "Board").

The Company purchased certain credit default swaps on the sovereign debt of

South Korea and put options on iShares MSCI South Korea as general market and

portfolio hedges, but generally did not hedge its exposure to interest rates or

foreign currencies during the period ended 30 June 2020 (2019: Nil). Please see

additional information about the nature of these hedges in the Investment

Manager's Report within.

Realisation Opportunity

In accordance with the Company's Articles of Incorporation and its Admission

Document, the Company offered all Shareholders the right to elect to realise

some or all of the value of their Ordinary Shares (the "Realisation

Opportunity"), less applicable costs and expenses, on or prior to the fourth

anniversary of Company's admission to AIM and, unless it has already been

determined that the Company be wound-up, every two years thereafter, the most

recent being 15 May 2019 (the "Realisation Date") and the next Realisation Date

taking place in May 2021.

Share Buybacks

In addition to the Realisation Opportunity, the Company has authority to

repurchase on the open market up to 40 percent of its outstanding Ordinary

Shares. During the period ended 30 June 2020, the Company purchased none (2019:

Nil) of its own Shares at a consideration of GBPNil (31 December 2019: GBPNil)

under its general buyback authority.

Shareholder Information

Northern Trust International Fund Administration Services (Guernsey) Limited

(the "Administrator") is responsible for calculating the Net Asset Value

("NAV") per Share of the Company. The unaudited NAV per Ordinary Share is

calculated on a weekly basis and at the month end by the Administrator, and is

announced by a Regulatory News Service and is available through the Company's

website www.weisskoreaopportunityfund.com.

Company financial highlights and performance summary for the period ended 30

June 2020

As at As at

30 June 2020 31 December 2019

GBP GBP

Total Net Assets 138,078,901 126,988,732

NAV per share 1.6918 1.5559

Basic and diluted earnings per 0.1754 0.0960

share

Mid-Market Share price 1.63 1.50

Discount to NAV* (3.7%) (3.6%)

As at close of business on 02 September 2020, the latest published NAV per

Share had increased to GBP1.8708 (as at 01 September 2020) and the Share price

stood at GBP1.86.

*The amount by which the market value exceeds or is less than the face value of

a stock.

Total Expense Ratio

The annualised total expense ratio for the period ended 30 June 2020 was 1.87

per cent (31 December 2019: 1.85 per cent). The annualised total expense ratio

includes charges paid to the Investment Manager and other expenses divided by

the average NAV for the period.

Chairman's Review

For the period ended 30 June 2020

We are pleased to provide the 2020 Half Yearly Report on the Company. During

the period from 31 December 2019 to 30 June 2020 (the "Period"), the Company's

net asset value increased by 11.3 per cent including reinvested dividends1 (the

return was also 11.3 per cent assuming dividends were not reinvested)2

outperforming the reference MSCI Korea 25/50 Net Total Return Index (the "Korea

Index"), which decreased 1.7 per cent in Pounds Sterling ("GBP"). Since the

admission of the Company to AIM in May 2013, the net asset value has increased

by 96.7 per cent including reinvested dividends1 (or 93.4 per cent assuming

dividends are not reinvested in the Company)2, compared to the Korea Index

returns of 42.9 per cent3. A report from the Investment Manager follows.

The Directors declared a dividend of 3.9549 pence per Share, ex-dividend date

21 May 2020, to distribute the income received by the Company in respect of the

year ended 31 December 2019. This dividend was paid to all Shareholders on 12

June 2020.

In my prior letter I commented on the rise of COVID-19, and the disruption and

uncertainty the virus would likely introduce to the Korean economy. Compared to

many, the Korean government and people have done a good job of containing the

virus. However, South Korea entered a technical recession at the end of Q2 and

cluster-based virus outbreaks continue to emerge. Until a vaccine is found, and

is effectively distributed, we anticipate continued COVID-19 disruption to the

South Korean economy and financial markets.

During the Period Korean equity markets fell by approximately 35 per cent then

staged a remarkable rebound from the mid-March lows. Trading volumes and

volatility were at levels not seen by the Company since its inception. I'm

particularly pleased to able to report meaningful outperformance against the

reference index during the first half of the year and credit the Investment

Manager's active management of the portfolio during this highly volatile

period.

Based on the fact that the assets currently held by the Company consist mainly

of securities that are readily realisable, whilst the Directors acknowledge

that the liquidity of these assets needs to be managed, the Directors believe

that the Company has adequate financial resources to meet its liabilities as

they fall due for at least twelve months from the date of this report, and that

it is appropriate for the Financial Statements to be prepared on a going

concern basis.

The Company has an active share repurchase program as part of its discount

management strategy. During the Period, the Board considered buying back Shares

on numerous occasions when the discount to NAV appeared to be wide. However,

the Korean stock market was so volatile that it was very difficult to ensure

that the discount quoted was achievable when realising part of the portfolio to

fund buybacks. With the stock market moving 5 per cent to 10 per cent each day,

I hope that Shareholders can understand the difficulties the Board and the

Investment Manager faced during that difficult period.

The Board is authorised to repurchase up to 40 per cent of the Company's

outstanding Ordinary Shares in issue as at 24 July 20204. Since Admission

almost six years ago, and as at the date of this document, the Company has

repurchased, at a discount to NAV, 12,590,250 Ordinary Shares of the original

105,000,000 Ordinary Shares issued at Admission. The Board also has in place

standing instructions with the Company's broker, N+1 Singer Advisory LLP

("Broker" or "N+1 Singer"), for the repurchase of the Company's Shares during

closed periods when the Board is not permitted to give individual instructions;

such closed periods typically occur around the preparation of the Annual and

Half Yearly Financial Reports. The Board intends to continue to aggressively

repurchase Shares if the Company's Shares are trading at a significant discount

to net asset value. We will continue to keep Shareholders informed of any share

repurchases through public announcements.

If you would like to speak with the Investment Manager or learn about potential

opportunities to meet with them, please contact N+1 Singer. I would like to

thank Shareholders for their support and look forward to the continued success

of the Company in the future.

Norman Crighton

Chairman

03 September 2020

1 This return includes all dividends paid to the Company's Shareholders and

assumes that these dividends were reinvested in the Company's Shares at the

next date for which the Company reports a NAV, at the NAV for that date.

2 This return includes the annual cash dividend paid to the Company's

Shareholders but does not assume such dividends are reinvested..

3 MSCI total return indices are calculated as if any dividends paid by

constituents are reinvested at their respective closing prices on the ex-date

of the distribution.

4 On 24 July 2020, the Company had 81,617,828 Ordinary Shares in issue.

Investment Manager's Report

For the period ended 30 June 2020

Performance

In the first half of 2020, WKOF's NAV in Pounds Sterling ("GBP") gained 11.3

per cent, including reinvested dividends5 (the return was also 11.3 per cent

assuming dividends are not reinvested in WKOF)6 outperforming the reference

MSCI South Korea Index ("the Korea Index")7, which decreased 1.7 per cent when

converted to GBP. From its inception in May 2013, WKOF has significantly

outperformed the Korean market. The total return to an investor in WKOF since

inception was 96.7 per cent including reinvested dividends5 (or 93.4 per cent

assuming dividends are not reinvested in WKOF),6 compared to returns of 42.9

per cent for the Korea Index over the same period.

The outperformance against the Korea Index during the first half of 2020 was

largely due to discount narrowing of preference shares owned, which contributed

9.6 per cent of the 11.3 per cent NAV performance as described in the table

below.

Return Attribution Component Year to June 30, 2020 Attribution

MSCI South Korea Index (KRW)8 -4.6%

WKOF Common Shares vs Korea Index 3.8%

(KRW)9

Discount Narrowing of Preference 9.6%

Shares Owned

Excess Dividend Yield of Preference 0.0%

Shares Owned10

Currency (KRW vs. GBP) 3.0%

Fees & Expenses -1.0%

Other 0.5%

NAV Performance in GBP 11.3%

Macroeconomic Impact of COVID-19

The major theme for the first half of 2020 was the emergence of the COVID-19

virus from Wuhan, China, and the resulting global pandemic. The economic impact

of COVID-19, quarantine measures and government intervention around the world

led to a tumultuous first half of the year across markets. We stated in our

2019 Investment Manager's Report that it would be difficult for us to predict

the full effects of the virus on the global economy, much less how equity

markets would react to new information about infection rates, government

stimulus, and the likelihood and timing of a vaccine.

Despite South Korea recording one of the highest numbers of cumulative COVID-19

cases in early March, the South Korean government's containment policies, based

on a test, trace and isolate strategy, appear to have been relatively effective

at abating the spread of the virus.11 Government tactics have included

establishing testing facilities at gas stations across the country and forming

teams of contact tracers who are empowered to access credit card and mobile

phone records for confirmed cases-typically within minutes. Perhaps due to

these government policies and compliance by the South Korean population, South

Korea has so far avoided the worst consequences of the pandemic without

incurring the massive budget deficits we've seen in the U.S. and Western

Europe. GDP in South Korea for the second quarter showed a year-on-year fall of

3 per cent compared with falls of 9.5 per cent in the U.S., 15 per cent in the

Euro area and 21.7 per cent in the U.K.12. As of August 24, South Korea had one

of the lowest per capita death tolls due to COVID-19 at 6.03 per million

population. By comparison, the COVID-19 death toll in Japan was 9.33, 19.69 in

Australia, 110.67 in Germany, 198.62 in Switzerland, 534.15 in the USA, and

610.27 in the U.K. As of the same date, South Korea reported a seven-day

rolling average of 0.01 deaths per million people. This compares with a

seven-day rolling average for the U.S. of 2.91 and 0.13 for the United Kingdom.

These results for South Korea are particularly impressive given the age of its

population-South Korea's median age is 43.7, which compares with a median age

in the USA of 38.3 and a median age in the U.K. of 40.5.

Macroeconomists have proposed several models to estimate the speed of eventual

economic recovery and the forms that equity market rebounds might take in a

post COVID-19 world. The broader Korean index experienced a "V"-shaped rebound

during the second quarter of 2020, with the closing price of the KOSPI 200

index on June 30 a mere 3.5 per cent lower than the closing price on January 2

of this year. To illustrate the velocity of the market drawdown and recovery,

the peak-to-trough change for the first half of 2020 for the KOSPI 200 was 35

per cent, and that drawdown had been almost fully recovered by June 30. As of

August 24 the KOSPI was up 6.0 per cent for the year. This has been one of the

strongest performing markets so far in 2020.

The Korean economy, however, still faces significant uncertainty due to the

likely lasting impacts of the pandemic on global aggregate demand and aggregate

supply. Weak global demand from Korea's main trading partners resulted in total

exports falling by approximately 11 per cent year-on-year to end June.13 A

recovery in exports to China and resilience in the semiconductor sector helped

avoid a steeper decline. Ultimately, the success of South Korea's containment

of COVID-19 and the strength of demand from its largest trading partners, China

and the US, will likely determine the speed of economic recovery.

In the meantime, the South Korean government has aggressively expanded its

stimulus spending by implementing broad measures including emergency cash

handouts to all South Korean households and longer term investments like the

"Korean Green New Deal" described below.

We believe that our competitive advantage is in investing into inefficiencies

caused by preference share discounts, not in timing macroeconomic trends.

Consequently, while our trading strategy is premised on a narrowing of

preference share discounts rather than on any specific macroeconomic condition,

the rapid rebound of the broader index was a welcome sight, as preference

shares are equity investments in Korean companies and the discounts are

partially driven by the companies' earnings and dividend payout ratios.

Portfolio Activity

One interesting observation during the first half of 2020 was a lack of

crowdedness in WKOF's investments. During the middle of March, the most violent

drawdowns largely occurred in less liquid asset classes. Despite preference

shares generally having lower liquidity than the corresponding ordinary shares,

we did not observe a corresponding general widening of discounts in the

preference shares owned by WKOF.

During and after March, preference share trading volumes and the volatility of

discounts of preference shares in WKOF's portfolio substantially increased.

This was most visible in certain illiquid securities, but also occurred in

larger capitalization preference shares. The increased volatility provided WKOF

with exceptional trading opportunities and resulted in rebalancing within the

top ten positions as WKOF continued to reallocate monies to those preference

shares that offered the best opportunities. In the past, this entailed

substantially reducing WKOF's exposure to Hyundai Motors. In the first half of

2020 WKOF reduced its weighting in Samsung Electronics, its largest holding,

from 22 per cent to 12 per cent. WKOF did this because the expected returns

from holding other preference shares were substantially higher than from

holding Samsung Electronics, whose preference share discount narrowed, at one

point reaching the tightest level since 1994.

Another theme we observed in the first half of 2020 was the ongoing

international focus on developing green energy resources and combating climate

change. For example, the European Union proposed to allocate 30 per cent of its

750 billion euro COVID-19 response stimulus to climate action and building a

sustainable green future. Similarly, the South Korean government has made the

"Korean Green New Deal" an important part of its 2020 economic policy, focusing

on green energy, electric vehicles, and contactless/digital payments. While the

specific details of this policy have not been formally announced, the market

expects government subsidies and investments into eco-friendly industries. As a

result, companies involved in the production of lithium-ion batteries,

renewable energy, and electric vehicles rallied strongly following the

announcement.

Selling activity has resulted in WKOF holding a larger Samsung Kodex 200 ETF

position than has been typical, as proceeds from sales were partially invested

into the ETF. We anticipate, considering the heightened volatility of current

market conditions, opportunistically reallocating from the ETF into wider

discount preference shares over the second half of the year.

Hedging

WKOF's portfolio is generally long only. However, as described more fully in

WKOF's Annual Report and Audited Financial Statements for the year ended 31

December 2019, because of political tensions in Northeast Asia, the Board

approved a hedging strategy in September 2017 intended to reduce exposure to

extreme events that would be catastrophic to its Shareholders' investments in

WKOF. As a result, WKOF has purchased credit default swaps when deemed cost

effective. These are securities that we believe would generate high returns

without introducing material new risks into the portfolio or exacerbating

existing risks if WKOF experienced an East Asian geo-political disaster. These

catastrophe hedges are not intended to make money. We expect that WKOF's hedges

will lose money most of the time - as with any insurance policy. The table

below provides details about the hedges as of 30 June 2020. Note that outside

of the general market and portfolio hedges described herein, WKOF has generally

not hedged interest rates or currencies.

Credit Default Notional Total Cost to Annual Price Paid as Expiration Duration

Swaps on South Value Expiration Cost (USD) per cent of Date (Years)

Korean Sovereign (USD) (USD) Notional Value

Debt (per annum)

5 yr CDS $20m $457,151 $91,430 45bps 2023 5.0

3 yr CDS $80m $431,216 $143,739 18bps 2023 3.0

Total Cost $888,367 $235,169

Conclusion

Financial markets, as well as life in general, were profoundly impacted by the

emergence of COVID-19 during the first half of 2020. As nations and companies

re-evaluate their priorities in light of the pandemic, some themes that have

been beneficial to WKOF, such as corporate governance reforms, will likely be

temporarily de-prioritized. At the same time, uncertainty and price volatility

may provide WKOF with exceptional trading and investment opportunities.

Weiss Asset Management LP

03 September 2020

5 This return includes all dividends paid to the Company's Shareholders and

assumes that these dividends were reinvested in the Company's Shares at the

next date for which the Company reports a NAV, at the NAV for that date.

6 This return includes the annual cash dividend paid to the Company's

Shareholders but does not assume such dividends are reinvested.

7 MSCI Korea 25/50 Net Total Return Index denominated in GBP. MSCI total return

indices are calculated as if any dividends paid by constituents are reinvested

at their respective closing prices on the ex date of the distribution.

8 MSCI Korea 25/50 Net Total Return Index denominated in KRW

9 WKOF Common Shares vs Korea Index (KRW) is calculated as the return of a

portfolio of common shares issued by the same issuers as the preference shares

the Company has owned, as if a hypothetical investor bought or sold an equal

quantity of those common shares on the same days that the Company purchased or

sold its preference share investments.

10 Excess dividend yield of preference shares owned relative to a portfolio of

the respective common shares. In Korea dividends are typically paid to the

entities who owned shares at the end of December, although the dividend amounts

are not declared until the next year, so while we received dividend income in

the first half of the year, those dividends were generally attributed to the

performance during the last half of 2019. The annual and semi-annual financials

include dividends with a record date prior to the end of the reporting period,

even if they had not been paid or even announced prior to the end of the

reporting period. In contrast, the weekly and monthly NAV announcements

published by the Company only include dividends upon receipt, with an

additional note stating the amount of announced but as yet unpaid dividends.

11 "Emerging COVID-19 success story: South Korea learned the lessons of MERS",

Oxford University's Our World in Data project, June 30, 2020, https://

ourworldindata.org/covid-exemplar-south-korea

12 Data from Haver Analytics, as reported in The Economist

13 "Korea's June exports decrease 10.9 per cent to 39.2 billion, show signs of

improvement" South Korea Ministry of Trade, Industry and Energy, July 1 2020,

https://english.motie.go.kr/en/pc/pressreleases/bbs/bbsView.do?bbs_seq_n=787&

bbs_cd_n=2¤tPage=1&search_key_n=&search_val_v=&cate_n=

Statement of Principal and Emerging Risks and Uncertainties

For the period ended 30 June 2020

The Company's risk exposure and the effectiveness of its risk management and

internal control systems are reviewed by the Audit Committee at its meetings

and annually by the Board. The Board believes that the Company has adequate and

effective systems in place to identify, mitigate, and manage the risks to which

it is exposed.

Emerging Risks

In order to recognise any new risks that may impact the Company and to ensure

that appropriate controls are in place to manage those risks, the Audit

Committee undertakes a regular review of the Company's Risk Matrix.

COVID-19

The Board continues to monitor the impact of the COVID-19 outbreak and the

impact that COVID-19 will continue to have on the future of the Company and the

performance of the Portfolio. Notwithstanding the impact the outbreak has

already had on the Company's share price and NAV performance, there remains

continued uncertainty as to the consequences of the COVID-19 outbreak on the

economy in general.

From an operational perspective, the Company uses a number of service providers

who have established, documented and regularly test their Business Resiliency

Policies to cover various possible scenarios whereby staff cannot be present at

the designated office and conduct business as usual. Since the COVID-19

pandemic outbreak, service providers have deployed these alternative working

policies to ensure continued business service.

Principal Risks and Uncertainties

In respect to the Company's system of internal controls and reviewing its

effectiveness, the Directors:

* are satisfied that they have carried out a robust assessment of the

principal risks facing the Company, including those that would threaten its

business model, future performance, solvency, or liquidity; and

* have reviewed the effectiveness of the risk management and internal

control systems, including material financial, operational, and compliance

controls (including those relating to the financial reporting process) and no

significant failings or weaknesses were identified.

The principal risks and uncertainties which have been identified and the steps

which are taken by the Board to mitigate them are as follows:

Investment Risks

The Company is exposed to the risk that its portfolio fails to perform in line

with its investment objective and policy if markets move adversely or if the

Investment Manager fails to comply with the investment policy. The Board

reviews reports from the Investment Manager at the quarterly Board Meetings,

with a focus on the performance of the portfolio in line with its investment

policy. The Administrator is responsible for ensuring that all transactions are

in accordance with the investment restrictions.

Operational Risks

The Company is exposed to the risk arising from any failures of systems and

controls in the operations of the Investment Manager, Administrator, and the

Custodian. The Board and its Committees regularly review reports from the

Investment Manager and the Administrator on their internal controls. The

Administrator will report to the Investment Manager any valuation issues which

will be brought to the Board for final approval as required.

Accounting, Legal and Regulatory Risks

The Company is exposed to the risk that it may fail to maintain accurate

accounting records, fail to comply with the requirements of its Admission

Document and fail to meet its listing obligations. The accounting records

prepared by the Administrator are reviewed by the Investment Manager. The

Administrator, Broker, and Investment Manager provide regular updates to the

Board on compliance with the Admission Document and changes in regulation.

Discount Management

The Company is exposed to Shareholder dissatisfaction through inability to

manage the Share price discount to NAV. The Board and its Broker monitor the

Share price discount (or premium) continuously and have engaged in Share

buybacks from time to time to help minimise any such discount. The Board

believes that it has access to sufficiently liquid assets to help manage the

Share price discount.

Liquidity of Investments

The Korean preferred shares typically purchased by the Company generally have

smaller market capitalisations and lower levels of liquidity than their common

share counterparts. These factors, among others, may result in more volatile

price changes in the Company's assets as compared to the South Korean stock

market or other more liquid asset classes. This volatility could cause the NAV

to go up or down dramatically.

Going Concern

The Company has continued in existence following the second Realisation

Opportunity and will continue to operate as a going concern unless a

determination to wind up the Company is made. Given this, the Directors will

propose further realisation opportunities for Shareholders who have not

previously elected to realise all of their Ordinary Shares. Such opportunities

will be made using a similar mechanism to previously announced Realisation

Opportunities. The next Realisation Opportunity will take place during May

2021.

Based on the fact that the assets currently held by the Company consist mainly

of securities that are readily realisable, whilst the Directors acknowledge

that the liquidity of these assets needs to be managed, the Directors believe

that the Company has adequate financial resources to meet its liabilities as

they fall due for at least twelve months from the date of this report and that

it is appropriate for the Unaudited Half-Yearly Financial Report to be prepared

on a going concern basis.

Directors

For the period ended 30 June 2020

The Company has three non-executive Directors, all of whom are considered

independent of the Investment Manager and details are set out below.

Norman Crighton (aged 54)

Mr Crighton is Chairman of the Company. He is also a non-executive chairman of

RM Secured Direct Lending plc and AVI Japan Opportunity Trust. Norman was,

until May 2011, an investment manager at Metage Capital Limited where he was

responsible for the management of a portfolio of closed-ended funds and has

almost three decades of experience in closed-ended funds having led teams at

Olliff and Partners, LCF Edmond de Rothschild, Merrill Lynch, Jefferies

International Limited and latterly Metage Capital Limited. His experience

covers analysis and research as well as sales and corporate finance. Norman is

British and resident in the United Kingdom. Norman was appointed to the Board

in 2013.

Stephen Charles Coe (aged 54)

Stephen is Chairman of the Audit Committee. He is also a director (and Chairman

of the Audit Committee) of Leaf Clean Energy Company and Merian Chrysalis

Investment Company. He has been involved with offshore investment funds and

managers since 1990 with significant exposure to property, debt, emerging

markets, and private equity investments.

He qualified as a Chartered Accountant with Price Waterhouse Bristol in 1990

and remained in audit practice, specialising in financial services, until 1997.

From 1997 to 2003 he was a director of the Bachmann Group of fiduciary

companies and Managing Director of Bachmann Fund Administration Limited, a

specialist third party fund administration company. From 2003 to 2006 Stephen

was a director with Investec in Guernsey and Managing Director of Investec

Trust (Guernsey) Limited and Investec Administration Services Limited. He

became self-employed in August 2006 providing services to financial services

clients. Stephen is British and resident in Guernsey. Stephen was appointed to

the Board in 2013.

Robert Paul King (aged 57)

Rob is a non-executive director for a number of open and closed-ended

investment funds including Tufton Oceanic Assets Limited (chairman), Chenavari

Capital Solutions Limited (chairman), and CIP Merchant Capital Limited. Before

becoming an independent non-executive director in 2011, he was a director of

Cannon Asset Management Limited and their associated companies. Prior to this

he was a director of Northern Trust International Fund Administration Services

(Guernsey) Limited (formerly Guernsey International Fund Managers Limited)

where he had worked from 1990 to 2007. He has been in the offshore finance

industry since 1986 specialising in administration and structuring of offshore

open and closed-ended investment funds. Rob is British and resident in

Guernsey. Rob was appointed to the Board in 2013.

Directors' Responsibility Statement

For the period ended 30 June 2020

The Directors are responsible for preparing the Unaudited Half-Yearly Financial

Report (the "Condensed Financial Statements"), which have not been audited by

an independent auditor, and confirm that to the best of their knowledge:

· these Condensed Financial Statements have been prepared in accordance

with International Financial Reporting Standards ("IFRS") and in accordance

with International Accounting Standard 34 "Interim Financial Reporting" issued

by the European Union and the AIM Rules of the LSE;

· these Condensed Financial Statements include a fair review of important

events that have occurred during the period and their impact on the Condensed

Financial Statements, together with a description of the principal risks and

uncertainties of the Company for the remaining six months of the financial

period as detailed in the Investment Manager's Report; and

· these Condensed Financial Statements include a fair review of related

party transactions that have taken place during the six month period which have

had a material effect on the financial position or performance of the Company,

together with disclosure of any changes in related party transactions in the

last Annual Report and Audited Financial Statements which have had a material

effect on the financial position of the Company in the current period.

The Directors confirm that the Condensed Financial Statements comply with the

above requirements.

On behalf of the Board,

Norman Crighton

Chairman

03 September 2020

Robert King

Director

03 September 2020

Condensed Statement of Financial Position

As at As at

30 June 31 December

2020 2019

(Unaudited) (Audited)

Notes GBP GBP

Assets

Current assets

Financial assets at fair value through 8 133,970,854 117,853,987

profit or loss

Derivative financial assets 9 - 33,218

Other receivables 119,262 2,445,789

Cash and cash equivalents 3,143,083 6,430,069

Margin account 3,204,448 1,435,750

Total assets 140,437,647 128,198,813

Liabilities

Current liabilities

Derivative financial 9 2,023,106 704,019

liabilities

Other payables 335,640 506,062

Total liabilities 2,358,746 1,210,081

Net assets 138,078,901 126,988,732

Represented by:

Shareholders' equity and

reserves

Share capital 10 68,124,035 68,124,035

Other reserves 69,954,866 58,864,697

Total shareholders' equity 138,078,901 126,988,732

Net assets per share 7 1.6918 1.5559

The Notes form an integral part of these Condensed Financial Statements.

The Condensed Financial Statements were approved and authorised for issue by

the Board of Directors on

03 September 2020.

Norman Crighton

Chairman

Robert King

Director

Condensed Statement of Comprehensive Income

For the period For the period

ended ended

30 June 2020 30 June 2019

(Unaudited) (Unaudited)

Note GBP GBP

Income

Net changes in fair value of financial assets 14,222,572 11,651,316

at fair value through profit or loss through profit

or loss

Net changes in fair value of derivative financial 1,581,263 206,014

instruments through profit or loss

Net foreign currency gains/(losses) 53,624 (137,822)

Other income 509,844 711,676

Total income 16,367,303 12,431,184

Expenses

Operating expenses (1,937,790) (1,554,650)

Total operating expenses (1,937,790) (1,554,650)

Profit for the period before 14,429,513 10,876,534

tax

Withholding tax (111,440) (156,739)

Profit for the period after 14,318,073 10,719,795

tax

Profit and total comprehensive income for the period 14,318,073 10,719,795

Basic and diluted earnings per Share 6 0.1754 0.1281

All items derive from continuing activities.

The Notes form an integral part of these Condensed Financial Statements.

Condensed Statement of Changes in Equity

Share Other

capital reserves Total

Notes GBP GBP GBP

Balance at 1 January 2020 68,124,035 58,864,697 126,988,732

Total comprehensive income for the period - 14,318,073 14,318,073

Transactions with Shareholders, recorded

directly in equity

Distributions paid 4 - (3,227,904) (3,227,904)

Balance at 30 June 2020 68,124,035 69,954,866 138,078,901

For the period ended 30 June 2019

(Unaudited)

Balance at 1 January 2019 72,080,642 54,408,953 126,489,595

Total comprehensive loss for the period - 10,719,795 10,719,795

Transactions with Shareholders, recorded

directly in equity

Redemption of Realisation Shares 10 (3,956,607) - (3,956,607)

Distributions paid 4 - (3,475,415) (3,475,415)

Balance at 30 June 2019 68,124,035 61,653,333 129,777,368

The Notes form an integral part of these Condensed Financial Statements.

Condensed Statement of Cash Flows

For the period For the period

ended ended

30 June 2020 30 June 2019

(Unaudited) (Unaudited)

Notes GBP GBP

Cash flows from operating activities

Profit for the period 14,318,073 10,719,795

Adjustments for:

Net change in fair value of financial assets held (14,276,196) (11,651,318)

at

fair value through profit or loss

Net change in fair value of derivative financial (1,581,263) (206,014)

instruments held at fair value through profit or

loss

Net change in NAV of Realisation Shares - (41,089)

Effect of foreign exchange rate 53,624 -

fluctuations

Decrease in debtors* 2,326,527 2,292,859

Increase in creditors (170,422) (211,529)

Net cash generated from operating 670,343 902,704

activities

Cash flows from investing activities

Purchase of financial assets at fair value (50,381,604) (2,085,317)

through profit or loss

Open of derivative financial instruments 1,720,421 (310,732)

Proceeds from the sale of financial assets 8 48,487,308 10,321,790

at fair value through profit or loss

Closure of derivative financial 1,213,148 1,884,115

instruments

(Increase)/decrease in margin account (1,768,698) 364,430

Net cash (used in)/generated from (729,425) 10,174,286

investing activities

Cash flows from financing activities

Redemption of Realisation Shares - (3,915,517)

Distributions paid 4 (3,227,904) (3,475,415)

Net cash used in financing activities (3,227,904) (7,390,932)

Net (decrease)/increase in cash and cash (3,286,986) 3,686,058

equivalents

Cash and cash equivalents at the beginning 6,430,069 1,304,537

of the period

Cash and cash equivalents at the end of 3,143,083 4,990,595

the period

The Notes form an integral part of these Condensed Financial Statements.

*Decrease in debtors includes dividends receivable.

Notes to the Unaudited Condensed Financial Statements

For the period ended 30 June 2020

1. General information

The Company was incorporated with limited liability in Guernsey, as a

closed-ended investment company on

12 April 2013. The Company's Shares were admitted to trading on AIM of the LSE

on 14 May 2013.

The Investment Manager of the Company is Weiss Asset Management LP.

At the AGM held on 27 July 2016, the Board approved the adoption of the new

Articles of Incorporation in accordance with Section 42(1) of the Companies

(Guernsey) Law, 2008 (the "Law").

2. Significant accounting policies

a) Statement of compliance

The Condensed Financial Statements of the Company for the period ended 30 June

2020 have been prepared in accordance with IFRS adopted by the European Union

and the AIM Rules of the London Stock Exchange. They give a true and fair view

and are in compliance with the Law.

b) Basis of preparation

The Condensed Financial Statements are prepared in Pounds Sterling (GBP), which

is the Company's functional and presentational currency. They are prepared on a

historical cost basis modified to include financial assets at fair value

through profit or loss.

The Condensed Financial Statements, covering the period from 1 January to 30

June 2020, are not audited.

The accounting policies adopted are consistent with those used in the Annual

Report and Audited Financial Statements for the year ended 31 December 2019.

The Condensed Financial Statements do not include all the information and

disclosures required in the Annual Report and Audited Financial Statements and

should be read in conjunction with the Annual Report and Audited Financial

Statements for the year ended 31 December 2019. The Auditor's Report contained

within the Annual Report and Audited Financial Statements provided an

unmodified opinion.

The preparation of the Condensed Financial Statements requires management to

make estimates and assumptions that affect the reported amounts of revenues,

expenses, assets, and liabilities at the date of these Condensed Financial

Statements. If in the future such estimates and assumptions, which are based on

management's best judgement at the date of the Condensed Financial Statements,

deviate from the actual circumstances, the original estimates and assumptions

will be modified as appropriate in the period in which the circumstances

change.

c) Going concern

The Company has continued in existence following the second Realisation

Opportunity and will continue to operate as a going concern unless a

determination to wind up the Company is made. Given this, the Directors will

propose further realisation opportunities for Shareholders who have not

previously elected to realise all of their Ordinary Shares. Such opportunities

will be made using a similar mechanism to previously announced Realisation

Opportunities. The next Realisation Opportunity will take place during May

2021.

Based on the fact that the assets currently held by the Company consist mainly

of securities that are readily realisable, whilst the Directors acknowledge

that the liquidity of these assets needs to be managed, the Directors believe

that the Company has adequate financial resources to meet its liabilities as

they fall due for at least twelve months from the date of this report, and that

it is appropriate for the Condensed Financial Statements to be prepared on a

going concern basis.

3. Taxation

The Company has been granted Exempt Status under the terms of The Income Tax

(Exempt Bodies) (Guernsey) Ordinance, 1989 to income tax in Guernsey. Its

liability is an annual fee of GBP1,200 (2019: GBP1,200).

The amounts disclosed as taxation in the Condensed Statement of Comprehensive

Income relate solely to withholding tax levied in South Korea on distributions

from South Korean companies at an offshore rate of 22 per cent.

4. Dividends to Shareholders

Dividends, if any, will be paid annually each year. An annual dividend of

3.9549 pence per Share (GBP3,227,904) was approved on 13 May 2020 and paid on

12 June 2020 in respect of the year ended 31 December 2019.

An annual dividend of 4.1195 pence per Share (GBP3,475,415) was approved on 1 May

2019 and paid on 31 May 2019 in respect of the year ended 31 December 2018.

5. Significant accounting judgements, estimates and assumptions

The preparation of the Condensed Financial Statements in conformity with IFRS

requires management to make judgements, estimates, and assumptions that affect

the application of policies and the reported amounts of assets and liabilities,

income and expense, and the accompanying disclosures. Uncertainty about these

assumptions and estimates could result in outcomes that require a material

adjustment to the carrying amount of assets or liabilities affected in future

periods. The significant judgements, estimates, and assumptions made by

management when applying the Company's accounting policies, as well as the key

sources of estimation uncertainty, were the same for these Condensed Financial

Statements as those that applied to the Annual Report and Audited Financial

Statements for the year ended 31 December 2019.

6. Basic and diluted earnings per Share

The basic and diluted earnings per Share for the Company has been calculated

based on the total comprehensive gain for the period of GBP14,318,073 (period

ended 30 June 2019: GBP10,719,795) and the weighted average number of Ordinary

Shares in issue during the period of 81,617,828 (period ended 30 June 2019:

83,666,809).

7. Net Asset Value per Ordinary Share

The NAV of each Share of GBP1.6918 (as at 31 December 2019: GBP1.5559) is

determined by dividing the net assets of the Company attributed to the Ordinary

Shares of GBP138,078,091 (as at 31 December 2019: GBP126,988,732) by the number of

Ordinary Shares in issue at 30 June 2020 of 81,617,828 (as at 31 December 2019:

81,617,828 Ordinary Shares in issue).

8. Financial assets at fair value through profit or loss

As at As at

30 June 31 December

2020 2019

GBP GBP

Cost of investments at beginning of the 106,419,418 110,153,284

period/year

Purchases of investments in the period/ 50,381,602 8,239,027

year

Disposal of investments in the period/year (48,487,307) (18,803,751)

Realised gain on disposal of investments in the 19,802,055 6,830,858

period/year

Cost of investments held at end of the 128,115,768 106,419,418

period/year

Unrealised gain on investments 5,855,086 11,434,569

Financial assets at fair value through 133,970,854 117,853,987

profit or loss

9. Derivative financial instruments at fair value through profit or loss

As at As at

30 June 31 December

2020 2019

GBP GBP

Cost of derivatives at beginning of the (1,174,737) (552,309)

period/year

Open of derivatives in the period/year (1,720,421) 593,087

Closure of derivatives in the period/year (1,213,146) (1,884,116)

Realised gain/(loss) on closure of derivatives in 2,100,459 668,601

the period/year

Net cost of derivatives held at end of the (2,007,845) (1,174,737)

period/year

Net changes in fair value on derivative financial (15,261) 503,936

instruments at fair value through profit or loss

Net fair value on derivative financial instruments (2,023,106) (670,801)

at fair value through profit or loss

The following are the composition of the Company's derivative financial

instruments at year end:

As at As at

30 June 31 December

2020 2019

Assets Liabilities Assets Liabilities

Derivatives held for GBP GBP GBP GBP

trading:

Options - - 33,218 -

Credit default swaps - (2,023,106) - (704,019)

Total - (2,023,106) 33,218 (704,019)

10. Share capital

The share capital of the Company consists of an unlimited number of Ordinary

Shares of no par value.

As at As at

30 June 31 December

2020 2019

Authorised

Unlimited Ordinary Shares at no par value - -

Issued at no par

value

81,617,828 (2019: 81,617,828) unlimited Ordinary Shares at - -

no par value

Reconciliation of number of Shares

As at As at

30 June 31 December

2020 2019

No. of No. of

Shares Shares

Ordinary Shares at the beginning of the 81,617,828 84,364,981

period/year

Purchase of Realisation Shares - (2,747,153)

Total Ordinary Shares in issue at the end of the 81,617,828 81,617,828

period/year

Share capital account

As at As at

30 June 31 December

2020 2019

GBP GBP

Share capital at the beginning of the 68,124,035 72,080,642

period/year

Purchase of Realisation Shares - (3,956,607)

Total Share capital at the end of the 68,124,035 68,124,035

period/year

Ordinary Shares

The Company has a single class of Ordinary Shares, which were issued by means

of an initial public offering on 14 May 2013, at 100 pence per Share.

The rights attached to the Ordinary Shares are as follows:

a) The holders of Ordinary Shares shall confer the right to all dividends in

accordance with the Articles of Incorporation of the Company.

b) The capital and surplus assets of the Company remaining after payment of

all creditors shall, on winding-up or on a return (other than by way of

purchase or redemption of own Ordinary Shares) be divided amongst the

Shareholders on the basis of the capital attributable to the Ordinary Shares at

the date of winding up or other return of capital.

c) Shareholders present in person or by proxy or (being a corporation)

present by a duly authorised representative at a general meeting have, on a

show of hands, one vote and, on a poll, one vote for every Share.

d) On 20 March 2019, being 46 days before the Subsequent Realisation Date, the

Company published a circular pursuant to the Realisation Opportunity, entitling

the Shareholders to serve a written notice during the election period (a

"Realisation Election") requesting that all or a part of their Ordinary Shares

be re-designated to Realisation Shares, subject to the aggregate NAV of the

continuing Ordinary Shares on the last business day before the Reorganisation

Date being not less than GBP50 million. As Shareholders elected to participate in

the Realisation Opportunity, the Company's portfolio was divided into two

pools: the Continuation Pool; and the Realisation Pool.

e) On 15 May 2019, 2,747,153 Ordinary Shares, which represented 3.3 per cent

of the Company's issued Ordinary Share capital were redesignated as Realisation

Shares. On the 7 June 2019 the Board approved the compulsory redemption of the

Realisation Shares in issue. The redemption price was 142.53 pence per

Realisation Share, being the net assets of the Realisation Pool of GBP3,915,557,

divided by the number of outstanding Realisation Shares in issue, being

2,747,153 Realisation Shares. The redemption proceeds were paid to the

Realisation Shareholders on 18 June 2019, after which the Realisation Shares

were cancelled and were no longer in issue.

Share buyback and cancellation

During the period ended 30 June 2020 and throughout 2019, the Company did not

purchase any of its own Ordinary Shares under the Share buyback authority

originally granted to the Company in 2014.

At the AGM held on 23 July 2020, Shareholders approved the authority of the

Company to buy back up to 40 per cent of the issued Ordinary Shares to

facilitate the Company's discount management. Any Ordinary Shares bought back

may be cancelled or held in treasury.

11. Related party transactions and material agreements

Related party transactions

a) Directors' remuneration and expenses

The Directors of the Company are remunerated for their services at such a rate

as the Directors determine provided that the aggregate amount of such fees does

not exceed GBP150,000 per annum.

The annual Directors' fees comprise GBP30,000 payable to Mr Crighton as the

Chairman, GBP27,500 to Mr Coe as Chairman of the Audit Committee and GBP24,000 to

Mr King.

During the period ended 30 June 2020, Directors' fees of GBP40,750 (period ended

30 June 2019: GBP40,750) were charged to the Company and GBPNil remained payable at

the end of the period (as at 31 December 2019: GBPNil).

b) Shares held by related parties

The Directors who held office at 30 June 2020 and up to the date of this Report

held the following number of

Ordinary Shares beneficially:

As at 30 June 2020 As at 31 December 2019

Ordinary % of issued Ordinary % of issued

Shares share Shares share

capital capital

Norman Crighton 20,000 0.02% 20,000 0.02%

Stephen Coe 10,000 0.01% 10,000 0.01%

Robert King 15,000 0.02% 15,000 0.02%

The Investment Manager is principally owned by Dr Andrew Weiss and certain

members of the Investment Manager's senior management team.

As at 30 June 2020, Dr Andrew Weiss and his immediate family members held an

interest in 6,486,888 Ordinary Shares (as at 31 December 2019: 6,486,888)

representing 7.95 per cent. (as at 31 December 2019: 7.95 per cent.) of the

issued share capital of the Company.

As at 30 June 2020, employees and partners of the Investment Manager other than

Dr Andrew Weiss, their respective immediate family members or entities

controlled by them or their immediate family members held an interest in

2,844,333 Ordinary Shares (as at 31 December 2019: 2,844,333) representing 3.48

per cent (as at 31 December 2019: 3.48 per cent.) of the issued share capital

of the Company.

c) Investment management fee

The Company's Investment Manager is Weiss Asset Management LP. In consideration

for its services provided by the Investment Manager under the IMA dated 8 May

2013, the Investment Manager is entitled to an annual management fee of 1.5 per

cent of the Company's NAV accrued daily and payable within 14 days after each

month end. The Investment Manager is also entitled to reimbursement of certain

expenses incurred by it in connection with its duties.

The IMA will continue in force until terminated by the Investment Manager or

the Company, giving to the other party thereto not less than 12 months' notice

in writing.

For the period ended 30 June 2020, investment management fees and charges of GBP

907,692 (for the period ended 30 June 2019: GBP935,306) were charged to the

Company and GBP176,829 (as at 31 December 2019: GBP310,841) remained payable at the

period end.

12. Financial risk management

IFRS 13 'Fair Value Measurement' requires the Company to establish a fair value

hierarchy that prioritises the inputs to valuation techniques used to measure

fair value. The hierarchy gives the highest priority to unadjusted quoted

prices in active markets for identical assets or liabilities (Level 1

measurements) and the lowest priority to unobservable inputs (Level 3

measurements).

The three levels of the fair value hierarchy under IFRS 13 'Fair Value

Measurement' are set as follows:

· Level 1 Quoted prices (unadjusted) in active markets for identical

assets or liabilities;

· Level 2 Inputs other than quoted prices included within Level 1 that are

observable for the asset or liability either directly (that is, as prices) or

indirectly (that is, derived from prices); and

· Level 3 Inputs for the asset or liability that are not based on

observable market data (that is, unobservable inputs).

The level in the fair value hierarchy within which the fair value measurement

is categorised in its entirety is determined on the basis of the lowest level

input that is significant to the fair value measurement. For this purpose, the

significance of an input is assessed against the fair value measurement in its

entirety.

If a fair value measurement uses observable inputs that require significant

adjustment based on unobservable inputs, that measurement is a Level 3

measurement. Assessing the significance of a particular input to the fair value

measurement requires judgement, considering factors specific to the asset or

liability.

The determination of what constitutes 'observable' requires significant

judgement by the Company. The Company considers observable data to be that

market data that is readily available, regularly distributed or updated,

reliable and verifiable, not proprietary, and provided by independent sources

that are actively involved in the relevant market.

The following table presents the Company's financial assets and liabilities by

level within the valuation hierarchy as of 30 June 2020:

Total

As at

30 June

Level 1 Level 2 Level 3 2020

GBP GBP GBP GBP

Financial assets/

(liabilities) at fair value

through

profit or loss:

Korean preferred 119,138,494 - - 119,138,494

shares

Exchange traded funds 14,832,360 - - 14,832,360

Financial derivative - (2,023,106) - (2,023,106)

liabilities

Total net assets 133,970,854 (2,023,106) - 131,947,748

Total

As at

31 December

Level 1 Level 2 Level 3 2019

GBP GBP GBP GBP

Financial assets/

(liabilities) at fair value

through

profit or loss:

Korean preferred 114,486,850 - - 114,486,850

shares

Exchange traded funds 3,367,138 - - 3,367,138

Financial derivative 33,218 - - 33,218

assets

Financial derivative - (704,019) - (704,019)

liabilities

Total net assets 117,887,206 (704,019) - 117,183,187

The Company recognises transfers between levels of the fair value hierarchy as

of the end of the reporting period during which the transfers have occurred.

During the period ended 30 June 2020, financial assets of GBPNil were transferred

from Level 2 to Level 1 (for the year ended 31 December 2019: GBPNil).

Investments whose values are based on quoted market prices in active markets,

and are therefore classified within Level 1, include Korean preference shares,

exchange traded funds, and exchange traded options.

The Company holds investments in derivative financial instruments which are

classified as Level 2 within the fair value hierarchy. These consist of credit

default swaps with a fair value of (GBP2,023,106) (as at 31 December 2019: (GBP

704,019).

As at 30 June 2020, Level 1 financial derivative assets of GBPNil were held (as

at 31 December 2019: GBP33,218).

13. NAV reconciliation

The Company announces its NAV to the LSE after each weekly and month end

valuation point. The following is a reconciliation of the NAV per Share

attributable to participating Shareholders as presented in these Condensed

Financial Statements, using IFRS to the NAV per Share reported to the LSE:

As at 30 June 2020 As at 31 December 2019

NAV per NAV per

Participating Participating

NAV Share NAV Share

GBP GBP GBP GBP

Net Asset Value reported to the 137,976,556 1.6905 124,536,322 1.5258

LSE

Adjustment to accruals and cash (6,203) (0.0001) 8,412 0.0001

Adjustment for dividend income 108,548 0.0014 2,443,998 0.0300

Net Assets Attributable to 138,078,901 1.6918 126,988,732 1.5559

Shareholders per Financial

Statements

The published NAV per Share of GBP1.6905 (as at 31 December 2019: GBP1.5258) is

different from the accounting NAV per Share of GBP1.6918 (as at 31 December 2019:

GBP1.5559) due to the adjustments noted above.

14. Subsequent events

These Condensed Financial Statements were approved for issuance by the Board on

03 September 2020. Subsequent events have been evaluated until this date.

Since the start of 2020, the outbreak of COVID-19 has adversely impacted global

commercial activities and financial markets. The rapid development and fluidity

of this situation precludes any prediction as to its ultimate impact, which may

have a continued adverse impact on economic and market conditions and may

trigger a period of global economic slowdown. The Company, consistent with

other in the industry, does not believe there is any impact to the financial

statements as of 30 June 2020 as a result of this subsequent event. No

additional events or transactions require further disclosure.

END

(END) Dow Jones Newswires

September 04, 2020 02:00 ET (06:00 GMT)

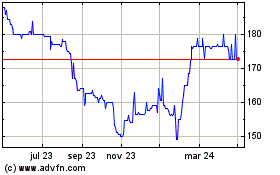

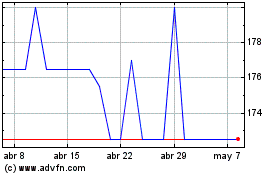

Weiss Korea Opportunity (LSE:WKOF)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Weiss Korea Opportunity (LSE:WKOF)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024