Report of Foreign Issuer (6-k)

15 Septiembre 2020 - 6:35AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of September, 2020

Commission File Number 1-15106

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

(Exact name of registrant as specified in its charter)

Brazilian Petroleum Corporation – PETROBRAS

(Translation of Registrant's name into English)

Avenida República do Chile, 65

20031-912 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras on contracting the sixth FPSO of Búzios

—

Rio de Janeiro, September

15, 2020 – Petróleo Brasileiro S.A. – Petrobras informs that it has started negotiations with SBM Offshore N.V.

(SBM) to contract the FPSO - floating production storage and offloading Almirante Tamandaré, to be installed in the Búzios

field, in Santos Basin.

The FPSO Almirante Tamandaré

will be the sixth production system of the Búzios field, with startup schedule for the second half of 2024. It will be the

largest oil production unit operating on the Brazilian coast and one of the largest in the world, with daily processing capacity

of 225 thousand barrels of oil and 12 million m3 of gas.

The hiring of SBM will occur

directly, in accordance with the law 13.303/16. Petrobras constantly monitors the FPSOs world market and has identified that, at

this moment, only SBM has the capacity to meet the technical, operational and availability requirements of the company.

The other two units to be

installed in Búzios, FPSOs P-78 and P-79, will be contracted by bidding, in the Engineering, Procurement and Construction

(EPC) modality. The contracting process is already underway and the winning companies of the public pre-qualification carried out

by Petrobras participate in it. The platforms will have the capacity to process 180 thousand barrels of oil and 7.2 million m3

of gas daily, and are expected to start operating in 2025. These two units are the result of Petrobras' strategy of developing

new projects of its own platforms, incorporating the lessons learned in the FPSOs already installed in the pre-salt, including

aspects of contracting and construction.

www.petrobras.com.br/ri

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investors Relations

email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. República do Chile, 65 – 1803

– 20031-912 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities

Trading Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates",

"believes", "expects", "predicts", "intends", "plans", "projects",

"aims", "should," and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties,

predicted or not by the Company. Therefore, future results of the Company's operations may differ from current expectations, and

the reader should not rely solely on the information included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: September 15, 2020

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Andrea Marques de Almeida

______________________________

Andrea Marques de Almeida

Chief Financial Officer and Investor Relations Officer

.

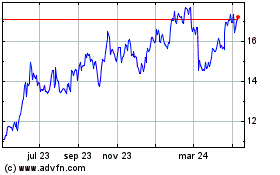

Petroleo Brasileiro ADR (NYSE:PBR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

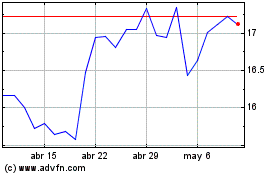

Petroleo Brasileiro ADR (NYSE:PBR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024