Report of Foreign Issuer (6-k)

16 Septiembre 2020 - 5:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER

PURSUANT TO RULE

13a-16 OR 15d-16

UNDER THE SECURITIES

EXCHANGE ACT OF 1934

For the month of

September, 2020

Commission File

Number 001-15106

PETRÓLEO

BRASILEIRO S.A. - PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation - PETROBRAS

(Translation of Registrant's

name into English)

Avenida República

do Chile, 65

20031-912 - Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

PETROBRAS ANNOUNCES FINAL RESULTS OF OFFER

TO EXCHANGE NEW REGISTERED SECURITIES FOR SECURITIES OFFERED IN PRIVATE TRANSACTIONS

RIO DE JANEIRO, BRAZIL – September 15,

2020 – Petróleo Brasileiro S.A. – Petrobras (“Petrobras”) (NYSE: PBR) announces that

holders of U.S.$4,037,681,000 aggregate principal amount of 5.093% Global Notes due 2030 (the “Old Notes”),

issued by its wholly-owned subsidiary Petrobras Global Finance B.V. (“PGF”), tendered their Old Notes prior

to 5:00 p.m., New York City time, on September 15, 2020 (the “Expiration Date”), pursuant to PGF’s previously

announced offer to exchange (the “Exchange Offer”).

The following table summarizes the final

results of the Exchange Offer, the aggregate principal amount of Old Notes that PGF has accepted to exchange and the aggregate

principal amount of new 5.093% Global Notes due 2030 (the “New Notes”) registered under the Securities Act of

1933, as amended to be issued:

|

Title

of Security

|

Old

Notes CUSIP/ISIN

|

Principal

Amount Outstanding

|

Principal

Amount of Old Notes Tendered and Accepted

|

Principal

Amount of New Notes to be Issued

|

New

Notes CUSIP/ISIN

|

5.093% Global

Notes due 2030

|

71647N BF5; US71647NBF50 / N6945A AL1; USN6945AAL19

|

U.S.$4,115,281,000

|

U.S.$4,037,681,000

|

U.S.$4,037,681,000

|

71647N BE8 / US71647NBE85

|

|

|

|

|

|

|

|

Old Notes that have been validly tendered

prior to the Expiration Date cannot be withdrawn, except as may be required by applicable law. The settlement date on which PGF

will exchange the Old Notes accepted in the Exchange Offer for New Notes is expected to be September 17, 2020.

The terms of the New Notes are substantially

identical to the Old Notes, except for terms with respect to additional interest payments, registration rights and legends reflecting

transfer restrictions. The New Notes are unconditionally and irrevocably guaranteed by Petrobras. Holders of Old Notes accepted

for exchange will receive interest on the corresponding New Notes and not on such Old Notes. Any Old Notes not tendered or accepted

for exchange will remain outstanding.

# # #

The Bank of New York Mellon acted as

the exchange agent for the Exchange Offer. Questions or requests for assistance related to the Exchange Offer may be directed to

The Bank of New York Mellon at +1 (212) 815-4259. You may also contact your broker, dealer, commercial bank, trust company or other

nominee for assistance concerning the Exchange Offer.

This announcement is for informational

purposes only. This announcement is not an offer to exchange any Old Notes. The Exchange Offer was not made to holders of Old Notes

in any jurisdiction in which the making or acceptance thereof would not be in compliance with the securities, blue sky or other

laws of such jurisdiction.

Forward-Looking Statements

This press release contains forward-looking

statements. Forward-looking statements are information of a non-historical nature or which relate to future events and are subject

to risks and uncertainties. No assurance can be given that the transactions described herein will be consummated or as to the ultimate

terms of any such transactions. Petrobras undertakes no obligation to publicly update or revise any forward-looking statements,

whether as a result of new information or future events or for any other reason.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

PETRÓLEO BRASILEIRO S.A--PETROBRAS

|

|

|

|

|

|

|

By:

|

/s/ Guilherme Rajime Takahashi Saraiva

|

|

|

|

Name: Guilherme Rajime Takahashi Saraiva

|

|

|

|

Title: Attorney in Fact

|

|

|

By:

|

/s/ Adriana Fernandes de Brito

|

|

|

|

Name: Adriana Fernandes de Brito

|

|

|

|

|

Title: Attorney in Fact

|

Date: September 16, 2020

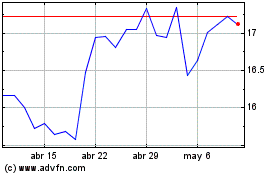

Petroleo Brasileiro ADR (NYSE:PBR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

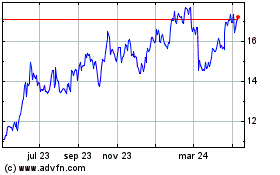

Petroleo Brasileiro ADR (NYSE:PBR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024