TIDMPOW

RNS Number : 9170Y

Power Metal Resources PLC

14 September 2020

14 September 2020

Power Metal Resources plc ("Power Metal" or the "Company")

Canadian Silver Project - Option Exercised

Power Metal Resources plc (LON:POW) the AIM listed metals

exploration and development company is pleased to announce the

Company has exercised its option (the "Option") to earn-in to the

Silver Peak Project (the "Silver Peak Project" or the "Project") in

British Columbia, Canada. The Project includes the Eureka-Victoria

Silver Mine, the first Crown-granted mineral property in British

Columbia.

HIGHLIGHTS:

-- Review of Project data, including a recently conducted due

diligence exploration programme, has provided positive outcomes

enabling Power Metal to exercise the Option within the 30-day

Option period;

-- Exercise of the Option enables Power Metal to earn-in to a

30% interest in the Project on terms outlined below and including

an additional CAD$225,000 committed by POW on ground

exploration;

-- Power Metal are now working with the Project vendors to

continue a technical review focused on launching next stage

exploration work including a Project drilling programme;

-- The Project earn-in, when complete, will provide Power Metal

with an interest in a high-grade silver exploration property in

Canada, including a former working silver mine;

-- Further updates to the market are anticipated in the near

term in respect of the ongoing technical review and further

exploration programme.

CHIEF EXECUTIVE OFFICER'S STATEMENT

Paul Johnson Chief Executive Officer of Power Metal Resources

plc commented "The decision to exercise this Option, on schedule,

provides Power Metal with its first, potentially high impact,

silver exploration project interest.

The cash component costs of earn-in exploration and Option

exercise payments are fully covered by recent warrant exercises

that have brought additional cash into Power Metal, meaning the

exercise of warrants and the money generated has been applied to

the expansion of our business. This is a theme we intend to

continue with warrant monies enabling growth in the Power Metal

business model.

The Silver Peak project is a material addition to the Power

Metal portfolio, bringing a strategic silver project into our

business, and one that offers much potential upside from positive

future exploration work.

Power Metal, alongside the vendors, intend to push ahead

expeditiously with exploration on the ground.

I would like to thank the vendors and the ground operational

team for their work and commitment and it is a pleasure to work

with proactive and supportive partners. We have achieved much in

just a month and look forward to continuing progress as we gather

more Project knowledge through imminent planned exploration."

FURTHER INFORMATION

Option Agreement and Due Diligence Exploration Programme

Background On 17 August 2020 the Company announced it

had entered into an option agreement (the "Option

Agreement") in respect of the Project.

The Option Agreement provided Power Metal the

Option of a 30-day exclusivity period for due

diligence in respect of the Project providing

Power Metal, on Option exercise, with a right

to earn-in to a 30% interest in the Project.

As part of this due diligence process the Company

undertook an exploration programme at the Project

to gather further information and to assist

the Company in its assessment of project prospectivity

and potential.

Project Overview The Silver Peak Project consists of a portfolio

of mineral claims (the "claims") over a system

of high grade, intrusion related, polymetallic

Ag-Pb-Zn-Cu veins, part of the historical Eureka-Victoria

Silver Mine, at Silver Peak in southern British

Columbia, Canada.

-----------------------------------------------------------

Due Diligence The work programme included various elements

Exploration Programme including channel sampling at close intervals

perpendicular to the existing known high-grade

veins and grab samples from a main target area

between the lower elevations and the Victoria

Adit.

The work also included enhancement of road

accessibility to the exploration area, and

the collation of detailed photographic and

video evidence of the project area for cross

referencing to existing project technical information.

A portable X-ray fluorescence analyser (pXRF)

was utilised to provide in-field, geochemical

analyses, in conjunction with confirmatory

laboratory assay testing where appropriate.

The work programme cost totalled C$25,000 (GBP14,512)

and the amount expended will be deducted from

the C$250,000 12-month project exploration

spend as Power Metal has exercised the Option.

-----------------------------------------------------------

Option Exercise Power Metal has now exercised the Option and

can earn-in to a 30% Project interest. The

transaction costs relating to Option exercise

and the earn-in to the Project interests are

outlined below.

-----------------------------------------------------------

Next Steps Continue ongoing technical review and plan,

prepare and launch an exploration drilling

programme at the project, subject to the receipt

of relevant approvals and permits.

-----------------------------------------------------------

THE TRANSACTION TERMS

The Vendor

The Project is currently 100% owned by private vendors Michael

Nugent and Jo Shearer (the "Vendors").

Right to Earn-in

Power Metal will now make a payment of GBP129,683 to the Vendors

comprising CAD$30,000 (GBP17,183) cash and GBP112,500 through the

issue of 9,000,000 new Ordinary Shares (the "Option Exercise

Shares") at a price of 1.25p per Option Exercise Share.

In addition, the Vendors will be granted 9,000,000 warrants to

subscribe for new Ordinary Shares in the Company at a price of

1.75p with a three-year life to expiry.

Power Metal must then spend CAD$250,000 (GBP143,193) on Project

exploration, within 12 months (the "Exploration Spend") and of this

amount CAD$25,000 has already been expended on the due diligence

exploration programme, leaving CAD$225,000 (GBP128,874)

outstanding.

Acquisition of Project Interest

Subject to meeting the Exploration Spend and the receipt of

satisfactory findings from exploration work, and by 31 August 2021,

Power Metal may elect to acquire a 30% interest in the Project by

making a final payment of CAD$200,000 (GBP114,554 and the "Final

Payment") with Power Metal having a choice to pay this in cash, or

in Company shares, as follows.

Final Payment payable in cash:

- Power Metal can make a final cash payment of CAD$200,000.

- Should Power Metal make the Final Payment as cash, warrants

will also be issued to the Vendors in such volume as equates to

CAD$100,000 divided by the 7-trading day volume weighted average

price of ("VWAP") of Power Metal shares immediately preceding the

day of announcing the acquisition of the Project interest and at a

price that equates to a 30% premium to the 7-day VWAP and with a

three year life to expiry.

Note: by way of example if the Acquisition of Project Interest

Final Payment is paid as cash.

If the CAD/GBP translation rate on the acquisition date is

0.57277 then CAD$100,000 equals c.GBP57,277. If at that time the

7-day VWAP of Power Metal is 3.0p, then GBP57,277 divided by 3.0p

would equate to 1,909,233 warrants to be issued, and the warrant

exercise price would be 3.9p.

Final Payment payable in shares:

- By payment of CAD$200,000 (GBP114,554) through the issue of

Power Metal shares at a price based on the 7-trading day VWAP

preceding the date of announcing the acquisition of the Project

interest ("Final Payment Shares").

- Should Power Metal elect to make the Final Payment in Power

Metal shares then the Vendors will be granted warrants to subscribe

for new Ordinary Shares in such volume as equates to 50% of the

Final Payment Shares and at an exercise price equating to a 30%

premium of the issue price of the Final Payment Shares and with a

three year life to expiry.

Note: by way of example if the Acquisition of Project Interest

Final Payment is paid as shares.

If the CAD/GBP translation rate on the acquisition date is

0.57277 then CAD$200,000 equals GBP114,554. If at that time the

7-day VWAP of Power Metal is 3.0p, then GBP114,554 divided by 3.0p

would equate to 3,818,467 new Ordinary Shares being issued to the

Vendors.

In addition, 50% of the new Ordinary Shares would equate to

1,909,233 warrants to be issued, and the warrant exercise price

would be 3.9p.

After the Acquisition of Project Interest

After completion of the Final Payment the ownership structure

will be the Project Vendors 70% and Power Metal 30%. Both parties

must contribute to exploration costs thereafter, in line with their

ownership percentage, or dilute in accordance with standard

industry dilution provisions.

The Vendors will retain a 2% Net Smelter Royalty over the total

Project.

Summary of Transaction Costs

For ease of reference the Option exercise and earn-in costs are

summarised below:

When payable Benefit Earnt Vendor Exploration Overall %

Payments Spend Total of

GBP GBP GBP Total

Option Exercise Right to Earn-in 129,683 129,683 33.5

Within 12 months Right to Earn-in 143,193 143,193 37.0

On acquisition 30% Project

of Interest Interest 114,554 114,554 29.5

Overall Total

(1) 244,237 143,193 387,430 100%

(1) Excluding warrants issued in respect of the transaction,

further details of which are provided above.

NEXT STEPS

Continue review of Project technical information, leading into

an exploration drill programme at the Project.

COMPETENT PERSON STATEMENT

The technical information contained in this disclosure has been

read and approved by Mr Nick O'Reilly (MSc, DIC, MAusIMM, FGS), who

is a qualified geologist and acts as the Competent Person under the

AIM Rules - Note for Mining and Oil & Gas Companies. Mr

O'Reilly is a Principal consultant working for Mining Analyst

Consulting Ltd which has been retained by Power Metal Resources PLC

to provide technical support.

ADMISSION AND TOTAL VOTING RIGHTS

Application will be made for the 9,000,000 Option Exercise

Shares to be admitted to trading on AIM which is expected to occur

on or around 21 September 2020 ("Admission"). Following Admission

of the Option Exercise Shares, POW's ordinary issued share capital

will comprise 810,066,542 ordinary shares of 0.1 pence each.

This number will represent the total voting rights in the

Company, and following Admission, may be used by shareholders as

the denominator for the calculation by which they can determine if

they are required to notify their interest in, or a change to their

interest in, the Company under the Financial Conduct Authority's

Disclosure and Transparency Rules. The new shares will rank pari

passu in all respects with the ordinary shares of the Company

currently traded on AIM.

The information contained within this announcement is considered

to be inside information prior to its release, as defined in

Article 7 of the Market Abuse Regulation No.596/2014 and is

disclosed in accordance with the Company's obligations under

Article 17 of those Regulations.

For further information please visit

https://www.powermetalresources.com/ or contact:

Power Metal Resources plc

Paul Johnson (Chief Executive Officer) +44 (0) 7766 465 617

SP Angel Corporate Finance (Nomad and Joint Broker)

Ewan Leggat/Charlie Bouverat +44 (0) 20 3470 0470

SI Capital Limited (Joint Broker)

Nick Emerson +44 (0) 1483 413 500

First Equity Limited (Joint Broker)

David Cockbill/Jason Robertson +44 (0) 20 7330 1883

Notes to Editors:

Power Metal Resources plc (LON:POW) is an AIM listed metals

exploration and development company seeking a large scale metal

discovery.

The Company has a global portfolio of project interests

including precious metal exploration in North America and Australia

together with base metal exploration in Africa. Project interests

range from early stage greenfield exploration to later stage drill

ready prospects.

The Board and its team of advisors have expertise in project

generation, exploration and development and have identified an

opportunity to utilise the Company's position to become a leader in

the London market for investors wishing to gain exposure to

proactive global metals exploration.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCSFIFFLESSEFU

(END) Dow Jones Newswires

September 14, 2020 08:30 ET (12:30 GMT)

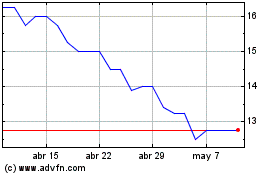

Power Metal Resources (LSE:POW)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Power Metal Resources (LSE:POW)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024