TIDMWATR

RNS Number : 2379Z

Water Intelligence PLC

17 September 2020

Water Intelligence plc (AIM: WATR.L)

Interim Results

Water Intelligence plc (AIM: WATR.L) ("Water Intelligence",

"Group", or the "Company"), a leading multinational provider of

precision, minimally-invasive leak detection and remediation

solutions for both potable and non-potable water is pleased to

provide its Interim Results for the six months ended 30 June

2020.

1H statutory profit before tax grew strongly by 33% to $2.01

million (1H 2019: $1.51 million) resulting in the Group being

comfortably at the top end of market expectations despite Covid-19

challenges.

3Q builds on and adds significant operational and financial

momentum to Group: Two additional franchise reacquisitions,

National insurance win and Salesforce.com implementation.

Brand profile sharpened for ESG Investors with receipt of the

London Stock Exchange's Green Economy Mark.

Financial Highlights

* Revenue for the period increased 8% to $1 7.10

million (1H 2019: $15.87 million)

o A ll revenue channels grow

* Royalty income up 1% to $3.46 million (1H 2019: $3.44

million)

* Franchise-related activities Including national

channel accounts up 7% t o $4.32 million (1H 2019:

$4.05 million) with Business-to Business insurance

channel component up 12% to $3.94 million (1H 2019:

$3.52 million)

* US corporate-operated locations up 12% to $7.60

million (1H 2019: $6.82 million)

* International corporate-operated locations up 10% to

$1.71 million (1H 2019: $1.56 million)

* Profit before tax at top-end of market expectations

o Statutory profit before tax up 3 3% to $2.01 million

(1H 2019: $1.51 million)

o Profit before tax adjusted for non-core, amortization

and share-based payments up 20% to $2.4 million (1H

2019: $2.0 million)

o Continued investment in hiring and technology R&D

* EPS Growth

o Statutory EPS up 27% to 10.0 cents (1H 2019: 7.9 cents)

o A djusted EPS up 14% to 12.0 cents (1H 2019: 10.6

cents)

* Balance Sheet strong

o Cash and equivalents increase to $7.44 million (1H

2019: $6.03 million)

o Net Cash at $0.91 million (cash minus borrowings)

Corporate Development Highlights

1H 2020

-- Strong Execution: Implementation of protocols and navigation of Covid-19 challenges

-- Franchise Reacquisitions: 2 accretive franchise

reacquisitions - Minneapolis, Minnesota and San Jose, California -

add operational scale, especially in Silicon Valley, and financial

scale

-- Strategic relationship: Salesforce.com enabling secure

automation of dispatch, scheduling, execution and reporting

-- Innovation: New product launch of sewer diagnostic device for residential and commercial use

3Q Subsequent Events

-- Brand: Green Economy Mark received from London Stock Exchange

-- Franchise Reacquisitions: 2 accretive franchise

reacquisitions: in the U.S. - Maryland; in Australia - Melbourne,

adding operational scale in Australia

-- Strategic Relationship: New National Account with leading Insurance company

Board Change

-- David Silverstone retires from the Board effective as of the

publication of the Interim Financials. Both the board and team

(corporate and franchise) appreciate his board service. David will

continue to assist the Company with his expertise in the municipal

business as part of an Advisory Board

Dr. Patrick DeSouza, Executive Chairman of Water Intelligence,

commented: " Given the challenges of operating in a Covid-19

marketplace, we are pleased, once again, to deliver strong

financial and operating results during 1H that reaffirm our stated

objective of sustainable multinational growth. Moreover, we

accelerated during 3Q along all dimensions of our growth plan.

Each quarter has been marked by a signature event that

communicates our strategic direction. During 1Q, we launched an

ambitious next five-year plan at a well-attended annual franchise

convention in Arizona. During 2Q, we launched a strategic

relationship with Salesforce.com that will advance our business

model of being an efficient distribution platform - a 'One Stop

Shop' - for water infrastructure services and products. Finally,

during 3Q we were honored to receive the Green Economy Mark from

the London Stock Exchange. We are enthusiastic that this

designation will further define our brand for ESG Investors. We

look forward to making a difference in providing solutions for the

various challenges facing the world's most precious resource and

its infrastructure."

For further information please contact:

Water Intelligence plc

Patrick DeSouza (Executive Chairman) Tel: +1 203 654

Adrian Hargrave (VP Corporate Development) 5426

Tel: 07775 701 838

WH Ireland Limited - NOMAD & Broker

Adrian Hadden Tel: 020 7220 1666

James Sinclair-Ford Tel: 020 3903 7721

Dowgate Capital

Stephen Norcross Tel: 07920 599 793

Chairman's Statement

Overview

We executed well and distinguished ourselves during the first

half, especially in light of Covid-19 challenges facing all

companies in the marketplace. World-wide lockdown orders that were

in effect during parts of March, April and May adversely affected

the Group, but our entire team worked relentlessly and implemented

additional health and safety protocols to safeguard our

stakeholders: customers, franchisees and employees.

Demand for our solutions remains strong. Water infrastructure is

a strategic area for the global economy even during a pandemic.

Water and wastewater solutions are "essential services" that need

to be provided even when our customers are subject to

"shelter-in-place" regulations. Our sense of corporate mission

drives us to find and stop potable water loss from leakage and to

safeguard public health by remediating clogged and leaking

wastewater pipes.

Undeterred by Covid-19, we announced at our annual franchise

convention last March an aggressive five-year growth plan that aims

to build upon our last five-year plan which produced compounded

annual growth of 35% in revenue and 33% in profit before tax over

the period. Post-convention, as discussed below, we have reaffirmed

this growth plan with reinvestment, customer wins and added

operational scale through more franchise reacquisitions. These

achievements should help sustain our growth trajectory for the

remainder of 2020, 2021 and beyond.

1H Operating Results

We are off to a good start on our next five-year plan. Water

Intelligence distinguished itself in the marketplace during 1H by

achieving 8% growth in revenue reaching $17.1 million (1H 2019:

$15.9 million) and an outstanding 33% growth in statutory profit

before tax reaching $2.0 million (1H 2019: $1.5 million). As

discussed in the financial section below, each of our revenue

channels grew profitably.

Each quarter has been marked by a signature event that advances

our business model and brand development. Our annual franchise

convention was well-attended. Important for our firm culture, the

Convention produced a sense of common purpose among franchisees and

corporate staff towards executing our next five-year growth plan

and providing green economy leadership to the marketplace. During

2Q, building on our sense of common purpose, the Company agreed to

a strategic partnership with Salesforce.com to implement an

enterprise application to enable secure, automated dispatch,

execution and reporting across the United States. Such reinvestment

in the business, by both franchisees and corporate, allows us to

achieve a competitive advantage and to more rapidly scale

operations. During 3Q, we were delighted to receive the Green

Economy Mark from the London Stock Exchange, a recognition of our

ESG credentials. Given the anticipated growth in spending on

sustainability over the next decade, especially given the impact of

climate change on water and infrastructure, we are in a better

position to communicate our brand given our strong

fundamentals.

We are well-positioned to achieve our growth plan and to help

lead the Green Economy. Under our American Leak Detection and Water

Intelligence International brands, we have over 140 locations

(franchise and corporate) across the United States, UK, Australia

and Canada from which to provide a matrix of technology-based

solutions for clean water and wastewater problems facing

residential, business-to-business and municipal customers. Across

these franchise and corporate locations, we touch over 200,000

customers with an aggregate of over $125 million of gross sales to

third parties. With our Salesforce implementation, we wiil be able

to automate execution to provide responsive customer service and

opportunities for up-selling additional solutions. Soon we will be

implementing a video e-commerce solution that will enable us to

transact follow-on business with customers in a frictionless way by

offering customers both water-related products and service

technicians who can then make the "smart home" a reality.

With a growing base of sales, array of offerings and a sense of

mission across all of our locations, we can communicate more

sharply our brand differentiation as a Green Economy platform with

on-going, scalable and repeatable customer relationships. As a

result, we are no longer simply a "support services" company with

one-off sales, as analysts positioned us five years ago. Rather we

have evolved into a distribution platform for clean water and

wastewater infrastructure solutions with recurring income and

scale. This model carries with it a much higher valuation multiple

than "support services." Our financial results validate our

business model.

Financial Results

As noted above, we operate through two subsidiaries: American

Leak Detection and Water Intelligence International. ALD focuses

largely on residential and commercial leak detection and

remediation in the US, Australia and Canada. WII focuses largely on

municipal leak detection and remediation in the UK and Australia.

Each cross-sells the other's service offerings to ready customers

in their respective geographies. While the numbers reported are for

1H, as discussed herein, the Group also has significant momentum

given 3Q "Subsequent Events" that are accelerating our growth

trajectory.

Four KPIs are set forth in the Strategic Report that forms part

of our Annual Report. The KPIs organize our on-going evaluation of

financial performance relative to our business model. First, on the

franchise side of our business, we continue to grow our franchise

System and our American Leak Detection brand. Royalties grew 1% to

$3.46 million (1H 2019: $3.44 million) despite Covid-19 and despite

additional franchise reacquisitions that continue to remove royalty

from an eligible pool of franchise royalties. As seen in our

segmental information herein, profits on royalty income grew 20% to

$0.96 million (1H 2019: $0.80 million). Margins on royalty income

improved to 28% even with increased re-investment in staffing to

assist the franchise System.

During 1H, the Group reacquired franchises in Minneapolis,

Minnesota, and San Jose, California. During 3Q, the Group

reacquired franchises in Maryland and Melbourne, Australia. These

reacquisitions help the franchise System by providing regional

corporate management to work with franchisees to grow their

businesses. The transitions have been seamless. Customers value the

brand and appreciate the responsiveness of our trained technicians

whether franchise or corporate.

Second, in tandem with the growth in royalty income,

Franchise-related Activities also grew 7% to $4.32 million (1H

2019: $4.05 million). However, within Franchise-related Activities,

our business-to-business insurance channel grew at a higher rate of

12% to $3.94 million (1H 2019: $3.52 million). The growth in jobs

from this channel to franchisees more than offset a decrease in new

equipment purchases as franchisees adjusted their budgets during

Covid-19. (1H 2020: $0.37 million vs. 1H 2019: $0.40 million). The

Group's business-to-business channel structure reinforces recurring

sales through our distribution platform and helps franchisees

continue to grow. During 3Q, the Group signed a new national

account with a leading U.S. insurance company. This relationship is

expected to further grow our business-to-business channel.

Third, during 1H, corporate-operated locations at ALD grew 12%

to $7.60 million (1H 2019: $6.82 million). Importantly, US

corporate-operated locations improved their profit margins to 19%

from 16% (1H 2020: $1.45 million; 1H 2019: $1.09 million). At 19%

profit margin, corporate-operated locations are approaching the

margins of franchise-operated locations. The transformation of

indirect royalty income to higher margin direct corporate store

income unlocks shareholder value and drives the Group's profits. To

illustrate: a 19% profit on a corporate-executed sale is higher

than 6% franchisee royalty income and a profit yield of

approximately 2% after the administrative and sales costs of

royalty income is taken into account. On the other hand, a healthy

royalty amount producing monthly recurring income with no bad debt

is still advantageous for optimizing capital formation because it

supports our ability to use bank debt effectively, which benefits

our equity holders.

Fourth, during 1H, international corporate results led by

UK-based WII also continued to grow despite Covid-19. WII primarily

executes our solutions for municipal customers like Thames Water

and Sydney Water. Revenue grew 10% to $1.71 million (1H 2019: $1.56

million). Profit before tax grew marginally to $80,000,

representing a 5% profit margin. This margin also includes

reinvestment expenses in building our municipal channel in the US

and in Australia and in pre-marketing for our sewer diagnostic

product to be commercialized during 2H.

Conclusion

Despite Covid-19 challenges, we have continued to execute on our

strategy and produce top-line growth and strong bottom-line

results. We feel confident in our prospects for both top-line and

bottom-line growth for three reasons. First, market demand for

water and wastewater solutions will only get stronger as the price

of water goes up. All jurisdictions around the world - whether the

US or Australia, where we operate, or India or China, where we seek

to expand with partners - will need to address aging infrastructure

that results in 15-40% daily water loss from leakage and additional

price increases from the resulting scarcity. Second, the Group has

a highly scalable and valuable business model as a distribution

platform providing various technology-based clean water and

wastewater solutions for residential, commercial and municipal

customers. Finally, all of the Group's stakeholders - franchise and

corporate teams, institutional investors, strategic partners and,

most importantly, our customers - are united by a common mission to

provide leadership with respect to a scarce natural resource. We

are excited to build upon the Green Economy Mark from the London

Stock Exchange in communicating our brand.

To reiterate, our last five-year plan produced compounded annual

growth of 35% in terms of revenue and 33% in terms of profit before

tax. We have launched our next five-year plan with confidence and

have navigated to a strong start despite marketplace

challenges.

Patrick DeSouza

Executive Chairman

September 16, 2020

Interim Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2020

Six months Six months Year ended

ended ended 31

30 June 30 June December

2020 2019 2019

------------------------------------ ------ ------------- ------------- -------------

Notes $ $ $

------------------------------------ ------ ------------- ------------- -------------

Unaudited Unaudited Audited

Revenue 4 17,096,587 15,867,440 32,363,935

Cost of sales (4,019,249) (3,658,507) (7,448,289)

------------------------------------ ------ ------------- ------------- -------------

Gross profit 13,077,338 12,208,933 24,915,646

Administrative expenses

* Other income 13,658 (1,403) -

* Share-based payments (100,895) (81,657) (176,960)

* Amortisation of intangibles (252,546) (159,475) (319,041)

* Other administrative costs (10,582,146) (10,350,375) (21,723,670)

------------------------------------ ------ ------------- ------------- -------------

Total administrative

expenses (10,921,929) (10,592,910) (22,219,671)

------------------------------------ ------ ------------- ------------- -------------

Operating profit 2,155,409 1,616,023 2,695,975

Finance income 57,103 31,871 61,754

Finance expense (205,231) (135,277) (400,241)

------------------------------------ ------ ------------- ------------- -------------

Profit before tax 4 2,007,281 1,512,617 2,357,488

Taxation expense (525,000) (396,950) (662,062)

Profit for the period 1,482,281 1,115,667 1,695,426

Attributable to:

Equity holders of

the parent 1,470,653 1,115,460 1,695,033

Non-controlling interests 11,628 207 393

------------------------------------ ------ ------------- ------------- -------------

1,482,281 1,115,667 1,695,426

Other comprehensive

income

Exchange differences

arising on translation

of foreign operations (66,452) (19,050) (164,144)

Fair value adjustment

on listed equity investment

(net of deferred tax) (574,728) - 584,378

Total comprehensive

income for the period 841,101 1,096,617 2,115,660

------------------------------------ ------ ------------- ------------- -------------

Earnings per share Cents Cents Cents

------------------------------------ ------ ------------- ------------- -------------

Basic 5 10.0 7.9 11.7

------------------------------------ ------ ------------- ------------- -------------

Diluted 5 9.7 7.4 11.1

------------------------------------ ------ ------------- ------------- -------------

Consolidated Statement of Financial Position as at 30 June

2020

At At At

30 June 30 June 31 December

2020 2019 2019

------------------------------ ------ ------------- ------------- -------------------

Notes $ $ $

------------------------------ ------ ------------- ------------- -------------------

Unaudited Unaudited Audited

ASSETS

Non-current assets

Goodwill 11,298,344 9,045,858 9,090,701

Listed equity investment 1,187,460 - 1,932,252

Other intangible assets 1,713,600 2,527,911 1,949,832

Property, plant and

equipment 3,983,818 2,168,062 3,898,133

Trade and other receivables 547,520 688,442 605,234

------------------------------ ------ ------------- ------------- -------------------

18,730,742 14,430,273 17,476,152

------------------------------ ------ ------------- ------------- -------------------

Current assets

Inventories 428,661 443,903 334,011

Trade and other receivables 6,101,549 5,977,998 5,036,149

Cash and cash equivalents 7,439,568 6,034,649 5,280,808

------------------------------ ------ ------------- ------------- -------------------

13,969,778 12,456,551 10,650,968

------------------------------ ------ ------------- ------------- -------------------

TOTAL ASSETS 4 32,700,520 26,886,824 28,127,120

------------------------------ ------ ------------- ------------- -------------------

EQUITY AND LIABILITIES

Equity attributable

to holders of the parent

Share capital 6 114,762 113,152 114,440

Share premium 6 9,741,797 9,569,988 9,717,349

Shares held in treasury 6 (619,368) - (539,834)

Merger reserve 1,001,150 1,001,150 1,001,150

Share based payment

reserve 517,595 321,453 416,700

Other reserves (973,038) (762,304) (907,344)

Reverse acquisition

reserve 6 (27,758,089) (27,758,089) (27,758,089)

Equity investment reserve 8,892 - 584,379

Retained profit 36,365,303 34,361,736 34,894,649

------------------------------ ------ ------------- ------------- -------------------

18,399,004 16,847,086 17,523,400

------------------------------ ------ ------------- ------------- -------------------

Equity attributable

to Non-Controlling interest

Non-controlling interest 112,421 100,706 100,793

------------------------------ ------ ------------- ------------- -------------------

Non-current liabilities

Borrowings 5,655,992 2,735,931 2,321,400

Deferred consideration 7 1,513,441 697,915 556,198

Deferred tax liability 955,883 700,378 588,684

------------------------------ ------ ------------- ------------- -------------------

8,125,316 4,134,224 3,466,282

------------------------------ ------ ------------- ------------- -------------------

Current liabilities

Trade and other payables 4,442,498 2,536,015 4,596,085

Borrowings 868,857 1,123,925 1,163,055

Deferred consideration 7 752,424 2,144,868 1,277,505

6,063,779 5,804,808 7,036,645

------------------------------ ------ ------------- ------------- -------------------

TOTAL EQUITY AND LIABILITIES 32,700,520 26,886,824 28,127,120

------------------------------ ------ ------------- ------------- -------------------

Interim Consolidated Statement of Changes in Equity

For the six months ended 30 June 2020

Share Share Shares Reverse Merger Share Other Equity Retained Total Non-controlling Total

Capital Premium held Acquisition Reserve based Reserves investment Profit interest Equity

in Reserve payment reserve

treasury reserve

$ $ $ $ $ $ $ $ $ $ $ $

--------------- -------- ---------- ---------- ------------- ---------- -------- ---------- ----------- ----------- ----------- ---------------- -----------

As at 1

January 2019 101,915 6,887,739 - (27,758,088) 1,001,150 239,740 (743,198) - 33,246,277 12,975,535 100,499 13,076,034

--------------- -------- ---------- ---------- ------------- ---------- -------- ---------- ----------- ----------- ----------- ---------------- -----------

IFRS 16

Adjustment - - - - - - - - (44,869) (44,869) (99) (44,968)

--------------- -------- ---------- ---------- ------------- ---------- -------- ---------- ----------- ----------- ----------- ---------------- -----------

Restated as at

1

January 2019 101,915 6,887,739 - (27,758,088) 1,001,150 239,740 (743,198) - 33,201,407 12,930,666 100,400 13,031,066

--------------- -------- ---------- ---------- ------------- ---------- -------- ---------- ----------- ----------- ----------- ---------------- -----------

Issue of

ordinary

shares 11,237 2,682,249 - - - - - - - 2,693,486 - 2,693,486

Share based

payment

expense - - - - - 81,713 - - - 81,713 - 81,713

Profit for the

period - - - - - - - - 1,115,460 1,115,460 306 1,115,667

Other

comprehensive

income - - - - - - (19,106) - - (19,106) - (19,106)

As at 30 June

2019

(unaudited) 113,152 9,569,988 - (27,758,088) 1,001,150 321,453 (762,304) - 34,361,737 16,847,086 100,706 16,947,792

--------------- -------- ---------- ---------- ------------- ---------- -------- ---------- ----------- ----------- ----------- ---------------- -----------

Issue of

ordinary

shares - 32,355 - - - - - - - 32,355 - 32,355

Options

purchase 515 115,006 - - - - - - - 115,521 - 115,521

Share-based

payment

expense - - - - - 95,247 - - - 95,247 - 95,247

Share buyback 772 - (539,834) - - - - - (1,792) (540,854) - (540,854)

Profit for the

period - - - - - - - - 579,574 579,574 186 579,760

Other

comprehensive

income - - - - - - (144,282) 583,621 - 439,339 - 439,339

As at 31

December

2019

(audited) 114,440 9,717,349 (539,834) (27,758,088) 1,001,150 416,700 (906,586) 583,621 34,894,649 17,523,401 100,793 17,624,194

--------------- -------- ---------- ---------- ------------- ---------- -------- ---------- ----------- ----------- ----------- ---------------- -----------

Issue of - - - - - - - - - - - -

ordinary

shares

Options

purchase 322 24,447 (79,534) - - - - - - (54,765) - (54,765)

Share based

payment

expense - - - - - 100,895 - - - 100,895 - 100,895

Profit for the

period - - - - - - - - 1,470,653 1,470,653 11,628 1,482,281

Other

comprehensive

loss - - - - - - (66,452) (574,728) - (641,180) - (641,180)

--------------- -------- ---------- ---------- ------------- ---------- -------- ---------- ----------- ----------- ----------- ---------------- -----------

As at 30 June

2020

(unaudited) 114,762 9,741,796 (619,368) (27,758,088) 1,001,150 517,595 (973,038) 8,893 36,365,302 18,399,004 112,421 18,511,425

--------------- -------- ---------- ---------- ------------- ---------- -------- ---------- ----------- ----------- ----------- ---------------- -----------

Interim Consolidated Statement of Cash Flows

For the six months ended 30 June 2020

Six months Six months Year ended

ended ended 31 December

30 June 2020 30 June 2019

2019

------------------------------------------- -------------- ------------ -------------

$ $ $

------------------------------------------- -------------- ------------ -------------

Unaudited Unaudited Audited

Cash flows from operating activities

Profit before tax 2,007,281 1,512,617 2,357,488

Adjustments for non-cash/non-operating

items:

Depreciation of plant and equipment 708,416 257,940 1,268,463

Amortisation of intangible assets 252,545 159,475 319,041

Share based payments 100,895 81,657 176,960

Interest paid 205,231 135,277 400,241

Interest received (57,103) (31,871) (61,754)

------------------------------------------- -------------- ------------ -------------

Operating cash flows before movements

in working capital 3,217,265 2,115,094 4,460,439

------------------------------------------- -------------- ------------ -------------

Decrease/(Increase) in inventories (94,650) 7,562 117,454

Increase in trade and other receivables (1,007,686) (1,836,453) (811,396)

(Decrease)/Increase in trade and

other payables 564,829 (33,318) 2,477,094

Cash generated by operations 2,679,758 252,885 6,243,591

------------------------------------------- -------------- ------------ -------------

Income taxes - (12,793) (535,693)

------------------------------------------- -------------- ------------ -------------

Net cash generated from operating

activities 2,679,758 240,092 5,707,898

------------------------------------------- -------------- ------------ -------------

Cash flows from investing activities

Purchase of plant and equipment (608,062) (493,047) (3,104,796)

Purchase of intangibles (16,000) (243,023) (200,000)

Purchase of listed equity investment (1) - (1,201,780)

Acquisition of subsidiaries - (740,225) (741,130)

Reacquisition of Franchises (2,393,682) (1,757,451) (2,480,417)

Interest received 57,103 31,871 61,754

------------------------------------------- -------------- ------------ -------------

Net cash used in investing activities (2,960,642) (3,201,875) (7,666,369)

------------------------------------------- -------------- ------------ -------------

Cash flows from financing activities

Issue of ordinary share capital - 11,237 11,237

Premium on issue of ordinary share

capital - 2,682,249 2,714,604

Share buy-back - - (540,853)

Options exercised (54,765) - 115,521

Interest paid (205,231) (135,277) (400,241)

Proceeds from borrowings 3,342,628 1,854,936 1,854,936

Repayment of borrowings (302,235) (433,118) (808,520)

Repayment of lease liabilities (340,754) - (723,812)

Net cash generated by/(used in) financing

activities 2,439,643 3,980,026 2,222,873

------------------------------------------- -------------- ------------ -------------

Net (decrease)/increase in cash and

cash equivalents 2,158,759 1,018,243 264,402

Cash and cash equivalents at the

beginning of period 5,280,808 5,016,406 5,016,406

Cash and cash equivalents at end

of period 7,439,567 6,034,649 5,280,808

------------------------------------------- -------------- ------------ -------------

Notes to the Interim Consolidated Financial Information

for the six months ended 30 June 2020

1 General information

The Group is a leading provider of non-invasive, leak detection

and remediation services. The Group's strategy is to be a provider

of "end-to-end" solutions for the problems of water loss through

leakage. The Group is a "one-stop shop" for residential, commercial

and municipal customers whether for potable or non-potable water

issues.

The Company is a public limited company domiciled in the United

Kingdom and incorporated under registered number 03923150 in

England and Wales. The Company's registered office is 27-28

Eastcastle Street, London, W1W 8DH.

2 Significant accounting policies

Basis of preparation and changes to the Group's accounting

policies

The accounting policies adopted in the preparation of the

interim consolidated financial information are consistent with

those of the preparation of the Group's annual consolidated

financial statements for the year ended 31 December 2019. Effective

1 June 2020, IFRS 16 was amended to provide a practical expedient

for lessee's accounting for rent concessions that arise as a direct

consequence of the COVID-19 pandemic. This amendment had no effect

on this interim consolidated financial information.

This interim consolidated financial information for the six

months ended 30 June 2020 has been prepared in accordance with IAS

34, 'Interim financial reporting'. This interim consolidated

financial information is not the Group's statutory financial

statements and should be read in conjunction with the annual

financial statements for the year ended 31 December 2019, which

have been prepared in accordance with International Financial

Reporting Standards (IFRS) and have been delivered to the Registrar

of Companies. The auditors have reported on those accounts; their

report was unqualified, did not include references to any matters

to which the auditors drew attention by way of emphasis of matter

without qualifying their report and did not contain statements

under section 498(2) or (3) of the Companies Act 2006.

The interim consolidated financial information for the six

months ended 30 June 2020 is unaudited. In the opinion of the

Directors, the interim consolidated financial information presents

fairly the financial position, and results from operations and cash

flows for the period. Comparative numbers for the six months ended

30 June 2019 are unaudited.

This interim consolidated financial information is presented in

US Dollars ($), rounded to the nearest dollar.

Foreign currencies

(i) Functional and presentational currency

Items included in this interim consolidated financial

information are measured using the currency of the primary economic

environment in which each entity operates ("the functional

currency") which is considered by the Directors to be the Pounds

Sterling (GBP) for the Parent Company and US Dollars ($) for

American Leak Detection Holding Corp. This interim consolidated

financial information has been presented in US Dollars which

represents the dominant economic environment in which the Group

operates and is considered to be the functional currency of the

Group. The effective exchange rate at 30 June 2020 was GBP1 = US$

1.2698 (30 June 2019: GBP1 = US$ 1.2760).

Critical accounting estimates and judgments

The preparation of interim consolidated financial information

requires management to make judgements, estimates and assumptions

that affect the application of accounting policies and the reported

amounts of assets and liabilities and the reported amounts of

income and expenses during the reporting period. Although these

estimates are based on management's best knowledge of current

events and actions, the resulting accounting estimates will, by

definition, seldom equal the related actual results.

In preparing this interim consolidated financial information,

the significant judgements made by management in applying the

Group's accounting policies and the key sources of estimation

uncertainty were the same as those that applied to the consolidated

financial statements for the year ended 31 December 2019.

3 Significant events and transactions

The World Health Organisation declared coronavirus and Covid-19

a global health emergency on 30 January 2020. With respect to the

Covid-19 pandemic of 2020, the Group has reviewed all applicable

Shelter-in-Place Orders and have determined that our operations

qualify as essential/critical infrastructure and that we are able

to continue to operate under those Orders. Our service technicians

are essential to the minimum basic operations of our business. All

non-essential personnel have been notified to work remotely until

further notice. Employees who are critical to the minimum basic

operations of the business have been instructed to comply with

social distancing rules/requirements in their jurisdictions, as

well as other safety and health precautions.

Analytical review of operations indicates that for a short

period (March to May 2020) it is estimated that revenue may have

been negatively impacted by at least $750,000 and net profit by at

least $150,000. As mentioned in the financial highlights, despite

this COVID-19 impact, over the course of 1H revenue grew by 8% and

net profit before taxes grew by 33%. The Group continues to execute

its growth plan and to build scale as an "essential service

provider" for water and wastewater infrastructure solutions despite

the challenges of Covid-19 affecting the broader marketplace.

PPP Program - The Paycheck Protection Program (PPP) brings much

needed relief to business owners affected by the coronavirus. Not

only does this loan program provide funding to maintain payroll and

other expenses, but if used for qualifying purposes, part or all of

the loan can be forgiven. ALD applied for and received funding of

$1,869,800 under this program in April 2020. Final rules for

applying for forgiveness have not been released as of the report

date. Management expects that the total funding will be forgiven

given that, among other things, payroll and expenses have been

maintained.

4 Segmental information

In the opinion of the Directors, the operations of the Group

currently comprise four operating segments: (i) franchise royalty

income, (ii) franchise-related activities including

business-to-business sales and product and equipment sales, (iii)

corporate-operated locations led by the Group's U.S.-based American

Leak Detection subsidiary and (iv) international corporate

locations led by the Group's UK-based Water Intelligence

International.

The Group mainly operates in the US, with operations in the UK,

Canada and Australia. In the six months to 30 June 2020, 89.6% (1H

2019: 90.2%) of its revenue came from the US-based operations; the

remaining 10.4% (1H 2019: 9.8%) of its revenue came from its

international corporate operated locations.

No single customer accounts for more than 10% of the Group's

total external revenue.

The Group adopted IFRS 8 Operating Segments with effect from 1

July 2008. IFRS 8 requires operating segments to be identified on

the basis of internal reports about components of the Group.

Information reported to the Group's Chief Operating Decision

Maker (being the Executive Chairman), for the purpose of resource

allocation and assessment of division performance is separated into

four income generating segments that serve as key performance

indicators (KPI's):

- Franchise royalty income;

- Franchise-related activities (including product and equipment

sales and Business-to-Business sales);

- US corporate operated locations; and

- International corporate operated locations.

Items that do not fall into the four segments have been

categorised as unallocated head office costs and non-core costs

which largely reflect transaction costs associated with the Group's

franchise re-acquisition strategy.

The following is an analysis of the Group's revenues, results

from operations and assets:

Revenue Six months Six months Year ended

ended ended 31 December

30 June 2020 30 June 2019 2019

$ $ $

Unaudited Unaudited Audited

------------------------------ --------------- --------------- -------------

Franchise royalty income 3,464,489 3,435,521 6,499,045

Franchise related activities 4,322,401 4,054,399 8,049,570

US corporate operated

locations 7,600,601 6,816,359 14,446,286

International corporate

operated locations 1,709,096 1,561,161 3,369,034

------------------------------- --------------- --------------- -------------

Total 17,096,587 15,867,440 32,363,935

------------------------------- --------------- --------------- -------------

Profit before tax Six months Six months Year ended

ended ended 31 December

30 June 2020 30 June 2019 2019

$ $ $

Unaudited Unaudited Audited

------------------------------ --------------- --------------- -------------

Franchise royalty income 958,079 796,929 1,603,149

Franchise related activities 303,151 394,489 601,281

US corporate operated

locations 1,449,825 1,090,578 2,025,095

International corporate

operated locations 79,932 73,826 226,215

Unallocated head office

costs (745,716) (577,357) (1,605,252)

Non-core costs (37,990) (265,848) (493,000)

------------------------------- --------------- --------------- -------------

Total 2,007,281 1,512,617 2,357,488

------------------------------- --------------- --------------- -------------

Assets Six months Six months Year ended

ended ended 31 December

30 June 2020 30 June 2019 2019

$ $ $

Unaudited Unaudited Audited

------------------------------ --------------- --------------- -------------

Franchise royalty income 12,317,290 9,737,259 9,412,402

Franchise related activities 2,006,273 1,007,599 1,862,887

US corporate operated

locations 14,208,693 10,700,439 11,772,004

International corporate

operated locations 4,168,264 5,441,527 5,079,827

------------------------------- --------------- --------------- -------------

Total 32,700,520 26,886,824 28,127,120

------------------------------- --------------- --------------- -------------

Geographic Information

The Group has two wholly-owned subsidiaries - American Leak

Detection (ALD) and Water Intelligence International (WII).

Operating activities are captured as both franchise-executed

operations and corporate-executed operations. ALD has both US

franchises and corporate-operated locations. It also has

international franchises, principally located in Australia and

Canada. Operations focus on residential and commercial water leak

detection and remediation with some municipal activities. By

comparison, WII has only corporate operations located outside the

United States. These WII international operations are principally

municipal activities. As noted herein, the Group's vision is to

become a multinational growth company.

Total Revenue

Six months ended 30 June Year ended 31 December

2020 2019

Unaudited Audited

US International Total US International Total

$ $ $ $ $ $

----------------------- ----------- -------------- ----------- ----------- -------------- -----------

Franchise royalty

income 3,402,402 62,087 3,464,489 6,355,811 143,234 6,499,045

Franchise related

activities 4,322,401 - 4,322,401 8,049,570 - 8,049,570

US corporate operated

locations 7,600,601 - 7,600,601 14,446,286 - 14,446,286

International

corporate operated

locations - 1,709,096 1,709,096 - 3,369,034 3,369,034

----------------------- ----------- -------------- ----------- ----------- -------------- -----------

Total 15,325,404 1,771,183 17,096,587 28,851,667 3,512,268 32,363,935

----------------------- ----------- -------------- ----------- ----------- -------------- -----------

5 Earnings per share

The earnings per share has been calculated using the profit for

the period and the weighted average number of ordinary shares

outstanding during the period, as follows:

Six months Six months Year ended

ended ended 31 December

30 June 2020 30 June 2019 2019

Unaudited Unaudited Audited

-------------------------- --------------- --------------- -------------

Earnings attributable

to shareholders of

the Company ($) 1,470,653 1,115,460 1,695,033

Weighted average number

of ordinary shares 14,702,371 14,127,248 14,426,694

Diluted weighted average

number of ordinary

shares 15,237,545 15,096,052 15,244,422

--------------------------- --------------- --------------- -------------

Earnings per share

(cents) 10.0 7.9 11.7

--------------------------- --------------- --------------- -------------

Diluted earnings per

share (cents) 9.7 7.4 11.1

--------------------------- --------------- --------------- -------------

Earnings per share are computed based on Ordinary shares. There

is a class of B Ordinary Shares discussed in Footnote 6 that are

not admitted to trading.

6 Share capital

The issued share capital at the end of the period was as

follows:

Group & Company

Ordinary Shares held

Shares of 1p each in treasury

Number

Number Total Number

-------------------- ------------------- ------------- ------------

At 30 June 2020 14,702,371 170,000 14,872,371

At 30 June 2019 14,702,371 - 14,702,371

-------------------- ------------------- ------------- ------------

At 31 December 2019 14,702,371 145,000 14,847,371

-------------------- ------------------- ------------- ------------

On 7 August 2020 the Group reserved and issued options for

500,000 shares to incentivize, based on performance goals, a new

group of executives who have joined or been promoted within the

Company. These new options vest upon the completion of three years

and have an exercise price of $5.60 which is more than 35% higher

than the market price at the time of grant. The net number of

options including the new grants and leavers from the Company

during 2020 is approximately 1,925,000.

Subsequent to 30 June 2020, the Company bought back 10,000

shares for treasury resulting in 180,000 shares in treasury.

The Company has also issued 2,200,000 Partly Paid Shares (B

Ordinary Shares) that carry voting rights but no economic rights

and are will not be converted into Ordinary Shares until fully

paid.

Group & Company Share Capital Share Premium Shares In

Treasury

$ $ $

-------------------- ------------- -------------- ---------

At 30 June 2020 114,762 9,741,797 (619,368)

At 30 June 2019 113,152 9,569,989

-------------------- ------------- -------------- ---------

At 31 December 2019 114,440 9,717,349 (539,833)

-------------------- ------------- -------------- ---------

Reverse acquisition reserve

The reverse acquisition reserve was created in accordance with

IFRS3 Business Combinations and relates to the reverse acquisition

of Qonnectis Plc by ALDHC in July 2010. Although these Consolidated

Financial Statements have been issued in the name of the legal

parent, the Company it represents in substance is a continuation of

the financial information of the legal subsidiary ALDHC. A reverse

acquisition reserve was created in 2010 to enable the presentation

of a consolidated statement of financial position which combines

the equity structure of the legal parent with the reserves of the

legal subsidiary. Qonnectis Plc was renamed Water Intelligence Plc

on completion of the reverse acquisition on 29 July 2010.

7 Reacquisition of franchisee territories in the period

On 30 April 2020, the Group completed the reacquisition of its

Minneapolis, Minnesota franchise within the Group's ALD franchise

business. Minneapolis is a significant reacquisition that enables

the Group to add further scale to Water Intelligence financially

and operationally. The purchase price was approximately $1.3

million to be paid evenly over four years. 2019 sales for the

Minneapolis franchise location was approximately $0.98 million and

pre-tax profits were approximately $0.31 million. Operationally,

the reacquisition of Minneapolis creates a corporate base in the

Upper Midwest region of the United States. During 2019, the Group

executed several significant municipal contracts in the Upper

Midwest affording cross-selling opportunities from the Group's

Water Intelligence International subsidiary.

On 1 June 2020, the Group completed the reacquisition of its San

Jose, California franchise territory within the Group's ALD

franchise business. San Jose is a strategic reacquisition because

of its location in Silicon Valley. The Group plans to use this

corporate base to advance its innovation roadmap and R&D. The

reacquisition also enables the Group to add further scale to Water

Intelligence financially and operationally. The purchase price was

approximately $1.05 million. 2019 sales for the San Jose franchise

location were approximately $0.7 million and pre-tax profits were

approximately $0.2 million. The reacquisition also reinforces

growth in the Bay Area with its multimillion dollar franchises in

the San Francisco and Berkeley territories.

8 Subsequent events

Franchise Reacquisitions

On 17 July 2020, the Group completed the reacquisition of its

Maryland franchise territory (entire state of Maryland) within the

Group's ALD franchise business. Maryland is a significant

reacquisition. As noted, the franchise territory covers the entire

state of Maryland which includes significant cities such as

Baltimore, Bethesda, and Annapolis. The reacquisition enables the

Group to add further scale to Water Intelligence, both

operationally and financially. For full-year 2019, Maryland

generated approximately $1.07 million of sales and approximately

$0.4 million of pre-tax profits. The purchase price for the

reacquisition which includes all assets to conduct operations

(trucks, equipment etc.) is $1.35 million.

On 4 August 2020, the Group completed the reacquisition of its

franchise operation in Melbourne, Australia within the Group's ALD

franchise business. Due to strong demand for water conservation -

residential, commercial and municipal - and an existing base of

corporate and franchise operations to fulfil such demand, Australia

is an important geography for the Group's strategic growth plan.

Melbourne is a significant reacquisition because it complements the

Group's other corporate base in Sydney. Between Melbourne and

Sydney, the Group can better support growth of its existing

franchise locations in the eastern half of Australia. For the

trailing twelve months, which includes six months of Covid-impacted

results, the Melbourne operation generated AUD$1.29 million in

sales and AUD$0.27 million in profits. The purchase price for the

reacquisition which includes all assets to conduct operations

(trucks, equipment etc.) is AUD$1.77 million.

Corporate Transactions

On 7 August 2020 the Group reserved and issued options for

500,000 shares to incentivize, based on performance goals, a new

group of executives who have joined or been promoted within the

Company. These new options vest upon the completion of three years

and have an exercise price of $5.60 which is more than 35% higher

than the market price at the time of grant.

Transaction in Own Shares - pursuant to the authority approved

by shareholders at the Company's Annual General Meeting dated 29

July 2020, the Company purchased the following shares (all to be

held in treasury).

6 August 2020 - 2,500 ordinary shares of 1 penny each at 324

pence.

7 August 2020 - 2,500 ordinary shares of 1 penny each at 319

pence.

10 August 2020 - 5,000 ordinary shares of 1 penny each at 315

pence.

Board

David Silverstone retires from the Board effective as of the

publication of the Interim Financials. Both the board and team

(corporate and franchise) appreciate his board service. David will

continue to assist the Company with his expertise in the municipal

business as part of an Advisory Board.

9 Publication of announcement and the Interim Results

A copy of this announcement will be available at the Company's

registered office ( 27-28 Eastcastle Street, London, W1W 8DH ) from

the date of this announcement and on its website -

www.waterintelligence.co.uk . This announcement is not being sent

to shareholders.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFFVFALIRLII

(END) Dow Jones Newswires

September 17, 2020 02:00 ET (06:00 GMT)

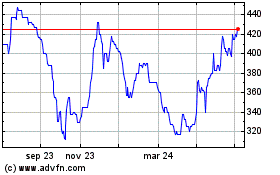

Water Intelligence (LSE:WATR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

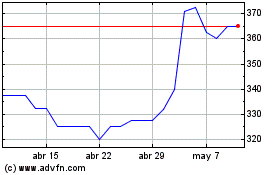

Water Intelligence (LSE:WATR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024