Premier Global Inf Publication of Circular, Notice of GM and Update

16 Septiembre 2020 - 1:00AM

UK Regulatory

TIDMPGIT TIDMPGIZ

16 September 2020

PREMIER GLOBAL INFRASTRUCTURE TRUST PLC ("PGIT" or the "Company")

and

PGIT SECURITIES 2020 PLC ("PGIZ")

(together, the "Group")

Publication of Circular, Notice of General Meeting and zero dividend preference

("ZDP") share Class Meeting (together, the "Notice of Meetings") in relation to

proposed amendment to the Company's investment policy and name change

Update regarding PGIZ's scheduled wind up

The Company announces that it will today post to its ordinary shareholders in

PGIT and ZDP shareholders in PGIZ (together, the "Shareholders") a circular

(the "Circular") in relation to the Company seeking approval from Shareholders

to amend its investment policy and, if the Company's new investment policy is

adopted, to change its name to Premier Miton Global Renewables Trust PLC

(together, the "Proposals").

These changes will see the Company move away from its previous emphasis on

investments in equity and equity-related securities of companies operating in

the energy and water sectors generally, as well as other generic infrastructure

investments, to a more targeted investment proposition that is dedicated to

renewable energy and sustainable infrastructure investments.

The Board believes that this change in investment strategy will build on the

Company's current investments in the renewable energy sector, as well as its

other related sustainable infrastructure investments, and will best secure the

Company's future success by affording existing and potential new ordinary

shareholders the opportunity to access attractive financial investments in the

growing renewable energy market, which has significant investment capacity.

The proposed amendments to the Company's investment policy are set out in the

Appendix to this announcement.

Implementation of the Proposals requires the approval of ordinary shareholders

and is therefore conditional on the passing of the resolutions to approve the

change in investment policy and name that will be proposed at a general meeting

to be held at 12:10 p.m. (or, if later, immediately after the conclusion of the

ZDP class meeting) on 9 October 2020, notice of which is set out in the

Circular.

In addition, any material change to the Company's investment policy may only be

made with the prior sanction of ZDP shareholders in PGIZ, the Company's

subsidiary. As such, the change to the Company's investment policy is also

conditional on the passing of a resolution that will be proposed at a separate

ZDP class meeting to be held at 12:00 p.m. on 9 October 2020, notice of which

is also set out in the Circular.

The Circular, Notice of Meetings, together with the forms of proxy, will be

submitted to the National Storage Mechanism and will shortly be available for

inspection at https://data.fca.org.uk/#/nsm/nationalstoragemechanism and will

also be available to download from the Company's website https://

www.premierfunds.co.uk/premier-global-infrastructure-trust-plc. Each of the

documents may also be obtained from the Company Secretary.

Update regarding PGIZ's scheduled wind up

The Company also provides a separate update in relation to PGIZ.

Following the approval by the Company's shareholders of the resolution at this

year's annual general meeting to continue the Company's life until the annual

general meeting in 2025, the Board has considered the various options that may

be available for refinancing the ZDP shares nearer to the scheduled winding up

of PGIT Securities 2020 PLC on 30 November 2020. It is noted that upon its

scheduled winding up ZDP shareholders in PGIT Securities 2020 PLC have a right

to receive a final capital entitlement of 125.6519p per ZDP Share

(approximately GBP30.2 million in total).

The options being considered by the Board include the issuance by the Group of

a follow-on zero dividend preference share, to allow ZDP shareholders who wish

to do so the opportunity to roll over their investment into a similar

investment, for which the Board believes there would be sufficient demand.

Against this background, the Board has requested the Group's manager, Premier

Fund Managers Limited, and its financial adviser, Nplus1 Singer Advisory LLP,

to consult with certain of the Group's ZDP shareholders to ascertain their

views. A further announcement will be made regarding the feedback from these

consultations in due course.

Enquiries:

Premier Fund Managers Limited + 44 (0) 1483 30 60 90

James Smith

Claire Long

N+1 Singer +44 (0) 20 7496 3000

James Maxwell

Iqra Amin

Appendix

If approved by ZDP shareholders at the ZDP class meeting and ordinary

shareholders at the general meeting, the Company's investment policy will be

restated, as will the means by which the Company will achieve its investment

objective, as follows with effect from the end of the general meeting:

Investment objective

The investment objectives of the Company are to achieve a high income from, and

to realise long-term growth in the capital value of its portfolio. The Company

seeks to achieve these objectives by investing principally in equity and equity

related securities of companies operating primarily in the renewable energy

sector, as well as other sustainable infrastructure investments.

Investment policy

The investment policy of the Company is that, in normal market conditions, the

portfolio of the Company should consist primarily of a diversified portfolio of

equity and equity-related securities of companies operating in the renewable

energy sector, as well as other sustainable infrastructure investments. There

are no restrictions on the proportion of the portfolio of the Company which may

be invested in any one geographical area or asset class but no more than 15 per

cent. of the Company's assets, at the time of acquisition, will be invested in

securities issued by any investee company. The Company may also invest up to 15

per cent. of its gross assets in investment companies provided they themselves

invest in renewable energy and other sustainable infrastructure. However, not

more than 10 per cent. of the Company's gross assets may be invested in other

UK listed closed-ended investment funds unless such funds themselves have

published investment policies to invest not more than 15 per cent. of their

total assets in other UK listed closed-ended investment funds (provided they

themselves invest in renewable energy and other sustainable infrastructure).

The Company may invest up to 15 per cent. of its gross assets in unquoted

securities.

There are no borrowings under financial instruments or the equivalent of

financial instruments but investors should be aware of the gearing effect of

ZDP shares within the Group's capital structure. The Company's policy is not to

employ any gearing through long-term bank borrowing. The Group can, however,

employ gearing through the issue of ZDP shares by a subsidiary of the Company.

The Group is not subject to a maximum level of such gearing save that the

number of new ZDP shares that may be issued is limited by the applicable cover

test in respect of those ZDP shares.

The Company will manage and invest its assets in accordance with its published

investment policy. Any material change to this policy will only be made with

the approval of ordinary Shareholders by ordinary resolution and the prior

sanction of a special resolution of ZDP shareholders, unless otherwise

permitted by the Listing Rules.

END

(END) Dow Jones Newswires

September 16, 2020 02:00 ET (06:00 GMT)

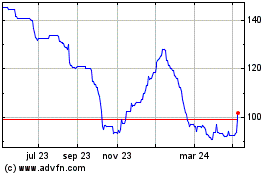

Premier Miton Global Ren... (LSE:PMGR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

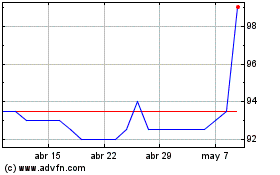

Premier Miton Global Ren... (LSE:PMGR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024