TIDMWTB

RNS Number : 6438Z

Whitbread PLC

22 September 2020

Whitbread

22 September 2020

FY21 H1 post close and operational review update

Trading:

-- H1 total sales were significantly down year-on-year

reflecting the closure of the vast majority of our hotels and

restaurants for a large part of the period

-- When able, hotels and restaurants reopened quickly and

safely, with the majority of the estate in the UK open by the start

of August, and 98% of hotels open by the end of H1

-- Since reopening, UK accommodation sales performance has been

ahead of the market, benefitting from the fast reopening, the

strength of the Premier Inn brand and our leading customer

proposition. We have seen strong demand in tourist locations, while

market demand remained subdued in metropolitan areas and London

-- Across our entire UK estate, occupancy levels steadily

improved on a weekly basis, averaging 51% in August, while UK

Restaurant performance was boosted by the positive impact of the

Eat Out To Help Out scheme. August UK total sales (accommodation

and food and beverage) improved to 38.5% down year-on-year

Near-term outlook & actions:

-- A rapid and robust operational response at the start of the

crisis helped protect our teams, guests and the continuity of the

business, and ensured the safe reopening of our hotels and

restaurants with strong social distancing and hygiene standards

-- Our financial response included significant reductions in

discretionary spend and capital expenditure, suspension of the

dividend, voluntary pay cuts for the Board and management team, and

use of UK and German government support packages

-- The completion of a GBP1bn rights issue enhanced both our

financial flexibility and our ability to successfully execute our

strategy in the UK and Germany

-- We continue to focus on taking measured and appropriate

action, at the right time, to protect the business. With market

demand expected to remain at lower levels in the short to

medium-term, we have now taken the very difficult decision to

announce our intention to enter into consultation on proposals that

could result in up to 6,000 redundancies for our hotel and

restaurant colleagues (representing 18% of our total workforce). We

expect a significant proportion of these redundancies to be

achieved voluntarily. Our priority now is to ensure that the

process is fair and that impacted colleagues are supported

throughout

-- This is a regrettable but necessary step to ensure that we

emerge from the crisis with a lower cost base, a more flexible

operating model and a stronger more resilient business

Medium-term opportunity:

-- The strength of the Premier Inn brand and winning operating

model is evidenced by our ability to quickly reopen our business

and perform ahead of the market

-- We are well-placed to continue this outperformance against

the budget branded and independent competitor sets, as both become

increasingly constrained

-- The business retains a strong balance sheet and is

well-placed to take advantage of enhanced structural opportunities

in the medium to long-term

H1 Financial performance:

UK like-for-like UK total sales UK & International

sales change change total sales

change

------------------- ------------------ ---------------------

Q2(1) H1(2) Q2(1) H1(2) Q2(1) H1(2)

----------------- --------- -------- -------- -------- ---------- ---------

Accommodation (77.1)% (78.2)% (76.6)% (77.7)% (75.5)% (77.1)%

Food & beverage (72.8)% (76.6)% (72.6)% (76.3)% (72.4)% (76.1)%

----------------- --------- -------- -------- -------- ---------- ---------

Total (75.6)% (77.6)% (75.2)% (77.2)% (74.5)% (76.8)%

----------------- --------- -------- -------- -------- ---------- ---------

1: Q2 = 13-week period ended 27 August 2020 | 2: H1 = 26-week

period ended 27 August 2020

The Group's financial performance in the first half of the year

reflects the closure of the UK business from the end of March until

the reopening of hotels and restaurants commenced at the start of

July, and the closure of our hotels in Germany from the end of

March until the middle of May.

In the UK, the vast majority of hotels and restaurants were

reopened by the first week of August, and a total of 801 hotels,

representing 98% of total UK capacity were open by the end of

August. In Germany, all six operational hotels were closed at the

end of March, and reopened during May, alongside 13 of the acquired

Foremost hotels that were fully refurbished and rebranded during

the lockdown period, to bring a total of 19 hotels now open.

Since reopening, total UK accommodation sales growth was ahead

of the market, benefitting from the fast reopening, the strength of

the Premier Inn brand and our leading customer proposition. Demand

was strong in seaside & tourist locations, with occupancy

levels of almost 80% during August in those locations. However,

demand remained subdued across the rest of the hotel market,

particularly in London and metropolitan areas. Across our entire UK

estate, overall occupancy levels steadily improved on a weekly

basis, averaging 51 % in August with year-on-year accommodation

sales recovering to -47.3%, while UK Restaurant performance was

boosted by the positive impact of the Eat Out to Help Out scheme.

Total UK sales (accommodation and food and beverage) improved to

-38.5% in August.

Performance trends in Germany mirrored the UK, with strong

demand and occupancy levels in tourist locations, while locations

with a greater business skew remained at low occupancy levels. In

August, total sales were over 300% ahead, boosted by the acquired

Foremost hotels, while occupancy recovered to 54%. We continue to

actively assess opportunities to accelerate our pipeline growth in

Germany.

Update on operational review and cost efficiency programme

Throughout the COVID-19 crisis, management has taken quick and

decisive action to protect the business and to position it for

long-term success. This included the rapid closure of our

businesses in March, the immediate postponement and cancellation of

all non-critical spend and accessing Government schemes to secure

the liquidity of the business, followed by the GBP1bn rights issue

that will help successfully position the business in the

medium-term. We are also close to completing a process that will

result in a reduction of our head office headcount by approximately

15%-20%.

In line with previous announcements, we expect demand to remain

subdued in the short to medium-term and the UK Government's

furlough scheme to come to an end in October. We have taken the

very difficult decision to announce our intention to enter into

consultation with our UK hotel and restaurant colleagues on

proposals that could result in up to 6,000 redundancies, of which

it is hoped that a significant proportion can be achieved

voluntarily, along with reductions in contracted hours for a

proportion of our colleagues. These changes create a more flexible

labour model that can adapt with changes in the demand environment

going forward. Our priority is to ensure that the process is fair

and that impacted colleagues are supported throughout.

The impact of these changes is already reflected in the external

guidance given at our full year results announcement on May 21st,

where every one percentage point of total revenue decline, net of

cost savings, resulted in a c.GBP18m adverse impact on profit.

One-off costs to achieve are expected to be approximately

GBP12-GBP15m.

Current trading and outlook:

Trading in the first two weeks of September saw year-on-year

total accommodation sales remain ahead of the market. Bookings in

tourist destinations remain strong, and business bookings are

growing, albeit from a low base. September and October are

traditionally a period when business bookings pick-up after the

quiet summer period, however at this point it is too early to

assess the impact of COVID-19 on this traditionally busy booking

period.

We also note recent UK Government announcements regarding

increased local and regional lockdowns and we will continue to

closely monitor the situation.

Whitbread will provide a further update at its interim results

announcement on the 27 October 2020.

Comment from Alison Brittain, CEO:

"Our teams have worked very hard to reopen our hotels and

restaurants and we are now firmly in the "restore" phase of our

response to the COVID-19 crisis. Our performance following the

reopenings has been ahead of the market, however, it has been clear

from the beginning of this crisis that even as restrictions are

eased and hospitality businesses such as ours reopen their doors,

that demand would be materially lower than FY20 levels for a period

of time. Given this backdrop, we have already taken extensive

action to protect the business, retain financial flexibility and

position it for long-term success. We continue to work hard to

ensure that we emerge from the crisis with a more flexible

operating model and a stronger, more resilient business.

With demand for travel remaining subdued, we are now having to

make some very difficult decisions, and it is with great regret

that today we are announcing our intention to enter into a

consultation process that could result in up to 6,000 redundancies

in the UK, of which it is hoped that a significant proportion can

be achieved voluntarily. In line with our longstanding values of

treating our people fairly, our priority is now to ensure that this

process is clear and transparent for all colleagues and that

everyone impacted is supported throughout.

We will continue to focus on the safety of our guests and teams

and the continuity of our business. Maintaining our financial

flexibility alongside our leading operating model and powerful

brand will allow Whitbread to pursue enhanced long-term structural

growth opportunities both in the UK and Germany. This will leave us

in a position of strength to continue to invest, increase market

share, support our colleagues, guests and suppliers and create

value for shareholders."

For more information please contact:

Investor queries | Whitbread |

investorrelations@whitbread.com

Media queries | Tulchan Communications, David Allchurch /

Jessica Reid | +44 (0) 20 7353 4200

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAXNFAFPEEFA

(END) Dow Jones Newswires

September 22, 2020 02:00 ET (06:00 GMT)

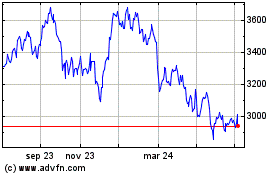

Whitbread (LSE:WTB)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

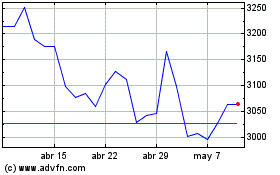

Whitbread (LSE:WTB)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024